How to Build Canadian Credit as a Newcomer

Relocating to a new country comes with its own share of exciting opportunities and practical challenges. One of the most crucial tasks for any newcomer to Canada is learning how to build Canadian credit as a newcomer. Your credit score can open doors—or close them. From getting your first apartment to financing your future home, your credit history is a powerful tool in your new life.

So, how can you, as a newcomer with no Canadian credit history, build a strong credit score from scratch? It’s easier than you think—but only if you take the right steps from the beginning.

Understanding the Canadian Credit System

Before you can build credit, you need to understand what it is. In Canada, your credit report is a detailed record of how you’ve used credit over time, while your credit score is a number that summarizes your creditworthiness. The higher the score (which ranges from 300 to 900), the better.

There are two major credit bureaus in Canada: Equifax and TransUnion. They collect and maintain your credit information, and you have the right to request your credit report from both for free.

Why Credit History Matters in Canada

In Canada, your credit history influences more than just your ability to borrow money. It can affect:

-

Rental approvals

-

Employment offers

-

Insurance rates

-

Interest rates on loans

Having no credit is almost as limiting as having poor credit, so building it should be a priority.

Get Started: Apply for a SIN and Bank Account

Your Social Insurance Number (SIN) is your gateway to almost all financial activity in Canada. Get it as soon as possible, then open a Canadian bank account. Many banks offer newcomer packages that include low-fee accounts and advice tailored to immigrants.

Get a Secured Credit Card

This is the single most recommended tool for newcomers. A secured credit card requires you to put down a refundable deposit that acts as your credit limit. As you use the card and make payments on time, your credit score begins to build. Some of the best providers for secured cards include:

-

Capital One Guaranteed Mastercard

-

Home Trust Secured Visa

-

Neo Financial Secured Card

Become an Authorized User

If you have a trusted family member or friend with good credit, ask them to add you as an authorized user on their credit card. Their positive history will help build your own, though not all lenders report authorized user activity—check first.

Try a Credit Builder Loan

A credit builder loan is like a savings plan that builds your credit. You “repay” the loan monthly, but the funds are held in a locked savings account until the term ends. Once done, you receive the full amount, and your positive payment history is reported to the credit bureaus.

Always Pay On Time and Keep Balances Low

Credit scoring models heavily favor on-time payments and low credit utilization (ideally under 30%). Even one late payment can lower your score significantly.

Use autopay features or calendar reminders to stay on top of your bills.

Check Your Score Regularly

Knowing your score is half the battle. You can check your Canadian credit score and report for free using tools like:

-

Credit Karma Canada

-

Borrowell

-

Equifax/TransUnion (annually)

Avoid These Common Mistakes

Newcomers often fall into traps such as:

-

Applying for too many credit products at once

-

Maxing out credit cards

-

Closing old accounts too soon

Avoid these, and your score will rise steadily.

Use Utility and Cell Phone Bills to Your Advantage

Some services now allow you to report on-time utility or cell phone payments to credit bureaus. Look into programs like Rent Advantage or KOHO Credit Building for this purpose.

Keep Building Over Time

Building credit is a marathon, not a sprint. Keep your accounts open, diversify your credit types, and stay consistent. In time, you’ll be eligible for lower-interest loans, better credit cards, and larger financial opportunities.

Frequently Asked Questions

How long does it take to build credit in Canada as a newcomer?

With consistent habits, you can begin seeing a credit score in as little as 3 to 6 months. A good score typically takes 12+ months to develop.

Can I transfer my credit history from my home country to Canada?

Usually no. Canadian credit bureaus do not recognize international credit history. You must start fresh.

Do all landlords and employers check credit scores in Canada?

Not all, but many do—especially in major cities. A good credit score boosts your credibility.

Is a credit score of 650 good in Canada?

Yes, 650 is considered fair. A score above 700 is good, and 750+ is excellent.

Will checking my credit score lower it?

Not if you use soft checks like Borrowell or Credit Karma. Hard inquiries from loan or card applications can lower it slightly.

What’s the best first credit card for newcomers in Canada?

The Home Trust Secured Visa and Neo Secured Card are great starters. Look for cards with low fees and no income requirements.

Conclusion

Building credit in Canada as a newcomer isn’t just possible—it’s highly achievable with the right knowledge and tools. By starting with secured cards, making timely payments, and using tools designed for immigrants, you can build a strong financial foundation that supports your new life in Canada.

Remember, your credit score is a reflection of your financial habits. Keep them clean, consistent, and controlled, and the opportunities in your new homeland will follow.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

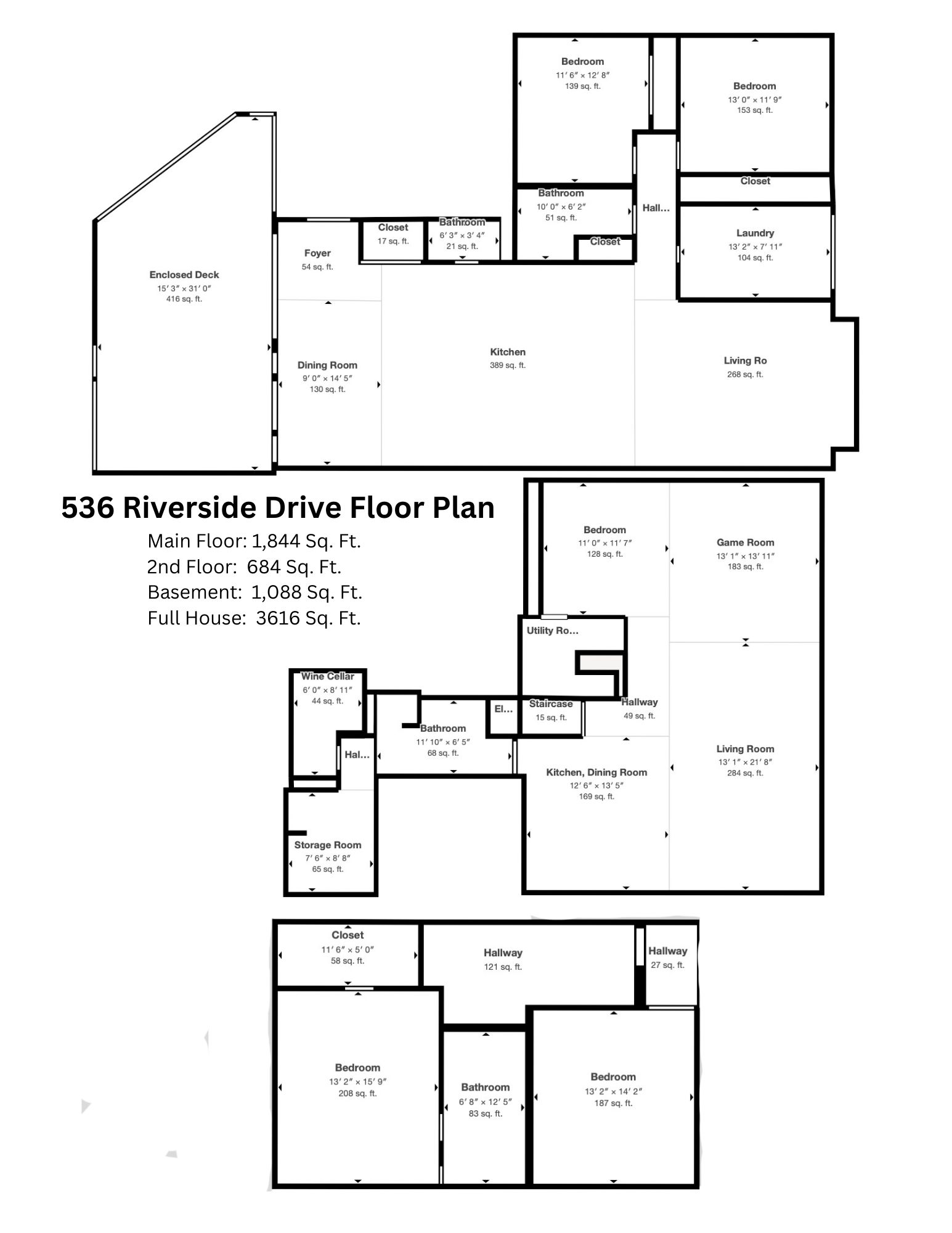

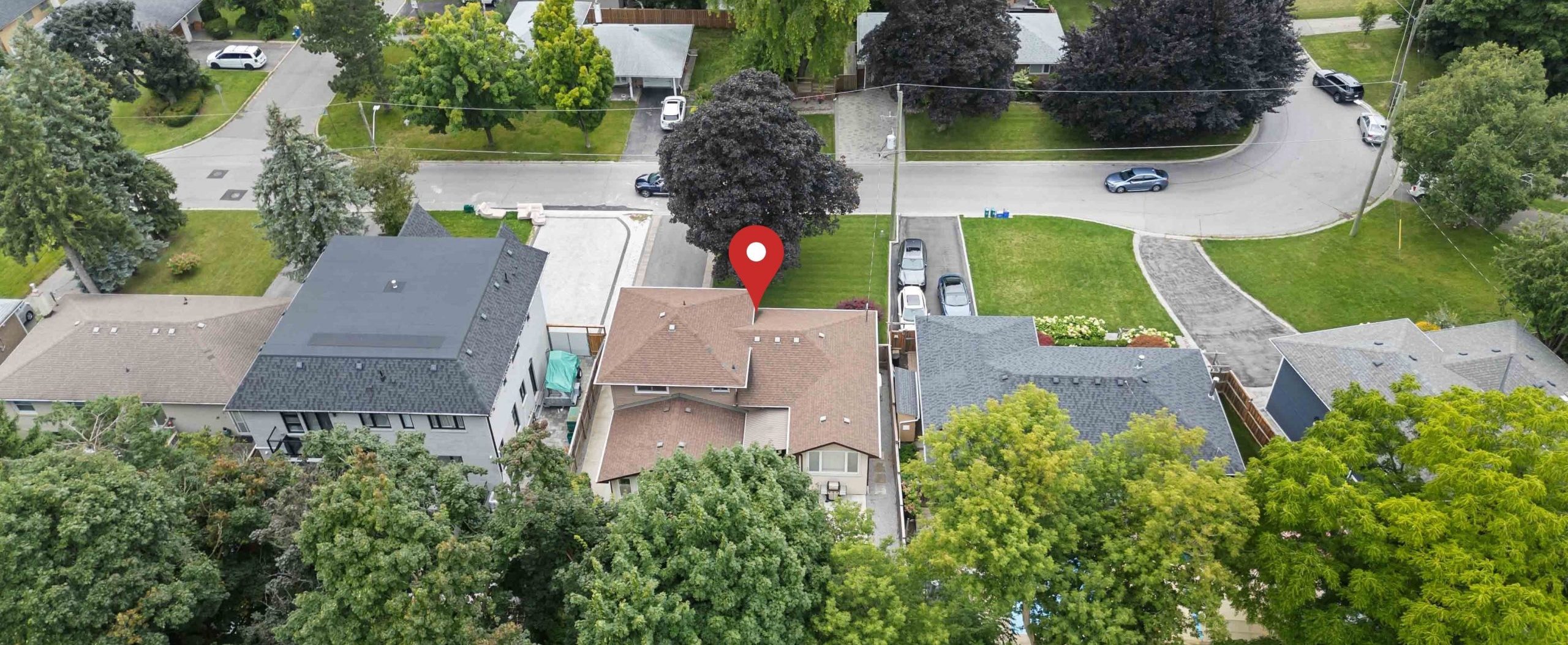

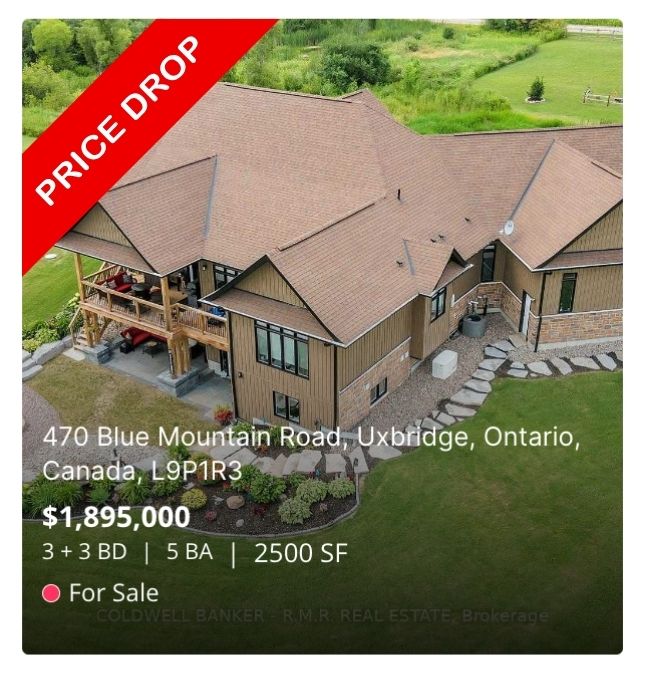

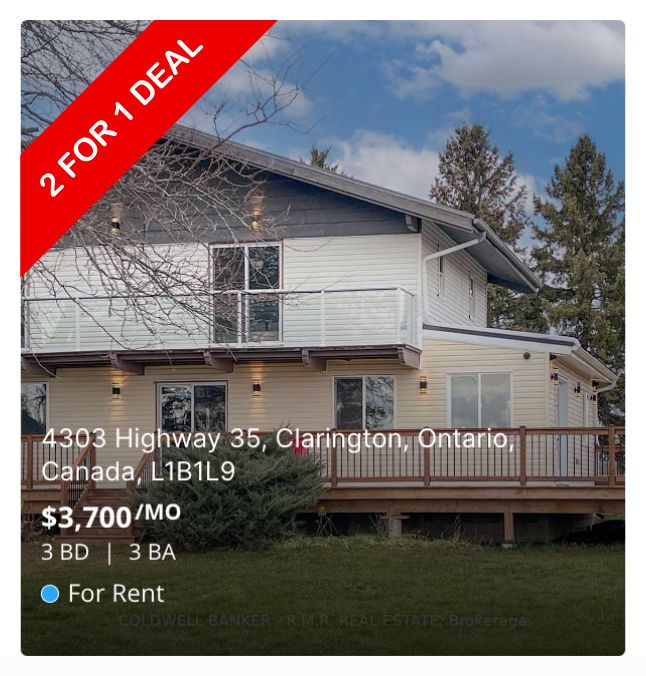

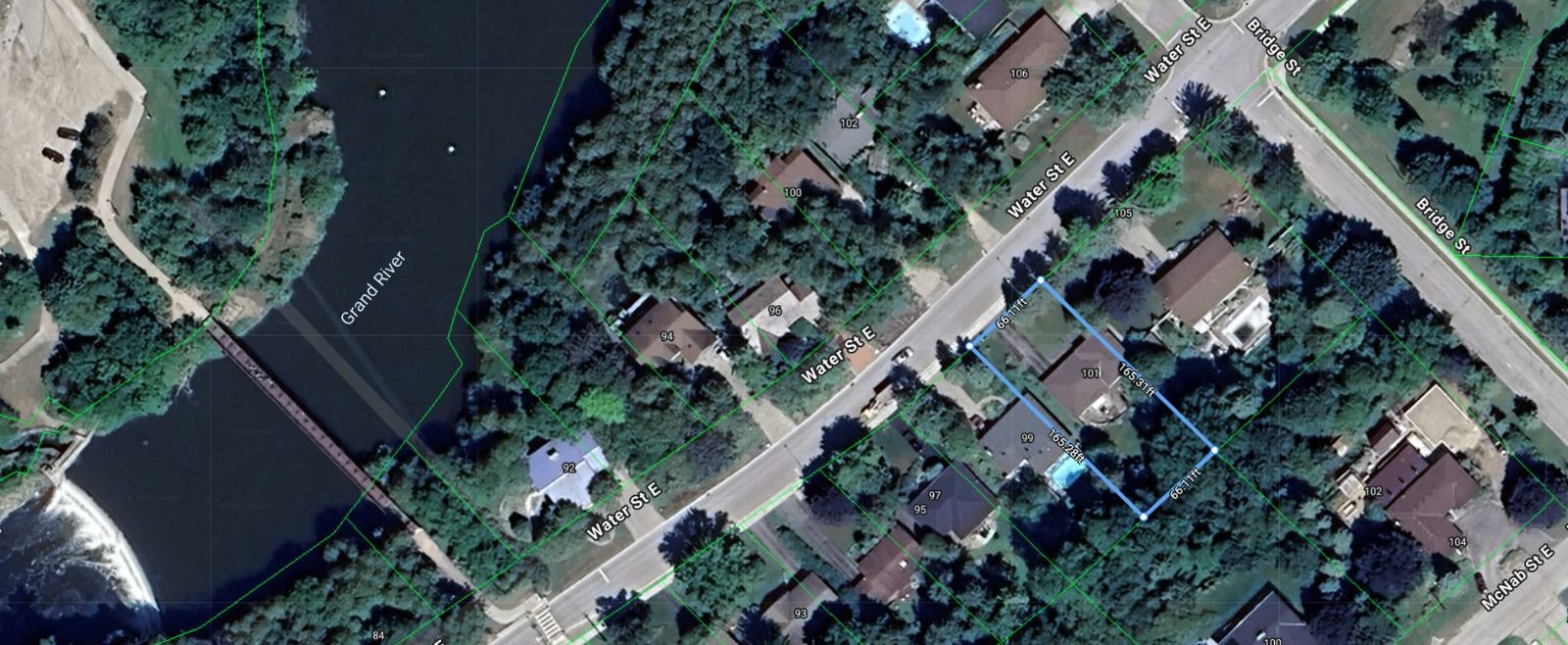

As you step into the grand foyer, the striking open-riser Scarlet O’Hara staircase takes center stage, immediately commanding attention. This architectural masterpiece gracefully ascends to the upper level, setting the tone for the home’s elegant design and offering a glimpse of the extraordinary living spaces that lie beyond.

As you step into the grand foyer, the striking open-riser Scarlet O’Hara staircase takes center stage, immediately commanding attention. This architectural masterpiece gracefully ascends to the upper level, setting the tone for the home’s elegant design and offering a glimpse of the extraordinary living spaces that lie beyond. The spacious living room is a testament to the home’s thoughtful design, featuring expansive windows that flood the space with natural light and frame views of the picturesque surroundings. Adjacent to this inviting space, the formal dining room provides an ideal setting for hosting elegant dinner parties or intimate family gatherings.

The spacious living room is a testament to the home’s thoughtful design, featuring expansive windows that flood the space with natural light and frame views of the picturesque surroundings. Adjacent to this inviting space, the formal dining room provides an ideal setting for hosting elegant dinner parties or intimate family gatherings. The impressive great room is the heart of the home, boasting soaring 19-foot ceilings, massive windows with enchanting wooded views, and a cozy fireplace. Solid hardwood floors flow seamlessly throughout the main areas, offering a timeless aesthetic, while the gourmet kitchen and baths feature durable tile flooring.

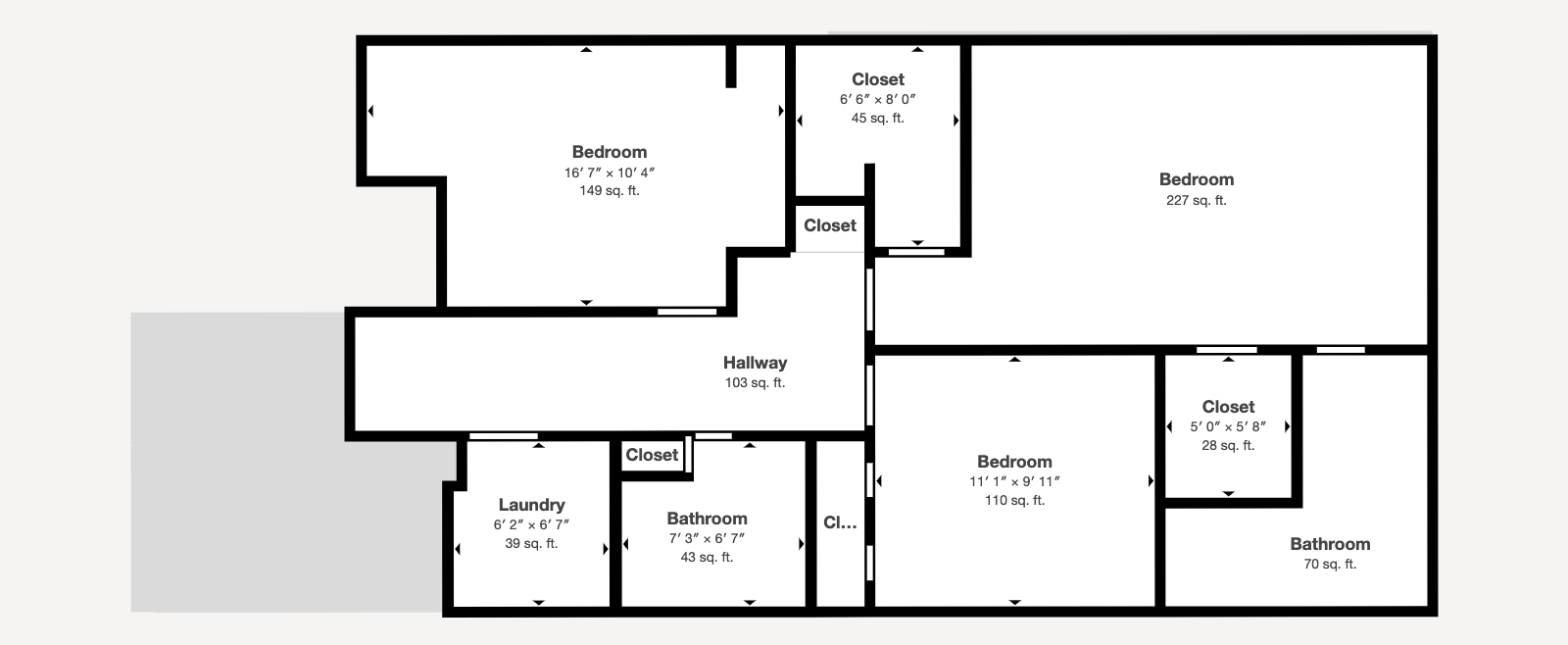

The impressive great room is the heart of the home, boasting soaring 19-foot ceilings, massive windows with enchanting wooded views, and a cozy fireplace. Solid hardwood floors flow seamlessly throughout the main areas, offering a timeless aesthetic, while the gourmet kitchen and baths feature durable tile flooring. Designed with culinary enthusiasts in mind, the oversized kitchen is a true masterpiece. It boasts premium finishes, ample workspace, and state-of-the-art appliances, ensuring both functionality and style. The practical layout includes a nearby laundry room, a walk-in closet, and a secondary entrance leading to the three-bay garage with 9×8-foot doors, providing ample space for vehicles and storage.

Designed with culinary enthusiasts in mind, the oversized kitchen is a true masterpiece. It boasts premium finishes, ample workspace, and state-of-the-art appliances, ensuring both functionality and style. The practical layout includes a nearby laundry room, a walk-in closet, and a secondary entrance leading to the three-bay garage with 9×8-foot doors, providing ample space for vehicles and storage. A sunroom situated off the main living areas offers an idyllic retreat. With slate flooring, a cozy fireplace, and walls of windows showcasing serene backyard views, this space is perfect for unwinding. Double doors lead to a private outdoor haven, seamlessly connecting indoor and outdoor living.

A sunroom situated off the main living areas offers an idyllic retreat. With slate flooring, a cozy fireplace, and walls of windows showcasing serene backyard views, this space is perfect for unwinding. Double doors lead to a private outdoor haven, seamlessly connecting indoor and outdoor living. The backyard retreat is a sanctuary of relaxation and beauty. An expansive patio, complete with a pergola, gazebo, and barbecue area, invites outdoor gatherings against the lush backdrop of perennial gardens. Mature trees, manicured shrubs, and vibrant planters enhance the natural charm, creating an environment that feels like a private escape.

The backyard retreat is a sanctuary of relaxation and beauty. An expansive patio, complete with a pergola, gazebo, and barbecue area, invites outdoor gatherings against the lush backdrop of perennial gardens. Mature trees, manicured shrubs, and vibrant planters enhance the natural charm, creating an environment that feels like a private escape. A spacious home office provides a quiet, functional workspace, while a well-appointed powder room completes the thoughtfully designed main floor.

A spacious home office provides a quiet, functional workspace, while a well-appointed powder room completes the thoughtfully designed main floor. Upstairs, five generously sized bedrooms await, each offering its own ensuite or semi-ensuite, ensuring comfort and privacy for family and guests alike.

Upstairs, five generously sized bedrooms await, each offering its own ensuite or semi-ensuite, ensuring comfort and privacy for family and guests alike. The primary suite is a sanctuary of luxury, occupying its own wing for maximum privacy. The expansive bedroom is complemented by a walk-in closet and a spa-like five-piece ensuite. This exquisite bathroom features a custom double vanity, a supersized glass shower, a deep soaker tub, and a separate water closet, offering a tranquil space to relax and recharge.

The primary suite is a sanctuary of luxury, occupying its own wing for maximum privacy. The expansive bedroom is complemented by a walk-in closet and a spa-like five-piece ensuite. This exquisite bathroom features a custom double vanity, a supersized glass shower, a deep soaker tub, and a separate water closet, offering a tranquil space to relax and recharge. The carefully planned basement provides remarkable versatility, making it ideal for multigenerational living. With private access from the garage, the in-law suite includes a bedroom, bathroom, living area, and kitchen, ensuring independence and comfort for extended family members.

The carefully planned basement provides remarkable versatility, making it ideal for multigenerational living. With private access from the garage, the in-law suite includes a bedroom, bathroom, living area, and kitchen, ensuring independence and comfort for extended family members. Additionally, the basement features a full gym, ample storage solutions, a cold cellar, and a utility room. Large windows throughout the lower level bring in natural light, creating a bright and welcoming environment.

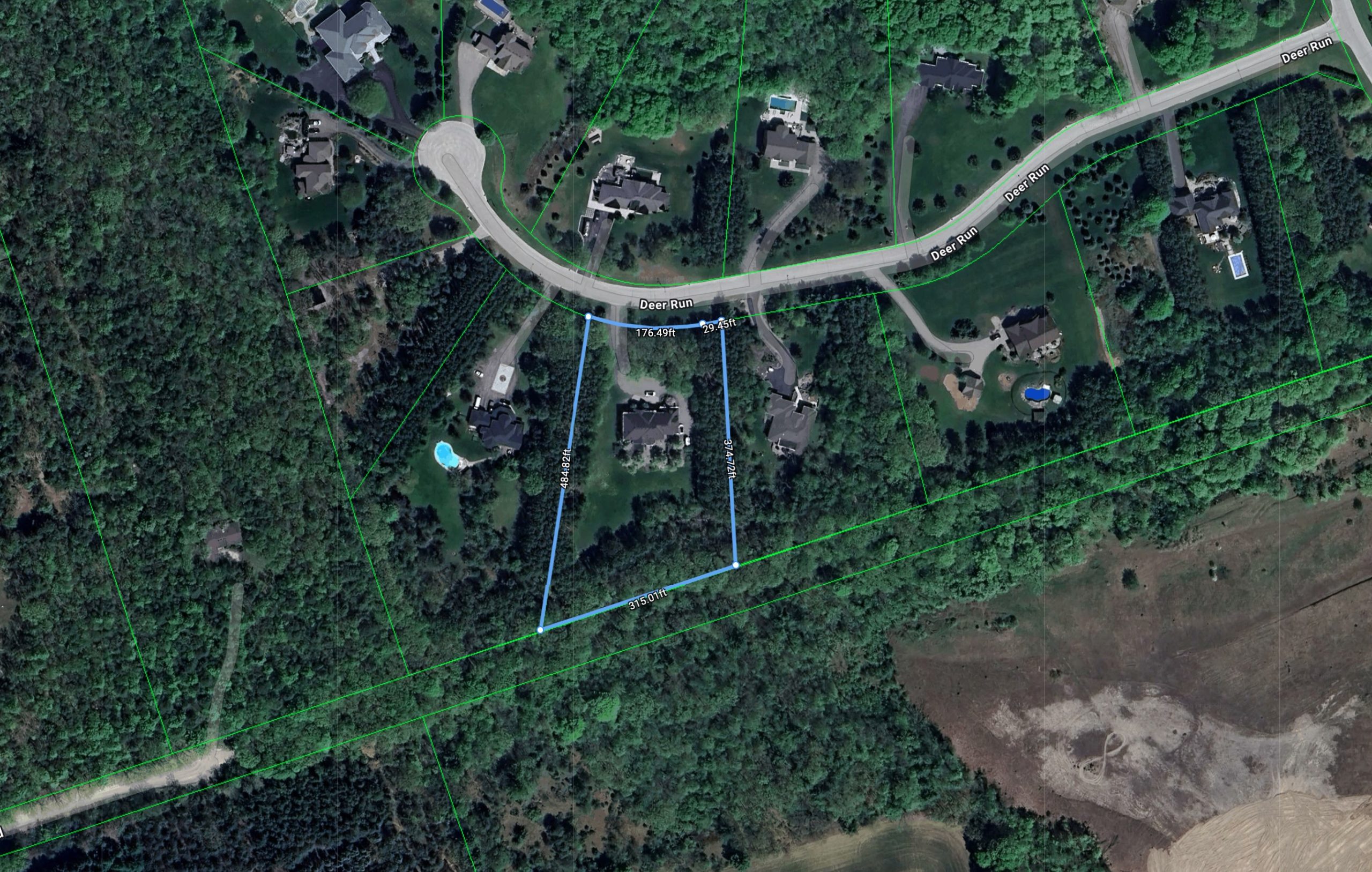

Additionally, the basement features a full gym, ample storage solutions, a cold cellar, and a utility room. Large windows throughout the lower level bring in natural light, creating a bright and welcoming environment. This estate stands as a testament to refined living. With its exceptional craftsmanship, thoughtful layout, and premium finishes, it offers a lifestyle that is both luxurious and functional. Surrounded by the natural beauty of FoxFire Estates, this property is more than a home-it is a statement of elegance and sophistication.

This estate stands as a testament to refined living. With its exceptional craftsmanship, thoughtful layout, and premium finishes, it offers a lifestyle that is both luxurious and functional. Surrounded by the natural beauty of FoxFire Estates, this property is more than a home-it is a statement of elegance and sophistication. For those seeking the ultimate in luxury and privacy, this builder’s private residence is a rare gem that must be experienced firsthand.

For those seeking the ultimate in luxury and privacy, this builder’s private residence is a rare gem that must be experienced firsthand.