Detached Properties For Sale UNDER $500,000 Canadian Dollars in the GTA

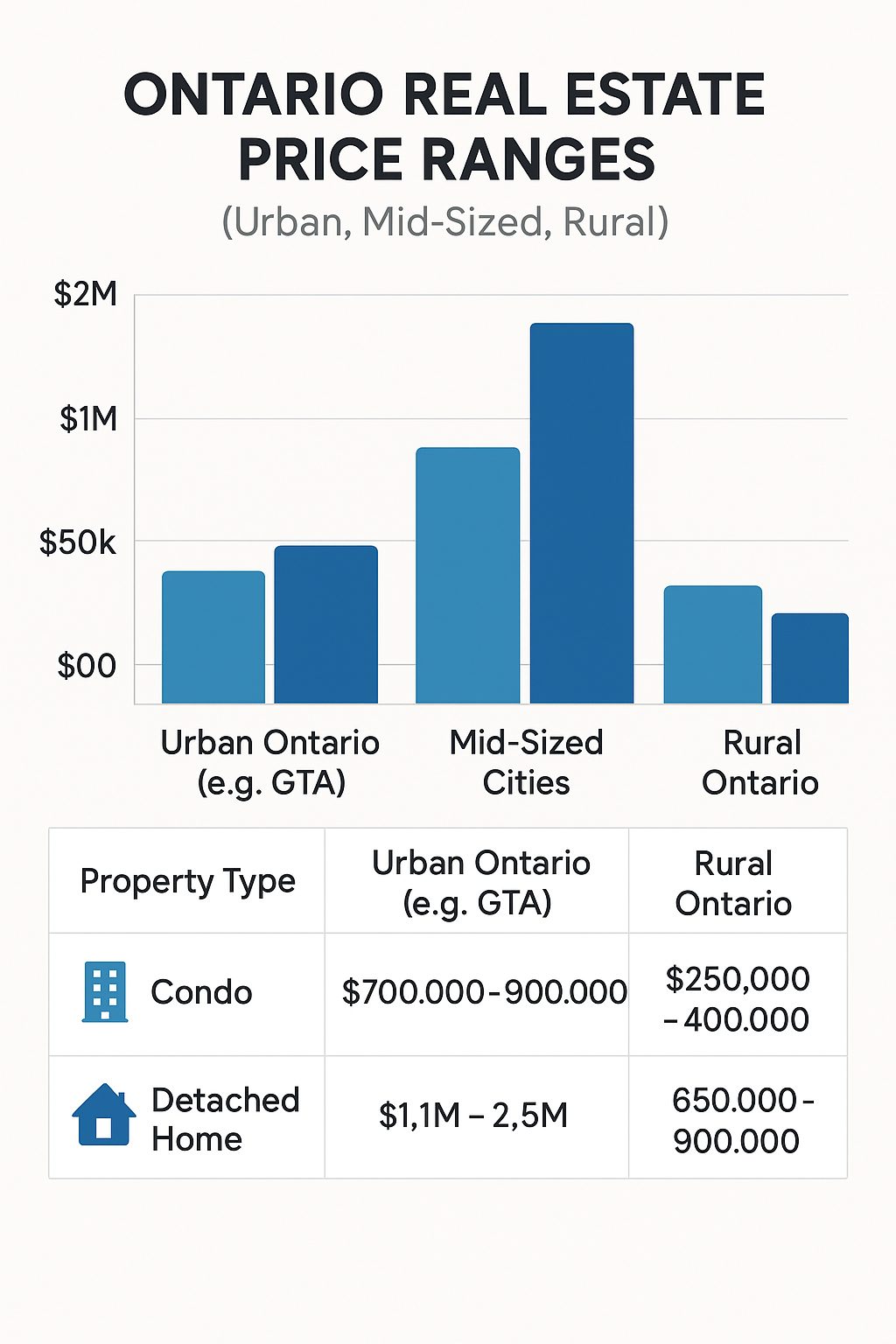

Detached homes priced under $500,000 in the Greater Toronto Area (GTA) are becoming increasingly scarce, yet they offer an exceptional opportunity for savvy buyers. In a market where the average detached property often costs well over $1 million, finding homes at this price point seems like a dream come true. However, these homes typically come with unique characteristics—many are fixer-uppers, stigmatized properties, estate sales, power of sale listings, or are deliberately priced low to ignite competitive bidding wars.

Despite these complexities, more than 30 such properties are currently listed across the GTA. The majority of these homes are found in Oshawa, Georgina, and Clarington—particularly in Newcastle and Bowmanville. Other regions like Brock, Scugog, Toronto, and Halton host only a handful of listings. Most are 2-bedroom bungalows, with some including 2 bathrooms, while the smaller group of 3-bedroom homes is split between those with 1 or 2 bathrooms.

Below, we break down the types of properties typically found in this price range, including their advantages, disadvantages, and potential caveats you should be aware of before making a purchase.

1. Fixer-Uppers

Fixer-uppers are homes in need of renovation or repair, often priced lower to reflect the investment required to bring them up to modern standards.

Advantages:

-

Lower initial purchase price

-

Opportunity to add value through renovations

-

Potential for customization to match your vision

Disadvantages:

-

Renovation costs can quickly add up

-

Might uncover hidden issues (plumbing, electrical, structural)

-

Financing can be trickier as lenders may demand repairs upfront

Caveats: Many of these homes will require detailed property condition disclosures. Always opt for a home inspection, even if it’s waived contractually, and budget for surprises.

2. Stigmatized Properties

These are homes where a death, crime, or other psychologically impactful event occurred, which may deter some buyers.

Advantages:

-

Significantly reduced price

-

Less competition from other buyers

Disadvantages:

-

Potential difficulty reselling in the future

-

Emotional discomfort depending on the situation

Caveats: In Ontario, sellers aren’t always legally required to disclose stigmas unless directly asked. It’s wise to conduct your own research or work with a local realtor who knows the history of the area.

3. Estate Sales

An estate sale occurs when the owner has passed away and their estate is selling off the home, often as-is.

Advantages:

-

More room for negotiation with motivated sellers

-

Can be priced below market to ensure a quick sale

Disadvantages:

-

Typically sold “as-is,” with no updates or repairs

-

Probate processes can delay closing

Caveats: There may be limited documentation on the property’s history, and disclosure can be minimal. You may also need to work through legal intermediaries rather than traditional sellers.

4. Power of Sale Properties

These occur when lenders seize and sell homes after mortgage defaults.

Advantages:

-

Priced below market value for a fast sale

-

Quicker closing processes in many cases

Disadvantages:

-

Sold without warranty or guarantee of condition

-

Minimal negotiation leverage

Caveats: Lenders are legally obligated to disclose any known defects, but they may not know much about the property’s condition. Buyers must conduct thorough due diligence and often accept “as-is” terms.

5. Deliberately Underpriced Listings for Bidding Wars

Some properties are intentionally priced below market value to spark a bidding war.

Advantages:

-

May appear to be a great deal at first glance

-

Occasionally, buyers snag a win if competition is low

Disadvantages:

-

Final sale price often exceeds listing price

-

Pressure to waive conditions (like inspections or financing) to stay competitive

Caveats: Fast-paced offers leave little time for proper evaluation. This high-pressure environment can lead to overpaying or skipping essential steps like due diligence.

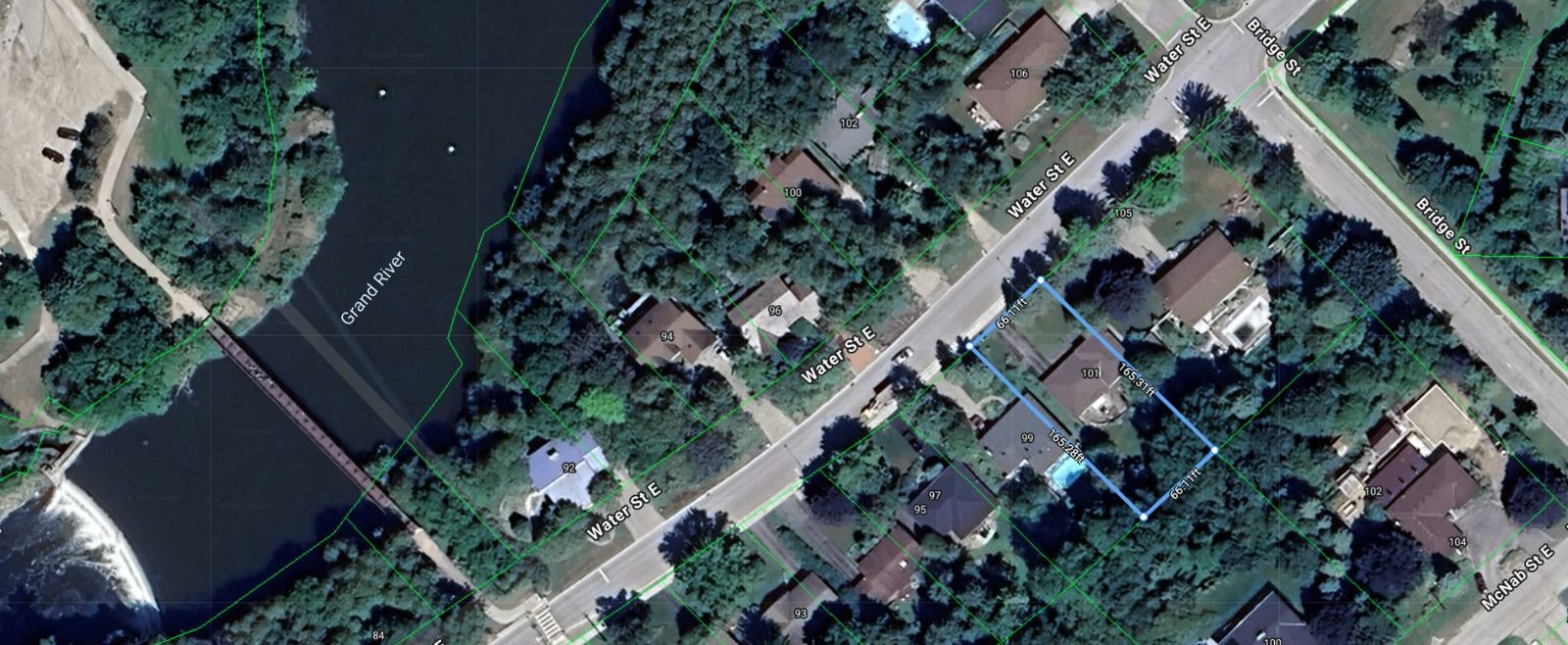

Where These Properties Are Found

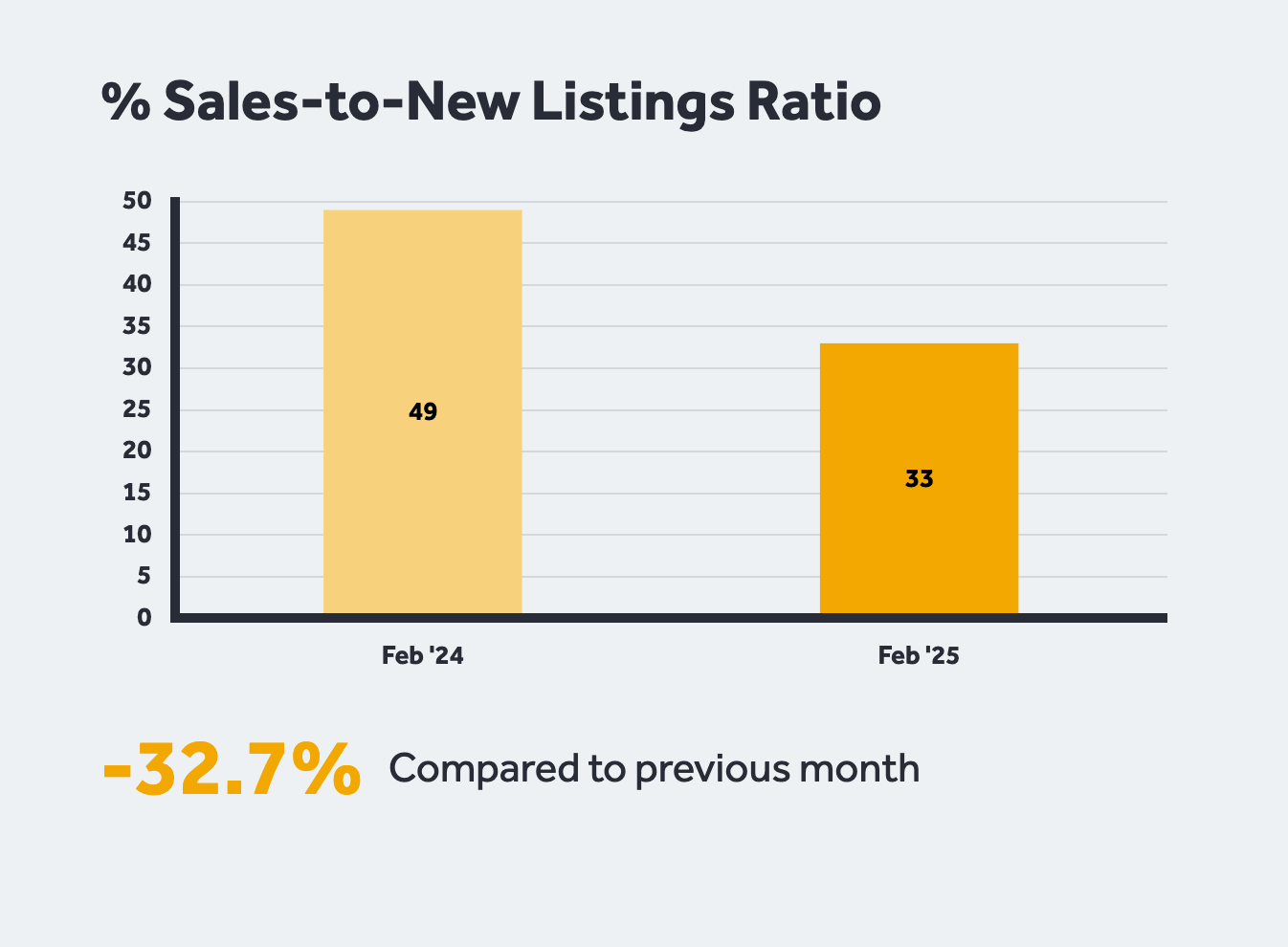

Let’s take a look at where the bulk of these listings are appearing (as at the time of this blog article):

The overwhelming majority are 2-bedroom homes, some with two bathrooms. Three-bedroom options are limited, and only half of those offer a second bathroom.

Who’s Buying These Properties?

Given their affordability and potential for future value, these listings are drawing attention from a range of buyers:

-

Contractors looking to flip or rebuild

-

Investors eyeing rental returns

-

First-time homebuyers seeking an entry point into the market

-

Landlords expanding their rental portfolios

Because of the heightened interest and reduced inventory, these homes don’t tend to last long on the market. In some cases, properties receive multiple offers within just a few days.

Important Disclosures and Legal Considerations

It’s essential to understand that many of these properties come with specific disclosure requirements. You may encounter:

-

Property-related disclosures: Structural issues, previous damages, or material latent defects.

-

Legal disclosures: Probate timelines, rights of way, and power of sale regulations.

-

Lender disclosures: For power of sale homes, lenders often provide limited information.

Buyers should always consult a qualified real estate agent and legal professional before proceeding. A property inspection, title search, and review of the seller’s disclosures are critical steps you shouldn’t skip.

📩 Call to Action: Get Your Custom List Now

Are you ready to explore the best detached property deals under $500,000 in the GTA?

👉 Click here or leave your email to receive a curated list of available properties, complete with photos, descriptions, and neighbourhood insights—delivered directly to your inbox.

These listings move fast—don’t miss your chance to grab a home in this rare price bracket!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

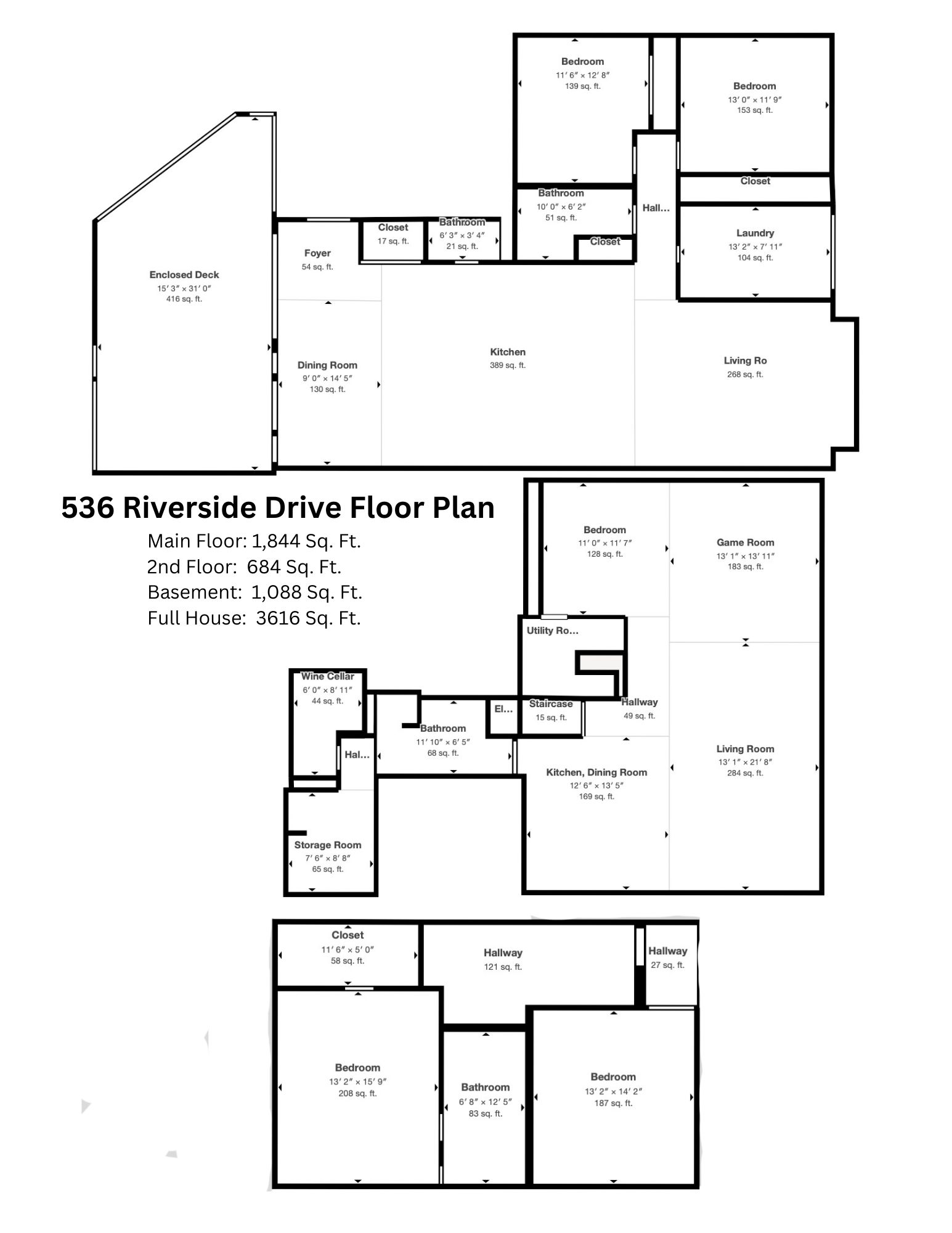

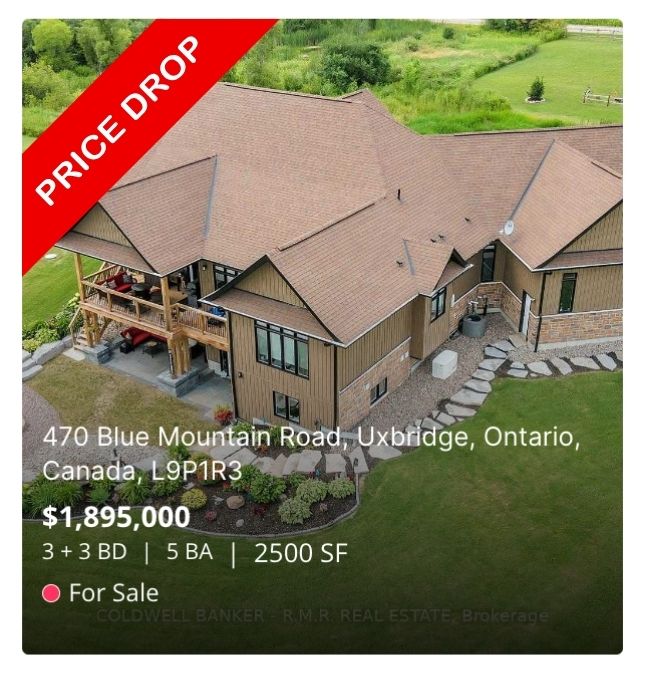

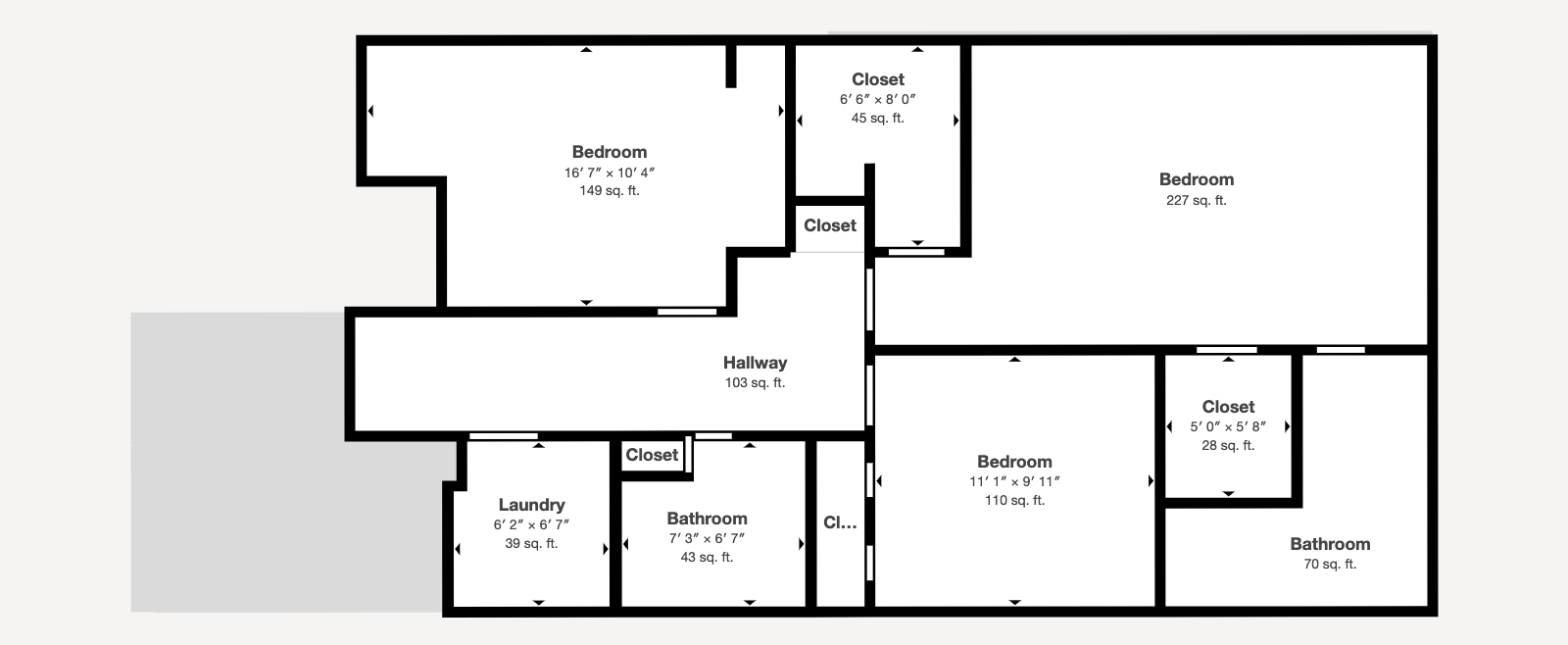

As you step into the grand foyer, the striking open-riser Scarlet O’Hara staircase takes center stage, immediately commanding attention. This architectural masterpiece gracefully ascends to the upper level, setting the tone for the home’s elegant design and offering a glimpse of the extraordinary living spaces that lie beyond.

As you step into the grand foyer, the striking open-riser Scarlet O’Hara staircase takes center stage, immediately commanding attention. This architectural masterpiece gracefully ascends to the upper level, setting the tone for the home’s elegant design and offering a glimpse of the extraordinary living spaces that lie beyond. The spacious living room is a testament to the home’s thoughtful design, featuring expansive windows that flood the space with natural light and frame views of the picturesque surroundings. Adjacent to this inviting space, the formal dining room provides an ideal setting for hosting elegant dinner parties or intimate family gatherings.

The spacious living room is a testament to the home’s thoughtful design, featuring expansive windows that flood the space with natural light and frame views of the picturesque surroundings. Adjacent to this inviting space, the formal dining room provides an ideal setting for hosting elegant dinner parties or intimate family gatherings. The impressive great room is the heart of the home, boasting soaring 19-foot ceilings, massive windows with enchanting wooded views, and a cozy fireplace. Solid hardwood floors flow seamlessly throughout the main areas, offering a timeless aesthetic, while the gourmet kitchen and baths feature durable tile flooring.

The impressive great room is the heart of the home, boasting soaring 19-foot ceilings, massive windows with enchanting wooded views, and a cozy fireplace. Solid hardwood floors flow seamlessly throughout the main areas, offering a timeless aesthetic, while the gourmet kitchen and baths feature durable tile flooring. Designed with culinary enthusiasts in mind, the oversized kitchen is a true masterpiece. It boasts premium finishes, ample workspace, and state-of-the-art appliances, ensuring both functionality and style. The practical layout includes a nearby laundry room, a walk-in closet, and a secondary entrance leading to the three-bay garage with 9×8-foot doors, providing ample space for vehicles and storage.

Designed with culinary enthusiasts in mind, the oversized kitchen is a true masterpiece. It boasts premium finishes, ample workspace, and state-of-the-art appliances, ensuring both functionality and style. The practical layout includes a nearby laundry room, a walk-in closet, and a secondary entrance leading to the three-bay garage with 9×8-foot doors, providing ample space for vehicles and storage. A sunroom situated off the main living areas offers an idyllic retreat. With slate flooring, a cozy fireplace, and walls of windows showcasing serene backyard views, this space is perfect for unwinding. Double doors lead to a private outdoor haven, seamlessly connecting indoor and outdoor living.

A sunroom situated off the main living areas offers an idyllic retreat. With slate flooring, a cozy fireplace, and walls of windows showcasing serene backyard views, this space is perfect for unwinding. Double doors lead to a private outdoor haven, seamlessly connecting indoor and outdoor living. The backyard retreat is a sanctuary of relaxation and beauty. An expansive patio, complete with a pergola, gazebo, and barbecue area, invites outdoor gatherings against the lush backdrop of perennial gardens. Mature trees, manicured shrubs, and vibrant planters enhance the natural charm, creating an environment that feels like a private escape.

The backyard retreat is a sanctuary of relaxation and beauty. An expansive patio, complete with a pergola, gazebo, and barbecue area, invites outdoor gatherings against the lush backdrop of perennial gardens. Mature trees, manicured shrubs, and vibrant planters enhance the natural charm, creating an environment that feels like a private escape. A spacious home office provides a quiet, functional workspace, while a well-appointed powder room completes the thoughtfully designed main floor.

A spacious home office provides a quiet, functional workspace, while a well-appointed powder room completes the thoughtfully designed main floor. Upstairs, five generously sized bedrooms await, each offering its own ensuite or semi-ensuite, ensuring comfort and privacy for family and guests alike.

Upstairs, five generously sized bedrooms await, each offering its own ensuite or semi-ensuite, ensuring comfort and privacy for family and guests alike. The primary suite is a sanctuary of luxury, occupying its own wing for maximum privacy. The expansive bedroom is complemented by a walk-in closet and a spa-like five-piece ensuite. This exquisite bathroom features a custom double vanity, a supersized glass shower, a deep soaker tub, and a separate water closet, offering a tranquil space to relax and recharge.

The primary suite is a sanctuary of luxury, occupying its own wing for maximum privacy. The expansive bedroom is complemented by a walk-in closet and a spa-like five-piece ensuite. This exquisite bathroom features a custom double vanity, a supersized glass shower, a deep soaker tub, and a separate water closet, offering a tranquil space to relax and recharge. The carefully planned basement provides remarkable versatility, making it ideal for multigenerational living. With private access from the garage, the in-law suite includes a bedroom, bathroom, living area, and kitchen, ensuring independence and comfort for extended family members.

The carefully planned basement provides remarkable versatility, making it ideal for multigenerational living. With private access from the garage, the in-law suite includes a bedroom, bathroom, living area, and kitchen, ensuring independence and comfort for extended family members. Additionally, the basement features a full gym, ample storage solutions, a cold cellar, and a utility room. Large windows throughout the lower level bring in natural light, creating a bright and welcoming environment.

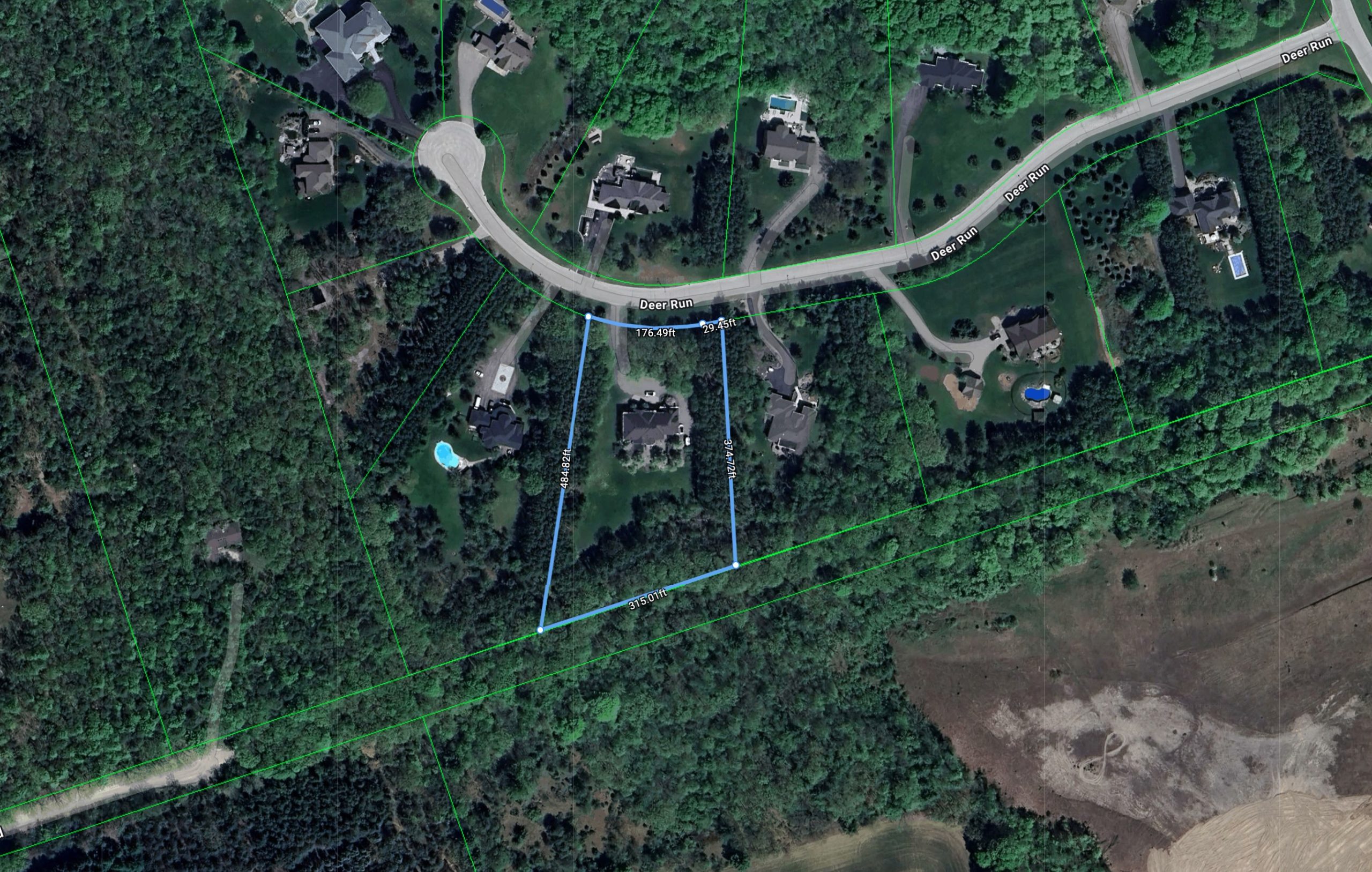

Additionally, the basement features a full gym, ample storage solutions, a cold cellar, and a utility room. Large windows throughout the lower level bring in natural light, creating a bright and welcoming environment. This estate stands as a testament to refined living. With its exceptional craftsmanship, thoughtful layout, and premium finishes, it offers a lifestyle that is both luxurious and functional. Surrounded by the natural beauty of FoxFire Estates, this property is more than a home-it is a statement of elegance and sophistication.

This estate stands as a testament to refined living. With its exceptional craftsmanship, thoughtful layout, and premium finishes, it offers a lifestyle that is both luxurious and functional. Surrounded by the natural beauty of FoxFire Estates, this property is more than a home-it is a statement of elegance and sophistication. For those seeking the ultimate in luxury and privacy, this builder’s private residence is a rare gem that must be experienced firsthand.

For those seeking the ultimate in luxury and privacy, this builder’s private residence is a rare gem that must be experienced firsthand.