Bank of Canada Cuts Interest Rates For The Fourth Time This Year So Far!

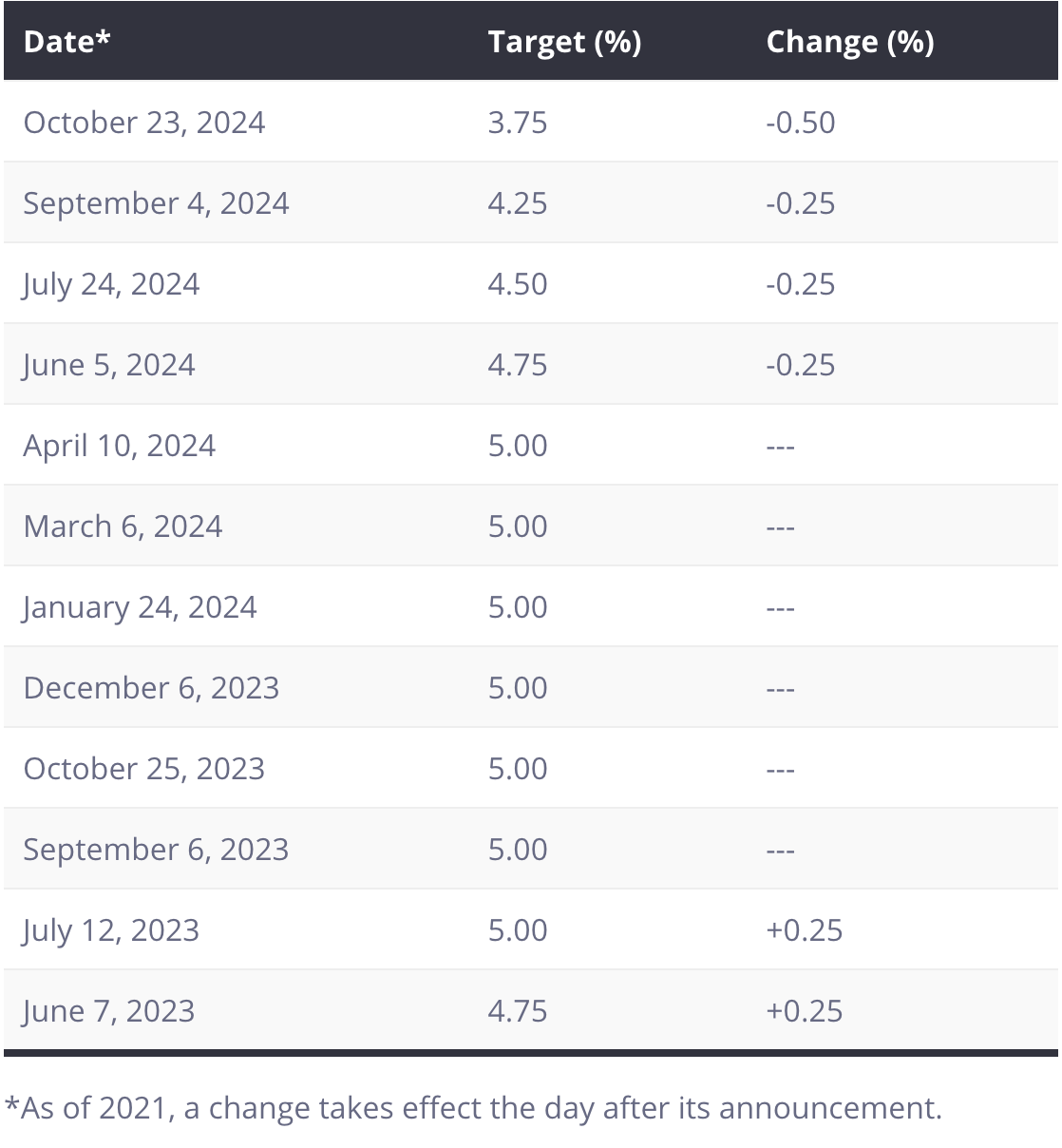

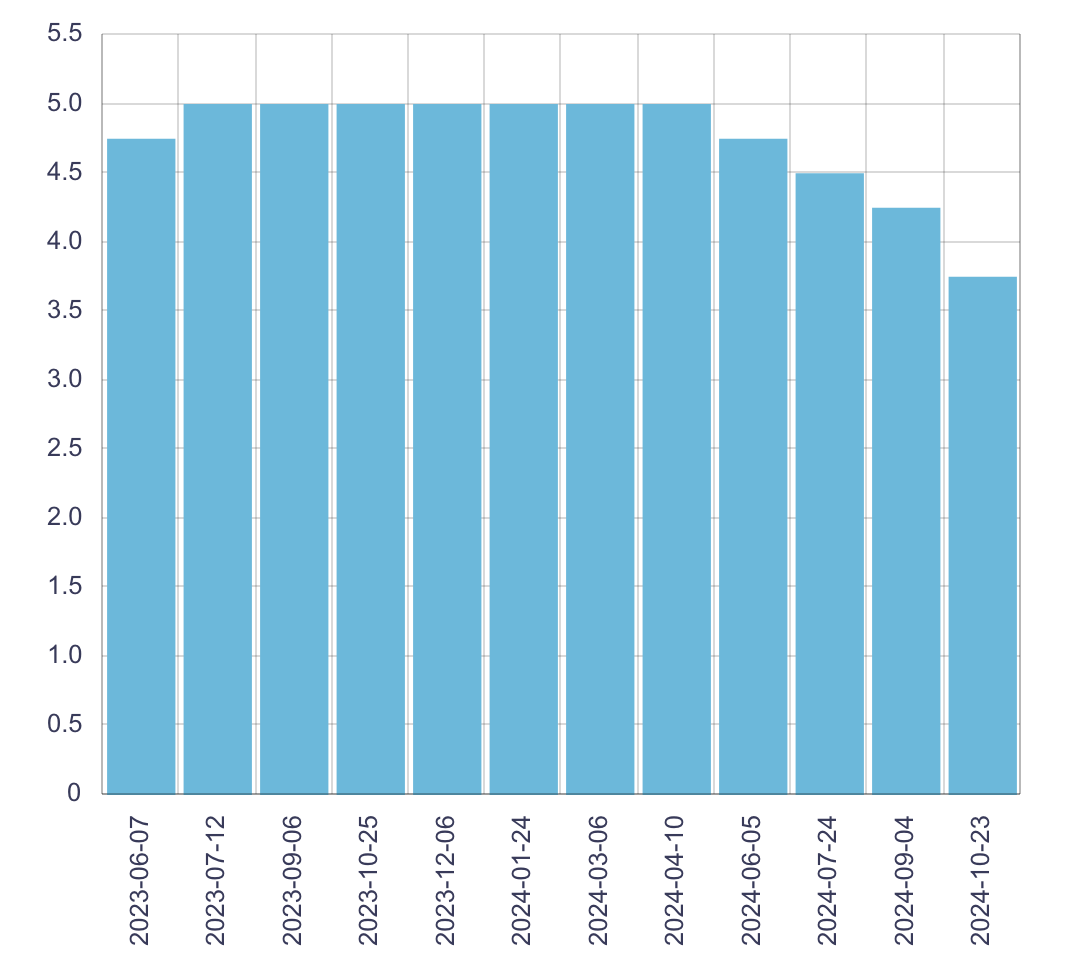

Today, the Bank of Canada lowered its key interest rate to 3¾%. This means the Bank Rate is now at 4%, and the deposit rate is also at 3¾%.

Inflation has been on the decline, with the Consumer Price Index (CPI) currently around 2%. This drop is due to lower energy prices and a general easing of underlying inflationary pressures. While inflation is close to the Bank’s target of 2%, the distribution of inflation rates across different goods and services is still uneven.

The Bank of Canada expects inflation to remain near its target over the next few years. Core inflation, which excludes volatile items like food and energy, is forecast to gradually decrease. However, there are risks that inflation could either rise above or fall below the target.

Canada’s economy has performed largely as expected. It grew slightly faster than anticipated in the second quarter but is expected to slow down in the third quarter. Overall, the economy is still producing more goods and services than are being demanded. The job market has weakened, especially for newcomers and young people. Wages are rising faster than productivity.

The Bank of Canada forecasts Canada’s economy to grow at an average rate of 2¼% over the next two years. This is due to expected increases in consumer spending and business investment, supported by lower interest rates. However, slower population growth and rising consumption per person will partially offset this growth. Export demand is also expected to remain strong.

The global economy is projected to grow at around 3% over the next few years. The United States is experiencing strong economic growth, but it is expected to slow down. In the euro area, growth is sluggish but expected to improve. Inflation in advanced economies is expected to be close to central bank targets. China’s economy has slowed due to weak domestic demand and the ongoing property crisis. However, new stimulus measures should help prevent further decline.

The weaker Chinese economy has reduced demand for oil. Global oil prices have fallen and remain volatile due to concerns about supply, demand, and the conflict in the Middle East.

Recent Data

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link