The Greater Toronto Area (GTA) real estate market continued to provide substantial choice for home buyers in February 2025, as resale inventory remained high while sales declined significantly compared to the previous year. With mortgage rates still elevated, affordability challenges persisted, but market experts anticipate improvements as borrowing costs are expected to drop later this year.

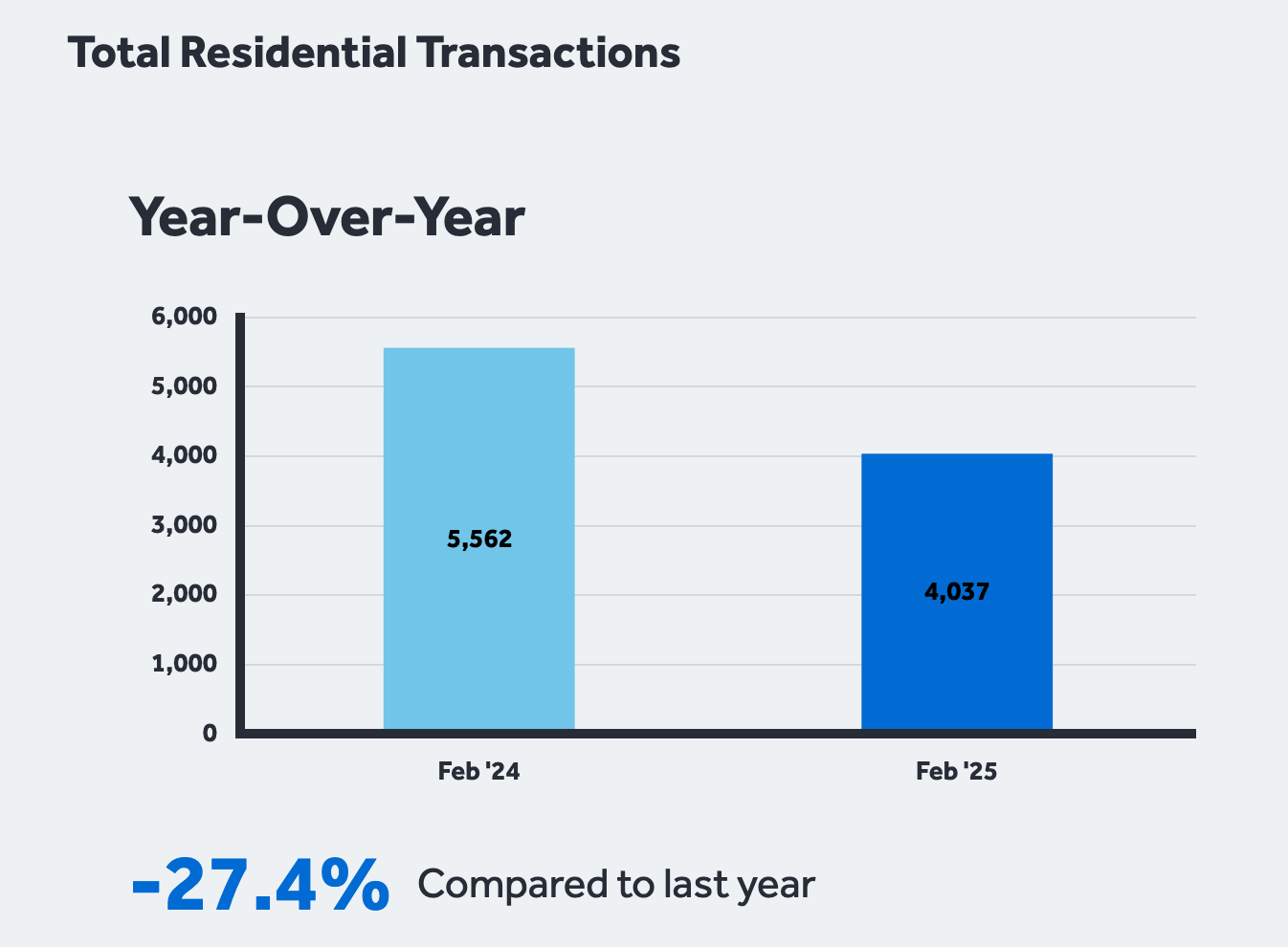

According to the Toronto Regional Real Estate Board (TRREB), home sales in February 2025 totaled 4,037 transactions, representing a 27.4% year-over-year decline. Meanwhile, new listings rose 5.4% YoY to 12,066, reinforcing buyer-friendly conditions with increased housing inventory.

Key Highlights of GTA’s February 2025 Housing Market

| Metric | February 2025 | February 2024 | YoY Change |

|---|---|---|---|

| Home Sales | 4,037 | 5,560 | ▼ 27.4% |

| New Listings | 12,066 | 11,450 | ▲ 5.4% |

| MLS® HPI Composite | ▼ 1.8% | – | ▼ 1.8% |

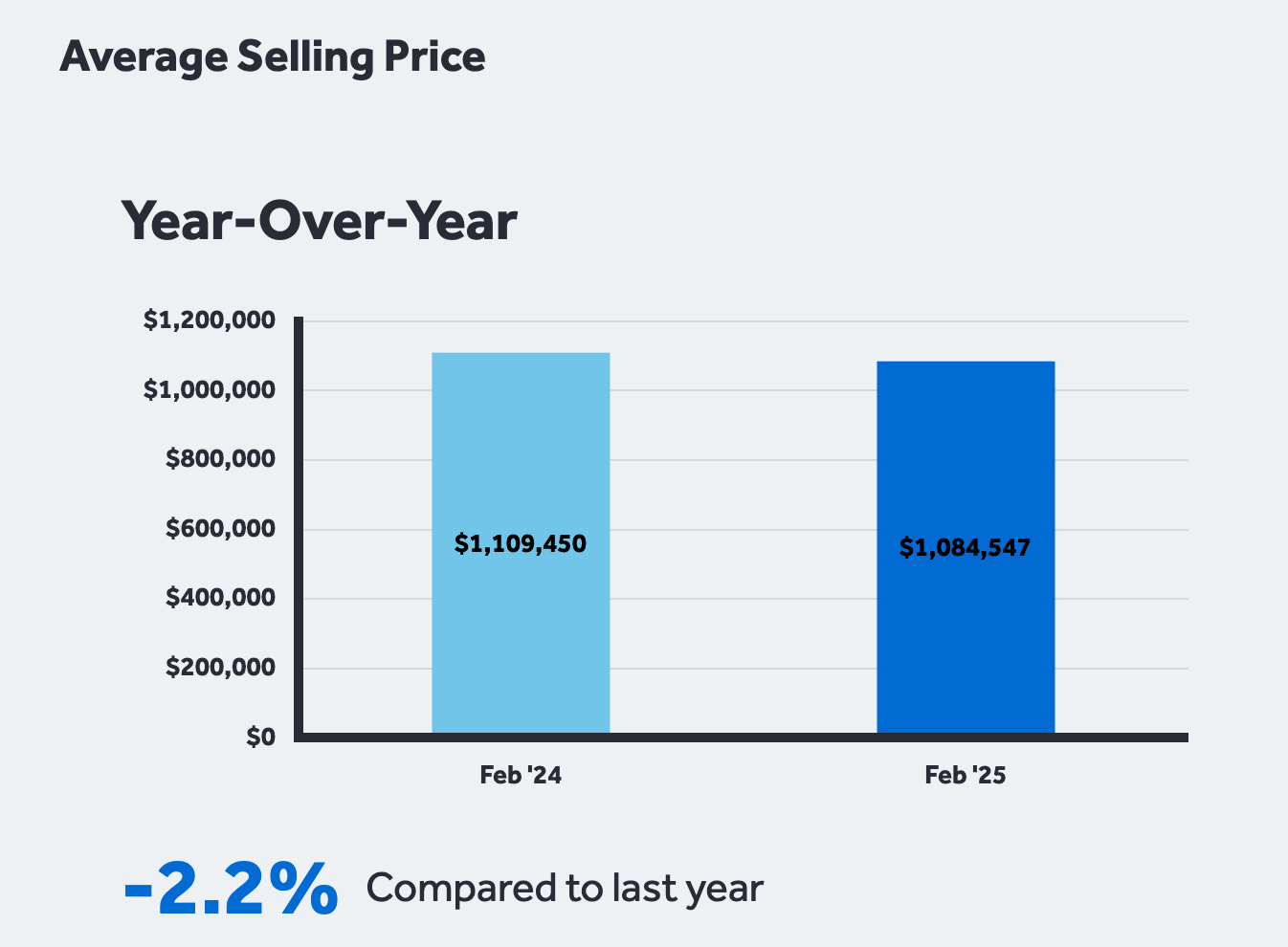

| Average Selling Price | $1,084,547 | $1,108,982 | ▼ 2.2% |

GTA Homebuyers Gain Negotiation Power Amid Market Slowdown

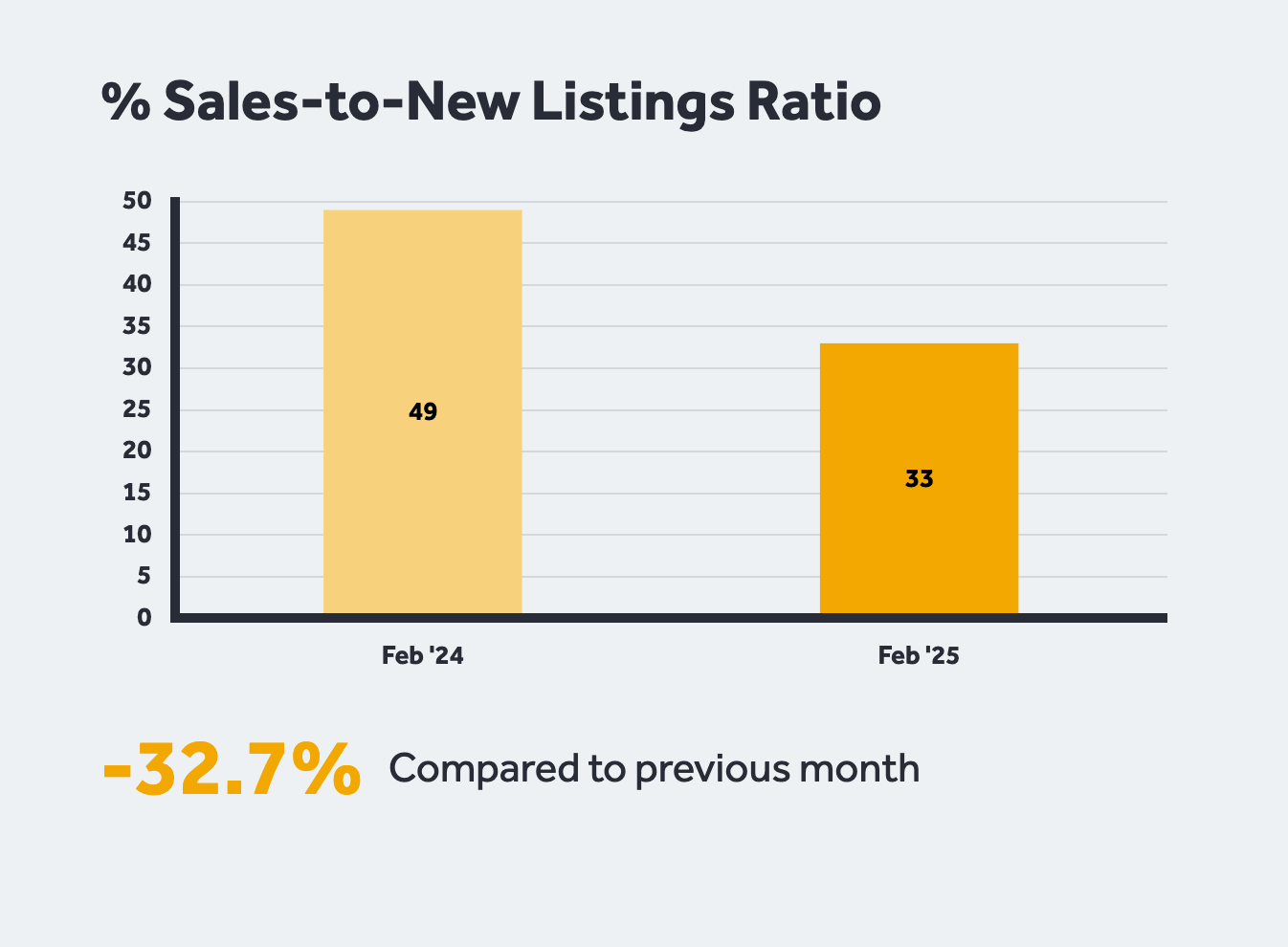

The GTA housing market in February 2025 clearly favoured buyers over sellers. The significant increase in available listings, combined with reduced sales, meant that buyers had greater negotiating power when making offers.

TRREB President Elechia Barry-Sproule acknowledged that while many GTA residents are eager to purchase homes, higher mortgage rates continue to impact affordability. However, she expressed optimism that borrowing costs could decline in the coming months, making homeownership more accessible.

“Many households in the GTA are eager to purchase a home, but current mortgage rates make it difficult for the average household income to comfortably cover monthly payments. Fortunately, we anticipate a decline in borrowing costs, which should improve affordability.”

With economic uncertainty still lingering—especially due to concerns over Canada’s trade relationship with the U.S.—many potential homebuyers are choosing to wait and see before making a purchase decision.

TRREB Chief Market Analyst Jason Mercer highlighted this sentiment, stating that if economic conditions stabilize and borrowing costs decrease, the second half of 2025 could see a rebound in sales activity.

“If trade uncertainty is alleviated and borrowing costs continue to trend lower, we could see much stronger home sales activity later this year.”

Home Prices Decline: What It Means for Sellers & Buyers

In addition to lower sales volume, GTA home prices also experienced a moderate decline in February 2025:

- The MLS® Home Price Index (HPI) Composite Benchmark declined by 1.8% YoY

- The average selling price fell 2.2% YoY to $1,084,547

On a seasonally adjusted basis, both the HPI Composite Benchmark and the average home price dropped slightly compared to January 2025, signaling a continued cooling in the market.

For Home Sellers:

- Sellers must price homes competitively to attract buyers in the current environment.

- Longer listing times are likely, as more inventory means buyers have multiple options.

For Home Buyers:

- More inventory = more choices and stronger negotiation power.

- Lower prices + potential rate cuts = improved affordability in the coming months.

Market Outlook: What to Expect in the Coming Months

Several key factors will shape the GTA housing market in 2025:

1. Interest Rate Cuts Could Revive Market Activity

Experts predict that Canada’s central bank may start cutting interest rates in mid-to-late 2025, which could lead to a surge in buyer demand. Lower rates will make mortgage payments more manageable, increasing housing affordability.

2. Economic & Trade Uncertainty Remains a Concern

Ongoing trade negotiations with the U.S. and overall economic stability will impact consumer confidence. If trade relations improve and economic uncertainty diminishes, more buyers may enter the market.

3. Policy Changes on Housing Supply & Affordability

With the Ontario provincial election behind us and federal policies in flux, housing supply and affordability remain hot-button issues. TRREB CEO John DiMichele emphasized the need for clear government direction:

“Policy makers need to clarify their plans for housing supply and affordability, as well as trade and economic strategies. Clear direction will go a long way to strengthen consumer confidence.”

4. Potential for a Stronger Second Half of 2025

If interest rates decrease and economic confidence rebounds, the GTA real estate market may experience a surge in sales activity in late 2025. Buyers who are currently waiting on the sidelines may re-enter the market, leading to increased competition.

Final Thoughts: Is Now a Good Time to Buy in GTA?

While February 2025 presented challenges for home sellers, it provided opportunities for buyers. With a higher inventory of listings, softer pricing, and the potential for lower interest rates, buyers may find favorable conditions to purchase homes in the GTA.

For Sellers: Pricing competitively and being patient will be key to securing a sale.

For Buyers: Now is the time to explore options and prepare for potential mortgage rate decreases later in the year.

As the market evolves, keeping an eye on mortgage rate trends, economic conditions, and government policy decisions will be essential for anyone planning to buy or sell in the GTA real estate market.

Check Out My Current Listings Below! |

||

|

|

|

|

|

|

|

|

|

|

Frequently Asked Questions (FAQs)

1. Why did GTA home sales decline in February 2025?

Home sales dropped 27.4% YoY due to high mortgage rates, economic uncertainty, and cautious buyer sentiment amid trade concerns.

2. Are home prices expected to drop further in 2025?

While prices dipped in February 2025, future trends will depend on interest rate cuts and economic conditions. A rebound is possible in late 2025 if borrowing costs decrease.

3. Is now a good time to buy a home in GTA?

Yes, buyers currently have strong negotiating power, a higher selection of listings, and may benefit from potential rate cuts later in 2025.

4. What impact will lower interest rates have on the housing market?

Lower rates will increase affordability, potentially leading to higher sales activity and price stabilization later in the year.

5. What should sellers do in the current market?

Sellers should price competitively, stage homes effectively, and be prepared for longer listing times due to increased inventory.

6. How does government policy impact the real estate market?

Housing policies on supply, affordability, and economic stability significantly influence market trends and consumer confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link