SOLD Property courtesy of YorkDurhamHomes

Just Listed – Kawartha Lakes Waterfront Property

Design by Gerald Lawrence

Enter February’s VIP Gift Card giveaway!

|

The Significance of the Kitchen in Homebuying Decisions

In the intricate dance of real estate transactions, where myriad factors influence the choice of a new abode, one element consistently emerges as a critical determinant: the kitchen.

Often hailed as the heart of the home, the kitchen holds sway over buyers’ minds and hearts, transcending its traditional role as a mere cooking space. In this extended exploration, we delve deeper into the multifaceted significance of the kitchen in the realm of homebuying.

Functionality and Efficiency:

At the core of the kitchen’s allure lies its functionality and efficiency. Homebuyers, keen on finding a sanctuary where daily routines seamlessly unfold, prioritize kitchens designed for optimal usability. A well-laid-out kitchen, equipped with ergonomic features such as ample counter space, strategically positioned appliances, and intelligently planned storage solutions, offers more than just a venue for culinary endeavors.

It becomes a sanctuary where the symphony of meal preparation unfolds effortlessly, transforming mundane tasks into moments of culinary creativity and familial bonding. For the discerning buyer, the kitchen represents a haven of efficiency, where the harmony of form and function orchestrates daily rituals with ease.

Aesthetics and Design:

Beyond its utilitarian purpose, the kitchen serves as a canvas for artistic expression and design innovation. Buyers, attuned to the visual harmony that pervades their living spaces, gravitate towards kitchens that exude aesthetic allure. From sleek, modern designs characterized by clean lines and minimalist sensibilities to cozy, rustic retreats infused with warmth and charm, the spectrum of kitchen aesthetics is as diverse as the individuals who inhabit them.

Meticulously chosen finishes, stylish fixtures, and thoughtfully curated accents converge to create a visual symphony that resonates with the buyer’s sense of style and sensibility. In the pursuit of their dream home, buyers seek kitchens that transcend mere functionality, offering an immersive sensory experience that tantalizes the eye and uplifts the spirit.

Social and Entertaining Spaces:

In an era marked by the celebration of social connectivity and communal living, the kitchen emerges as a nexus of social interaction and conviviality. Buyers, envisioning a lifestyle characterized by vibrant gatherings and cherished moments shared with loved ones, prioritize kitchens designed for entertaining. Open-concept layouts seamlessly integrate the kitchen with adjoining living spaces, fostering a sense of connectivity and inclusivity that transcends physical boundaries.

From casual brunches with friends to elaborate dinner parties that unfold with theatrical flair, the kitchen serves as a stage for culinary artistry and social engagement. In the eyes of the discerning buyer, a well-appointed kitchen isn’t merely a functional space—it’s a dynamic hub of social activity and shared experiences, where the tapestry of life unfolds in all its richness and complexity.

Investment Potential:

Beyond its intrinsic value as a living space, the kitchen holds considerable investment potential for both buyers and sellers alike. Recognizing the pivotal role that kitchens play in shaping buyer perceptions and driving purchasing decisions, sellers are increasingly inclined to invest in kitchen renovations and upgrades. From modernizing outdated fixtures to incorporating state-of-the-art appliances and premium finishes, strategic enhancements can significantly elevate a property’s market value and desirability.

Savvy buyers, attuned to the transformative power of kitchen renovations, view such investments not as expenses, but as strategic opportunities to enhance their quality of life and maximize their return on investment. In this symbiotic relationship between buyer and seller, the kitchen emerges as a focal point of negotiation and investment, where the promise of future returns converges with the pursuit of personal fulfillment and domestic bliss.

In the grand tapestry of homebuying decisions, the kitchen stands as a luminous thread that weaves together disparate elements of functionality, aesthetics, social connectivity, and investment potential. Beyond its role as a mere culinary workspace, the kitchen embodies the essence of home—a sanctuary where daily rituals are imbued with meaning, and cherished memories are forged amidst the warmth of familial bonds.

As buyers embark on their quest for the perfect abode, they find themselves inexorably drawn to kitchens that transcend the ordinary, offering a sanctuary where the art of living unfolds in all its splendor and grace. In the timeless dance of real estate transactions, the kitchen reigns supreme as a beacon of comfort, creativity, and domestic harmony—a testament to the enduring significance of home in the human experience.

Enhancing Your Home’s Curb Appeal: Elevate Your Property’s First Impression

Landscaping forms the foundation of your home’s exterior aesthetics. Start by maintaining a well-manicured lawn, trimmed hedges, and neatly pruned trees. Add pops of color with seasonal flowers and plants to create a welcoming ambiance. Consider investing in professional landscaping services for a polished look that complements your home’s architecture.

Exterior Painting: Refresh and Renew

A fresh coat of paint can breathe new life into your home’s exterior. Choose colours that complement your surroundings while reflecting your style. Pay attention to details like the front door, shutters, and trim, as these accents can make a significant impact. Don’t forget to prep the surfaces properly for long-lasting results.

Upgrade Your Front Door: The Gateway to Welcome

The front door is the focal point of your home’s facade. Consider upgrading to a stylish, energy-efficient door that enhances both security and aesthetics. Opt for bold colours or unique designs to make a statement and create a memorable first impression. Complete the look with complementary hardware and lighting fixtures.

Illuminate Your Entryway: Guiding Light

Well-placed outdoor lighting enhances safety and adds a touch of elegance to your home’s exterior. Install fixtures along pathways, near the front door, and around landscaping features to create visual interest and highlight architectural details. Choose energy-efficient LED lights for cost-effective and environmentally friendly solutions.

Upgrade Your Garage Door: Seamless Integration

The garage door often occupies a significant portion of the home’s facade. Replace outdated or worn garage doors with modern, stylish options that complement your home’s architecture. Choose materials and finishes that blend seamlessly with the overall aesthetic while prioritizing functionality and durability.

Clean and Maintain Exterior Surfaces: Shine Bright

Regular cleaning and maintenance are essential for preserving your home’s exterior surfaces. Pressure wash siding, decks, and driveways to remove dirt, grime, and mildew buildup. Repair any cracks or damage to stucco, brick, or wood surfaces promptly to prevent further deterioration and maintain curb appeal.

Add Architectural Details: Character and Charm

Architectural details can add character and charm to your home’s exterior. Consider installing decorative trim, moulding, or brackets to enhance the visual interest and break up large expanses of siding. Incorporate elements like window boxes, pergolas, or awnings to create depth and dimension.

Upgrade Your Mailbox and Address Numbers: Attention to Detail

Small details like the mailbox and address numbers can make a big difference in your home’s curb appeal. Choose stylish, durable mailbox designs that complement your home’s style and colour scheme. Ensure that address numbers are prominently displayed and easy to read from the street for added convenience.

Create Outdoor Living Spaces: Extend Your Home’s Appeal

Outdoor living spaces are increasingly popular and can significantly enhance your home’s curb appeal. Create inviting areas for relaxation and entertainment with comfortable seating, dining areas, and outdoor kitchens. Incorporate landscaping elements like pergolas, fire pits, or water features to create a tranquil oasis.

Enhance Your Entryway: Inviting and Welcoming

The entryway sets the tone for the rest of your home. Make it inviting and welcoming with stylish furniture, accessories, and decor. Add a welcoming doormat, seasonal wreath, or potted plants to add warmth and personality. Consider upgrading the porch flooring or adding a porch swing for added charm.

Conceal Eyesores: Strategic Solutions

Every home has its flaws, but strategic solutions can help conceal or minimize them. Hide unsightly features like air conditioning units, utility boxes, or trash bins with clever landscaping, fencing, or decorative screens. Create visual distractions with focal points like water features or garden art to draw attention away from problem areas.

Invest in Professional Photography: Capture the Beauty

Once you’ve enhanced your home’s curb appeal, don’t forget to document it with professional photography. High-quality images can showcase your property’s best features and attract potential buyers or renters. Highlight architectural details, landscaping, and outdoor living spaces to create a compelling visual narrative that resonates with viewers.

Elevating your home’s curb appeal is a worthwhile investment that pays dividends in both aesthetic appeal and property value. By implementing these tips and paying attention to detail, you can create a welcoming exterior that leaves a lasting impression on visitors and passersby alike. Remember that even small changes can make a big difference in enhancing your home’s overall appeal and making it stand out in the neighbourhood.

Tighter Market Conditions in January 2024 When Compared to the Previous Year

TRREB: Tighter Market Conditions in January 2024 When Compared to the Previous Year

TORONTO, ONTARIO, February 6, 2024 – Home sales were up in January 2024 in comparison to January 2023. This annual increase came as some homebuyers started to benefit from lower borrowing costs associated with fixed rate mortgage products. New listings were also up year-over-year but by a lesser annual rate compared to sales. The resulting tighter market conditions when compared to the same period a year earlier, potentially points toward renewed price growth as we move into the spring market.

“We had a positive start to 2024. The Bank of Canada expects the rate of inflation to recede as we move through the year. This would support lower interest rates which would bolster home buyers’ confidence to move back into the market. First-time buyers currently facing high average rents would benefit from lower mortgage rates, making the move to homeownership more affordable,” said TRREB President Jennifer Pearce.

There were 4,223 sales reported through TRREB’s MLS® System in January 2024 – an increase of more than one-third compared to January 2023. The number of new listings was also up year-over-year but by a lesser annual rate of approximately six percent. Stronger sales growth relative to listings suggests buyers experienced tighter market conditions compared to a year ago.

On a month-over-month seasonally adjusted basis, both sales and new listings were up. Sales increased more than listings which means market conditions tightened relative to December 2023.

“Once the Bank of Canada actually starts cutting its policy rate, likely in the second half of 2024, expect home sales to pick up even further. There will be more competition between buyers in 2024 as demand picks up and the supply of listings remains constrained. The end result will be upward pressure on selling prices over the next two years,” said TRREB Chief Market Analyst Jason Mercer.

The MLS® Home Price Index Composite in January 2024 was down by less than one per cent year-over-year in January. The average selling price was down by one per cent year-over-year to $1,026,703. On a month-over-month seasonally adjusted basis, both the MLS® HPI Composite and the average selling price also trended lower.

“While housing market conditions are expected to improve with lower borrowing costs, there are still a number of policy issues that need to be addressed. At the federal level, more reflection on the Office of the Superintendent of Financial Institution (OSFI) mortgage stress test is required, especially to its application at different points in the interest rate cycle. The focus for the Province needs to remain on building 1.5 million new homes. At the municipal level, raising property taxes without consistent support from the federal and provincial governments won’t eliminate Toronto’s structural deficit. Helping first-time homebuyers get into the ownership

Sellers Are Coming: Over The Next 2 Years | 7 Million People Turn 65

In the dynamic realm of real estate, trends and demographics play a pivotal role in shaping the market landscape. A significant shift is on the horizon as the next two years will witness a surge of individuals turning 65 – a staggering 7 million people to be exact. This demographic milestone has profound implications for the real estate market, particularly for sellers. As a REALTOR® in Ontario, Canada, it is crucial to anticipate and adapt to the evolving needs of this aging population.

The first ripple effect of this demographic shift is the influx of homes hitting the market. With a significant portion of the population reaching retirement age, there will be a surge in properties for sale. This surge not only presents opportunities for buyers but also challenges for sellers in a more competitive market. As your REALTOR®, it becomes imperative to strategically position your properties and effectively market them to stand out in this influx. Please reach out to me as soon as you can so we can discuss the real estate opportunities as you make your retirement plans.

Furthermore, the unique preferences and requirements of this aging demographic will necessitate a nuanced approach to real estate transactions. Older sellers may have distinct needs, such as downsizing or seeking homes with accessibility features. Tailoring services to accommodate these needs will be essential in providing exceptional service and ensuring client satisfaction. As a Senior’s Real Estate Specialist – SRES®, I have gained special training and experience to handle the unique situations around this demographic of sellers and buyers.

Beyond the immediate implications for the housing market, the economic impact of this demographic shift cannot be overlooked. The selling and buying of properties contribute significantly to the economy, and the sheer volume of transactions anticipated in the next two years will undoubtedly have ripple effects across various sectors.

Moreover, the rise of remote work has altered the real estate landscape, with individuals no longer bound by geographical constraints. This opens up opportunities for sellers as a broader pool of potential buyers may express interest in properties located in areas that are not as populous as Toronto, such as Durham Region, York Region, Simcoe County and Kawartha Lakes amongst others in Ontario, Canada. As a REALTOR®, I fully leverage digital platforms and marketing strategies to reach this expanded audience which becomes crucial for success of my sellers seeking maximum exposure for the highest price in the shortest time

Despite the opportunities, challenges also arise. Increased competition among sellers may put pressure on pricing strategies. REALTORS® must navigate this landscape adeptly, employing strategic pricing models and negotiation skills to ensure optimal outcomes for their clients or for buyer clients who want to leave no stones unturned when looking for the perfect property.

The demographic shift also underscores the importance of staying abreast of evolving market dynamics and trends. As a REALTOR® in Ontario, continuous education and adaptation to emerging market conditions have been essential to me for providing clients with informed guidance and facilitating seamless transactions, especially as it relates to new real estate laws, provincial rules and federal regulations that get introduced or changed from time to time.

In conclusion, the next two years promise a significant wave of sellers entering the real estate market, driven by the aging demographic turning 65. As a REALTOR® in Ontario, recognizing the multifaceted implications of this demographic shift and adapting strategies accordingly will be paramount. Therefore, I am fully embracing innovation, understanding unique client needs, and staying informed about market trends that will position me for success on behalf of my clients in navigating this exciting yet challenging landscape.

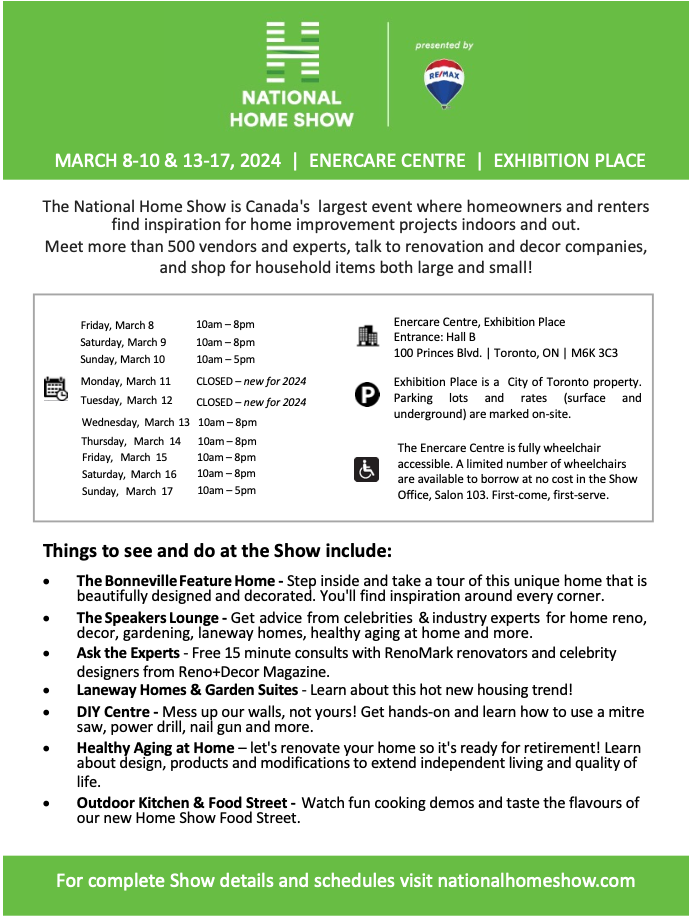

Get a FREE Ticket To The National Home Show!

Unveiling the National Home Show: A Must-Attend Event in Toronto, Ontario, Canada

As a proud resident of Ontario, Canada, you likely have an appreciation for the vibrant and dynamic real estate scene in the province. For those with a keen interest in home improvement, interior design, and the latest trends in the housing market, the National Home Show in Toronto stands out as a must-attend event.

Overview of the National Home Show:

The National Home Show, hosted annually at the Enercare Centre in Exhibition Place, Toronto, is a premier exhibition that brings together industry experts, professionals, and enthusiasts. This event serves as a one-stop destination for all things related to homes, providing invaluable insights, inspiration, and the latest innovations in the real estate and home improvement sectors.

What to Expect:

Spanning from March 8-10th and 13-17th, the National Home Show promises an exciting array of exhibits, workshops, and presentations. Renowned experts and influencers in the real estate and home improvement industry gather to showcase the latest trends, technologies, and designs. From cutting-edge smart home solutions to eco-friendly innovations, the event caters to a diverse audience with varied interests.

Exclusive Offer for Clients:

As a keen REALTOR®, it’s my pleasure to extend an exclusive offer to you. I am delighted to offer One-(1) FREE ticket for the National Home Show, allowing you and if you refer another person to register who can be a family member, friend, co-worker or colleague to immerse yourselves in the wealth of knowledge and inspiration that the event has to offer. ONLY 1 TICKET per person.

How to Redeem Your Free Tickets:

If you would like to claim your complimentary tickets, all you need to do is sign up for the Neighbourhood News Report and/or get an INSTANT Free Home Value in 10 Seconds. Once you’ve done so, I will make sure that you and your plus one receive your passes promptly. Please note that this offer is available for a limited time only, so act quickly to secure your spot at this prestigious event.

Networking Opportunities:

Besides showcasing fascinating exhibits, the National Home Show serves as an excellent platform for networking. Connect with industry professionals, and potential clients, and stay ahead of the curve in the ever-evolving real estate landscape.

Conclusion:

The National Home Show is not just an event; it’s an experience that promises to elevate your understanding of the real estate and home improvement sectors. Avail yourself of this exclusive offer and join us at the Enercare Centre in Toronto from March 8-10th and 13-17th for a weekend filled with innovation, inspiration, and invaluable connections.

I look forward to seeing you at the National Home Show!

Jan 24, 2024 | Bank of Canada maintains policy rate, continues quantitative tightening

The Bank of Canada today held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

Global economic growth continues to slow, with inflation easing gradually across most economies. While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment. In the euro area, the economy looks to be in a mild contraction. In China, low consumer confidence and policy uncertainty will likely restrain activity. Meanwhile, oil prices are about $10 per barrel lower than was assumed in the October Monetary Policy Report (MPR). Financial conditions have eased, largely reversing the tightening that occurred last autumn.

The Bank now forecasts global GDP growth of 2½% in 2024 and 2¾% in 2025, following 2023’s 3% pace. With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025.

In Canada, the economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024. Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted. With weak growth, supply has caught up with demand and the economy now looks to be operating in modest excess supply. Labour market conditions have eased, with job vacancies returning to near pre-pandemic levels and new jobs being created at a slower rate than population growth. However, wages are still rising around 4% to 5%.

Economic growth is expected to strengthen gradually around the middle of 2024. In the second half of 2024, household spending will likely pick up and exports and business investment should get a boost from recovering foreign demand. Spending by governments contributes materially to growth through the year. Overall, the Bank forecasts GDP growth of 0.8% in 2024 and 2.4% in 2025, roughly unchanged from its October projection.

CPI inflation ended the year at 3.4%. Shelter costs remain the biggest contributor to above-target inflation. The Bank expects inflation to remain close to 3% during the first half of this year before gradually easing, returning to the 2% target in 2025. While the slowdown in demand is reducing price pressures in a broader number of CPI components and corporate pricing behaviour continues to normalize, core measures of inflation are not showing sustained declines.

Given the outlook, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. The Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation. Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour. The Bank remains resolute in its commitment to restoring price stability for Canadians.

Information note

The next scheduled date for announcing the overnight rate target is March 6, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on April 10, 2024.

The real estate market inside scoop for the community you love. See homes that are for sale and have recently sold. Find out if home sales in your neighbourhood are trending up or down. See what homes around you are currently selling for.

Navigating the Ontario Real Estate Market: A Guide for First-Time Homebuyers

Embarking on the journey of purchasing your first home in Ontario is an exciting but sometimes overwhelming experience. From understanding the market dynamics to taking advantage of government incentives, there’s much to consider. In this blog post, we’ll explore essential tips for first-time homebuyers in Ontario, with a special focus on the government’s First-Time Home Buyer Incentive programs.

Financial Preparedness:

Before diving into the market, assess your financial situation. Establish a budget, taking into account not just the purchase price but also closing costs, moving expenses, and potential renovations. Being financially prepared is a crucial first step.

Explore First-Time Home Buyer Incentives:

The Ontario government offers incentives to support first-time homebuyers. Programs like the First-Time Home Buyer Incentive (FTHBI) can provide shared equity loans, reducing the overall mortgage burden. Research and understand the eligibility criteria and benefits of these incentives.

Get Pre-Approved for a Mortgage:

Knowing your budget beforehand is essential. Secure a mortgage pre-approval to understand how much you can borrow and to show sellers that you are a serious and qualified buyer.

Understand Market Trends:

Stay informed about the current real estate market trends in Ontario. Knowing whether it’s a buyer’s or seller’s market can influence your negotiation strategy and timing.

Work with a REALTOR®:

Engaging the services of a professional REALTOR® like myself can be invaluable, especially for first-time buyers. As Realtors we can provide insights into neighbourhoods, guide you through the buying process, and help you make informed decisions.

Consider Additional Costs:

Beyond the purchase price, factor in additional costs such as property taxes, utilities, and potential homeowners’ association fees. Being aware of these expenses will prevent unexpected financial strain.

Attend Open Houses:

Visit open houses to get a feel for different neighborhoods and property types. This hands-on approach helps you refine your preferences and priorities.

Inspect Before You Invest:

A thorough home inspection is crucial. Identify potential issues before finalizing the purchase to avoid unexpected expenses down the line.

Be Mindful of Closing Costs:

Closing costs can add up, including legal fees, land transfer taxes, and home insurance. Understand these costs in advance to avoid any last-minute surprises.

Plan for the Future:

Consider your long-term plans and whether the property aligns with your future goals. A home is a significant investment, and thinking ahead can contribute to a more successful and satisfying purchase.

Conclusion:

Navigating the Ontario real estate market as a first-time homebuyer requires careful planning and consideration. By incorporating these tips and exploring government incentive programs like the First-Time Home Buyer Incentive, you can make informed decisions and embark on your homeownership journey with confidence. Remember, with the right preparation, your first home purchase in Ontario can be a rewarding and fulfilling experience.

Mastering the Art of Home Staging: Your Guide to a Swift Home Sale!

In the bustling Ontario real estate market, making a memorable first impression is crucial for a quick and successful home sale. One of the key strategies to achieve this is effective home staging. In this blog post, we’ll explore essential home staging tips tailored to the Ontario market, helping sellers create a captivating environment that resonates with potential buyers.

- Declutter and Depersonalize:

Begin the home staging process by decluttering and depersonalizing your space. Remove personal items, excessive furniture, and any clutter that might distract potential buyers. This allows them to envision the space as their own and emphasizes the property’s potential. - Highlight Key Features:

Identify and emphasize the unique features of your home. Whether it’s a stunning fireplace, spacious kitchen, or picturesque window views, showcasing these highlights can leave a lasting impression on potential buyers.

- Let in Natural Light:

Ontario is known for its beautiful natural light especially during the summer months. Maximize this asset by opening curtains and blinds during showings. Well-lit spaces feel more inviting and spacious, contributing to a positive viewing experience. - Neutralize Color Palette:

Neutral tones create a blank canvas that appeals to a broader audience. Consider repainting walls in soft, neutral colors and using neutral-colored furnishings. This not only enhances the overall aesthetic but also helps potential buyers envision their own décor in the space.

- Invest in Quality Photography:

In today’s digital age, many homebuyers begin their search online. High-quality photos are essential for attracting attention and encouraging potential buyers to schedule a viewing. Consider hiring a professional photographer to capture your home’s best angles. - Arrange Furniture Thoughtfully:

Proper furniture placement can enhance the flow and functionality of each room. Arrange furniture in a way that highlights the room’s purpose and makes it easy for potential buyers to navigate.

- Create Inviting Outdoor Spaces:

In Ontario, outdoor spaces are highly valued. Ensure that your yard, balcony, or patio is well-maintained and inviting. Consider adding cozy seating, potted plants, or outdoor lighting to enhance the appeal of these areas. - Address Minor Repairs:

Take care of any minor repairs or maintenance issues before listing your home. This includes fixing leaky faucets, squeaky doors, and any visible signs of wear and tear. A well-maintained home suggests that it has been cared for, instilling confidence in potential buyers.

- Stage Each Room’s Purpose:

Clearly define the purpose of each room to help potential buyers visualize their lifestyle in the space. If you have a multipurpose room, consider staging it with a specific function in mind to avoid confusion. - Keep it Fresh:

Lastly, ensure your home is clean, fresh, and inviting. Open windows for ventilation, use air fresheners sparingly, and consider adding fresh flowers or plants to enhance the overall atmosphere.

Conclusion:

Effective home staging is an invaluable tool in the competitive Ontario real estate market. By creating a visually appealing and welcoming environment, sellers increase the likelihood of capturing the attention of potential buyers, ultimately leading to a quicker and more successful home sale. Implement these tips to make your property stand out in the bustling real estate landscape.

The Power of Pre-Listing Home Inspections in Ontario Real Estate

In the competitive and dynamic real estate market of Ontario, sellers are often seeking ways to stand out and streamline the selling process. One strategy gaining popularity is the utilization of pre-listing home inspections.

In this blog post, we’ll explore the significance of this proactive approach and how it can positively impact the real estate journey for both sellers and buyers.

- Setting the Stage for a Smooth Transaction:

A pre-listing home inspection involves assessing a property’s condition before it hits the market. By identifying potential issues upfront, sellers can address them proactively, minimizing surprises during the negotiation phase. This transparency fosters a smoother transaction and builds trust with potential buyers.

- Building Seller Confidence:

Knowing the ins and outs of their property allows sellers to confidently discuss its condition with potential buyers. This knowledge empowers sellers to make informed decisions, answer buyer inquiries with confidence, and potentially justify their asking price.

- Attracting Serious Buyers:

Buyers often appreciate the transparency and effort put into a pre-listing inspection. They are more likely to consider a property that has undergone this process as it signals the seller’s commitment to an honest and transparent transaction. This can attract serious and qualified buyers.

- Pricing Accuracy:

A pre-listing inspection helps sellers accurately price their homes. By factoring in the condition of the property and any necessary repairs, sellers can set a fair and competitive asking price. This can lead to quicker sales and potentially higher offers.

- Minimizing Negotiation Hurdles:

With known issues addressed beforehand, there are fewer negotiation hurdles during the sale. Buyers are less likely to request extensive repairs or demand price reductions, as they are already aware of the property’s condition.

- Expediting the Closing Process:

Pre-listing inspections contribute to a faster closing process. With fewer surprises, the time-consuming back-and-forth negotiations are minimized, expediting the transition from offer acceptance to closing.

- Enhancing Marketability:

A property with a clean bill of health from a pre-listing inspection is inherently more marketable. Sellers can leverage this advantage in marketing materials, emphasizing the property’s well-maintained condition and the confidence they have in its structural integrity.

- Strengthening Negotiation Position:

Armed with a comprehensive inspection report, sellers have a stronger negotiation position. They can confidently discuss the property’s strengths and acknowledge any weaknesses, contributing to a more balanced negotiation process.

Conclusion:

In the competitive Ontario real estate landscape, a pre-listing home inspection is a powerful tool that benefits both sellers and buyers. From instilling confidence in sellers to attracting serious buyers and expediting the closing process, this proactive approach is a win-win for all parties involved, ultimately contributing to a more efficient and transparent real estate transaction.

➡ OFFER: If you are thinking or selling within the next 6-12 months, please feel free to contact me to discuss your plans along with me providing a no-obligation in-depth home market analysis. In the meantime, if you want a quick FREE Instant Home Value in only 10 seconds, click this link.

Property Pre-Qualification & Pre-Approval Guide

Securing pre-approval is a pivotal step for homebuyers in Canada, as it provides a more comprehensive and concrete commitment from lenders compared to pre-qualification. To initiate this process, prospective buyers should gather essential financial documents, including proof of income, employment verification, and details about existing debts. These documents help lenders assess the buyer’s financial stability and capacity to repay a mortgage, forming the basis for a pre-approval decision.

Choosing a reputable mortgage professional or financial institution is paramount when seeking pre-approval. The selected expert will carefully review the buyer’s financial documentation, conducting a thorough analysis of their creditworthiness. This evaluation goes beyond the initial pre-qualification, providing a more accurate estimate of the loan amount the buyer can secure. With pre-approval, buyers gain a clearer understanding of their budget, streamlining the home search process and allowing them to focus on properties within their financial means. Please contact me so I can refer you to the trusted and highly recommended mortgage professionals that my clients and brokerage have used.

Upon successful pre-approval, buyers receive a formal commitment from the lender, often in the form of a letter. This document specifies the approved loan amount, interest rate, and other pertinent details. Armed with this pre-approval letter, buyers demonstrate to sellers that they are not only serious about purchasing a home but also financially capable. In a competitive real estate market, having pre-approval significantly enhances a buyer’s negotiating power and increases the likelihood of their offer being accepted.

Buyers should be aware that pre-approval typically has a validity period, usually ranging from 60, 90 or 120 days. During this time, it is crucial for buyers to actively search for a home and finalize their purchase. If the homebuying process extends beyond the pre-approval‘s expiration date, they may need to undergo the process again, taking into account any changes in their financial circumstances.

In conclusion, obtaining pre-approval is a strategic move for homebuyers in Canada. By diligently preparing financial documentation, collaborating with a trusted mortgage professional, and actively pursuing properties within their approved budget, buyers can position themselves as serious and capable contenders in the competitive real estate landscape. The pre-approval process not only streamlines the home buying journey but also instills confidence in both buyers and sellers throughout the transaction.

REALTOR® Cooperation Policy Comes into Force January 2024

On January 3, 2024, the REALTOR® Cooperation Policy will be enforced, bringing into operation the new “Duty of Cooperation” as outlined in Article 30 of the REALTOR® Code.

What is mandated by this policy?

- In cases where public marketing of a residential listing takes place, REALTORS® must ensure the inclusion of the listing on an MLS® System within the timeframe specified by their respective board or association, unless an exemption is applicable. The policy allows for a maximum timeframe of up to three-(3) days.

Are there any exemptions?

- The policy does not restrict brokers from exclusively representing a buyer or seller.

- Moreover, it stipulates that REALTORS® must apprise their seller clients of the advantages of marketing their listing on an MLS® System. Should the seller opt to forgo the benefits of public marketing, this decision must be confirmed in writing.

What is defined as public marketing?

- Public marketing refers to reaching out to the general public and/or any REALTOR® not directly affiliated with the listing brokerage/office in a business capacity.

- It is not categorized as public marketing when a listing REALTOR® directly markets to REALTORS® from another brokerage or office. “One-to-one” marketing does not trigger the policy, while “one-to-many” does.

How does this policy positively impact you and your clients?

- Benefits for sellers: Inclusion on an MLS® System enhances exposure to potential buyers.

- Benefits for buyers: A greater number of sellers on MLS® Systems translates to increased options for buyers.

- Benefits for REALTORS®: Collaboration between REALTORS® remains fundamental to the success of every real estate transaction.

The real estate market inside scoop for the community you love. See homes that are for sale and have recently sold. Find out if home sales in your neighbourhood are trending up or down. See what homes around you are currently selling for.

Ontario Modernizing Rules Governing Province’s Real Estate Services Sector

News Release From The Ministry of Public and Business Service – Ontario

New protections designed to strengthen consumer confidence when dealing with brokerages, brokers, and salespersons

November 28, 2023

TORONTO — The Ontario government is updating the rules governing the province’s real estate brokerages, brokers, and salespersons to strengthen consumer protection, educate home buyers and sellers, and enhance professionalism. The new rules, effective December 1, 2023, will give Ontarians more choice in the real estate trade process by allowing a brokerage to disclose the details of competing offers. They also include an updated Code of Ethics to strengthen professional obligations related to integrity, conflict of interest and the prevention of fraud.

“Buying, leasing and selling real estate is one of the biggest and most important decisions a person or business will ever make so it’s critical that rules for real estate brokerages, brokers, and salespersons reflect modern business practices that foster a strong and vibrant real estate market,” said Todd McCarthy, Minister of Public and Business Service Delivery. “We want to ensure Ontarians feel empowered and informed when participating in real estate transactions, and for professionals in the sector to be seen as trusted and ethical. These latest rule changes coming into effect December 1 will help us do just that.”

Phase 2 of legislative and regulatory changes introduced under the Trust in Real Estate Services Act (TRESA), 2020, will modernize the province’s real estate market by:

- Allowing real estate brokerages to disclose the details of competing offers if the seller directs them to do so, excluding personal or identifying information.

- Better protecting and educating Ontarians through enhanced disclosure requirements for real estate brokerages, brokers and salespersons (known as registrants) and the development of an information guide to help individuals make informed decisions when they trade in real estate.

- Requiring registrants to comply with an updated Code of Ethics that strengthens professionalism by focusing on their obligations related to integrity, quality of service and conflicts of interest.

- Providing the Real Estate Council of Ontario (RECO) with new powers and tools to better hold registrants accountable for non-compliance with the rules.

- Allowing brokerages to enter designated representation agreements so clients could be represented by a specific broker or salesperson at a brokerage who would actively promote their interests in a trade.

“Phase 2 of TRESA represents the most significant change in consumer protection measures for Ontario’s real estate sector since the 1990s,” said Michael Beard, Chief Executive Officer, Real Estate Council of Ontario (RECO). “Ontarians who buy or sell a home now have greater clarity on their rights, as well as the duties owed to them by real estate agents and brokerages. The changes also include new powers that will further strengthen RECO’s compliance and enforcement efforts. Ultimately, this represents important progress for consumers, while also enhancing professionalism for real estate salespeople and brokers.”

“Ontario’s REALTORS® are thrilled to see the Phase Two legislative and regulation changes come into effect. This marks a historic moment for real estate professionals in Ontario and is the result of a decade of hard work, advocacy and collaboration with the province,” said Tim Hudak, Chief Executive Officer, Ontario Real Estate Association (OREA). “Thanks to TRESA, Ontario will raise the bar on consumer protections and become a North American leader in professional standards, ethics, and modern business tools. OREA commends the Ontario government for their work on TRESA and looks forward to collaborating on the third phase of implementation.”

Quick Facts

- RECO administers and enforces the Real Estate and Business Brokers Act, 2002 (REBBA), the legislation governing Ontario’s brokerages, brokers and salespersons.

- On December 1, 2023, REBBA will be renamed the Trust in Real Estate Services Act, 2002.

- The Trust in Real Estate Services Act (TRESA), 2020, which amends REBBA, was passed by the legislature on February 28, 2020, and received Royal Assent on March 4, 2020.

- The first phase of changes related to TRESA, 2020, came into effect in October 2020. Those changes allowed salespersons and brokers to incorporate and be paid through a personal real estate corporation. They also allowed registrants to use more recognizable terms like “real estate agent” and “REALTOR®” in their advertisements to better reflect the services they provide.

- Additional regulations are required to fully implement the amendments made by TRESA, 2020.

Additional Resources

Media Contacts

Doug Allingham

Minister’s Office

doug.allingham@ontario.ca

Media Desk

Ministry of Public and Business Service Delivery Communications Branch

MPBSD.MediaRelations@ontario.ca

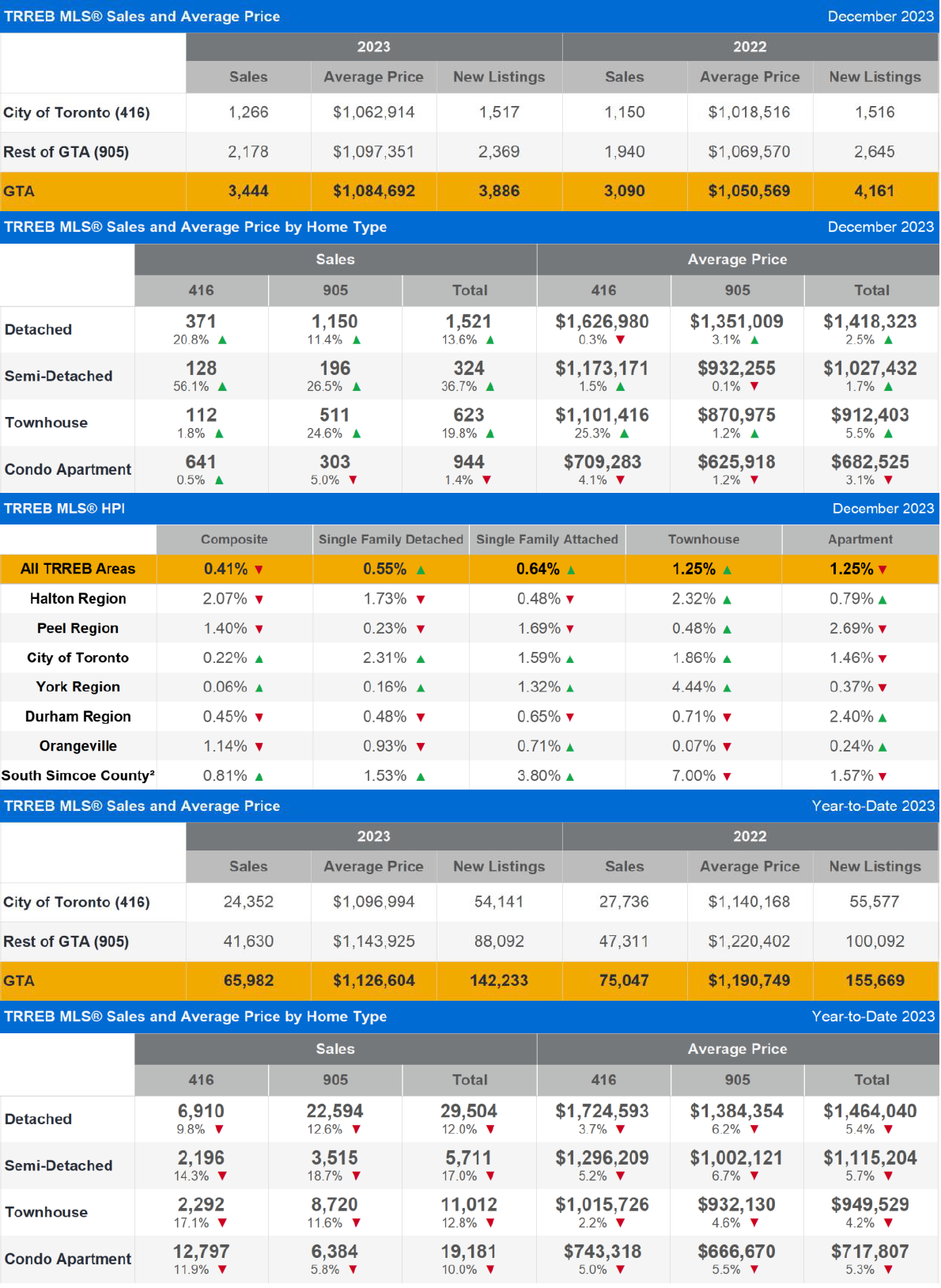

The 2023 GTA Housing Market: High Borrowing Costs and Growing Affordability Challenges

TRREB: The 2023 GTA Housing Market: High Borrowing Costs and Growing Affordability Challenges

TORONTO, ONTARIO, January 4, 2024 – While the overall demand for housing remained buoyed by record immigration in 2023, more of this demand was pointed at the rental market. The number of Greater Toronto Area (GTA) home sales in 2023 came in at less than 70,000 due to affordability issues brought about by high mortgage rates.

“High borrowing costs coupled with unrealistic federal mortgage qualification standards resulted in an unaffordable home ownership market for many households in 2023. With that said, relief seems to be on the horizon. Borrowing costs are expected to trend lower in 2024. Lower mortgage rates coupled with a relatively resilient economy should see a rebound in home sales this year,” said new Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

There were 65,982 home sales reported through TRREB’s MLS® System in 2023 – a 12.1 per cent dip compared to 2022. Despite an uptick during the spring and summer, the number of new listings also declined in 2023. The trend for listings has been largely flat-to-down over the past decade, which is problematic in the face of a steadily growing population. On a seasonally adjusted monthly basis, sales increased compared to November, while new listings declined for the third straight month.

The average selling price for all home types in 2023 was $1,126,604, representing a 5.4 per cent decline compared to 2022. On a seasonally adjusted monthly basis, the average selling price edged higher, while the MLS® Home Price Index Composite edged lower.

“Buyers who were active in the market benefitted from more choice throughout 2023. This allowed many of these buyers to negotiate lower selling prices, alleviating some of the impact of higher borrowing costs. Assuming borrowing costs trend lower this year, look for tighter market conditions to prompt renewed price growth in the months ahead,” said TRREB Chief Market Analyst Jason Mercer.

“Record immigration into the GTA in the coming years will require a corresponding increase in the number of homes available to rent or purchase. People need to have comfort in knowing that they can plan their lives and future with the certainty that they will have the stability of an affordable place to live,” said TRREB CEO John DiMichele.

TRREB is releasing its 2024 Market Outlook and Year in Review report and digital digest on Thursday, February 8. Discover the listings, sales and price forecast for 2024 and a more in-depth look at the 2023 housing market. The outlook will also include the latest Ipsos polling on home buying and selling intentions, homeowners’ viewpoints on government policy and taxation, and insights on immigration.

|

|

|

|

|

|

|

|

|

Happy New Year | 2024!

May this year bring you joy, success, and new opportunities. As we embark on another chapter, may it be filled with love, laughter, and memorable moments. Here’s to a prosperous and fulfilling year ahead!

The Pros and Cons of Listing Your Home for Sale in Winter: A Guide for Ontario Residents

In the dynamic real estate market of Ontario, Canada, deciding when to list your home for sale is a crucial decision. While many homeowners prefer the warmer months for the selling process, listing your property in winter comes with its own set of advantages and disadvantages. In this blog, we’ll explore both sides to help you make an informed decision.

Advantages of Winter Listings:

- Less Competition Because Of Fewer Listings:

- One significant advantage of listing your home in winter is the reduced competition. With fewer sellers on the market, your property may stand out more, attracting serious buyers looking to make a purchase despite the season.

- Motivated Buyers Who Are More Serious:

- Winter buyers are often more motivated. Whether due to job relocations, changes in family dynamics, or other factors, those looking for homes in winter are generally serious about making a purchase. This could lead to a quicker and smoother selling process.

- Cozy Atmosphere and Warm Ambience:

- Winter provides an opportunity to showcase the cozy and inviting aspects of your home. A well-heated, well-lit home can create a warm atmosphere that resonates with potential buyers during chilly weather.

Disadvantages of Winter Listings:

- Weather Challenges:

- Ontario winters can be harsh, with snow, ice, and cold temperatures. This can make it challenging for potential buyers to visit your property, leading to fewer showings. Additionally, weather-related issues may affect the overall market activity.

- However, this may not be as much a disadvantage since I use 3D Interactive Virtual Tours. In the competitive real estate market, a 3D Interactive Virtual Tour emerges as a powerful tool for sellers in Ontario, Canada, seeking to showcase their homes with unparalleled detail. This cutting-edge technology allows potential buyers to virtually navigate through every room, providing a realistic and immersive experience from the comfort of their own homes. Sellers benefit by thoroughly presenting their properties, highlighting unique features and intricate details that might be overlooked in traditional photographs. This interactive approach not only captures the attention of prospective buyers but also saves time by attracting individuals genuinely interested in the property’s layout and design. By offering a virtual walkthrough, sellers can effectively convey the true essence of their homes, fostering a stronger connection with potential buyers and increasing the likelihood of a successful sale.

- Curb Appeal:

- Winter landscapes may not showcase your property’s exterior as well as during the warmer months. Snow and ice can cover landscaping elements, making it harder for buyers to visualize the full potential of the outdoor space. As a seasoned Realtor®, I address this challenge by proactively scheduling professional photography and/or videos during the summer months whenever feasible. Moreover, I curate summer photos from homeowners’ family members and employ digital editing techniques to eliminate any individuals or pets from the visuals. Additionally, I leverage aerial photography resources available to Realtors, enhancing the overall visual presentation of the property. This meticulous approach ensures that the marketing materials accurately reflect the property’s features and appeal, providing potential buyers with a compelling and unobstructed view of the home.

- Holiday Distractions:

- The winter season is often filled with holidays and festivities, which can distract potential buyers. Schedules may be busier, and some individuals might postpone their home-buying decisions until after the holidays. While the statement holds validity, we believe that stunning holiday decorations can elevate the overall aesthetic of a space, offering potential buyers insights into how they might personally decorate the home. Despite the bustling nature of the holiday season for many individuals, it serves as a unique time for some families to explore properties collectively. This period may be one of the few instances in the year when families can thoroughly consider and decide on a property together, benefiting from the fact that they may have more time off from work than usual, facilitating joint decision-making with everyone’s input.

Conclusion:

Deciding when to list your home for sale in Ontario involves weighing the pros and cons of each season. While winter may present challenges, it also offers unique advantages, such as less competition and motivated buyers. Consider your specific circumstances, the condition of your home, and your target market to determine the best time to embark on the selling journey. Consulting with a professional REALTOR® like myself, I can provide valuable insights tailored to your situation. If you plan to list your home in the Spring instead, please check out my blog on what to do in the winter to prepare for listing your home in the Spring.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link