NO RATE CHANGE! But Still a Chance For Increase Next Time!

Bank of Canada maintains policy rate, continues quantitative tightening

The Bank of Canada today held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is also continuing its policy of quantitative tightening.

Inflation in advanced economies has continued to come down, but with measures of core inflation still elevated, major central banks remain focused on restoring price stability. Global growth slowed in the second quarter of 2023, largely reflecting a significant deceleration in China. With ongoing weakness in the property sector undermining confidence, growth prospects in China have diminished. In the United States, growth was stronger than expected, led by robust consumer spending. In Europe, strength in the service sector supported growth, offsetting an ongoing contraction in manufacturing. Global bond yields have risen, reflecting higher real interest rates, and international oil prices are higher than was assumed in the July Monetary Policy Report (MPR).

The Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures. Economic growth slowed sharply in the second quarter of 2023, with output contracting by 0.2% at an annualized rate. This reflected a marked weakening in consumption growth and a decline in housing activity, as well as the impact of wildfires in many regions of the country. Household credit growth slowed as the impact of higher rates restrained spending among a wider range of borrowers. Final domestic demand grew by 1% in the second quarter, supported by government spending and a boost to business investment. The tightness in the labour market has continued to ease gradually. However, wage growth has remained around 4% to 5%.

Recent CPI data indicate that inflationary pressures remain broad-based. After easing to 2.8% in June, CPI inflation moved up to 3.3% in July, averaging close to 3% in line with the Bank’s projection. With the recent increase in gasoline prices, CPI inflation is expected to be higher in the near term before easing again. Year-over-year and three-month measures of core inflation are now both running at about 3.5%, indicating there has been little recent downward momentum in underlying inflation. The longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.

With recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy, Governing Council decided to hold the policy interest rate at 5% and continue to normalize the Bank’s balance sheet. However, Governing Council remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behavior are consistent with achieving the 2% inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.

Information note

The next scheduled date for announcing the overnight rate target is October 25, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the Monetary Policy Report at the same time.

August 2023 VIP GiveAway

If you have already entered this contest, free to get a FREE Home Evaluation in 10 Seconds with No HASSLE!

August 2023 VIP Club Giveaway

August 2023 VIP Club GiveawayEnter your name and email address below. You’ll be entered in the a VIP Gift Card giveaway draw.

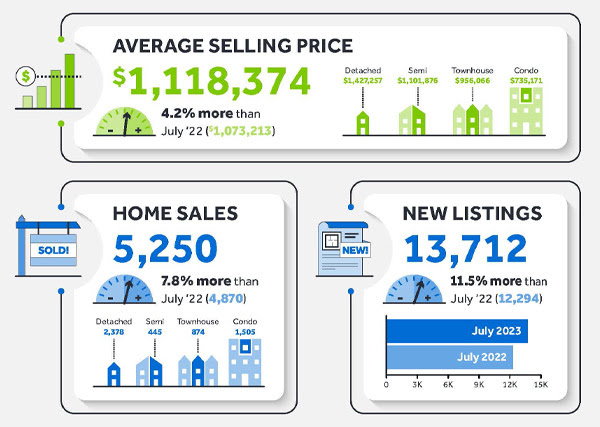

Interesting Change: See the July 2023 Real Estate Statistics for the Greater Toronto Area & Beyond!

GTA home sales, new listings, and home prices were up in July 2023 when compared to the same time last year.

Discover Your Dream Home in Oshawa, Ontario: A Kassigner Gem

Oshawa, Ontario – Nestled within the welcoming community of Oshawa, a hidden gem awaits, offering the perfect blend of comfort, convenience, and elegance. Introducing a superb Kassigner-built home that exudes charm and function, providing an idyllic family home for you and your loved ones.

A Perfect Family-Oriented Location

Located in a fantastic family-oriented area, this property boasts a prime location, making it a top choice for families seeking a warm and friendly neighborhood. With proximity to five top-notch schools, parents can rest assured their children will receive an excellent education.

Nature’s Playground at Your Doorstep

Nature lovers will rejoice in the abundance of green spaces nearby. Just a mere 5-minute stroll will lead you to three picturesque parks, offering endless opportunities for outdoor activities and quality family time. For more play options, you’ll find four inviting playgrounds and two expansive sports fields within a pleasant 20-minute walk.

Convenience at Your Fingertips

For those with a daily commute, the property’s unbeatable convenience comes to light. A transit stop is just 4 minutes away, providing easy access to public transportation options.

Exquisite Interior and Generous Spaces

Step inside to be greeted by stunning hardwood and tile floors on the main level, creating a warm and inviting ambiance. The second level showcases elegant parquet flooring, adding a classic touch to every room.

The home boasts four spacious bedrooms, offering ample space for your family’s comfort. Additionally, an unfinished fifth bedroom in the basement provides exciting possibilities for customizing your living space. With three total bathrooms, including one with a rough-in for an additional shower, there is tremendous potential for expanding your home to suit your needs.

A Garage Fit for Your Needs

No need to worry about parking space – the high and deep garage is perfect for accommodating your large vehicle, complete with a soaring 9ft header for extra height.

Your Private Oasis Awaits

Step outside to your own private oasis, a fully fenced backyard providing the perfect sanctuary for relaxation, entertaining friends, and creating cherished family memories.

Welcome Home

Don’t miss this incredible opportunity to call this beautiful property your forever home. Contact us today for more information and to schedule your private tour of this fantastic Kassigner gem.

Oshawa, Ontario offers the perfect blend of city amenities and a welcoming community, making it the ideal place to call home. Take the first step towards your dream life by discovering the charm and elegance of this superb Kassigner-built residence.

Disclaimer: This property is currently listed for $799,900. (Listing ID: E6701622)

Coldwell Banker R.M.R. Real Estate, Brokerage is a leading real estate agency in Durham Region, dedicated to helping you find your dream home. For inquiries and to book a viewing, please contact Gerald Lawrence at 416-556-0238.

Disclaimer: The above blog is for informational purposes only and is not a formal real estate listing. Prices and availability are subject to change. Please verify all information with the respective real estate agent.

Bank Of Canada Raises Overnight Interest Rates Again! – They are not done yet!

Bank of Canada raises policy rate 25 basis points, continues quantitative tightening

The Bank of Canada today increased its target for the overnight rate to 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is also continuing its policy of quantitative tightening.

Global inflation is easing, with lower energy prices and a decline in goods price inflation. However, robust demand and tight labour markets are causing persistent inflationary pressures in services. Economic growth has been stronger than expected, especially in the United States, where consumer and business spending has been surprisingly resilient. After a surge in early 2023, China’s economic growth is softening, with slowing exports and ongoing weakness in its property sector. Growth in the euro area is effectively stalled: while the service sector continues to grow, manufacturing is contracting. Global financial conditions have tightened, with bond yields up in North America and Europe as major central banks signal further interest rate increases may be needed to combat inflation.

The Bank’s July Monetary Policy Report (MPR) projects the global economy will grow by around 2.8% this year and 2.4% in 2024, followed by 2.7% growth in 2025.

Canada’s economy has been stronger than expected, with more momentum in demand. Consumption growth has been surprisingly strong at 5.8% in the first quarter. While the Bank expects consumer spending to slow in response to the cumulative increase in interest rates, recent retail trade and other data suggest more persistent excess demand in the economy. In addition, the housing market has seen some pickup. New construction and real estate listings are lagging demand, which is adding pressure to prices. In the labour market, there are signs of more availability of workers, but conditions remain tight, and wage growth has been around 4-5%. Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing.

As higher interest rates continue to work their way through the economy, the Bank expects economic growth to slow, averaging around 1% through the second half of this year and the first half of next year. This implies real GDP growth of 1.8% in 2023 and 1.2% in 2024. The economy will move into modest excess supply early next year before growth picks up to 2.4% in 2025.

Inflation in Canada eased to 3.4% in May, a substantial and welcome drop from its peak of 8.1% last summer. While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from easing underlying inflation. With the large price increases of last year out of the annual data, there will be less near-term downward momentum in CPI inflation. Moreover, with three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal.

In the July MPR projection, CPI inflation is forecast to hover around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in the January and April projections. Governing Council remains concerned that progress towards the 2% target could stall, jeopardizing the return to price stability.

In light of the accumulation of evidence that excess demand and elevated core inflation are both proving more persistent, and taking into account its revised outlook for economic activity and inflation, Governing Council decided to increase the policy interest rate to 5%. Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target. The Bank remains resolute in its commitment to restoring price stability for Canadians.

Information note

The next scheduled date for announcing the overnight rate target is September 6, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the Monetary Policy Report on October 25, 2023.

June 2023 Market Stats – Lack Of Listings Led to Tighter GTA Market Conditions in June – TRREB

LACK OF LISTINGS LED TO TIGHTER GTA MARKET CONDITIONS IN JUNE TRREB Urges Governments to Accelerate Action on Housing Supply TORONTO, ONTARIO, July 6, 2023 – Home sales and the average selling price in the Greater Toronto Area (GTA) in June 2023 remained above last year’s levels. Seasonally adjusted sales dipped on a month-over-month basis. The seasonally adjusted average selling price and the MLS® Home Price Index (HPI) Composite benchmark were up compared to the previous month.

“The demand for ownership housing is stronger than last year, despite higher borrowing costs. With this said, home sales were hampered last month by uncertainty surrounding the Bank of Canada’s outlook on inflation and interest rates. Furthermore, a persistent lack of inventory likely sidelined some willing buyers because they couldn’t find a home meeting their needs. Simply put, you can’t buy what is not available,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

GTA REALTORS® reported 7,481 sales through TRREB’s MLS® System in June 2023 – up 16.5 per cent compared to June 2022. The number of listings was down by three per cent over the same period.

The year-over-year increase in sales coupled with the decrease in new listings mean market conditions were tighter this past June relative to the same period last year. The average selling price was up by 3.2 per cent to $1,182,120. The MLS® HPI Composite benchmark was still down by 1.9 per cent on a yearover-year basis – the lowest annual rate of decline in 2023. On a month-over-month basis the seasonally adjusted average price and MLS® HPI Composite benchmark were up.

“A resilient economy, tight labour market and record population growth kept home sales well above last year’s lows. Looking forward, the Bank of Canada’s interest rate decision this month and its guidance on inflation and borrowing costs for the remainder of 2023 will help us understand how much sales and price will recover beyond current levels,” said TRREB Chief Market Analyst Jason Mercer.

“GTA municipalities continue to lag in bringing new housing online at a pace sufficient to make up for the current deficit and keep up with record population growth. Leaders at all levels of government, including the new mayor-elect of Toronto, have committed to rectifying the housing supply crisis. We need to see these commitments coming to fruition immediately, or we will continue to fall further behind each month,” stressed TRREB CEO John DiMichele.

“In addition to the impact of the listing shortage, housing affordability is also hampered on an ongoing basis by taxation and fees associated with home sales and construction as well as the general level of taxation impacting households today. Going forward, we need to look at all of the factors influencing the household balance sheet and people’s ability to house themselves,” continued DiMichele.

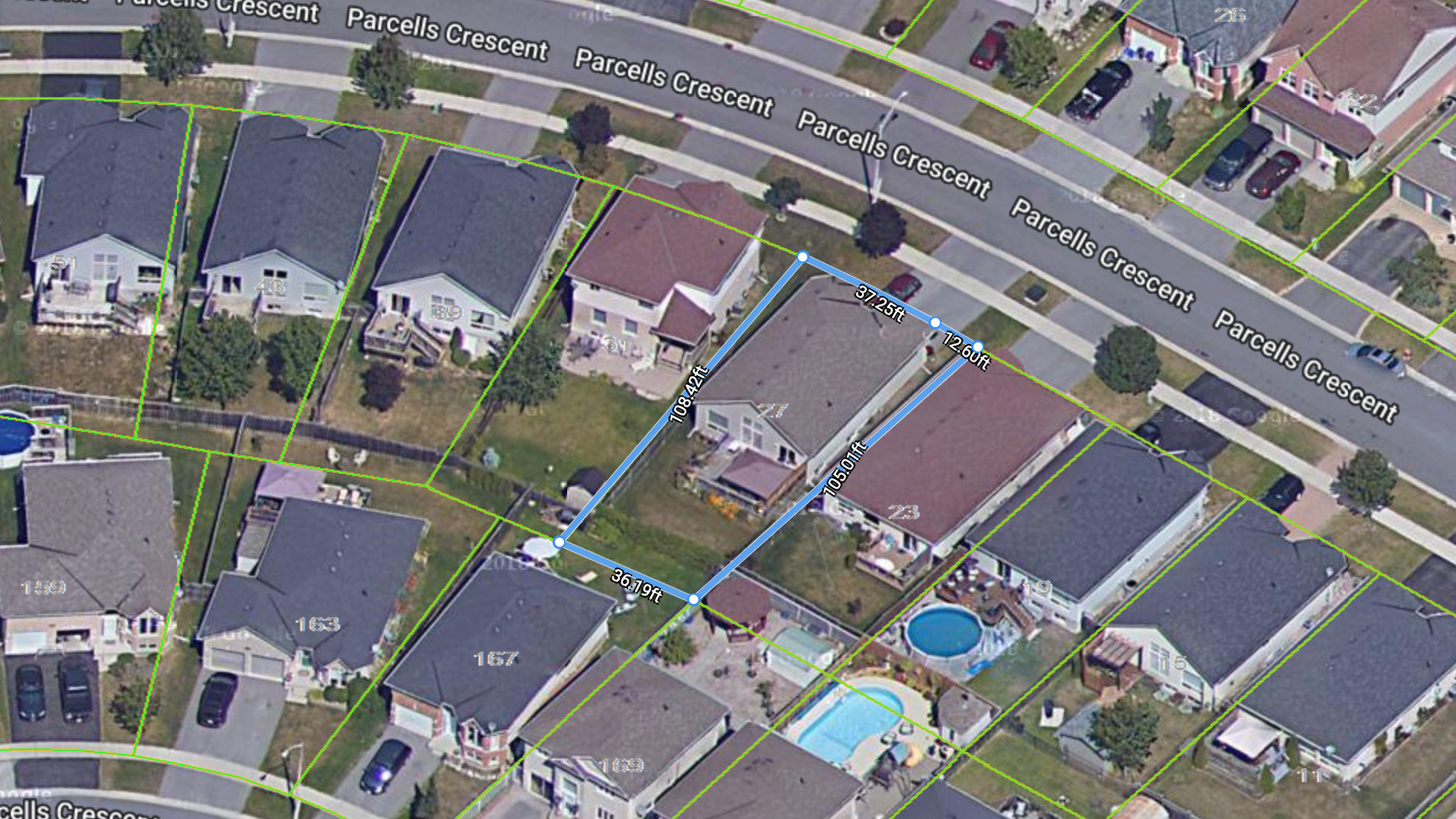

Embrace Tranquility and Convenience: A Closer Look at a Beautiful 2+2 Bedroom Open Concept Bungalow

Introduction:

Welcome to my blog post, where I invite you to explore the charm and elegance of a truly remarkable property. Nestled in a desirable location, this beautiful 2+2 bedroom, 3 full bathroom open concept bungalow offers a sanctuary of comfort and style. With its impeccable design and thoughtful features, it presents an opportunity for a lovely home for small family or downsizers .

Exquisite Design and Features:

Built in 2004, this brick and vinyl siding bungalow seamlessly blends modern aesthetics with enduring quality. The open concept layout provides a sense of spaciousness, perfect for both relaxation and entertainment.

The 1258 square footage above grade ensures ample room to create memorable experiences. As you step outside, a large wooden deck awaits, offering a breathtaking southwest view that promises unforgettable sunsets and gatherings with loved ones.

Step inside and be captivated by the elegant vinyl laminate floors that adorn the entire main floor. The vaulted ceilings in the family room create an airy and grand ambiance, complemented by the stylish Hunter Douglas blinds on three windows. These blinds offer the perfect balance of privacy and natural light, allowing you to create the ideal atmosphere for every occasion.

Comfort and Convenience:

This bungalow features 2+2 well-appointed bedrooms, providing space for relaxation and restful nights. With 3 full bathrooms, the morning rush will be a thing of the past, ensuring everyone can start their day with ease.

Located just steps away from Valleymore Park, you’ll have nature’s beauty at your fingertips. Take leisurely walks, engage in outdoor activities, and immerse yourself in the serenity of the surroundings.

The convenient proximity to Lansdowne Street and Hwy 7/115 makes commuting and accessing amenities a breeze. Whether you’re heading out for work or leisure, you’ll find that everything you need is just a short drive away.

A Cozy and Versatile Basement:

The finished basement offers a retreat for relaxation or recreation. Plush broadloom creates a warm and inviting atmosphere, making it the perfect space for movie nights, home office setups, or even a play area for the little ones. The possibilities are endless.

Conclusion:

In summary, this beautiful 2+2 bedroom, 3 full bathroom open concept bungalow presents an unparalleled opportunity for a fulfilling lifestyle. From its tasteful design and captivating features to the convenient location near Valleymore Park, Lansdowne Street, and Hwy 7/115, every aspect of this home has been thoughtfully considered.

Come and experience the tranquility, convenience, and elegance this property has to offer. Embrace the warmth of the wooden deck, the charm of vinyl laminate floors, and the versatility of the finished basement. Make this beautiful bungalow your own and savor a life of comfort and contentment in a truly remarkable setting.

See More Information And Other Details About The Home An Neighbourhood By Clicking Here!

Escape to Tranquility: Discover a Beautifully Appointed 3-Bedroom Home in McRae Beach Private Lake Community

Welcome to this beautifully appointed 3-bedroom, 2-bathroom home situated on a quiet cul-de-sac, nestled on a 100 x 150 ft double lot that abuts a serene forest. Located in the sought-after McRae Beach Private Lake Community, this sun-filled home offers a delightful living experience.

As you step inside, you’ll immediately notice the abundance of natural light that fills the space, creating a warm and inviting atmosphere. The main floor features two natural gas fireplaces, adding both charm and coziness to the living areas. The layout of the home has been thoughtfully designed with entertaining in mind, making it ideal for hosting guests or enjoying quality time with family.

Hardwood floors flow gracefully throughout the main level, enhancing the elegance of the home. From the foyer, you’ll be greeted by a heated marble floor that leads into the large, eat-in kitchen. This well-appointed kitchen is perfect for culinary enthusiasts, offering ample space for meal preparation and a comfortable dining area.

One of the highlights of this home is its connection to nature. With six walk-outs on the main floor, you can easily access the wraparound deck and enjoy the tranquility of the surroundings. The deck provides a fantastic outdoor space for relaxation, entertaining, or simply taking in the picturesque views of the forest and the expansive double lot.

The primary bedroom is a true retreat, featuring his and her closets complete with closet organizers to keep your belongings tidy and organized. Additionally, the main floor conveniently includes a laundry room for added convenience.

The partially finished basement offers versatility and additional living space, providing ample room for a variety of activities or storage needs. With plenty of closets and storage spaces throughout the home, you’ll have no shortage of room to keep your belongings neatly stowed away.

Residents of this remarkable property have the privilege of enjoying the nearby lake, as well as two private parks with a boat launch and community docks, offering easy access to water activities and boating adventures. A nominal beach association fee of $60 per year grants access to these exclusive amenities.

Immerse yourself in the beauty of this location, where you can witness spectacular sunsets and indulge in the crystal-clear waters of the lake. This home presents an incredible opportunity to embrace a peaceful and idyllic lifestyle within a desirable community.

Click here for more information

Crunching The Figures: Navigating the Pros and Cons of Higher Interest Rates for Buyers in Canada

Advantages of Higher Interest Rates for Buyers:

- Reduced Inflation: Higher interest rates can help control inflation by making borrowing more expensive. This can prevent prices from rising too quickly and maintain the purchasing power of consumers.

- Attractive Returns for Savers: Higher interest rates often lead to increased returns on savings accounts and fixed-income investments. Buyers who prioritize saving can benefit from higher interest rates by earning more on their savings.

- Discourages Impulsive Buying: With higher interest rates, borrowing becomes more expensive. This can discourage buyers from making impulsive purchases and encourage more thoughtful financial decision-making.

Disadvantages of Higher Interest Rates for Buyers:

- Increased Cost of Borrowing: When interest rates rise, the cost of borrowing money increases. This can result in higher monthly payments for loans, including mortgages, auto loans, and personal loans. Buyers may find it more challenging to afford large purchases or may need to adjust their budget.

- Reduced Affordability: Higher interest rates can reduce the affordability of homes and other big-ticket items. The increased cost of borrowing can limit the purchasing power of buyers, making it harder to qualify for loans or afford the desired property.

- Slower Economic Growth: Higher interest rates can sometimes slow down economic growth. When borrowing becomes more expensive, businesses may scale back on investments, and consumers may reduce their spending. This can lead to slower economic activity and potentially impact job growth and overall prosperity.

It’s important to note that the impact of higher interest rates on buyers can vary depending on individual financial circumstances, market conditions, and the overall health of the economy.

For further explanation of an important disadvantage to buyers:

Reduced Affordability: Higher interest rates can reduce the affordability of homes and other big-ticket items. The increased cost of borrowing can limit the purchasing power of buyers, making it harder to qualify for loans or afford the desired property.

When interest rates rise, the cost of borrowing money increases, which directly impacts mortgage rates. For potential homebuyers, this means that the monthly mortgage payments will be higher compared to when interest rates were lower. As a result, buyers may find it more challenging to qualify for a mortgage or may need to adjust their budget to accommodate the increased payments.

For example, let’s consider a hypothetical scenario where a potential homebuyer is looking to purchase a house with a mortgage of $300,000. If the interest rate is 4% over a 30-year term, the monthly mortgage payment would be approximately $1,432. However, if the interest rate increases to 6%, the monthly payment would rise to around $1,798. This $366 increase in monthly payments can make a significant difference in the affordability of the property.

Furthermore, higher interest rates can also affect other big-ticket purchases, such as cars or major appliances, as these often involve financing options. The increased cost of borrowing can lead to higher monthly payments or longer repayment terms, making it more challenging for buyers to afford these items within their budget.

Reduced affordability due to higher interest rates can have a broader impact on the housing market and the economy as a whole. It can slow down the demand for housing, potentially leading to a decline in property prices or a slowdown in the housing market activity. This, in turn, can have implications for homeowners, builders, and related industries.

However, it’s important to consider that affordability is influenced by various factors, including income levels, savings, housing supply, and regional market conditions. While higher interest rates can impact affordability negatively, it’s crucial to take a holistic approach when evaluating the overall impact on buyers and the real estate market. Buyers may need to adjust their expectations, explore alternative financing options, or consider different housing choices to adapt to the changing affordability landscape.

If you or anyone you know are thinking about buying or selling in the near future, please do not hesitate to contact me. In the meantime, get a No-Obligation FREE Home Market Evaluation Today by clicking here!

Lake Simcoe Retreat: A Serene Haven for Seasonal Bliss

Introduction:

Welcome to our blog, where we invite you to discover the enchanting beauty of Lake Simcoe and the perfect seasonal retreat it offers. Join us as we explore a charming bungalow that beckons you with its idyllic setting, modern features, and limitless potential for creating cherished memories. Let’s dive into the details of this picturesque getaway and embrace the tranquility of lakeside living.

A Blissful Escape:

Nestled on the shores of Lake Simcoe, this seasonal cottage is a haven of peace and relaxation. With its open concept living and kitchen areas, bathed in natural light that pours through the vaulted ceiling and newer windows, you’ll feel instantly at ease. The cozy bungalow offers two comfortable bedrooms, ensuring a restful night’s sleep after a day of lakeside adventures.

Unleash Your Imagination:

What sets this cottage apart is its potential for expansion. Whether you’re envisioning additional rooms to accommodate loved ones or dreaming of a custom-built home that perfectly suits your desires, this property offers endless possibilities. Let your imagination soar as you shape this retreat into your personal paradise.

Embrace the Outdoors:

The large front and back yards of this cottage provide ample space for outdoor activities, relaxation, and creating unforgettable moments. Picture yourself hosting lively barbecues, playing games with family and friends, or simply unwinding in the gentle breeze as you bask in the beauty of the surroundings. A convenient garden shed ensures your outdoor essentials are neatly stored, keeping your retreat clutter-free.

Lakefront Bliss:

Indulge in the blissful experience of private lake access on the McCrae beach. Immerse yourself in the crystal-clear waters of Lake Simcoe, take leisurely walks along the shore, or simply lounge on the sandy beach, soaking up the sun’s warm rays. The tranquility and natural beauty of the lake will undoubtedly rejuvenate your spirit.

Uncover Nearby Amenities:

While this retreat offers a serene escape, it’s comforting to know that essential amenities and conveniences are just a short distance away. Virginia is nearby, providing easy access to everyday necessities such as bread, milk, soft drinks, gasoline, and propane. Sutton offers a variety of shopping options along High Street and Dalton Road, including supermarkets, drug stores, hardware and building supplies, and a wide selection of restaurants. Pefferlaw boasts its own charm, with banking services, a gardening nursery, and diverse dining options. For a greater shopping experience, Keswick awaits with an array of shops, including major retailers such as Canadian Tire and Walmart. And if you’re seeking big-box stores and a wider range of options, Newmarket is a short drive away.

Safety and Security:

Peace of mind is paramount when it comes to your seasonal retreat. The York Regional Police Marine Unit has implemented a Cottage Watch Program to enhance the safety and security of all seasonal residents in the Lake Simcoe patrol area. With periodic spot checks and emergency notifications, the program aims to reduce crimes against property and ensure your peace and security throughout your stay.

Conclusion:

As we conclude our journey through this exquisite seasonal cottage by Lake Simcoe, we hope you’ve been captivated by its beauty, potential, and the promise of unforgettable experiences. Whether you choose to embrace the current bungalow or embark on a journey of expansion, this retreat offers a serene haven where you can escape the hustle and bustle of daily life and immerse yourself in the splendor of lakeside living. Lake Simcoe awaits you, ready to bestow its tranquility and natural wonders upon your soul.

To learn more about this gorgeous cottage in the Lake Simcoe Waterfront Community, please visit this link: https://GeraldLawrence.Realtor/27BlueHeronDrive

Embrace Serenity and Endless Potential: Discover the Extraordinary Estate in Sunderland

Introduction:

Welcome to a remarkable property that captures the essence of tranquility and presents boundless opportunities. Nestled in the picturesque town of Sunderland, this extraordinary estate spanning 225 acres is a sanctuary of natural beauty. With its abundance of features and expansive grounds, this property truly offers a lifestyle beyond compare.

A Natural Paradise:

As you step onto this vast property, you are greeted by a breathtaking landscape. Spanning 225 acres, the estate boasts a picturesque Vrooman Creek, protected greenspace, and open fields, providing a canvas for your imagination to roam. Immerse yourself in the serene surroundings, explore the trails along the river, or simply find solace in the beauty of nature.

Exceptional Living Spaces:

This magnificent property features four spacious bedrooms and three full bathrooms, ensuring ample room for comfortable living. With two kitchens, with one that includes an eat-in breakfast area, hosting gatherings and culinary adventures become effortless. The partially finished basement offers a blank canvas for customization, allowing you to create the ultimate recreational or entertainment space.

Versatility at Its Finest:

The estate showcases its versatility with two staircases, providing convenient access to each floor. Two road frontages offer accessibility and flexibility for various endeavors. Additionally, the property is not only capable of sustaining cash crop farming and boarding animals, but the house also presents the potential for three rental suites, providing a lucrative opportunity to generate additional income.

Endless Possibilities:

With its expansive grounds and diverse features, this estate presents endless possibilities. Embrace the opportunity to cultivate the land, start your own agricultural venture, or transform it into an idyllic equestrian estate. Alternatively, you can explore the potential for income generation through rental suites, tapping into the thriving rental market. The choice is yours to create a lifestyle that aligns with your dreams and aspirations.

Location:

Situated in Sunderland, Brock Township, Ontario, Canada, this property offers the perfect balance of tranquility and convenience. Enjoy the serenity of the countryside while being within reach of essential amenities and nearby attractions. Immerse yourself in the vibrant community and take advantage of everything the surrounding area has to offer.

Conclusion:

Step into a world of serenity and endless possibilities with this exceptional estate in Sunderland. With its 225 acres of natural beauty, four spacious bedrooms, multiple kitchens, and potential for cash crop farming and rental suites, this property is a true gem. Seize the opportunity to create a lifestyle that embraces nature, versatility, and boundless potential.

Contact me today at 416-556-0238 or Gerald-Lawrence@ColdwellBanker.ca to explore this remarkable estate and embark on a journey of endless possibilities in Sunderland.

Disclaimer: The availability and details of the property mentioned in this blog post are subject to change. Please contact the provided contact information for the most up-to-date information.

April 2023 Market Statistics – Low Inventory, Lower Rates, More Buyers, Prices Improve!

TRREB: GTA SALES AND PRICE CONTINUE TO IMPROVE WHILE LISTINGS REMAIN CONSTRAINED TORONTO, ONTARIO,

May 3, 2023 – The Greater Toronto Area (GTA) housing market continued to tighten in April 2023. On a year-over-year basis, sales edged lower compared to April 2022, but new listings were down by more than one-third. Fewer listings relative to sales meant there was more competition between buyers, supporting an improvement in selling prices since the beginning of this year.

“In line with TRREB’s outlook and recent consumer polling results, we are seeing a gradual improvement in sales and average selling price. Many buyers have come to terms with higher borrowing costs and are taking advantage of lower selling prices compared to this time last year. The issue moving forward will not be the demand for ownership housing, but rather the ability to meet this demand with adequate supply. This is a policy issue that requires sustained effort from all levels of government,” said TRREB President Paul Baron.

GTA REALTORS® reported 7,531 sales through TRREB’s MLS® System in April 2023 – down by 5.2 per cent compared to April 2022. In comparison to March 2023, sales increased on an actual and seasonally adjusted basis. On a year-over-year basis, new listings were down by 38.3 per cent in April 2023.

The MLS® Home Price Index (HPI) Composite Benchmark was down by 12.1 per cent year-over-year in April 2023. Compared to March, the benchmark price was up on an actual and seasonally adjusted basis. The average selling price in the GTA was $1,153,269 in April 2023 – down 7.8 per cent compared to $1,250,704 in April 2022. The average selling price also increased compared to March, both on an actual and seasonally adjusted basis.

“As demand for ownership housing has picked up relative to supply, we are seeing renewed upward pressure on home prices. For a short period of time, higher borrowing costs trumped the impact of the constrained housing supply in the GTA. Renewed competition between buyers is once again shining the spotlight on the persistent lack of listings and resulting impact on affordability,” said TRREB Chief Market Analyst Jason Mercer.

“Lack of affordability in the GTA ownership and rental housing markets has been well-documented. On top of this, households faced with steep price increases for basic goods and services have had to make tough decisions to adapt. It is time for governments to make tough choices as well. On average, every dollar a household makes in the first half of the year goes to taxes. Governments need to provide more value for every tax dollar they collect and should be looking for ways to reduce tax burdens moving forward,” said TRREB CEO John DiMichele.

Couchiching $$$ – Want to Live In a Lakeside Community Up North?

Search for Waterfront Properties on Lake Couchiching in Ramara

Lake Couchiching is a beautiful lake located in Washago, Ontario, Canada. It is part of the Trent-Severn Waterway, a 386 km long canal system that connects Lake Ontario to Georgian Bay. Lake Couchiching is approximately 16 km long and 5 km wide, and it has a maximum depth of 15 meters. The lake is situated adjacent to Lake Simcoe, and they are separated by a narrow channel called the Narrows.

Lake Couchiching is a popular destination for tourists and locals alike, thanks to its pristine waters, beautiful scenery, and endless opportunities for outdoor activities. The lake is known for its clear waters, which make it a popular spot for swimming, boating, and fishing. The lake is home to a variety of fish species, including bass, pike, walleye, and muskie, making it a popular destination for anglers.

Search for Waterfront Properties on Lake Couchiching in Ramara

In addition to fishing, Lake Couchiching is also a great spot for boating. The lake has several marinas and boat launches, making it easy to access the water. There are also several rental companies that offer boats and watercraft for visitors who don’t have their own.

For those who prefer to stay on land, Lake Couchiching offers plenty of opportunities for hiking, biking, and picnicking. The lake has several parks and nature reserves, including the Mara Provincial Park, which is located on the eastern shore of the lake. The park offers hiking trails, camping facilities, and beautiful views of the lake.

Another popular attraction on Lake Couchiching is the Casino Rama Resort. The casino is located on the eastern shore of the lake and offers a variety of gaming options, as well as entertainment and dining.

Lake Couchiching is also a popular destination for winter sports enthusiasts. The lake freezes over in the winter, providing an excellent spot for ice fishing, skating, and snowmobiling. The lake is also located near several ski resorts, making it a great spot for skiing and snowboarding.

Search for Waterfront Properties on Lake Couchiching in Ramara

In addition to its recreational opportunities, Lake Couchiching is also an important ecological resource. The lake is home to several species of waterfowl, including loons, herons, and ducks. It is also an important spawning ground for fish species, making it an important area for conservation efforts.

Overall, Lake Couchiching is a beautiful and diverse destination that offers something for everyone. Whether you’re looking for a spot to fish, boat, hike, or simply relax, Lake Couchiching is a must-visit destination in Washago, Ontario.

Take the time to check out this cottage property across the road from the lake!

Search for Waterfront Properties on Lake Couchiching in Ramara

Cottage For Long Term Lease In Lakeside Community

Looking for a stunning lakeside home with all the amenities and comforts you need? Look no further! This beautiful house, located on a quiet private road, is just steps away from the picturesque Lake Couchiching.

Enjoy lakefront living at its best with direct access to the lake from across the road. Swim, sunbathe, or simply relax by the water’s edge. Inside, you’ll find a bright and spacious open-concept design with beautiful finishes throughout. The second bedroom on the main floor is currently being used as a second living space, giving you plenty of room to spread out and enjoy your surroundings.

Located just minutes from shopping, restaurants, and recreational activities, this home offers the perfect combination of convenience and serenity. Take advantage of nearby trails and outdoor activities, or head into Orillia just 15 minutes away for even more options. And if you’re feeling lucky, Casino Rama is only 7 minutes down the road.

Don’t miss your chance to experience lakeside living at its finest. Contact us today to schedule a viewing of this beautiful home!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link