Home Sellers, Make Your Dream Real With Coldwell Banker®

www.QuickHomeValues.ca

Good News For Buyers: Interest Rates Stay Unchanged – BOC

Bank of Canada maintains policy rate, continues quantitative tightening

The Bank of Canada today held its target for the overnight rate at 4½%, with the Bank Rate at 4¾% and the deposit rate at 4½%. The Bank is also continuing its policy of quantitative tightening.

Inflation in many countries is easing in the face of lower energy prices, normalizing global supply chains, and tighter monetary policy. At the same time, labour markets remain tight and measures of core inflation in many advanced economies suggest persistent price pressures, especially for services.

Global economic growth has been stronger than anticipated. Growth in the United States and Europe has surprised on the upside, but is expected to weaken as tighter monetary policy continues to feed through those economies. In the United States, recent stress in the banking sector has tightened credit conditions further. US growth is expected to slow considerably in the coming months, with particular weakness in sectors that are important for Canadian exports. Meanwhile, activity in China’s economy has rebounded, particularly in services. Overall, commodity prices are close to their January levels. The Bank’s April Monetary Policy Report (MPR) projects global growth of 2.6% this year, 2.1% in 2024, and 2.8% in 2025.

In Canada, demand is still exceeding supply and the labour market remains tight. Economic growth in the first quarter looks to be stronger than was projected in January, with a bounce in exports and solid consumption growth. While the Bank’s Business Outlook Survey suggests acute labour shortages are starting to ease, wage growth is still elevated relative to productivity growth. Strong population gains are adding to labour supply and supporting employment growth while also boosting aggregate consumption. Housing market activity remains subdued.

As more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly, consumption is expected to moderate this year. Softening foreign demand is expected to restrain exports and business investment. Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year. This implies the economy will move into excess supply in the second half of this year. The Bank now projects Canada’s economy to grow by 1.4% this year and 1.3% in 2024 before picking up to 2.5% in 2025.

CPI inflation eased to 5.2% in February, and the Bank’s preferred measures of core inflation were just under 5%. The Bank expects CPI inflation to fall quickly to around 3% in the middle of this year and then decline more gradually to the 2% target by the end of 2024. Recent data is reinforcing Governing Council’s confidence that inflation will continue to decline in the next few months. However, getting inflation the rest of the way back to 2% could prove to be more difficult because inflation expectations are coming down slowly, service price inflation and wage growth remain elevated, and corporate pricing behaviour has yet to normalize. As it sets monetary policy, Governing Council will be particularly focused on these indicators, and the evolution of core inflation, to gauge the progress of CPI inflation back to target.

In light of its outlook for growth and inflation, Governing Council decided to maintain the policy rate at 4½%. Quantitative tightening continues to complement this restrictive stance. Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target. The Bank remains resolute in its commitment to restoring price stability for Canadians.

Uxbridge Real Estate Update – March 2023

Real estate activity in Uxbridge, Ontario for March 2023 showed a slight decrease in the average selling price of homes compared to March of the previous year. The average selling price for a home in Uxbridge in March 2023 was $1,329,780, which is a 9.6% decrease from the previous year’s average selling price of $1,470,730.

There were a total of 25 home sales in March 2023, compared to 37 in March of the previous year, indicating a decrease of 32%. This decrease in home sales can be attributed to a variety of factors, including economic uncertainty, changing interest rates, and the ongoing COVID-19 pandemic.

The number of new listings in March 2023 was 43, compared to 45 in March of the previous year, which is a slight decrease of 4.4%. This decrease in new listings could be a sign that homeowners are choosing to hold onto their properties, potentially due to the lower average selling price.

The sales-to-listing ratio for March 2023 was 58%, a significant decrease from the previous year’s ratio of 82%. This means that fewer homes are being sold compared to the number of homes that are being listed for sale. A lower sales-to-listing ratio could be a sign that buyers have more negotiating power in the market, potentially leading to lower prices or more favorable terms.

Overall, the real estate market in Uxbridge, Ontario for March 2023 showed some signs of slowing down compared to the previous year. While the average selling price decreased slightly and the number of new listings decreased slightly, the decrease in home sales and sales-to-listing ratio could indicate that the market is becoming more favorable to buyers but sellers in certain price ranges are experiencing quick sales close to, at or over-asking in less than a week.

Reach out to know how much your home is worth in today’s market.

Bill 97, Helping Homebuyers, Protecting Tenants Act (“HHPA”), 2022

Today, the Government of Ontario introduced new housing legislation – Bill 97, Helping Homebuyers, Protecting Tenants Act (“HHPA”), 2022.

The HHPA is the latest in a series of steps the Province is taking to increase the housing supply and help more Ontarians find a home they can afford. Since 2015, TRREB has been a leading voice at the table with the Province advocating for policies to make homes more affordable for families, and we are thrilled to see the HHPA is acting on several TRREB recommendations.

The HHPA and assorted regulatory postings are proposing policy changes in three key areas:

- Helping Landlords & Tenants;

- Streamlining Land-Use Planning Policy; and

- Helping Homebuyers.

Here’s what you need to know about the Bill:

Helping Landlords & Tenants

The province is moving forward on a series of measures to clear the Landlord and Tenant Board (“LTB”) backlog and strengthen protections for renters and tenants.

Here are the proposed changes:

Clearing the Landlord and Tenant Backlog

- An additional $6.5 million to appoint 40 additional adjudicators to improve service standards for landlords and tenants and reduce timeframes for decisions;

- Implement a Lean review of the current LTB processes and find opportunities for efficiencies; and

- More training for adjudicators to speed up file and hearing management.

Access to Air Conditioning

- Proposed changes that would clarify and enhance tenants’ rights to install window or portable air conditioning in their units.

Reinforcing Rules Against Evictions

- Proposed changes to further strengthen renter protections from evictions for renovations or when landlord/family member wants to move in.

- For example, when evicting a tenant to renovate a unit, landlords would be required to provide a report from a qualified person stating that the unit must be vacant for renovations to take place and the estimated completion date.

- For example, when evicting a tenant, the landlord (or their family) would be required to move into the unit by a specific deadline (to be prescribed).

Doubling Fines Under the RTA

- The Province is proposing to double fines under the Residential Tenancies Act (“RTA”) for things like bad faith evictions:

- from $50,000 to $100,000 for individuals

- from $250,000 to $500,000 for corporations

Rent Arears Repayment Agreements

- The Province is proposing to require the use of the LTB’s plain language repayment agreement form when a tenant is entering into a rent repayment agreement with the landlord.

Build More Homes for Renters

- The Province is consulting on regulation-making authorities that will help enable the creation of a balanced framework governing municipal rental replacement by-laws aimed at helping streamline the construction or revitalization of rental housing.

- For example, the regulations could include requirements that replacement units have the same core features as original units (e.g., bedrooms) or giving existing tenants the right to move back into the unit at the same rent.

Streamlining Land-Use Planning Policy

The government is seeking input on a proposed new land use planning policy document – the Provincial Planning Statement – that would combine the Provincial Policy Statement and a Place to Grow: Growth Plan for the Greater Golden Horseshoe to streamline and simplify Ontario’s land-use planning rules.

These proposed changes include several TRREB recommendations. Here are the highlights:

Increasing Housing Supply

- Maintain a mix of housing types. (TRREB recommendation) All municipalities would be required to provide a range and mix of housing options (e.g., low or mid-rise apartments) to address full range of housing needs in their community.

- Build up near transit. (TRREB recommendation) Twenty-nine of Ontario’s largest and fastest growing municipalities would be required to plan for growth in major transit station areas, and other strategic growth areas.

- Supporting multigenerational farming families. Permit family-owned farms to build three new residences on their existing property. In questions with the Ministry, it was explained that this would take the form of allowing three lots per family-owned farm property and up to two dwelling units per lot.

- Managing settlement boundary areas. Municipalities would have more flexibility deciding when and where to expand their settlement area boundaries, providing more land where it’s needed for housing.

Infrastructure to Support New Homes

- Schools and child-care in planning. The Province is proposing to require municipalities and school boards to work more closely to plan for schools and childcare facilities and integrate new facilities into developments.

- Planning for Pipes. The Province is proposing to reduce duplication in planning for water, wastewater and stormwater infrastructure to get more land ready for housing development.

Helping Homebuyers

Finally, the Province is proposing a series of changes aimed at helping-homebuyers. TRREB will be very engaged on the proposed cooling-off period for new freehold homes to ensure that a similar policy is not enacted for resale properties.

First Home Savings Account Protections

- The Province is proposing regulatory changes to provide unlimited deposit protection insurance for First Home Savings Account (FHSAs) held at Ontario credit unions or caisses populaires.

- FHSAs were introduced by the federal government in 2022 to give prospective first-time homebuyers the ability to save up to $40,000 on a tax-free basis.

Cooling-Off Period and Legal Review for New Home Purchases

- The Province will consult on a cooling-off period when people buy a new freehold home from a builder and a requirement that builders tell their customers about the cooling-off period.

- This change would allow buyers to cancel their purchase agreement within a specified time frame. The Province is seeking feedback on how long the cancellation period should last, disclosure requirements, and whether to include a purchaser cancellation charge.

- The Province is also seeking feedback on a requirement that buyers of new homes receive legal advice about their purchase agreements.

Next Steps

As a leading voice for new housing supply, TRREB is at the table with government consulting on these important changes.

Going forward, we will provide feedback directly to officials on the new legislation and proposed regulatory changes that emphasize the need for increased housing supply and stronger protections for new home buyers while avoiding unnecessary red tape for Greater Toronto Area REALTORS® and real estate.

Stay tuned for more updates from TRREB on these important changes.

JUST SOLD: 3+1 Beds, 3 Baths, 2-Car Garage on 1 Acre*

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Prohibition on the Purchase of Residential Property by Non-Canadians Act

On January 1, 2023, the federal Prohibition on the Purchase of Residential Property by Non-Canadians Act and associated Regulations (the “Act”) came into force and effect. As the name suggests, the Act bans Non-Canadians, as defined by the Act, from directly or indirectly purchasing certain Residential Property in Canada for a period of two years.

- Prohibition on the Purchase of Residential Property by Non-Canadians Act

- Prohibition on the Purchase of Residential Property by Non-Canadians Regulations

- Canadian Canada Mortgage and Housing Corporation (CMHC) FAQ

NEW AMENDMENTS EFFECTIVE MARCH 27, 2023

Enable more work permit holders to purchase a home to live in while working in Canada.

The amendments will allow those who hold a work permit or are authorized to work in Canada under the Immigration and Refugee Protection Regulations to purchase residential property. Work permit holders are eligible if they have 183 days or more of validity remaining on their work permit or work authorization at time of purchase, and they have not purchased more than one residential property. The current provisions on tax filings and previous work experience in Canada are being repealed.

Repealing existing provision so the prohibition doesn’t apply to vacant land.

We are repealing section 3(2) of the regulations, so the prohibition does not apply to all lands zoned for residential and mixed use. Vacant land zoned for residential and mixed use can now be purchased by non-Canadians and used for any purpose by the purchaser, including residential development.

Exception for development purposes.

This exception allows non-Canadians to purchase residential property for the purpose of development. The amendments also extend the exception currently applicable to publicly traded corporations under the Act, to publicly traded entities formed under the laws of Canada or a province and controlled by a non-Canadian.

Increasing the corporation foreign control threshold from 3% to 10%.

For the purposes of the prohibition, with regards to privately held corporations or privately held entities formed under the laws of Canada or a province and controlled by a non-Canadian, the control threshold has increased from 3% to 10%. This aligns with the definition of ‘specified Canadian Corporation’ in the Underused Housing Tax Act.

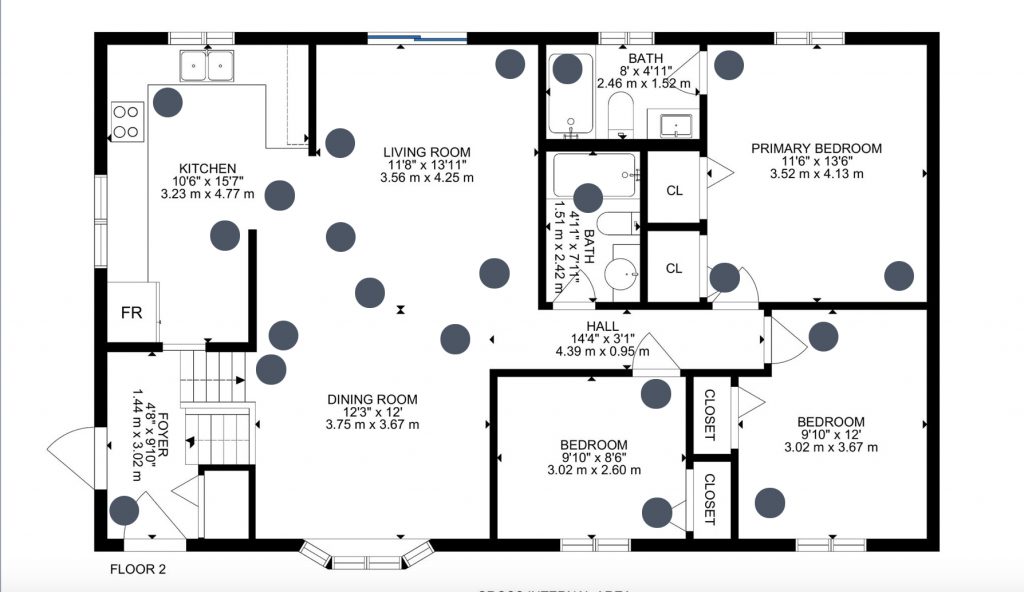

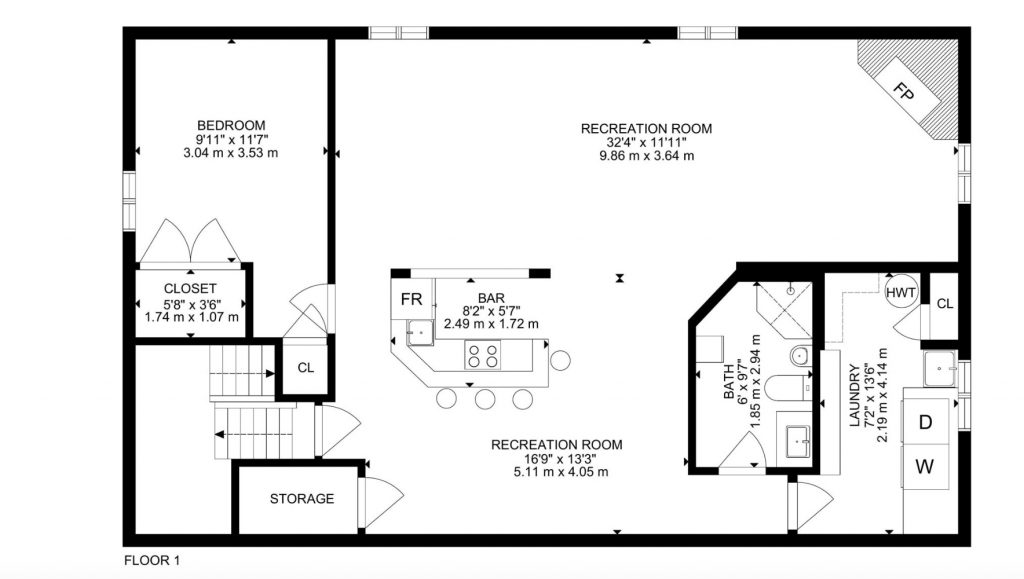

Stunning Brick Bungalow with Fully Updated Kitchen, Finished Basement, and an Incredible Backyard Oasis Sitting On 1 Acre Near Pigeon Lake!

If you’re looking for a cozy and spacious home in a peaceful neighborhood, this red brick bungalow with 3+1 bedrooms, and 3 bathrooms on a sprawling 1-acre lot with a finished basement is definitely worth considering. Located in the tranquil area of Downeyville, this property has a lot to offer with its impressive backdrop and country setting.

As soon as you step inside the house, you’ll be greeted by the bright and airy living space with an open-concept living and dining area. The bay window and sliding doors provide ample natural light and create a welcoming atmosphere. The floors add a warm touch, and the elegant finishes throughout the home create a relaxed feel.

The fully-finished basement is one of the standout features of this property. It includes a bedroom, a 3-piece bathroom with a urinal, a wet bar, a gym area, a laundry room, and a cozy fireplace. This space is perfect for relaxing, hosting gatherings, or even converting into a separate living space. You’ll have plenty of room for all your hobbies and interests.

When it’s time to unwind, head to the fully fenced backyard. The pergola provides shade and adds character to the space, while the hammock and fire pit offer the perfect place to relax and enjoy the outdoors. The hot tub is an excellent feature that adds relaxation to your lifestyle, while the perennial gardens and adjoining planted forest add a touch of nature to your surroundings. The garden shed provides ample storage for your tools and equipment.

Overall, this red brick bungalow is a must-see for anyone looking for a comfortable and convenient home with an abundance of flora and fauna. The combination of functional, spacious living areas, decently sized bedrooms, and beautiful outdoor space make this property an excellent investment for families or anyone who loves to entertain.

Book a showing today and see for yourself all that this property has to offer!

February 2023 Real Estate Market Update Videos

Durham Region Real Estate Market Update

York Region Real Estate Market Update

Greater Toronto Area Real Estate Market Update

Township Of Uxbridge Real Estate Market Update

Town Of Whitchurch-Stouffville Real Estate Market Update

Town Of Ajax Real Estate Market Update

City Of Pickering Real Estate Market Update

Town Of Whitby Real Estate Market Update

City Of Oshawa Real Estate Market Update

City Of Markham Real Estate Market Update

Town Of Newmarket Real Estate Market Update

Town Of Aurora Real Estate Market Update

City Of Vaughan Real Estate Market Update

Municipality Of Clarington Real Estate Market Update

Town Of Caledon Real Estate Market Update

City Of Barrie Real Estate Market Update

City Of Brampton Real Estate Market Update

City Of Mississauga Real Estate Market Update

February 2022 Real Estate Market Update For The Greater Toronto Area

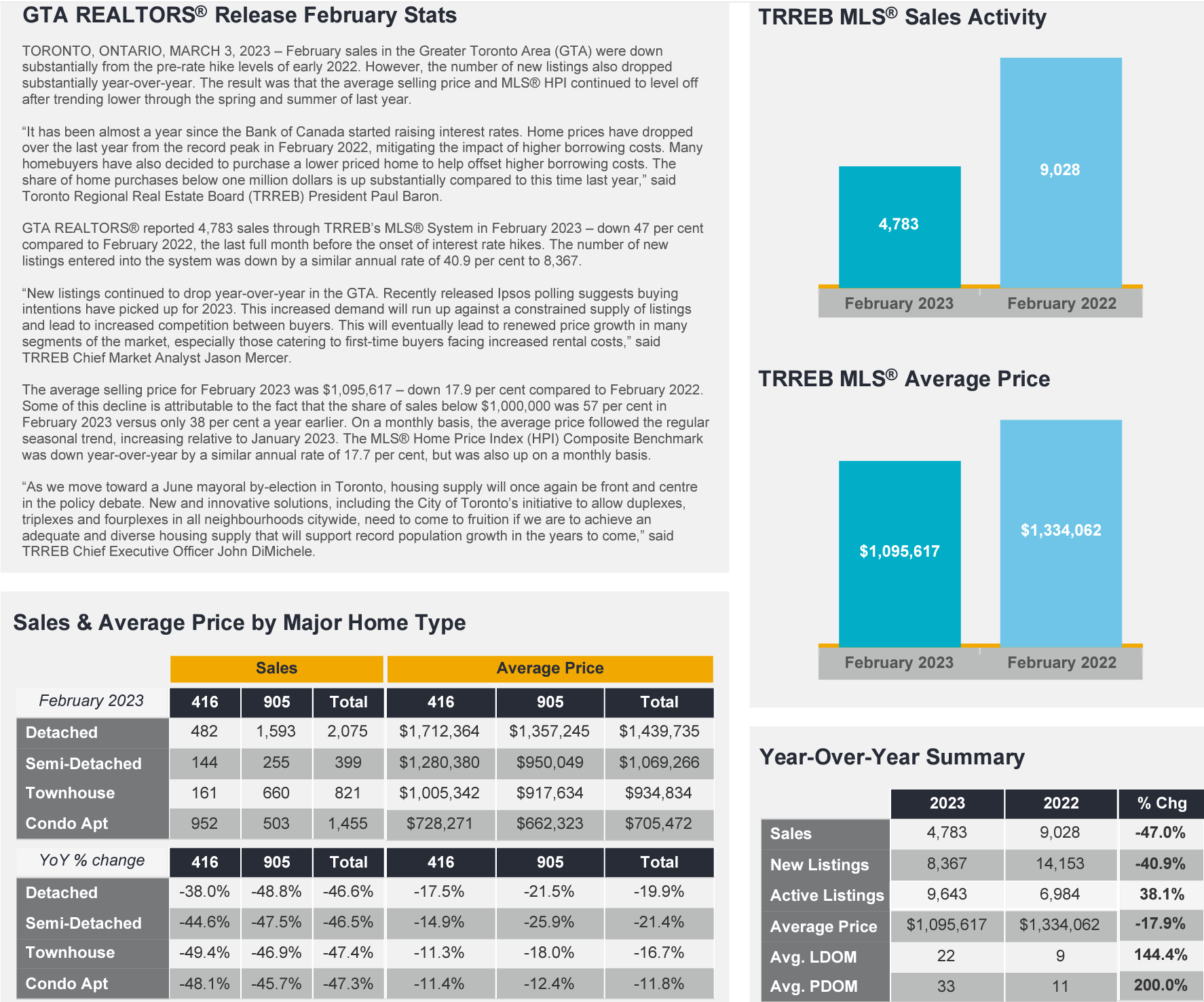

GTA HOME SALES AND LISTINGS DROP IN FEBRUARY Uptick in Homebuying Expected Later This Year TORONTO, ONTARIO, MARCH 3, 2023 – February sales in the Greater Toronto Area (GTA) were down substantially from the pre-rate hike levels of early 2022. However, the number of new listings also dropped substantially year-over-year. The result was that the average selling price and MLS® HPI continued to level off after trending lower through the spring and summer of last year.

“It has been almost a year since the Bank of Canada started raising interest rates. Home prices have dropped over the last year from the record peak in February 2022, mitigating the impact of higher borrowing costs. Many homebuyers have also decided to purchase a lower-priced home to help offset higher borrowing costs. The share of home purchases below one million dollars is up substantially compared to this time last year,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

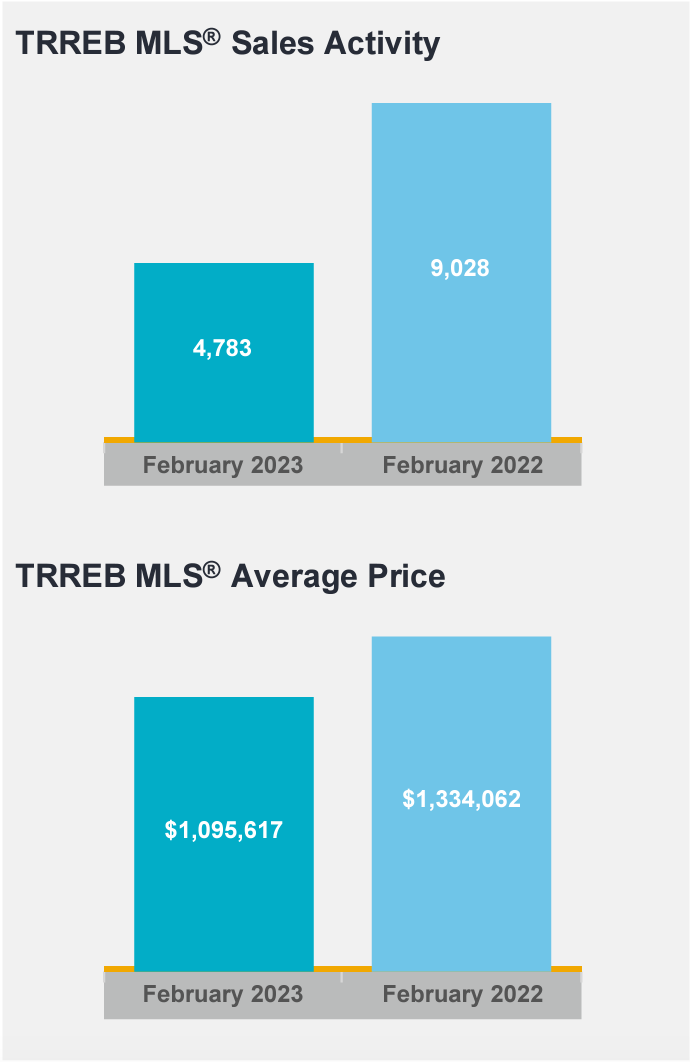

GTA REALTORS® reported 4,783 sales through TRREB’s MLS® System in February 2023 – down 47 per cent compared to February 2022, the last full month before the onset of interest rate hikes. The number of new listings entered into the system was down by a similar annual rate of 40.9 per cent to 8,367.

“New listings continued to drop year-over-year in the GTA. Recently released Ipsos polling suggests buying intentions have picked up for 2023. This increased demand will run up against a constrained supply of listings and lead to increased competition between buyers. This will eventually lead to renewed price growth in many segments of the market, especially those catering to first-time buyers facing increased rental costs,” said TRREB Chief Market Analyst Jason Mercer.

The average selling price for February 2023 was $1,095,617 – down 17.9 per cent compared to February 2022. Some of this decline is attributable to the fact that the share of sales below $1,000,000 was 57 per cent in February 2023 versus only 38 per cent a year earlier. On a monthly basis, the average price followed the regular seasonal trend, increasing relative to January 2023. The MLS® Home Price Index (HPI) Composite Benchmark was down year-over-year by a similar annual rate of 17.7 per cent, but was also up on a monthly basis.

“As we move toward a June mayoral by-election in Toronto, housing supply will once again be front and centre in the policy debate. New and innovative solutions, including the City of Toronto’s initiative to allow duplexes, triplexes and fourplexes in all neighbourhoods citywide, need to come to fruition if we are to achieve an adequate and diverse housing supply that will support record population growth in the years to come,” said TRREB Chief Executive Officer John DiMichele.

Open House Weekend – Executive Home in Gated Community

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link