JUST LISTED: 52 Wyndance Way, Uxbridge (The Estates Of Wyndance)

January 2023 Market Update

GTA REAL ESTATE MARKET STARTS THE NEW YEAR THE SAME AS IT ENDED LAST YEAR

TORONTO, ONTARIO, FEBRUARY 3, 2023 – As we moved from 2022 into 2023, the Greater Toronto Area (GTA) housing market unfolded as expected. The number of January sales and the overall average selling price were similar to December 2022. On a year-over-year basis, both sales and prices were down markedly, continuing to highlight the impact of higher borrowing costs on affordability over the last year.

“Home sales and selling prices appear to have found some support in recent months. This coupled with the Bank of Canada announcement that interest rate hikes are likely on hold for the foreseeable future will prompt some buyers to move off the sidelines in the coming months. Record population growth and tight labour market conditions will continue to support housing demand moving forward,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

GTA REALTORS® reported 3,100 sales through TRREB’s MLS® System in January 2023 – in line with the December 2022 result of 3,110, but down 44.6 per cent from January 2022. The average selling price for January 2023 at $1,038,668 was slightly lower than the December 2022 result and down by 16.4 per cent compared to the January 2022 average price reported before the onset of Bank of Canada interest rate hikes. The MLS® Home Price Index (HPI) Composite Benchmark was in line with the December result, but down by 14.2 per cent compared to January 2022.

“Home prices declined over the past year as homebuyers sought to mitigate the impact of substantially higher borrowing costs. While short-term borrowing costs increased again in January, negotiated medium-term mortgage rates, like the five-year fixed rate, have actually started to trend lower compared to the end of last year. The expectation is that this trend will continue, further helping with affordability as we move through 2023,” said TRREB Chief Market Analyst Jason Mercer.

“All three levels of government have announced policies to enhance housing affordability over the long term, including many initiatives focussed on increasing housing supply in the ownership and rental markets. Most recently, we were encouraged to see Toronto City Council support the Mayor’s 2023 Housing Action Plan as part of the City’s overall $2 billion commitment to housing initiatives,” said TRREB CEO John DiMichele.

Just Listed: End Unit Townhouse in the heart of downtown

Just Listed For Sale In North Durham Region

Click Here To See This Listing With All Pictures & More Information

This Luxurious End-Unit Overlooking Green Space On 2 Sides Is Completely Finished From Top To Bottom With Upgrades & Luxury Finishes! An Entertainer’s Dream, Enjoy The Brightly Lit Kitchen & Living Room With 9Ft Ceilings, Custom Island, Ss Appliances, Quartz Counters, Gas Fireplace, Shiplap Accent Walls In Entryway & Living Room And Custom Motorized Blinds. The Primary Bedroom Features A Shiplap Wall, Custom Bathroom With Stunning Shower, His & Hers Sinks And Heated Floors Along With A Custom Walk-In Closet! Even The 2nd Floor Laundry Room Has Been Upgraded To Include Upper Cabinets. The Second & Third Bedrooms Share A Jack & Jill 5 Piece Bathroom, With One Bedroom Having Double Closets And The Other Having A Walk-In. Fully Finished Basement With Potlights, Heated Floors, 3 Pc Bathroom, French Doors With Built-In Blinds Which Lead Out Onto The Landscaped Backyard With A Covered Patio With Potlights, Fan And A Shed.

| Bedrooms | 3 |

| Bathrooms | 4 |

| Square Footage | 1500-2000 |

| Garage Spaces | 1 |

Click Here To See This Listing With All Pictures & More Information

The Full-Width Deck Has A Like New Blaze Bbq With Natural Gas, 100% Waterproof Tufdeck Flooring, A Remote Retractable Awning Which Overlooks Green Space. The Garage Is Fully Heated & Insulated, Including The Door, With Epoxy Finished Floor.

Rental Report: POPULATION GROWTH AND HIGH INTEREST RATES DRIVE RENTAL DEMAND IN GTA

TORONTO, ONTARIO, January 31, 2023 – Average condominium apartment rents continued to increase by double-digit annual rates in the fourth quarter of 2022. However, while market conditions remained tight enough to support very strong rent growth, there was more balance in the rental marketplace compared to the same period a year earlier in 2021.

The number of condominium apartment rental transactions reported through the Toronto Regional Real Estate Board’s (TRREB) MLS® System was down on a year-over-year basis by 19.9 per cent in the fourth quarter of 2022. The number of rental listings was also down over the same period, but by a lesser annual rate of 11.8 per cent. The fact that the number of units leased was down by more than the number of units listed suggests that would-be renters benefitted from more choice compared to a year ago.

“Strong population growth based on record immigration and robust job creation across a diversity of economic sectors drove rental demand in 2022. In addition, aggressive interest rate hikes by the Bank of Canada impacted affordability for many households, prompting a shift from homeownership to rental. All of these factors will continue to support strong rental demand in 2023,” said TRREB President Paul Baron.

The average rent for a one-bedroom condominium apartment increased by 19 per cent to $2,503 in the fourth quarter of 2022. Over the same period, the average two-bedroom rent increased by 14.1 per cent to $3,178.

“Tight rental market conditions and strong rent increases will be the norm more often than not for the foreseeable future. On one hand, we will continue to experience strong rental demand in the GTA based on solid fundamentals. On the other hand, the persistent supply shortage will continue to result in strong competition between would-be renters, exerting upward pressure on rents. The solution is no secret: we need to see new policies pointed on more supply to translate into shovels in the ground for many years to come,” said TRREB Chief Market Analyst Jason Mercer.

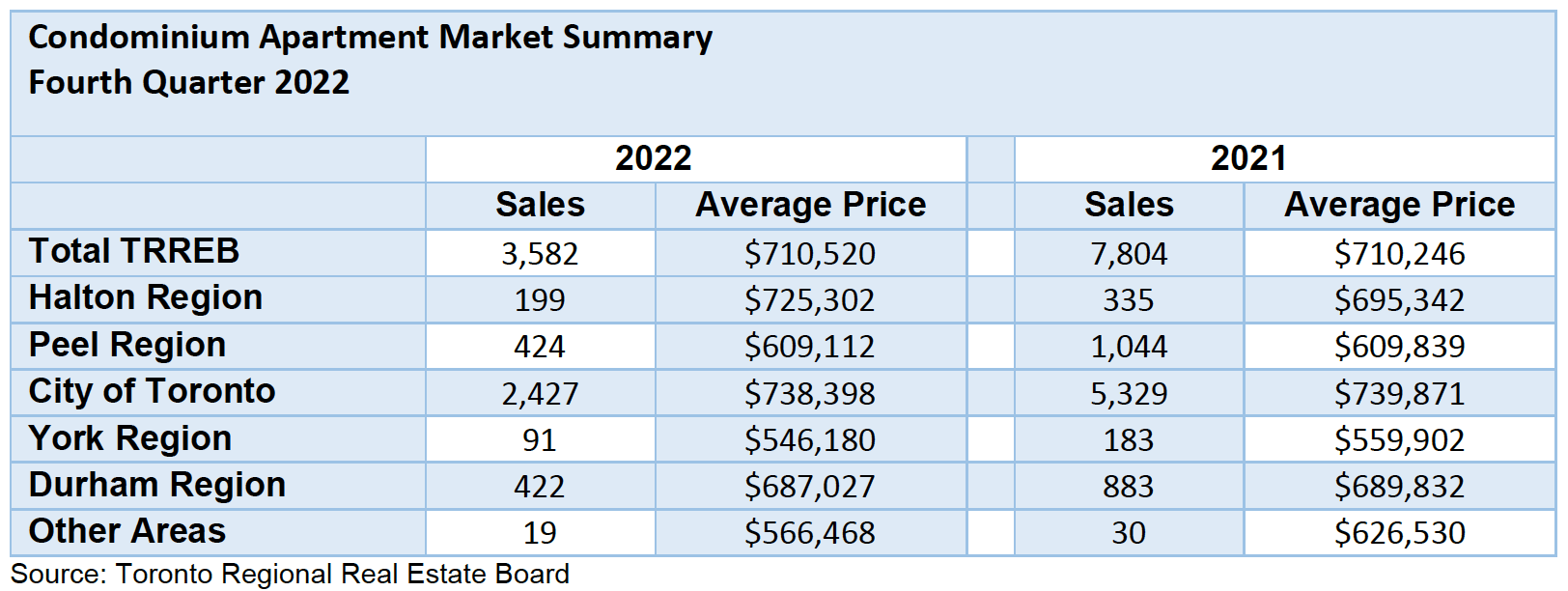

TRREB: GTA CONDO SALES DOWN WHILE PRICES REMAIN FLAT

TORONTO, ONTARIO, January 31, 2023 – Selling prices for condominium apartments bucked the overall downward trend in the housing market during the fourth quarter of 2022. The average selling price in Q4 2022 stayed in line with the average in Q4 2021.

“While condo market conditions have become more balanced over the past year, there has been enough demand relative to supply to support selling prices. On average, the condo market segment is the most affordable. Therefore, it makes sense that we didn’t see the same type of price adjustment, in the face of higher borrowing costs, compared to other more expensive segments like detached homes,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

Total condo apartment sales amounted to 3,582 in Q4 2022 – down 54.1 per cent compared to Q4 2021. New listings were also down on a year-over-year basis by 14.3 per cent. The average Q4 2022 selling price was $710,520, which was slightly higher than the Q4 2021 average of $710,246. Looking at individual Greater Toronto Area (GTA) regions, a similar trend played itself out, with average selling prices remaining flat compared to last year.

“Condo apartments remain an important segment of the market. They are the key entry point for many first-time buyers. Investor-owned condos are also an important source of rental supply in many parts of the GTA. As immigration into Canada continues at a record pace for the foreseeable future, the GTA will welcome many new households. This should see the demand for condos, in both the ownership and rental markets, strengthen moving forward,” said TRREB Chief Market Analyst Jason Mercer.

Just Sold! – 13 Hickory Drive

|

See the full listing and sold price by clicking on my website link here.

Buying and selling a home can be a complicated and stressful process. You need a knowledgeable and skilled agent like me to assist you with the sale of your property or the purchase of a new home.

Go to www.QuickHomeValues.ca For a FREE Home Market Evaluation Today!

I will diligently guide you through your real estate transactions from beginning to close.

Contact me today to discuss your real estate needs and in the meantime, check out your own Neighbhourhood News or for any other postal code in Canada!

|

December 2022 Peterborough & Kawartha Lakes Market Update

Executive Home in Newer Subdivision of Rockwood (Guelph/Eramosa) Near Conservation For Sale

I am pleased to announce my listing at 13 Hickory Drive in Rockwood. This bungalow with loft is truly a must-see, with 3+2 bedrooms, 4 bathrooms, and a finished basement. The home also features a 2-car attached garage, providing plenty of space for all your storage needs.

Click This Picture To See 101 HDR Photos, 3-D Interactive Matterport Virtual Tour And More Details Of The Home!

The open-concept main floor boasts a spacious open-concept living room, dining room, and a professionally designed gourmet kitchen, making it the perfect space for entertaining. The kitchen is fully equipped with stainless steel appliances and plenty of counter space as well as a large island. The main floor also includes a master bedroom with a 5-piece ensuite spa-like bathroom and a very large walk-in closet. Contact me today to schedule a showing.

Click This Picture To See 101 HDR Photos, 3-D Interactive Matterport Virtual Tour And More Details Of The Home!

The finished basement with high ceilings is the perfect space for a family room or home office, with two additional bedrooms and a 3-piece bathroom. The cozy fireplace is the focal point in the entertainment room with a large pool table. Contact me today to schedule a showing.

Click This Picture To See 101 HDR Photos, 3-D Interactive Matterport Virtual Tour And More Details Of The Home!

The backyard is viewed from a large covered deck with ample space for extra seating, and a barbecue for summer entertainment. The 2-car attached garage provides ample space for your vehicles with the additional 2 parking spaces in the private driveway. Contact me today to schedule a showing.

Click This Picture To See 101 HDR Photos, 3-D Interactive Matterport Virtual Tour And More Details Of The Home!

Don’t miss out on this amazing opportunity to own a beautiful home in Rockwood. Contact me today to schedule a showing.

Why Homebuyers must get a Mortgage Pre-Approval NOW!

Click NOW To Get That Mortgage Pre-Approval Without Delay!

If you plan to buy real estate this year at all, get a mortgage pre-approval right now! Don’t wait, do it now and at least have a rate locked in that the lender will honor for up to 120 days even if interest rates go up right after you receive said approval.

The Bank of Canada has plans to make at least two-(2) interest rate announcements this quarter on January 25th and March 8th respectively. We aren’t certain of what will be announced but it’s fair to assume that another rate increase is very possible.

In general, it is a good idea for home buyers to get pre-approved for a mortgage before they start looking for a home. A mortgage pre-approval is a commitment from a lender to provide you with a home loan for a specific amount, based on your financial situation.

It is important because it helps you understand how much you can borrow and what your monthly payments will be. It also gives you a competitive edge when you are making an offer on a home, as it shows the seller that you are a serious and qualified buyer.

If you are considering buying a home, it is a good idea to speak with a lender and get pre-approved for a mortgage as soon as possible. The lender will review your financial situation and help you determine how much you can borrow and what your monthly payments will be. This will give you a better understanding of what you can afford and help you narrow down your search to homes that are within your budget.

A Look Back At The 2022 GTA Housing Market

Sign Up for Neighborhood News Today!

Home Sales & Listings Down While Selling Price & Rent Up

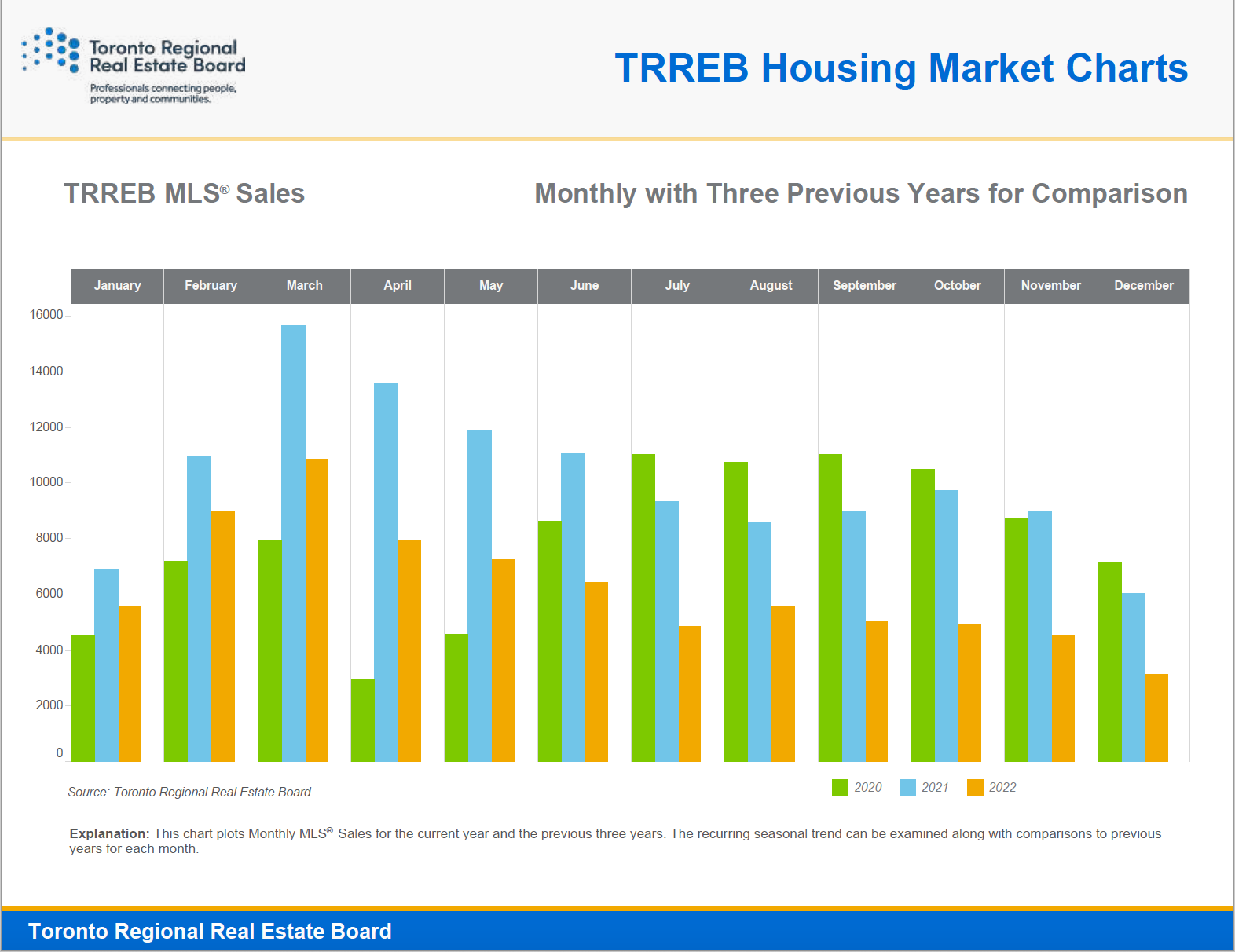

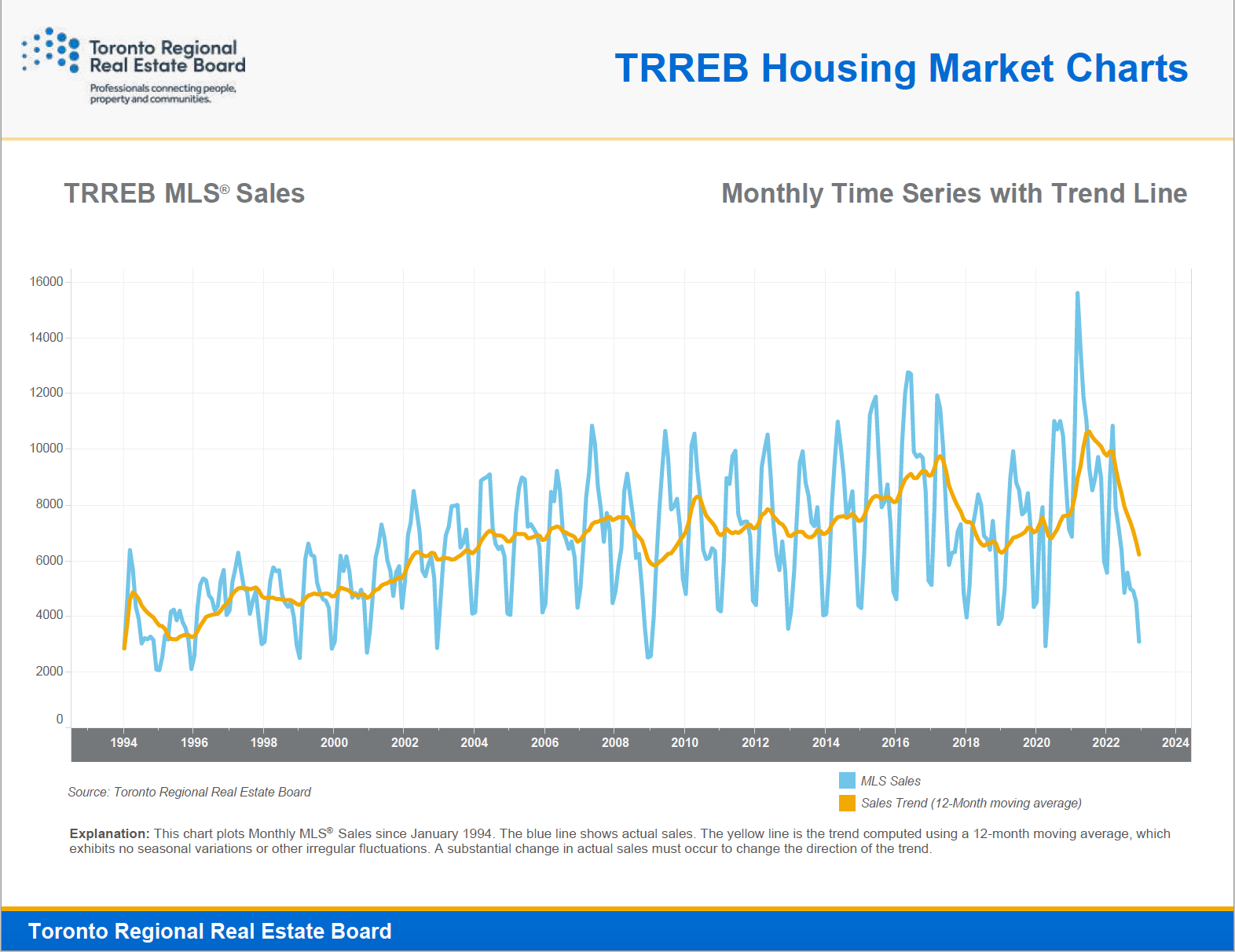

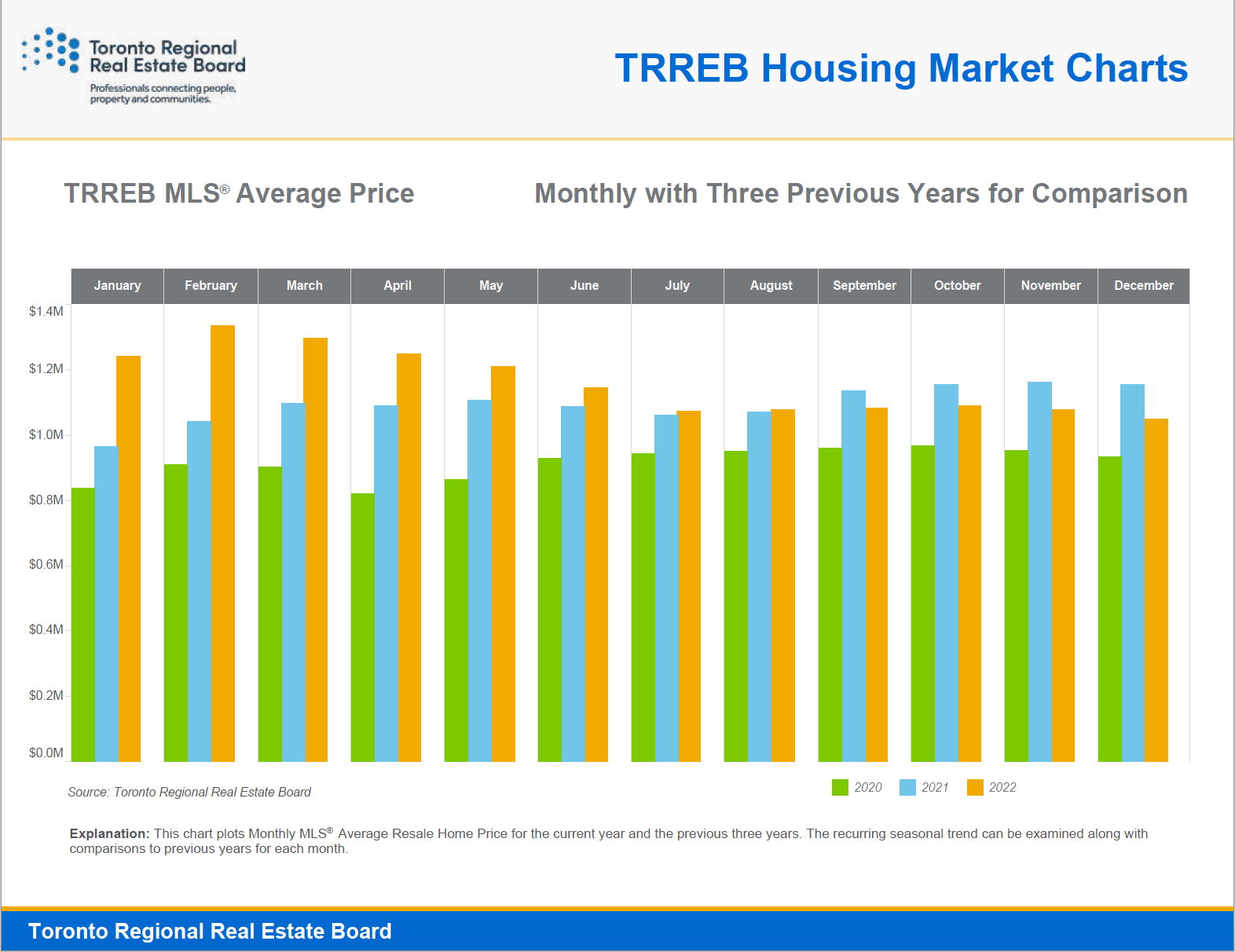

TORONTO, ONTARIO, January 5, 2023 – The Greater Toronto Area (GTA) housing market experienced a marked adjustment in 2022 compared to record levels in 2021. Existing affordability issues brought about by a lack of housing supply were exacerbated by sustained interest rate hikes by the Bank of Canada.

Interest Rates & Mortgage Stress Test

“Following a very strong start to the year, home sales trended lower in the spring and summer of 2022, as aggressive Bank of Canada interest rate hikes further hampered housing affordability. With no relief from the Office of Superintendent of Financial Institutions (OSFI) mortgage stress test or other mortgage lending guidelines including amortization periods, home selling prices adjusted downward to mitigate the impact of higher mortgage rates. However, home prices started levelling off in the late summer, suggesting the aggressive early market adjustment may be coming to an end,” said new Toronto Regional Real Estate Board (TRREB) President Paul Baron.

Sign Up for Neighborhood News Today!

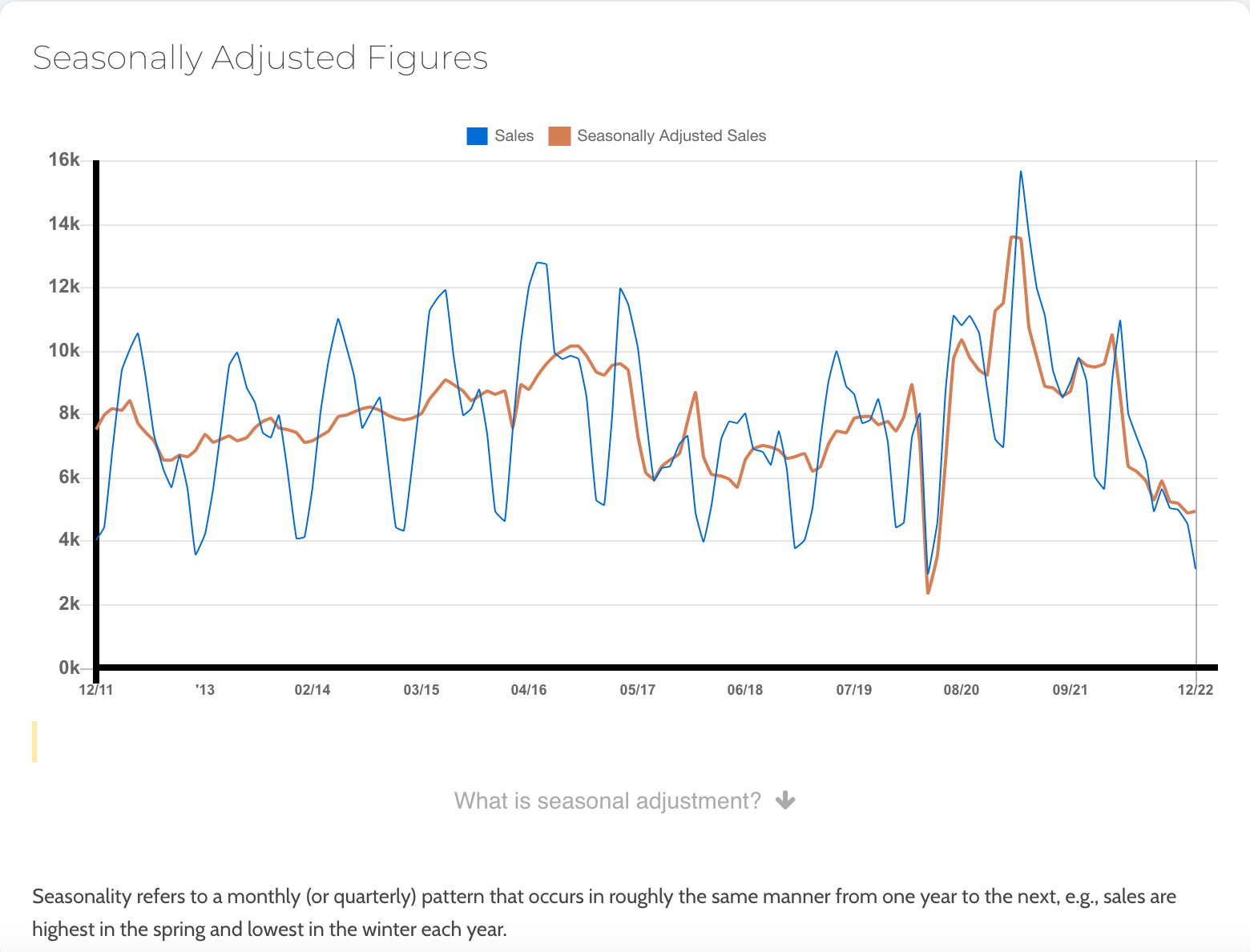

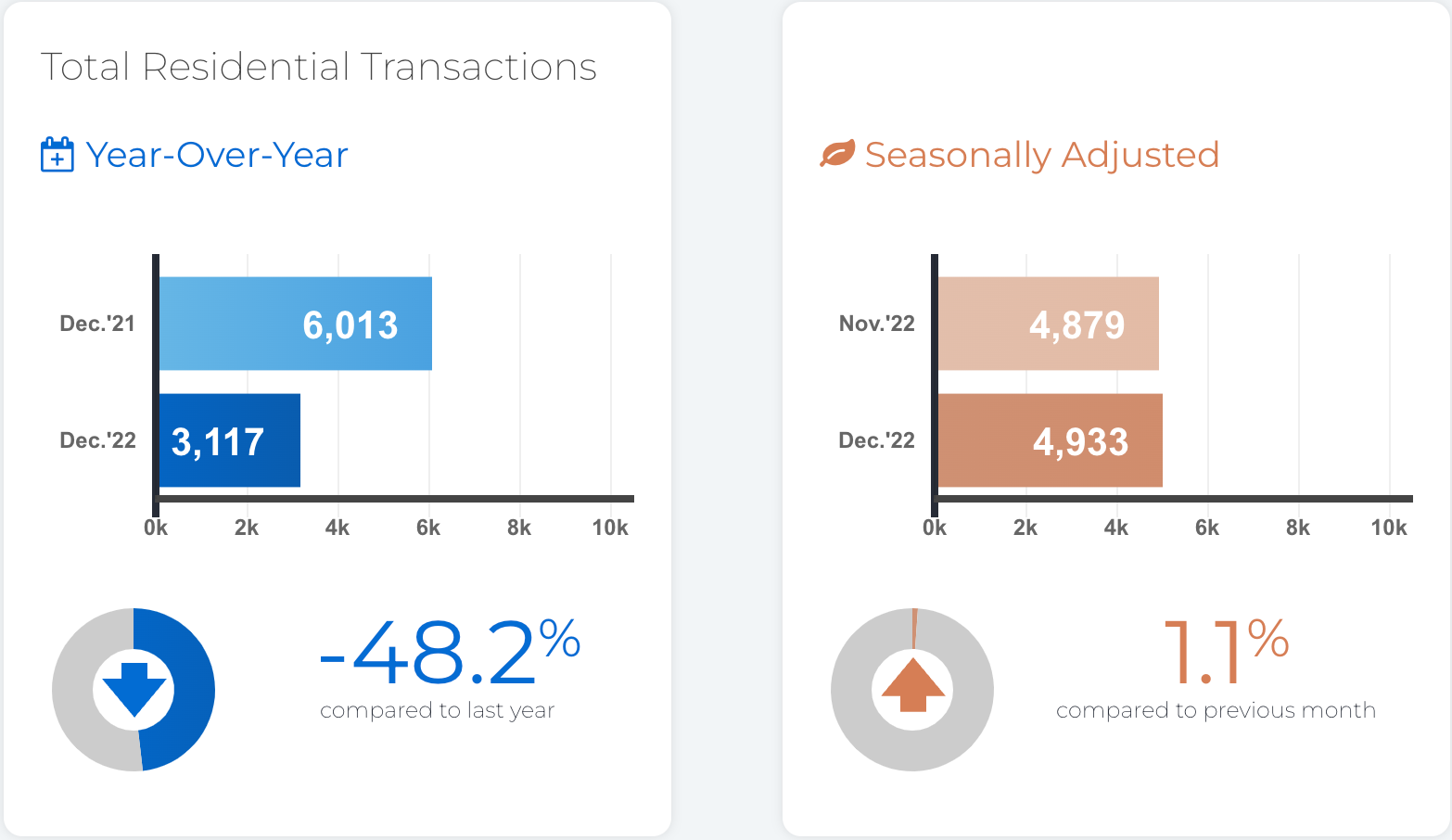

Total Number Of Sales With Seasonally Adjusted Figures

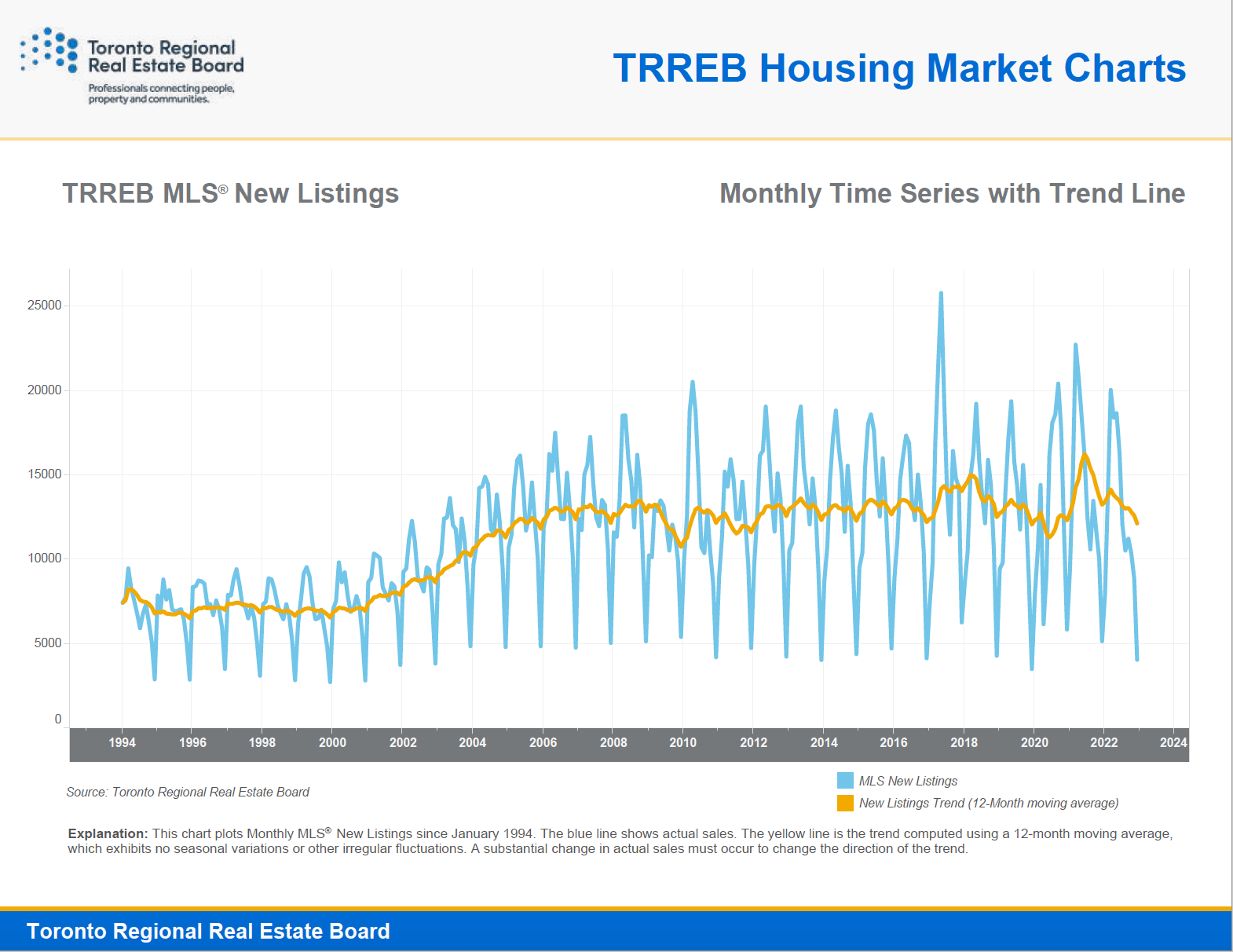

There were 75,140 sales reported through TRREB’s MLS® System in 2022 – down 38.2 per cent compared to the 2021 record of 121,639. The number of new listings amounted to 152,873 – down 8.2 per cent compared to 166,600 new listings in 2021. Seasonally adjusted monthly data for sales and price data show a marked flattening of the sales and price trends since the late summer.

Sign Up for Neighborhood News Today!

Total Residential Transactions With Seasonally Adjusted Figures

“While home sales and prices dominated the headlines in 2022, the supply of new listings continued to be an issue as well. The number of homes listed for sale in 2022 was down in comparison to 2021. This helps explain why selling prices have found some support in recent months. Lack of supply has also impacted the rental market. As renting has become more popular in this higher interest rate environment, tighter rental market conditions have translated into double-digit average rent increases,” said TRREB Chief Market Analyst Jason Mercer.

Sign Up for Neighborhood News Today!

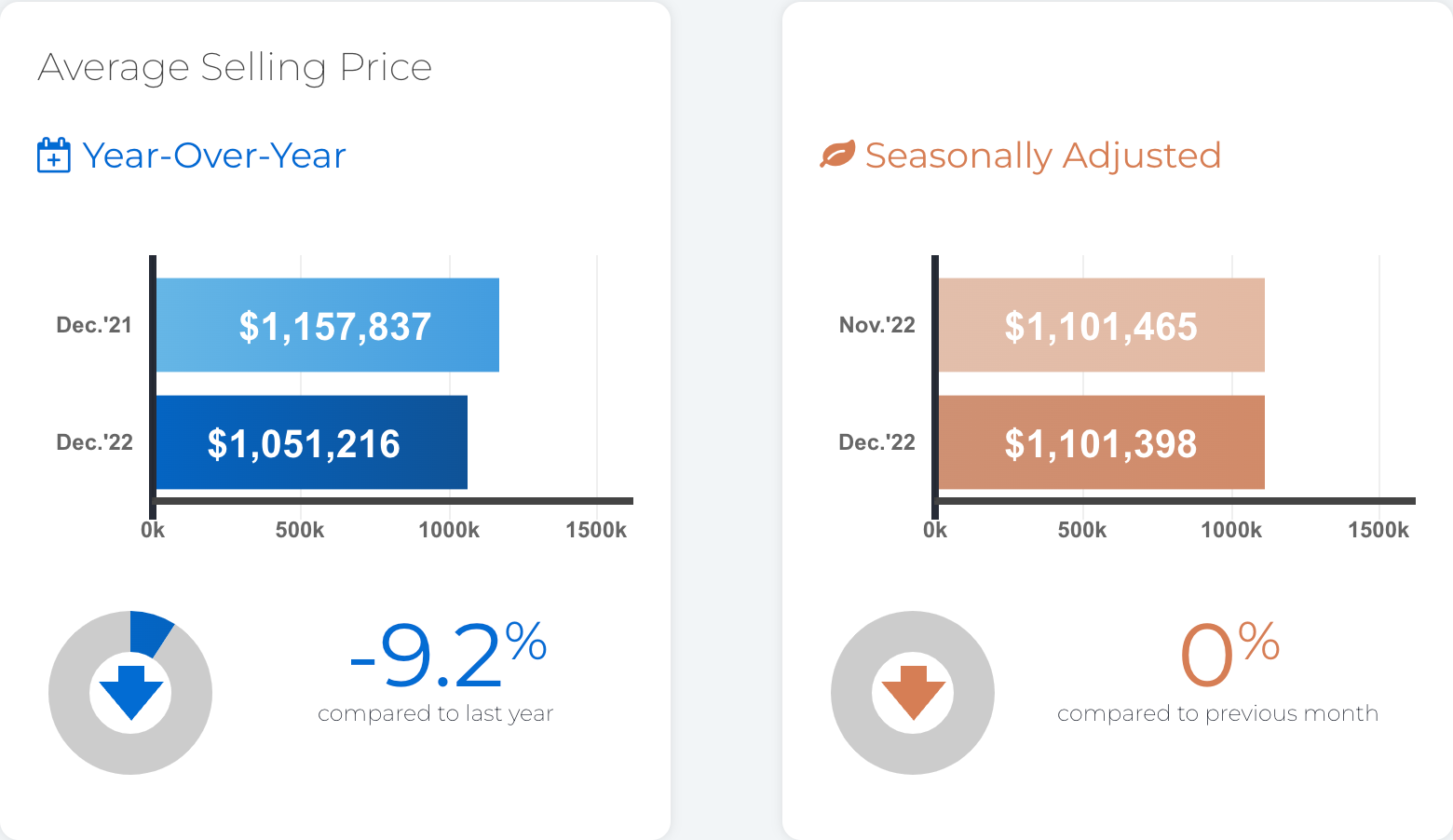

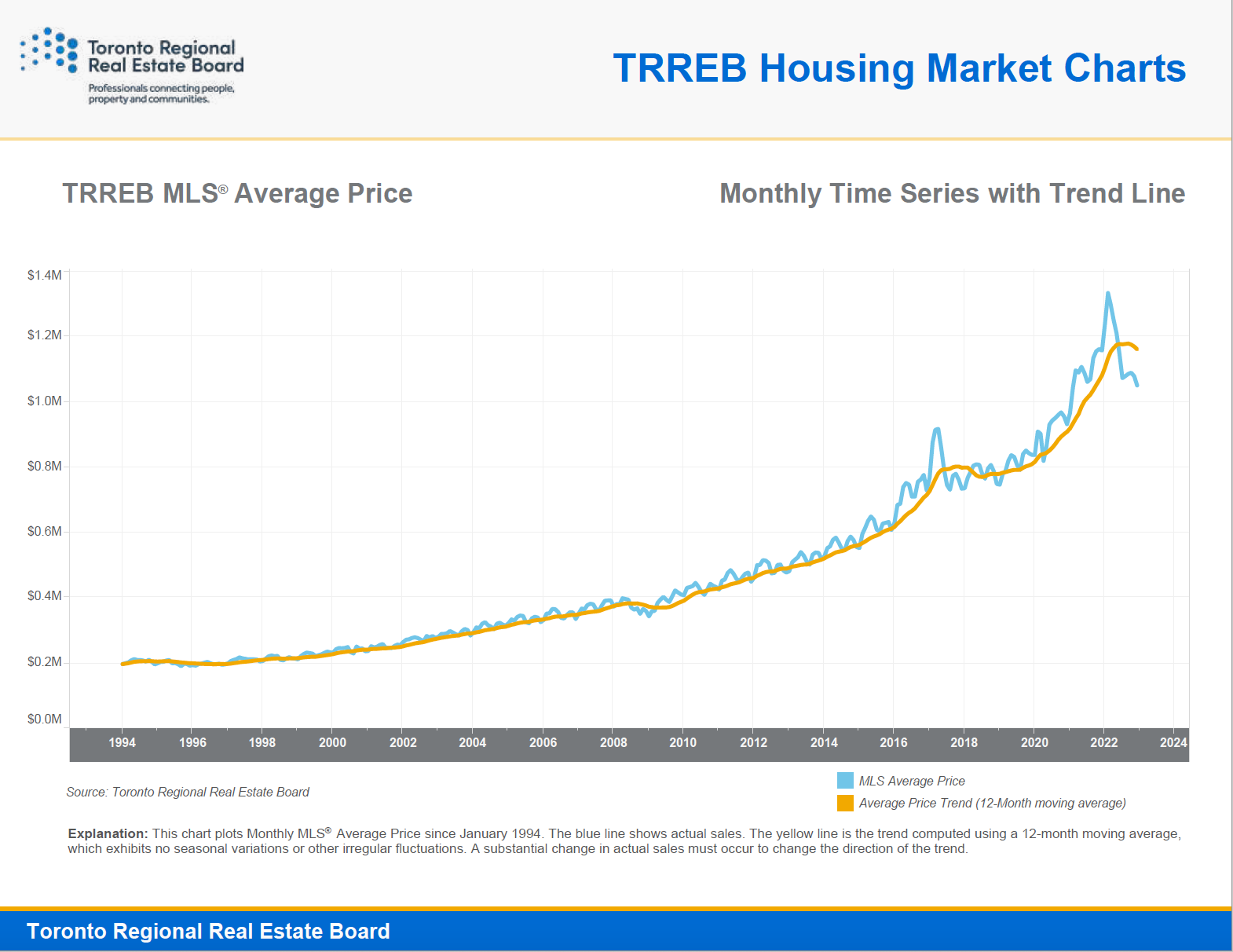

Average Selling Price With Seasonally Adjusted Figures

The average selling price for 2022 was $1,189,850 – up 8.6 per cent compared to $1,095,333 in 2021. This growth was based on a strong start to the year, in terms of year-over-year price growth. The pace of growth moderated from the spring of 2022 onwards.

Sign Up for Neighborhood News Today!

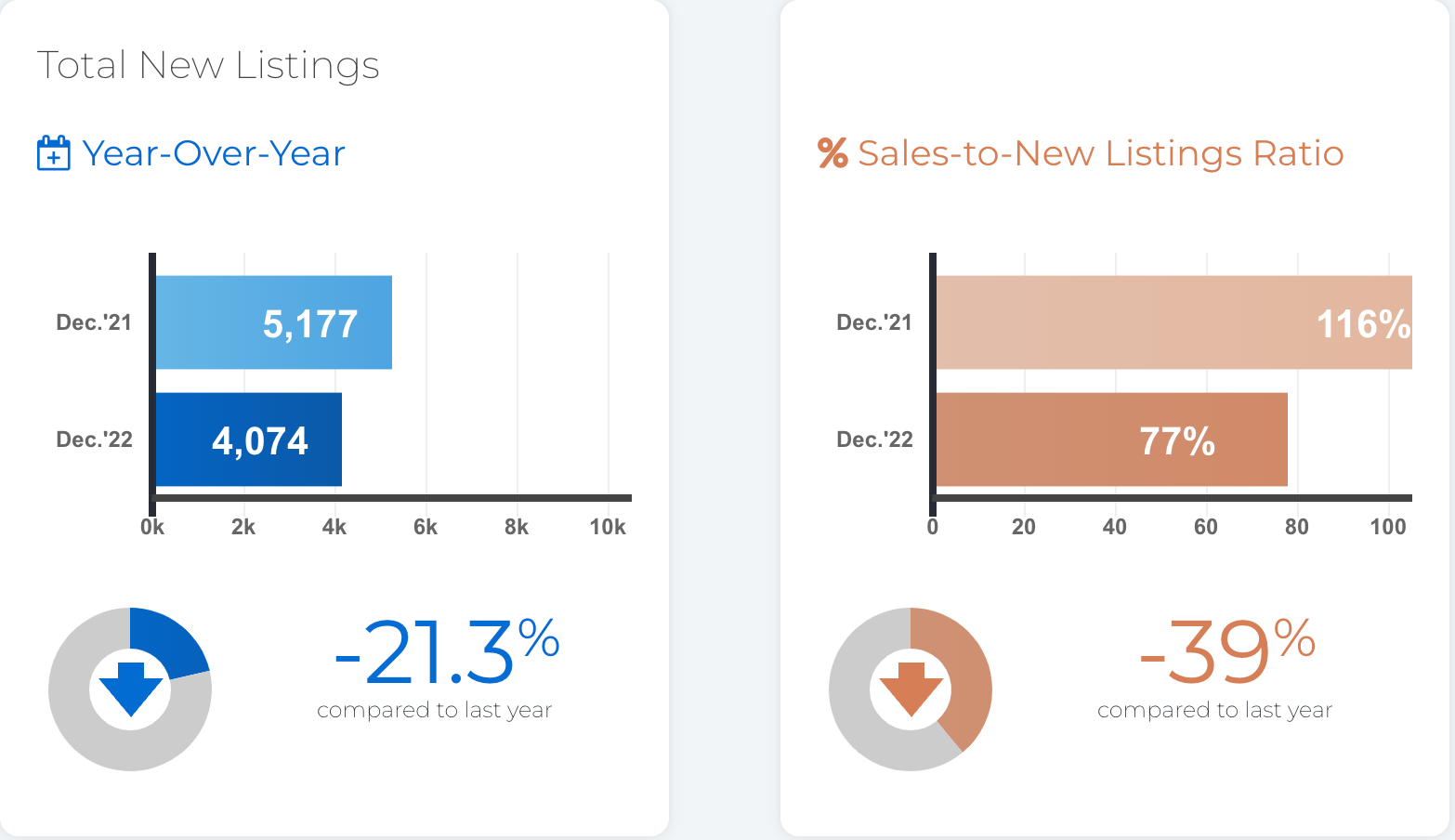

Total New Listings With Seasonally Adjusted Figures

“As we look forward into 2023, there will be two opposite forces impacting the housing market. On the one hand, we will continue to feel the impact of higher borrowing costs. On the other hand, record levels of immigration will support demand for ownership and rental housing, while we struggle to come to terms with a housing and infrastructure deficit in the Greater Golden Horseshoe. These themes will be discussed in TRREB’s upcoming Market Outlook and Year in Review report to be released in early February,” said TRREB CEO John DiMichele.

Sign Up for Neighborhood News Today!

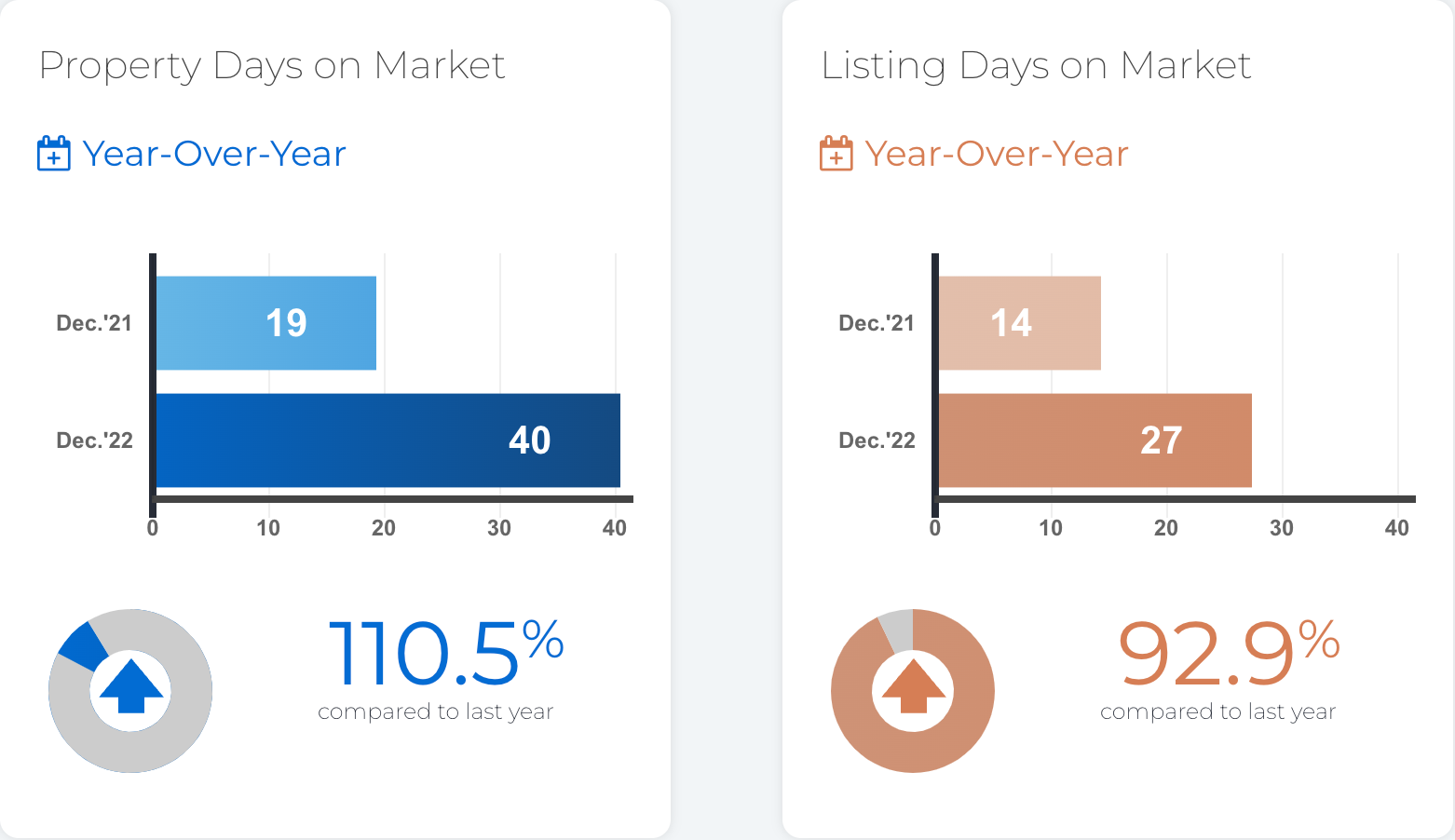

Property Days and Listing Days On Market

December 2022 Results

- There were 3,117 sales reported through TRREB’s MLS® System in December 2022 – down 48.2 per cent compared to December 2021.

- New listings totalled 4,074 – down 21.3 per cent compared to 5,177 in December 2021.

- The MLS® Home Price Index Composite benchmark was down 8.9 per cent on a year-over-year basis in December 2022.

- The December average selling price, at $1,051,216, was down by 9.2 per cent compared to the December 2021 average of $1,157,837.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link