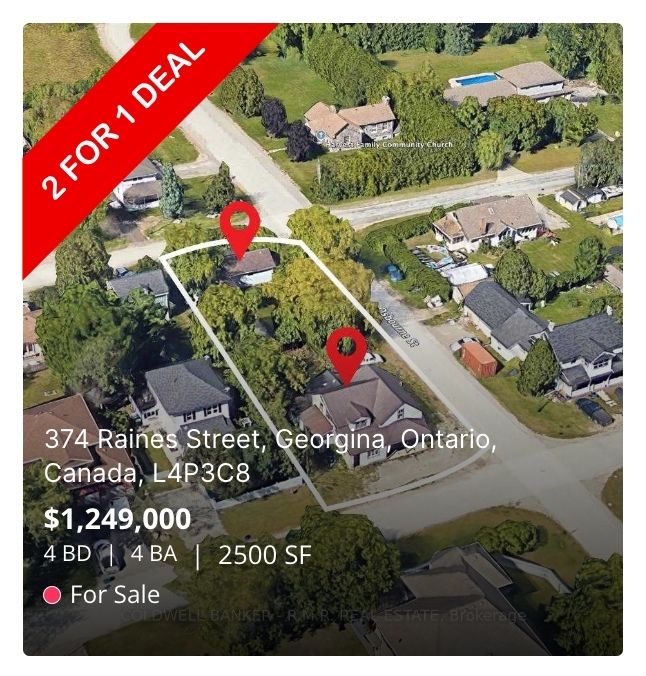

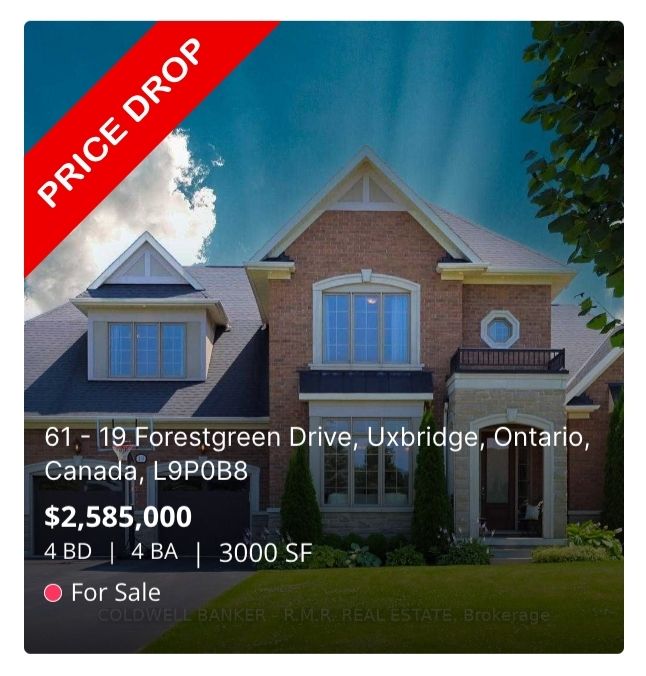

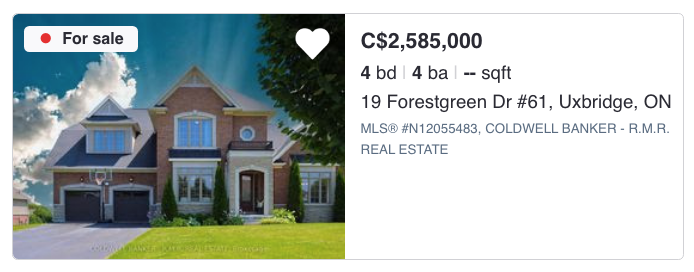

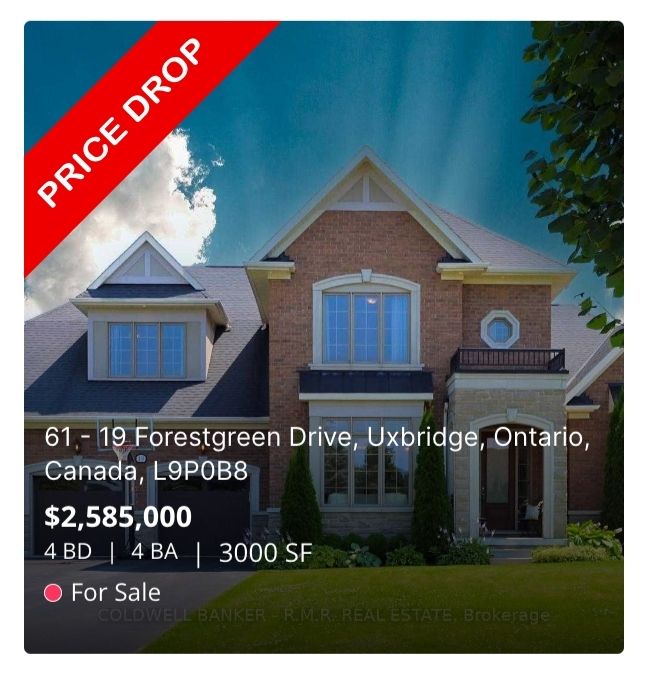

Thanks for Booking A Showing for 19 Forestgreen Dr by Gerald Lawrence, REALTOR®

“Pay to Say”: The Controversial New Rule Blocking Tenants From Court (Unless They Pay Up)

Bill 60 Deep Dive: The Ultimate Guide for Ontario Landlords, Tenants, Buyers, and Sellers

Bill 60, formally known as the Fighting Delays, Building Faster Act, 2025, has officially shaken up the landscape of rental housing in Ontario. Whether you are a seasoned investor, a first-time renter, or someone looking to buy or sell a tenanted property, these changes are not just “fine print”—they fundamentally alter your rights, timelines, and financial obligations.

This comprehensive guide breaks down every critical aspect of the new legislation, offering detailed analysis, practical scenarios, and checklists to keep you compliant and protected.

What is Bill 60?

At its core, Bill 60 was introduced by the Ontario government with the stated aim of “reducing red tape” and clearing the massive backlog at the Landlord and Tenant Board (LTB). For years, both landlords and tenants have suffered from wait times that can stretch to 8-12 months for a simple hearing.

While the goal of speed is universally appreciated, the methods used in Bill 60 have sparked intense debate. The legislation aggressively shortens timelines for evictions and limits certain tenant defenses, tilting the procedural balance significantly.

The 4 Key Changes You Must Know

1. The “Cash for Keys” Trade-Off (N12 Compensation)

-

Old Rule: If a landlord wanted to move into their unit (or move a family member in), they had to give 60 days’ notice and pay the tenant 1 month’s rent as compensation.

-

New Bill 60 Rule: Landlords can now avoid paying the 1-month compensation if they provide a longer notice period of 120 days (4 months) instead of the standard 60 days.

-

Note: This specifically applies to Section 48 (Landlord’s Own Use).

-

Strategy: This creates a “Time vs. Money” decision for landlords. If you are cash-poor but have time, you can save money. If you need the unit fast, you pay the compensation for the 60-day exit.

-

2. “Pay to Say” (Rent Arrears Hearings)

-

Old Rule: If a landlord filed for eviction due to unpaid rent (L1 application), the tenant could show up at the hearing and raise “new issues” like maintenance problems or harassment to explain why they withheld rent.

-

New Bill 60 Rule: Tenants can no longer raise these issues at an arrears hearing unless they:

-

Provide advance written notice.

-

Pay 50% of the alleged rent arrears into the Board or to the landlord before the hearing can proceed with those arguments.

-

Impact: This effectively bars tenants who are withholding rent due to severe disrepair (and have spent the money on repairs or other needs) from using that defense without a significant upfront payment.

-

3. The 7-Day Eviction Clock (N4 Notice)

-

Old Rule: If a tenant missed rent, the landlord gave an N4 notice. The landlord had to wait 14 days after the notice was served before they could file an application with the LTB.

-

New Bill 60 Rule: The waiting period has been slashed to 7 days.

-

Impact: This cuts a week off the eviction timeline. If rent is due on the 1st and unpaid, an N4 can be issued on the 2nd, and the LTB filing can happen as early as the 9th or 10th.

-

4. Slashed Appeal Windows

-

Old Rule: Parties had 30 days to appeal an LTB decision to the Divisional Court or request a review.

-

New Bill 60 Rule: The appeal window is reduced to 15 days.

-

Impact: You must have your legal counsel and paperwork ready immediately after a decision is rendered.

-

Pros and Cons Analysis

For Landlords

For Tenants

Real-World Scenarios

Scenario A: The “Patient” Landlord

Situation: Sarah owns a condo downtown. Her daughter is graduating university in 5 months and needs the unit.

Action: Sarah serves an N12 notice now, opting for the 120-day termination date.

Result: Sarah does not have to pay her tenant the standard $2,800 compensation. The tenant gets 4 months to find a place, and Sarah saves nearly $3,000.

Scenario B: The “Emergency” Repair Defense

Situation: Mark, a tenant, stops paying rent because his roof is leaking and destroying his furniture. He owes $4,000 in back rent.

Bill 60 Impact: The landlord files for eviction. Mark wants to show photos of the roof at the hearing. The adjudicator asks, “Have you paid $2,000 (50%) of the arrears?” Mark has not.

Result: Mark is blocked from raising the maintenance issue as a defense against the eviction. The eviction for non-payment is likely granted, and Mark must pursue a separate (and later) application for the roof.

Critical Advice for Buyers and Sellers of Tenanted Properties

This is the most complex area of the new bill. The distinction between Landlord’s Own Use (Section 48) and Purchaser’s Own Use (Section 49) is vital.

For Sellers

-

The “Compensation Trap”: If you are selling a tenanted property, do not assume you can waive the compensation for the buyer. The legislation specifically amends Section 48 (Landlord’s Own Use). It is legally risky to assume this applies to Section 49 (Purchaser’s Own Use).

-

Recommendation: If your buyer wants vacant possession, stick to the standard 60-day N12 and pay the compensation. Using the 120-day rule to save a few thousand dollars could spook a buyer who doesn’t want to wait 4 months to close.

-

Marketing: If you have a long closing (e.g., 5-6 months), you might be able to use the 120-day notice before listing or early in the process to clear the unit cost-effectively, but consult a paralegal first.

For Buyers

-

Closing Dates: If you are buying a tenanted property for your own use, demand a standard 60-day N12. Do not let the seller try to save money with the 120-day notice unless you are perfectly happy waiting 4+ months to move in.

-

Vacant Possession Clauses: Ensure your Agreement of Purchase and Sale (APS) has a strict clause requiring the Seller to provide vacant possession. With the new appeal window shortened to 15 days, you will know sooner if a tenant is fighting the eviction, allowing you to walk away or renegotiate faster.

Actionable To-Do Lists

For Landlords

-

[ ] Update Your Forms: Ensure you are using the newest versions of N4 and N12 forms that reflect Bill 60 changes. Old forms may be considered defective.

-

[ ] Audit Your Arrears: If a tenant is late, issue the N4 on day 2. Mark your calendar for Day 8 to file the L1 application (down from Day 15).

-

[ ] Budget for Legal: If you plan to use the 120-day notice, verify with a legal professional that your specific scenario qualifies for the compensation waiver.

For Tenants

-

[ ] Don’t Withhold Rent: Under Bill 60, withholding rent is riskier than ever. Pay your rent, and file a separate T6 (Maintenance) application immediately if repairs are needed.

-

[ ] Act Fast on N4s: If you receive a 7-day notice, contact a rent bank or legal clinic immediately. You have half the time you used to have.

-

[ ] Check the Notice: If a landlord gives you 120 days notice and doesn’t pay compensation, make sure they are actually moving in. If they re-rent it or sell it, you can file a T5 (Bad Faith) application for significant damages.

Conclusion

Bill 60 is a double-edged sword. It offers speed and cost-saving potential for landlords but demands rigorous adherence to new, tighter schedules. For tenants, it strips away financial leverage and safety nets, making “paying rent on time” the only safe harbor. Whether you agree with the politics or not, understanding these rules is the only way to survive in Ontario’s new rental reality.

Bill 60 protest video This video provides visual context on the public reaction and protests regarding Bill 60, highlighting the intensity of the debate surrounding these changes.

🚨 Critical Action: Are Your New Notices Legal?

Bill 60 has eliminated your margin for error. The new 7-day N4 timelines and the complex N12 compensation waivers mean a single mistake on paperwork can lead to your LTB application being dismissed—forcing you to start over, or worse, facing substantial bad-faith fines.

Don’t rely on outdated templates or guesswork. Ensure your documentation is 100% compliant with the new Fighting Delays, Building Faster Act before you file.

Protect Your Investment: Book a Bill 60 Compliance Audit

Click below to schedule a rapid, 15-minute audit with a licensed paralegal specializing in Ontario landlord-tenant law.

We will confirm if:

-

Your 7-day N4 is properly timed and served.

-

Your 120-day N12 compensation waiver is legally applicable to your scenario (Section 48 vs. Section 49).

-

Your selling strategy complies with the new purchaser use rules.

Protect your legal right to the unit and save thousands in potential compensation and fines.

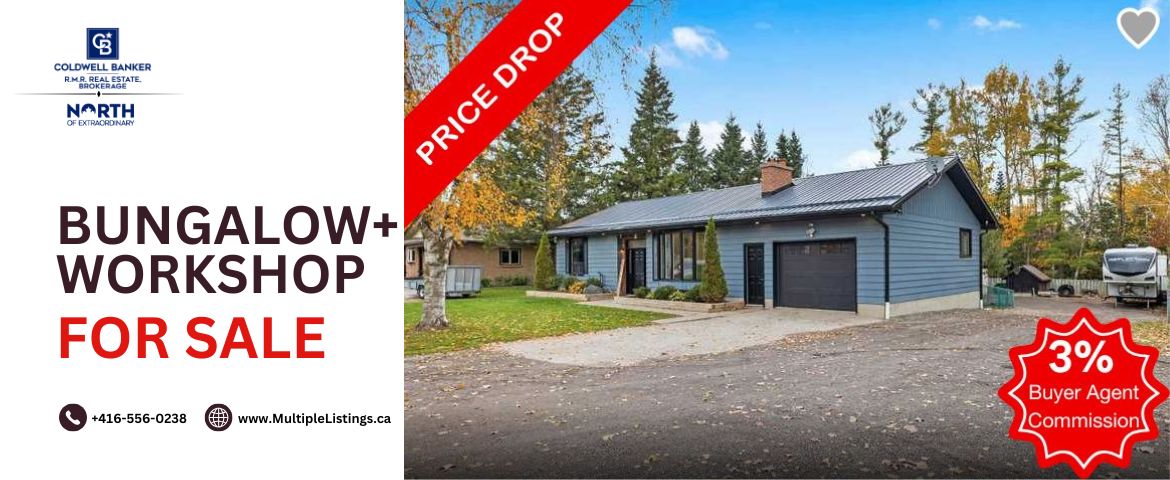

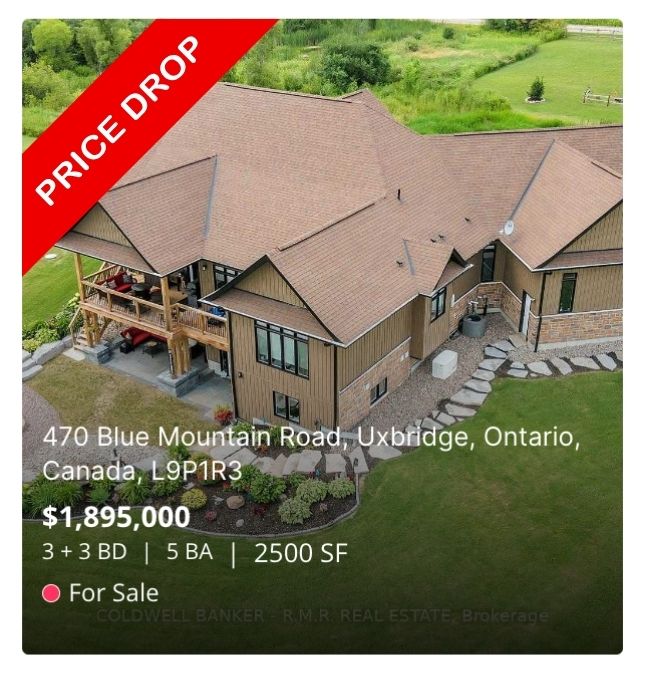

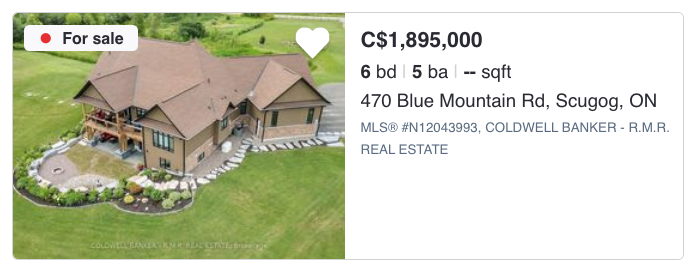

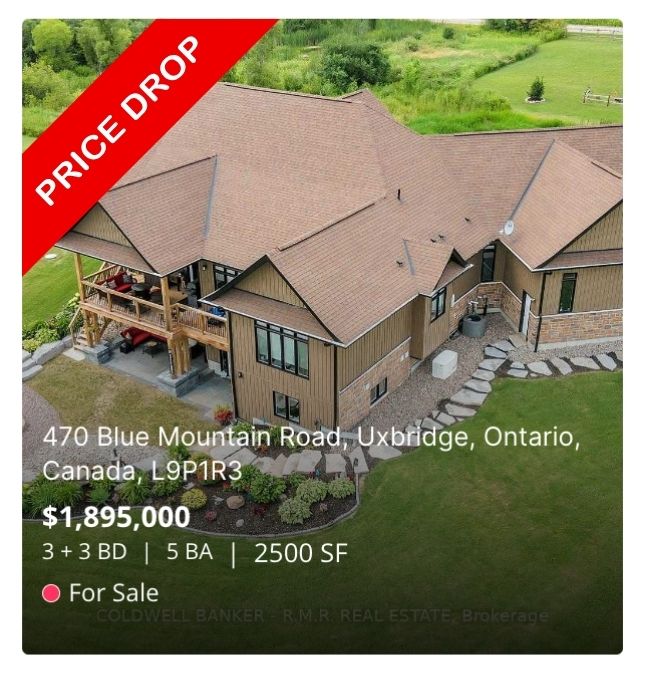

Thank You For The Booked Showing – 470 Blue Mountain Rd!

Thanks for Booking A Showing for 470 Blue Mountain Rd by @YorkDurhamHomes

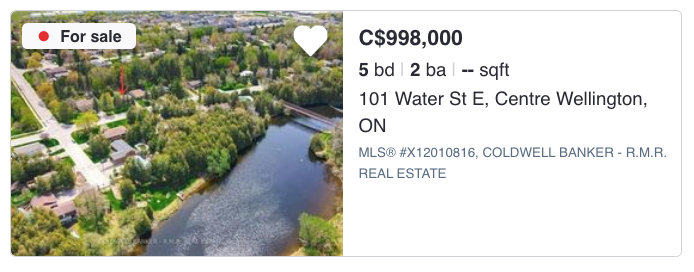

Thank You For The Booked Showing – 12885 Hwy 12!

Thanks for Booking A Showing for 12885 Hwy 12! Gerald Lawrence -REALTOR®

STOP WAITING: GTA Home Prices CRASHED 7.2%! 📉 The October/November Secret Buyers Need to Know Now

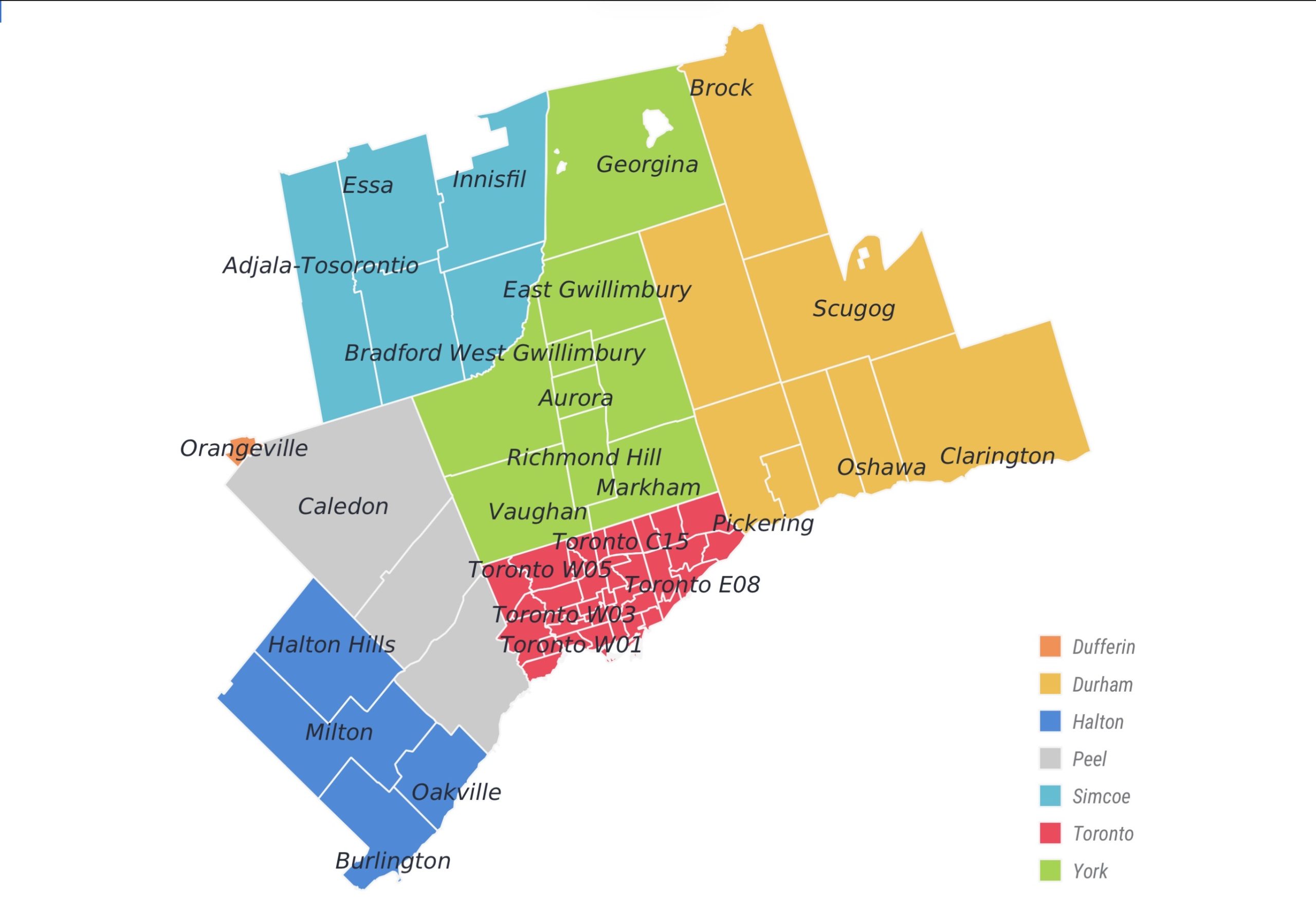

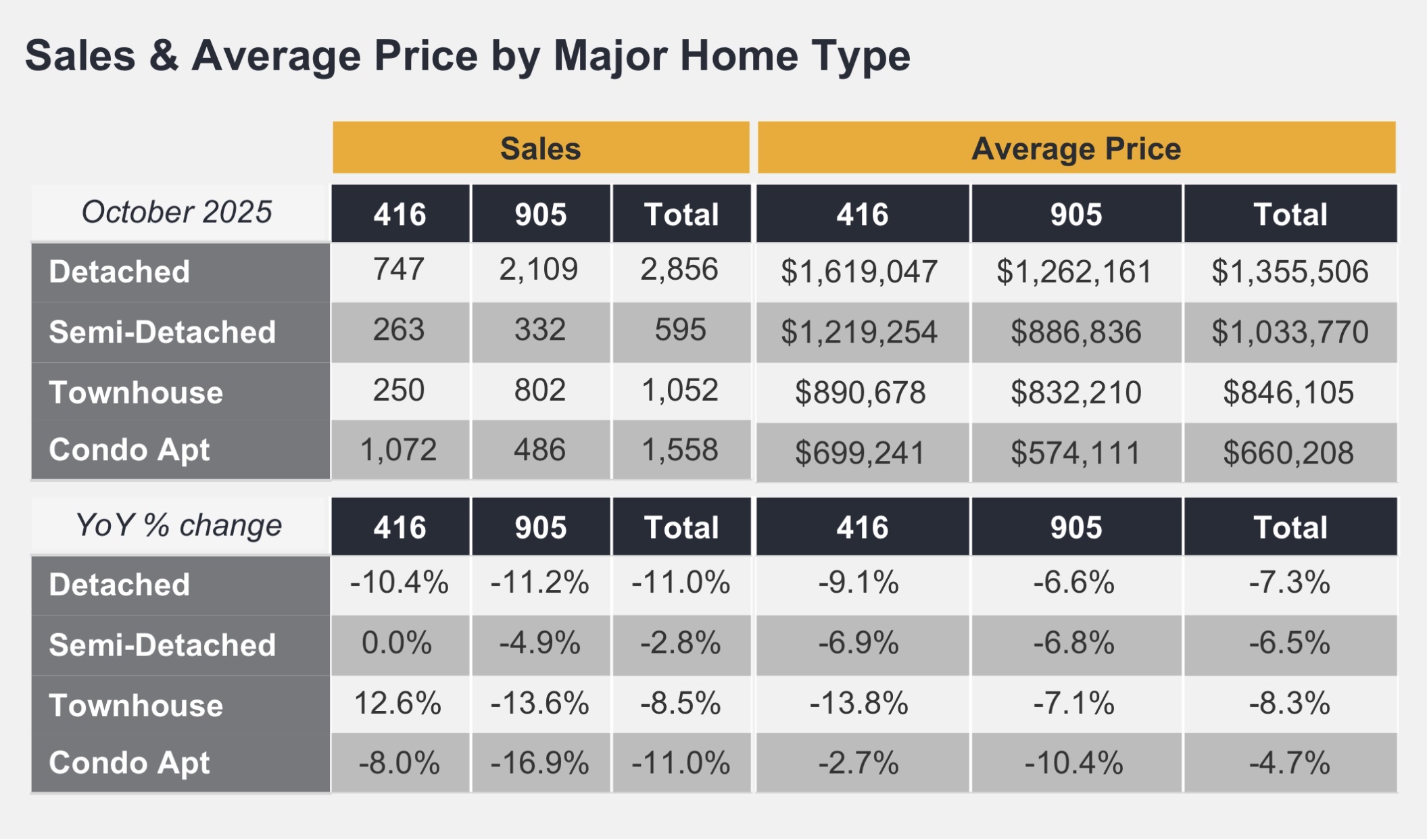

The October 2025 Durham Region real estate report reveals a balanced housing market characterized by lower home sales, increased inventory, and easing prices. The average sale price in Durham slipped by about 4-5% year-over-year to roughly $850,000, while homes sold for just under their list price and spent more time on the market. Inventory levels climbed to multi-year highs, giving buyers more options and shifting negotiations in their favor, yet some segments remain competitive—especially lower-priced properties. Sellers are adjusting expectations as market balance improves, and buyers benefit from greater choice and negotiating room, all amid ongoing economic uncertainty, declining mortgage rates, and steady but cautious transactional activity.

Screenshot

Durham Region Real Estate Market October 2025: Key Insights

October 2025 saw shifting dynamics in the Durham Region housing market. Home sales experienced a decline year-over-year, while new listings edged up, signaling a more favorable climate for buyers than in recent years. Lower mortgage rates and downward adjustments in selling prices improved affordability, though broader economic uncertainties are holding some buyers back.

Year-Over-Year Performance

-

Sales Volume: Home sales were down 9.5% in October 2025 compared to October 2024, echoing a region-wide cooling trend.

-

Listings: New listings increased by 2.7% year-over-year; active listings supply remains healthy, bolstering buyer options.

-

Average Price: The region’s average selling price fell by 7.2% compared to October 2024, showing a significant year-over-year price correction.

-

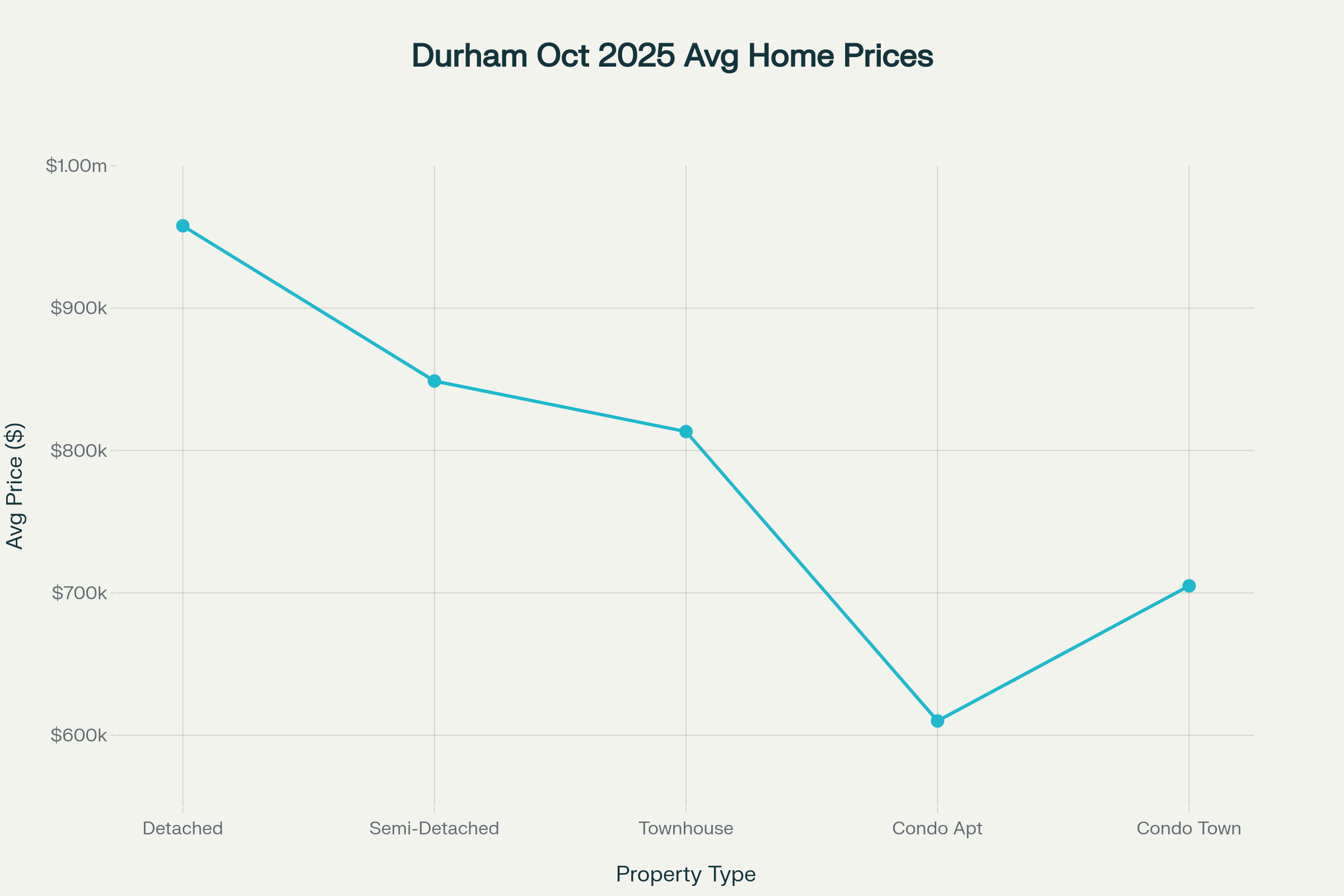

Benchmarks: In Durham, detached homes averaged $957,800, while townhouses and condos posted average prices of $813,300 and $610,000, respectively.

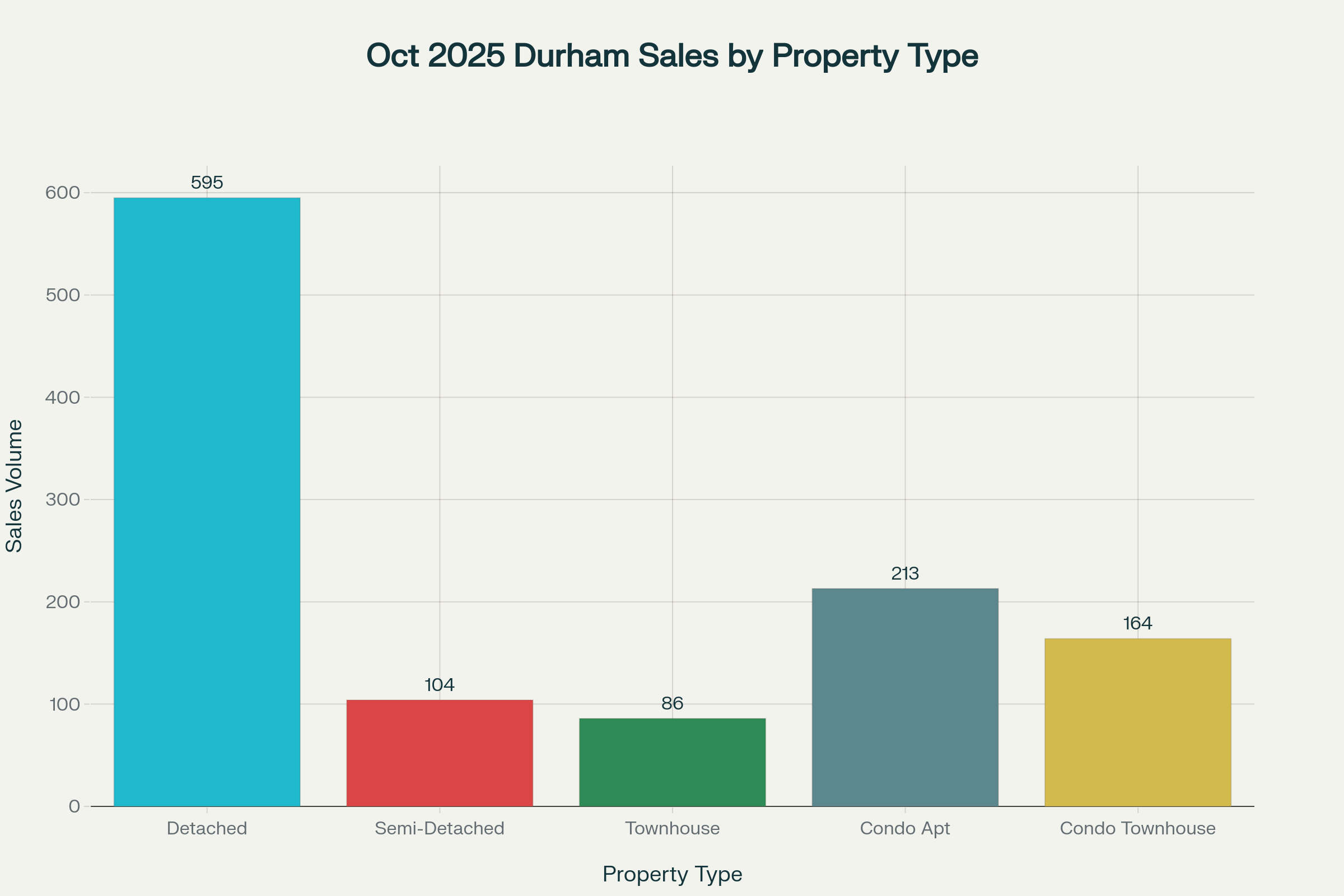

Market Segmentation: Home Types and Price Ranges

Detached and Semi-Detached Trends

-

Detached Homes: Average price was $957,800, with 595 transactions. Volumes were down and prices adjusted by about 10% year-over-year, reflecting overall softer market conditions.

-

Semi-Detached: These properties averaged $848,800 with 104 sales. Year-over-year price drop was about 8%, underscoring increasing price sensitivity among buyers.

Townhouses and Condominiums

-

Townhouses: The average sale price for townhomes stood at $813,300, slightly higher supply and moderate demand led to more negotiation on sales prices.

-

Condo Apartments: Durham’s average price for a condo apartment in October 2025 was $610,000, down almost 7% year-over-year. The volume for condo apartment sales was 213, demonstrating stable but selective buyer intent in this segment.

-

Condo Townhouses: These reached an average price of $704,900, signaling relative stability in entry-level housing.

Sales Volume and Price Range Data

| Home Type | Sales Volume | Avg. Price | YoY % Change |

|---|---|---|---|

| Detached | 595 | $957,800 | -10% |

| Semi-Detached | 104 | $848,800 | -8% |

| Att/Row Townhouse | 86 | $813,300 | -7% |

| Condo Apt | 213 | $610,000 | -7% |

| Condo Townhouse | 164 | $704,900 | -7% |

Inventory, Listings, and Buyer/Seller Dynamics

Inventory and Listings

-

Months of Inventory: Durham Region held around 4–5 months of inventory, up slightly year-over-year. This metric indicates a slowly growing buyer’s market, with more choice and less upward price pressure.

-

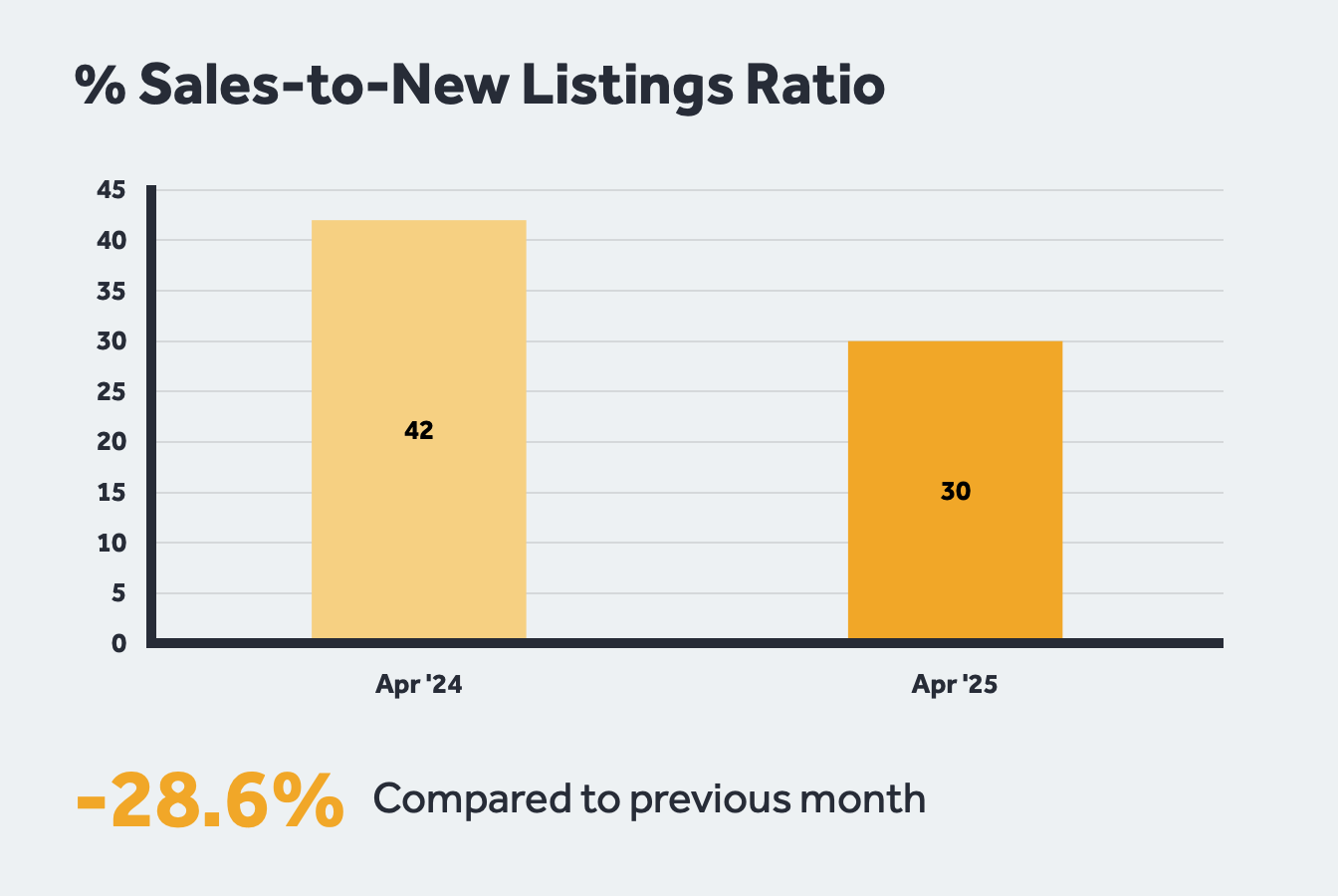

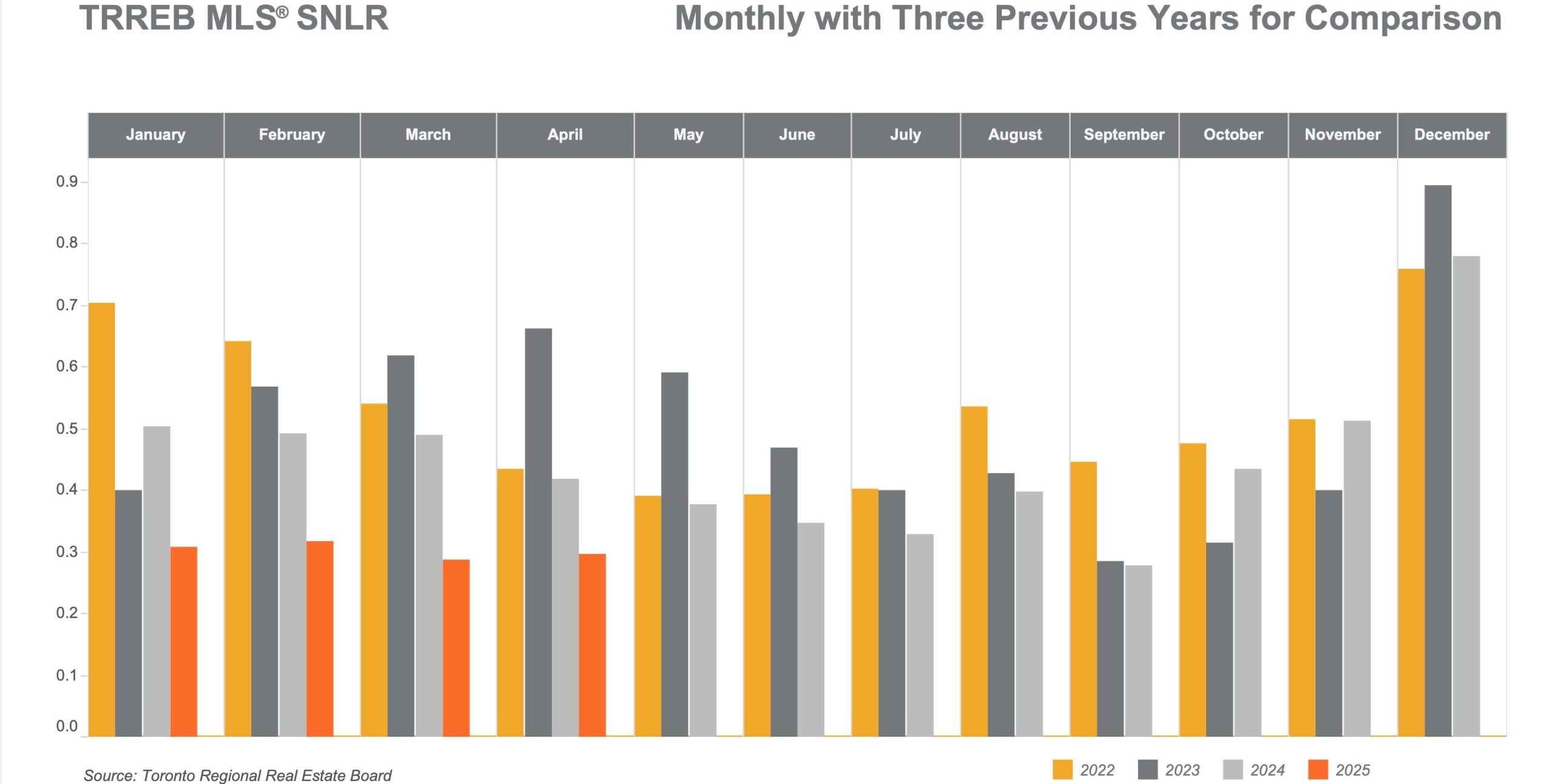

SNLR (Sales-to-New-Listings Ratio): Durham’s ratio hovered in the low 30s, indicative of balanced market conditions. Buyers now have more negotiating power, which translates into lower sale-to-list price ratios.

Buyer and Seller Strategies

-

Affordability: Lower interest rates and price drops have improved affordability for qualified buyers, especially those with job security and stable financing.

-

Listing Strategy: Sellers need to price realistically and stage homes attractively, as days-on-market are up, and average property days on market (PDOM) often exceeds 30 days.

-

Investor Impact: Investors have returned to monitoring the market closely for signs of price bottoms, but most are remaining selective, focused on properties that will cash-flow under higher interest costs.

Durham Region: Community-Specific Highlights

-

Ajax: 48 detached homes sold at an average of $957,800, while 15 condos averaged $610,000. Average listing days on market ranged from 20 to 30 days.

-

Oshawa: 144 detached transactions with an average price of $704,900; the town remains a magnet for entry-level buyers due to relatively affordable prices across all property categories.

-

Pickering and Whitby: Both cities maintained robust new listing activity and had average sale prices in the high $900,000s for detached, with strong diversity in available inventory from condos to large single-family homes.

Economic Factors and Forward-Looking Statements

-

Interest Rates: The Bank of Canada’s overnight rate in October was 4.7%, with most mortgage products reflecting favorable buyer terms. Weaker monthly sales contributed to weaker price gains, but falling borrowing costs create longer-term optimism.

-

Unemployment: Toronto’s seasonally adjusted unemployment rate dropped to 2.3%, supporting buyer confidence but not eliminating broader economic anxieties.

-

Policy Watch: Calls continue for governments to cut buyer costs, end exclusionary zoning, and prioritize new construction, especially as the population grows and housing diversity becomes critical.

What to Expect in Durham Region Real Estate

The Durham Region real estate market in October 2025 provided a classic example of the transition to a buyer-favored environment. While price corrections and increased supply benefitted buyers, overall sales volumes declined as some remained sidelined due to uncertainty. If macroeconomic confidence rebounds, expect pent-up demand to gradually return, particularly if borrowing costs remain low and local job markets stay robust. For now, Durham’s property market offers opportunity for buyers and a clear message to sellers: adapt strategies to this more competitive climate.

The Greater Toronto Real Estate Market Update

The Greater Toronto Area (GTA) real estate market in October 2025 has created a rare and powerful window of opportunity for homebuyers. The latest stats from GTA REALTORS® confirm a clear shift to a buyer’s market, marked by increased inventory, lower prices, and more affordable mortgage payments.

If you’ve been waiting on the sidelines, this is your sign to move forward with confidence.

📉 Buyer Advantage: Prices & Payments Are Down

October’s data presents an undeniable financial benefit for buyers with long-term certainty in their employment and income.

- Average Selling Price Down: The average selling price in the GTA dropped to $1,054,372, a significant 7.2% decrease compared to October 2024.

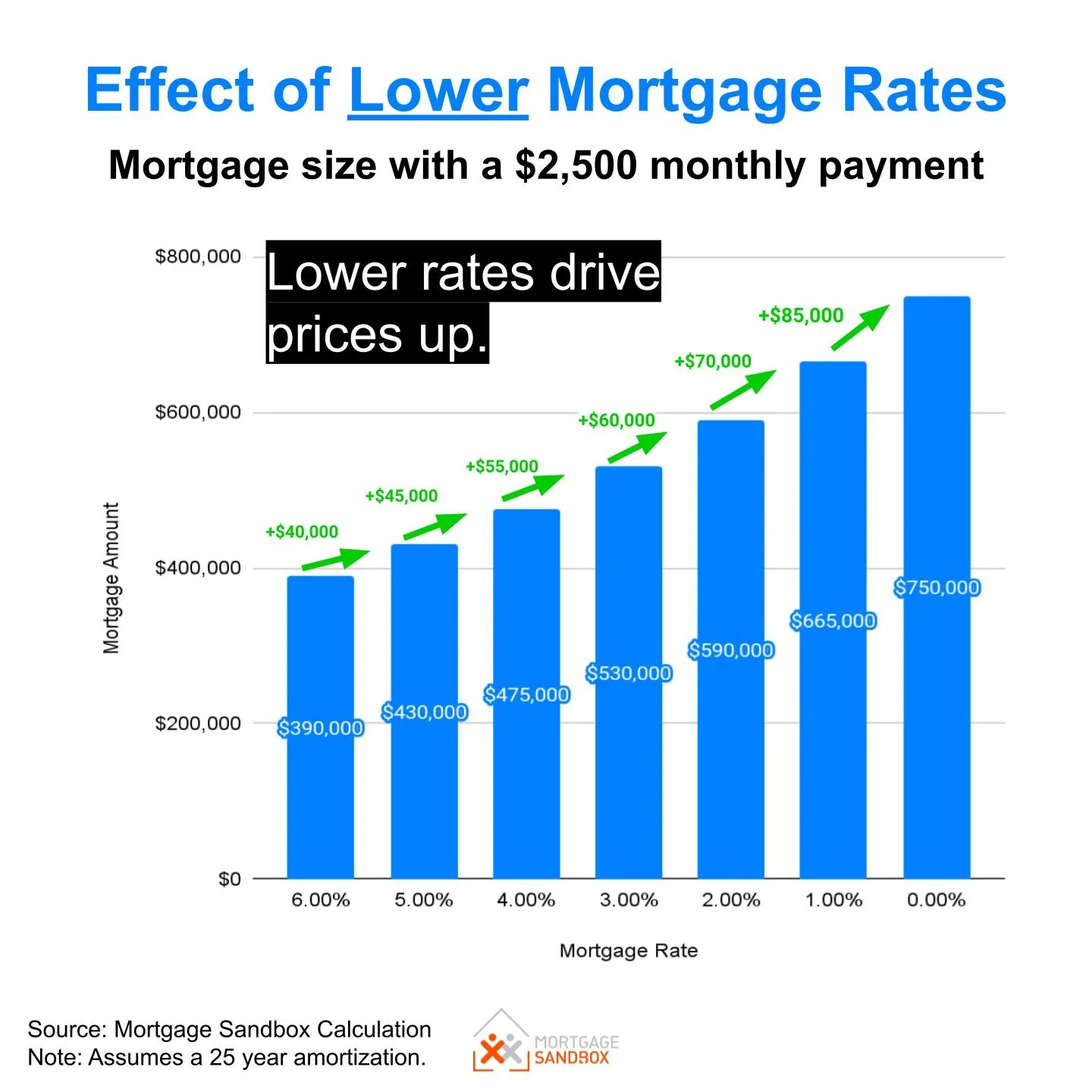

- Lower Monthly Payments: As TRREB’s Chief Information Officer noted, the monthly mortgage payment for an average-priced home is trending lower. This is due to the combined effect of negotiated price reductions and generally lower borrowing costs, making homeownership more accessible.

- Price Benchmark Eased: The MLS® Home Price Index (HPI) Composite benchmark was down by five per cent year-over-year. This indicates a broader, sustained cooling in home values.

Key Takeaway: You can now enter the GTA housing market at a more affordable price point and secure a lower monthly payment than buyers faced just one year ago.

🏡 More Choice: Inventory Is Up

Buyers now have time to breathe, compare, and make a decision without the pressure-cooker bidding wars of the past.

- Listings Increase: New listings totaled 16,069 in October, a 2.7% increase year-over-year. While sales were down, the increase in listings means a more diverse selection of properties for you to choose from.

- Conditions Favour Buyers: With sales down by 9.5% year-over-year against a rise in new listings, the competition is significantly reduced. This is the definition of market conditions that favour homebuyers, giving you the negotiating leverage you’ve been waiting for.

🚀 Seize the Negotiation Window!

The current market dynamic won’t last forever. As TRREB experts suggest, once economic uncertainty fades and business confidence returns, demand is likely to increase and tighten the market again.

The time to act is now, while inventory is high, prices are favourable, and your negotiation power is at its peak.

Don’t wait for the next wave of buyers to jump in. Secure your future home and lock in your price before the market starts to turn.

🔥 Buyers: Stop Waiting! Schedule Your Exclusive Strategy Call TODAY.

Ready to capitalize on lower prices and higher negotiating power? Let’s discuss a tailored buying strategy to find your dream home at the best possible value.

Click Here to Schedule a Free, No-Obligation Buyer Consultation Now!

Are you a homeowner thinking of selling? Even in a buyer’s market, a properly priced and professionally marketed home will still attract the right buyer.

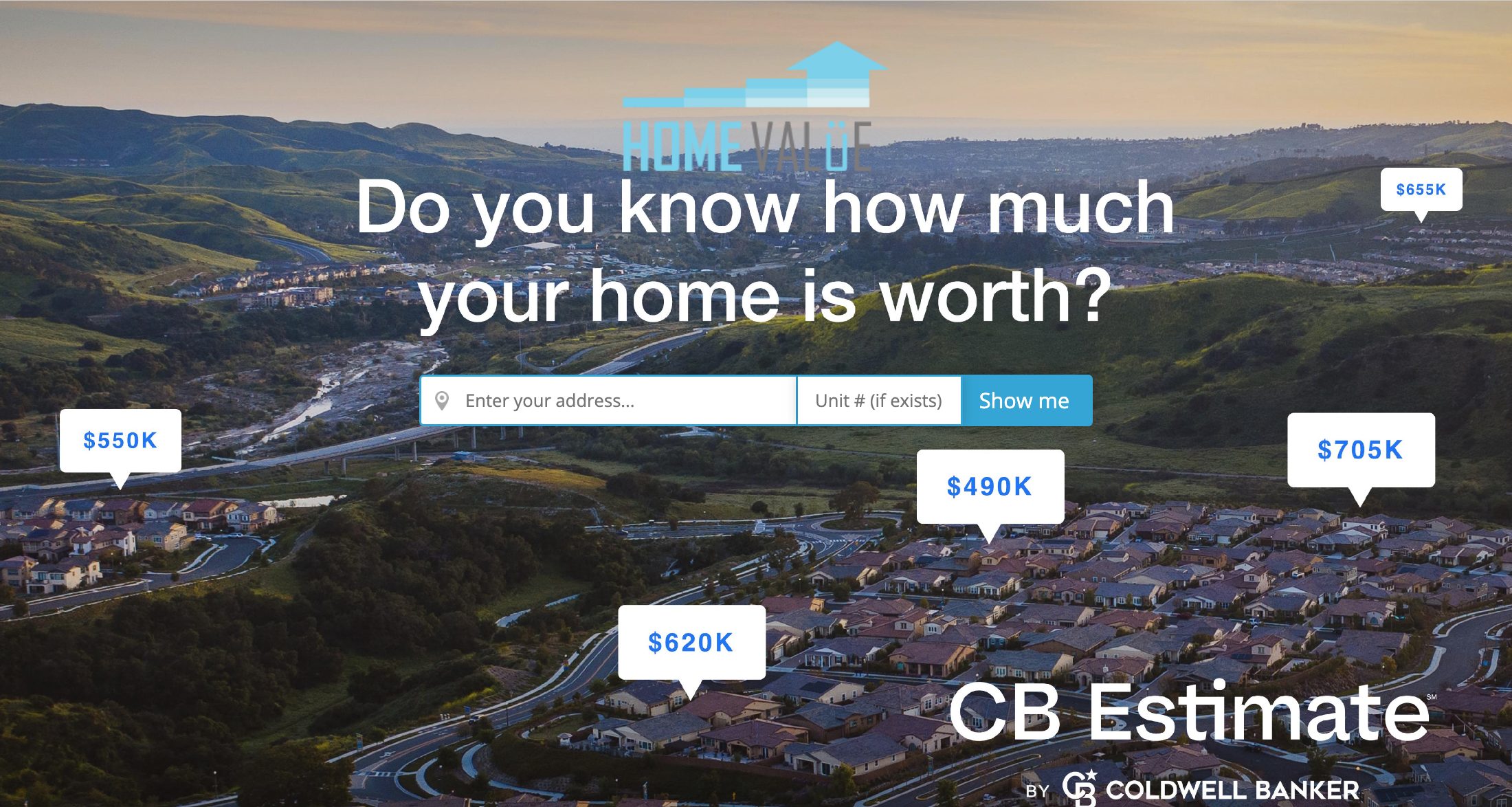

✅ Sellers: Get a Free, Expert Home Valuation.

Don’t let market headlines scare you. Discover what your home is truly worth in today’s competitive environment.

Find Out Your Home’s Current Value – Get Your FREE Market Report!

GTA Real Estate Market, October 2025 Stats, Buyer’s Market GTA, Lower Mortgage Payments, Toronto Home Prices Down, GTA Housing Market Forecast, Buy a Home in Toronto, Negotiation Power Real Estate, Affordable GTA Homes

🤯 A Weekend of Overload: Clocks, Cleats, and ‘Staches in the GTA

What a whirlwind! If you live in the Greater Toronto Area, this past weekend wasn’t just another spin around the calendar—it was a sensory overload of major events, from time-bending clock changes to nail-biting sports drama and the annual start of a hairy health initiative. It truly felt like everything was happening all at once.

Let’s break down the trifecta that made the last couple of days a massive moment in the city.

⏰ The Great Fall Back: An Extra Hour of Chaos

It began late Saturday night/early Sunday morning with the semi-annual ritual that is Daylight Saving Time (DST) ending. The clocks “fell back” an hour, giving us all the theoretical gift of a glorious extra hour of sleep.

But let’s be honest, it was a little more chaotic than peaceful. Did you set your clock back an hour before bed? Did your phone do it automatically? Did you wake up an hour early, momentarily panic, and then realize you had a bonus hour to… well, probably check Twitter for Blue Jays updates? The GTA’s collective internal clock just got a hard reset, and it’s a groggy adjustment for everyone.

💔 The Heartbreak on the Diamond: Blue Jays’ World Series Thriller

Speaking of Blue Jays updates, the end of DST coincided with one of the most agonizing and electric finishes to a baseball season in recent memory! The last two Blue Jays World Series games were nothing short of a spectacular, emotional rollercoaster.

Game 6 and the decisive Game 7 had us all glued to our screens, shouting at the television, and riding every pitch. The games were a nail-biting, edge-of-your-seat marathon, culminating in a truly heartbreaking loss in extra innings in Game 7. From incredible plays to clutch home runs that had the Rogers Centre crowd absolutely roaring, the team left absolutely everything on the field. It was a tough end, but what an unforgettable run! Thank you, Blue Jays, for a season that kept the entire country on the edge of its collective dugout.

The Show Must Go On: What’s Next for Toronto Sports?

With the baseball season officially over, the Toronto sports focus immediately pivots. This past weekend’s drama was actually preceded and followed by major action on the ice and the court! The Toronto Maple Leafs (NHL) and the Toronto Raptors (NBA) are already well into their seasons, providing the next major events to rally around. After a few rescheduled games to accommodate the Jays, the Leafs and Raptors now take centre stage in their respective title chases. Expect the excitement to shift from the Rogers Centre to the Scotiabank Arena for the foreseeable future!

🧔 Grow for a Great Cause: Movember is HERE!

As the calendar officially flipped, November arrived, and with it, the start of Movember. For those new to the movement, Movember is a global initiative dedicated to raising funds and awareness for men’s health, particularly prostate cancer, testicular cancer, and men’s mental health and suicide prevention.

The visible sign of support? Men growing out their moustaches for the entire month! This weekend was the crucial “Shave Down,” where countless men across the GTA went clean-shaven, ready to start growing their ‘staches for the cause. It’s an excellent conversation starter and a highly visible tribute to the fight against men’s health issues. Keep an eye out for the fledgling Mos around town!

How to Get Involved with Movember Fundraising

Want to do more than just grow a killer ‘stache? There are many ways to support Movember in the GTA:

- Grow a Mo: The classic way! Register on the Movember website, shave down, and get your friends and family to donate to your “Mo Space” fundraising page.

- Move for Movember: Not a grower? Commit to running or walking 60km over the month. That’s 60 kilometres for the 60 men we lose to suicide globally, every single hour.

- Host a Mo-ment: Organize a fun event, like a trivia night, a bake sale, or a friendly sports tournament (maybe a post-Blue Jays softball game!) and charge an entry fee as a donation.

- Mo Your Own Way: Take on any unique challenge! Give up coffee for the month and donate the savings, or try a personal fitness challenge.

The money raised goes to fund groundbreaking men’s health projects, so every action makes a difference!

A Weekend to Remember

So, this past weekend was a lot. We collectively gained an hour, lost a championship, and started an entire month-long facial hair journey, all within a 48-hour window. It was a weekend that proved the city doesn’t slow down, even when the clocks do. Now, as we adjust to the earlier sunsets, mourn the season, and embrace the fuzz, let’s carry that incredible energy into the next phase of the Toronto sports calendar and the vital mission of Movember.

What was the most memorable part of your whirlwind weekend? Let me know in the comments!

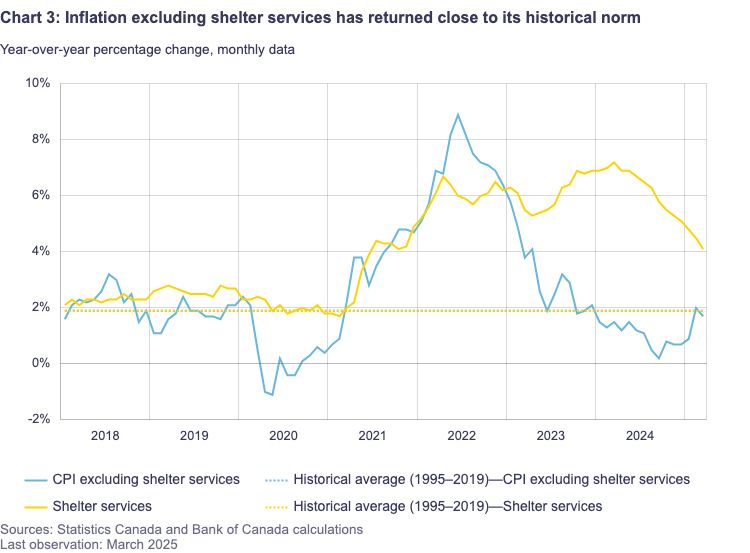

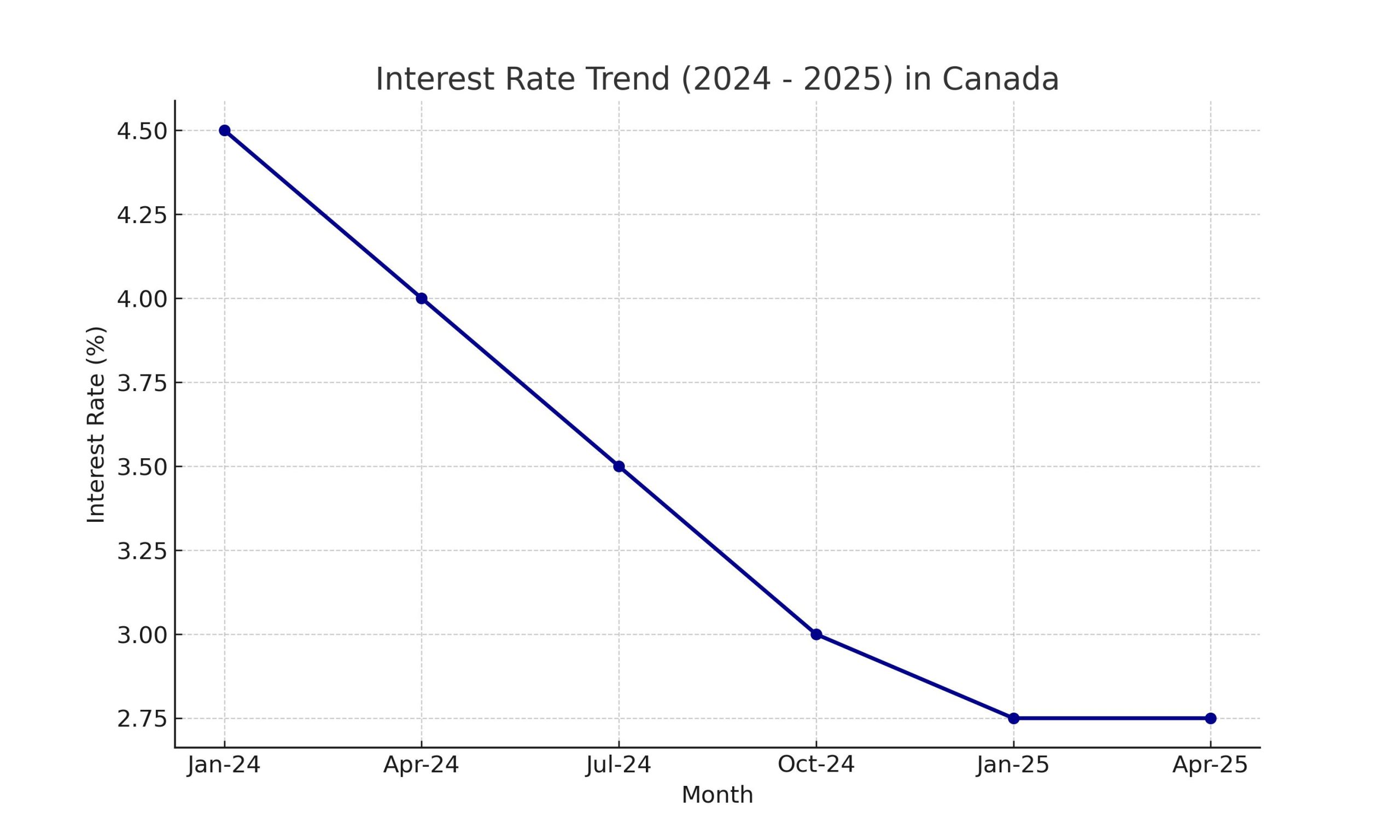

What the Bank of Canada’s Recent Rate Cut to 2.25% Means for Real Estate in Ontario 🏡

As a REALTOR® working in the Toronto area, this week’s interest-rate decision by the Bank of Canada (BoC) is very meaningful for you—whether you are on the buy side or the sell side of a real-estate transaction. Below is a breakdown of the decision, its real-estate implications, and how you and your clients can respond.

1. What did the Bank of Canada decide?

-

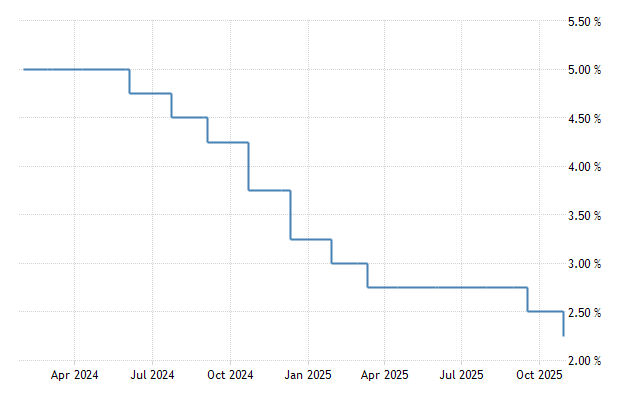

On October 29, 2025 the Bank of Canada cut its target overnight rate by 25 basis points, bringing it to 2.25%.

-

The Bank Rate now stands at 2.50% and the deposit rate at 2.20%.

-

The BoC signalled that, if inflation and activity evolve broadly in line with its October projections, “the current policy rate is at about the right level …” and further cuts are not guaranteed.

-

The underlying economic backdrop: modest growth, trade-headwinds (particularly U.S. tariffs) and inflation near, but slightly above, 2% (with core inflation a little higher) are influencing the decision.

In short: borrowing costs for banks should ease slightly (or at least stabilise) and the BoC is signalling caution about further rate moves—so this is a window of opportunity.

2. Why this is especially relevant for the real-estate market

For Buyers:

-

Lower policy rates => banks may offer slightly better mortgage terms (or at least less upward pressure) which can boost affordability.

-

If variable-rate or adjustable mortgage products respond quickly to BoC moves, you may see a dip in payments or an improved debt‐service ratio.

-

With this rate cut signalling a potential floor, buyers may be more confident stepping into the market now rather than waiting.

Call to action for buyers: If you’ve been on the fence, let’s review your financing options now—this could be a timely moment to lock in favourable terms before any shifting sentiment or rate increases.

For Sellers:

-

A marginally better affordability environment can broaden the buyer pool—especially first-time buyers or investors who were hassled by elevated rates.

-

Motivation to list now: If rates remain near current levels and affordability improves, competition can heat up. Listing later could mean facing more competition or less favourable financing for buyers.

Call to action for sellers: Let’s evaluate your home’s market value now, prepare your property for listing, and capitalise on potentially improved buyer demand while this window is open.

3. What’s going on in the Ottawa decision and economy

-

The BoC emphasised that “ongoing weakness in the economy and inflation expected to remain close to the 2 % target” drove the decision.

-

On the flip side, the trade‐shock (tariffs) has elevated costs for certain sectors and added uncertainty, meaning the Bank remains cautious.

-

According to projections, growth remains modest and risks remain elevated — meaning the BoC has to balance supporting the economy and keeping inflation contained.

-

Mortgage rates don’t immediately mirror the policy rate, but the policy rate serves as a key anchor for banks’ cost of funds and thus influences what lenders offer.

📌 Real-estate note: While a 25 basis-point cut may not immediately translate into a dramatic drop in mortgage rates, the expectation of easier policy and stable rates matters for buyer psychology and listing strategies.

4. How this affects the Toronto / Ontario market specifically

-

In the greater Toronto region, affordability has been a key issue—higher interest rates squeezed budgets and slowed some sales activity. An easing environment can help.

-

Sellers who might have been cautious may now find there are more qualified buyers coming off the sidelines.

-

For investors: lower financing costs can improve cash-flow projections and return calculations, making small-scale investment properties more attractive again.

-

For first-time buyers: this may be a timely reminder to revisit budgeting and purchase-readiness.

-

As your REALTOR®, I can help interpret how this interest-rate backdrop translates into your specific neighbourhood, home-type, and budget scenario.

5. Strategic next-steps for you

Buyers:

-

Get pre-qualified now—we’ll work with your lender to survey the impact of the rate cut on your mortgage options.

-

Review fixed vs variable rate strategies in light of this decision and your risk-tolerance.

-

Expand your search with confidence: if the payment burden eases, you might access homes you thought were out of reach.

-

Let’s craft an offer strategy that capitalises on this moment of improved affordability.

Sellers:

-

Let’s conduct a market evaluation now: assess your home’s competitive positioning in the upcoming window of opportunity.

-

Prepare your home—staging, minor repairs, presentation—to ensure you’re ready to list when buyer interest rises.

-

Timing matters: listing now may catch buyers before they shift focus to other markets or before inventory builds.

-

Let’s discuss pricing strategy that reflects the slightly improved financing environment for buyers.

6. Visualising the Impact

7. Final Thoughts & Your Next Move

This week’s rate cut by the Bank of Canada is an important signal to both buyers and sellers: the environment for real-estate transactions is shifting favourably. Buyers have an opportunity to act with somewhat improved affordability, and sellers have a chance to access a broader buyer pool.

👉 If you are considering entering the market — contact me today. I’ll provide a tailored consultation:

-

For buyers: we’ll map out the best financing strategy and target homes at your new budget.

-

For sellers: we’ll prepare your home for listing, capitalise on current conditions, and hit the market at an optimal time.

Let’s leverage this interest-rate moment together. Markets move quickly when policy pivots. I’m here to ensure you’re ready.

Interest Rates Drop Again — Is Now the Time to Buy or Sell in the Greater Toronto Area?

Bank of Canada Rate Cut + GTA Market Snapshot

Bank of Canada Rate Cut + GTA Market Snapshot

On September 17, 2025, the Bank of Canada made its latest policy move:

-

The overnight rate was cut to 2.50%, down from 2.75%.

-

This came after several “holds” and in the context of weaker economic data: job losses, rising unemployment, softening demand, cooling inflation.

This change has immediate and potential implications, especially in a market like the GTA, which has been under pressure from affordability issues, declining prices, and high inventories. Let’s dig into what’s happening locally and how both buyers and sellers might respond.

GTA Real Estate Market: Key Metrics & Trends

Here are some of the more recent GTA housing market numbers (August 2025) that matter, especially in light of the rate cut:

| Metric | Value / Trend | Implication |

|---|---|---|

| Average home sale price (GTA, all types) | ~$1,022,143 — down ~4.9% year-over-year. | Prices have softened; potential opportunity for buyers, less upside for sellers unless property is strongly differentiated. |

| Detached homes | ~$1,312,240 — among the biggest drops (~7.2% YoY) in GTA. | Detached remains a premium segment; risk of more correction especially in outer suburbs or less in-demand locations. |

| Condominums | ~$642,195 — down ~4.8% YoY. | Condos remain under pressure, though lower entry cost may draw first-timers or investors. |

| Townhouses / Semi-Detached | Townhouses: ~$946,395; Semi-detached: ~$980,102; both down YoY. | Mid-priced homes have some correction, but not as steep in all sub-markets. |

| Sales vs. Listings (Supply) | Active listings high (~27,495 in August), up substantially vs previous years; new listings up; supply has outpaced demand. | Buyers have more options; more negotiating power; sellers will have to compete. |

| Sales Trend | Sales are increasing year-over-year modestly; buyer activity returning. | Suggests that affordability improvements are starting to matter. |

What the Rate Cut Means for GTA Buyers

With the Bank of Canada cutting to 2.50%, here are possible effects on buyers within the GTA, and strategies to take advantage.

| Benefit | How to Act |

|---|---|

| Lower borrowing costs | If you’re using a variable rate mortgage (or renewing soon), you may see immediate relief. Even small monthly savings can free up budget. |

| Improved affordability | Price drops + lower interest = a more favorable payment schedule. Particularly helpful for first-time buyers or those moving up. |

| More negotiation power | Greater choice among listings; less competition (fewer bidding wars in many segments); sellers may need to make concessions. |

| Opportunity to lock in | If fixed mortgage rates begin to follow (depends on bond yields), getting pre-approved and locking in could help avoid future costs. |

Risks / cautions for buyers:

-

Fixed mortgage rates may lag the policy rate change; not all lenders pass cuts immediately, and bond market conditions matter.

-

Economic uncertainty in the GTA/ON (jobs, trade, immigration) may dampen confidence; some buyers may still hesitate.

-

Even with lower rates, total cost (down payment, maintenance, taxes, etc.) remains high.

Recommended buyer strategies:

-

Get pre-approved now. Know exactly what you can afford.

-

Watch property types: mid-segments (townhouses/semi’s) may see better value than peak detached-home pricing.

-

Negotiate well: longer days on market, higher inventory = greater leverage. Ask for closing cost help, flexible possession, repairs.

-

Consider fixed vs variable carefully: variable may benefit sooner, but fixed gives stability if rates reverse.

-

Think long term: Even if market dips more, buying in GTA tends to build value over years—if you have the ability to hold.

What the Rate Cut Means for GTA Sellers

This rate cut may help stabilize some downward trends, but sellers need to adapt to current realities. Here’s how:

| Potential Opportunities | Things You’ll Need to Do Differently |

|---|---|

| More buyer interest | Buyers discouraged by high rates may return. Homes that are well priced and well presented will see attention. |

| Faster sales for strong listings | Properties that stand out (location, condition, value) may sell faster, even in a buyer’s market. |

| Benefit from easing affordability | Lower monthly payments for buyers expand the pool somewhat. Sellers need to recognize where buyers’ budgets are now. |

Challenges / risks for sellers:

-

Prices are down, particularly in detached and condos. Expect lower offers.

-

Longer time on market; more competition from other sellers.

-

Buyers will expect more — inspections, incentives, maybe closing terms.

Seller strategies:

-

Price realistically from the start — avoid overpricing. If you start too high, you’ll lose momentum.

-

Invest in presentation and staging — a well-maintained, move-in-ready home will stand out among many.

-

Flexible terms & incentives — consider assisting with closing costs, offering flexible closing dates, or providing minor upgrades/allowances.

-

Market smartly — highlight affordability relative to past peaks; show what monthly payments could look like post-rate cut.

-

Watch inventory & timing — there is evidence that inventory, after peaking, is starting to pull back. Becoming one of the early listings in a tightening market helps.

GTA Market Outlook & What Comes Next

Putting it all together:

-

The rate cut to 2.50% is generally favorable for the GTA, given ongoing price softening and high supply. It helps pull some buyers off the sidelines.

-

But this is not a magic fix: structural affordability remains a challenge — prices are still high relative to incomes, and many buyers remain cautious.

-

The balance of power still leans toward buyers in many neighbourhoods, though some sub-areas (especially in high demand) may see more balanced conditions as listings fall.

-

If economic data worsens (unemployment, trade, inflation), more rate cuts are possible. Conversely, if inflation spikes or supply gets tight, rates could stay stable or even rise again.

Call to Action

If you’re in the GTA and thinking about moving, now’s not the time to stay passive. Whether buying or selling, you need a plan. Here’s what to do:

-

Buyers: Reach out to mortgage brokers, get price-sensitive search set up, lock in pre-approval. Don’t just browse—calculate what your monthly payments will look like and act when you find value.

-

Sellers: Talk to one of our team member realtors who know your neighbourhood deeply. Price smart, spruce up your listing, and use the interest cut to show buyers what their payments might be under current conditions.

Want help zeroing in on your neighbourhood? I can pull together a custom GTA-neighbourhood report (price trends, comparable sales, days on market) so you can see whether your area is trending with the broader market, or diverging. Do you want me to put one together for your specific area?

Post #12278

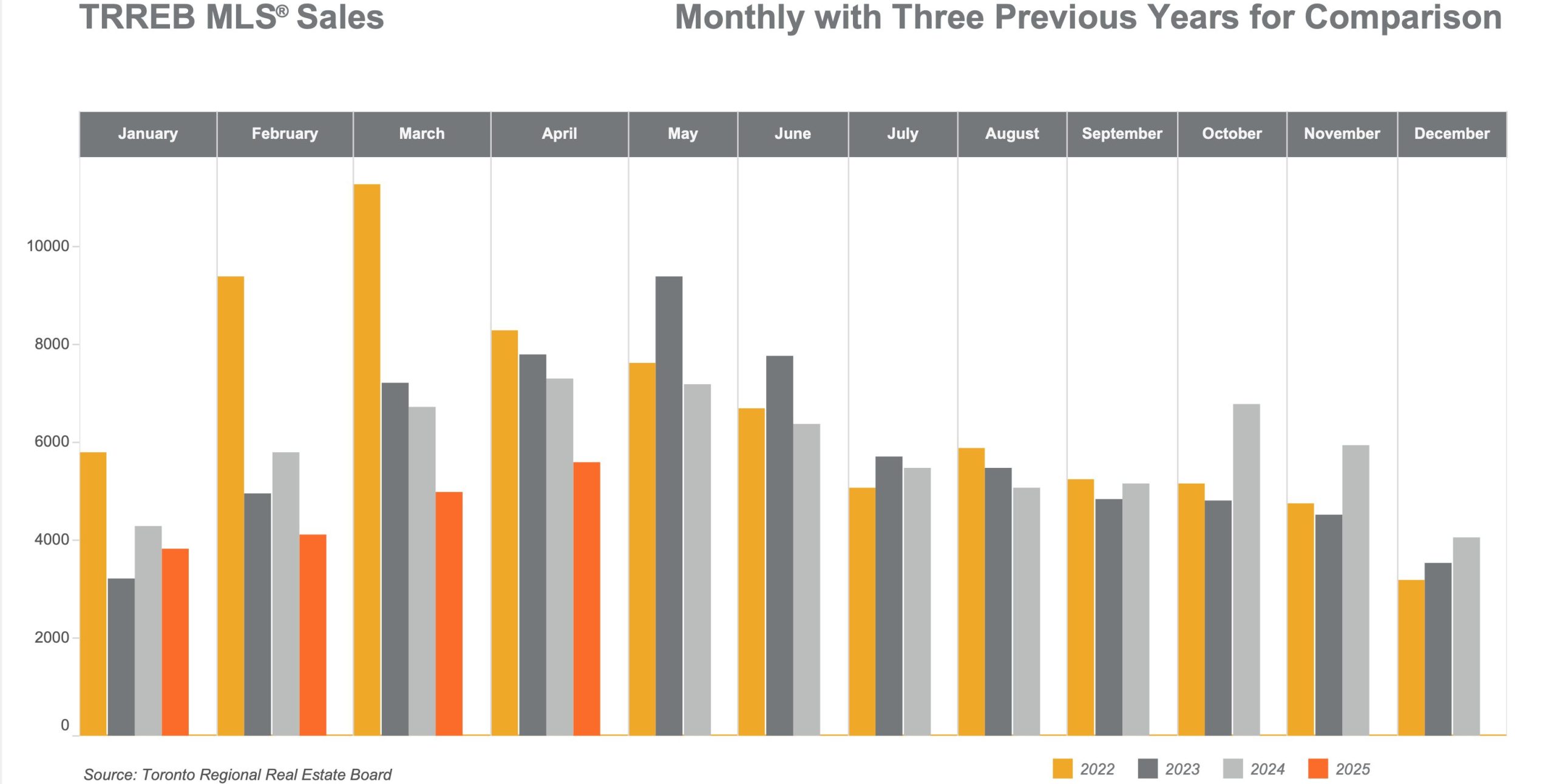

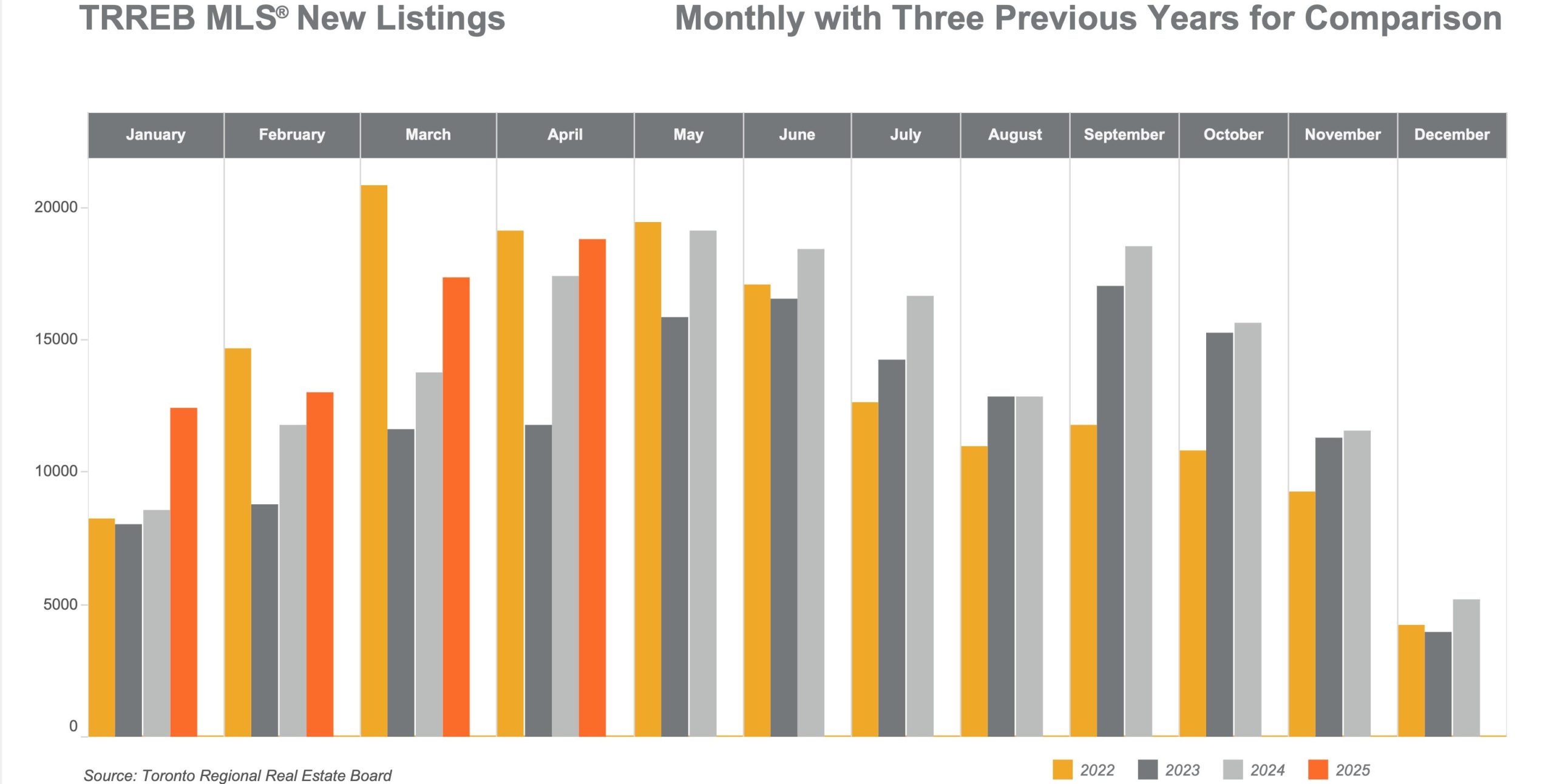

📊 GTA Housing Market Update: June 2025

Your Complete Guide to Greater Toronto Area Real Estate Trends

🎯 Market Snapshot: What You Need to Know

The Greater Toronto Area housing market is showing fascinating dynamics in June 2025. Whether you're a potential buyer looking for the perfect opportunity or a seller considering your next move, understanding these trends is crucial for making informed decisions. Let's dive deep into the numbers that are shaping our market today.

6,243

Total Home Sales

↓ 2.4% vs June 2024$1,101,691

Average Selling Price

↓ 5.4% vs June 202419,839

New Listings

↑ 7.7% vs June 202431%

Sales-to-Listings Ratio

↓ 4% vs June 2024🏠 SELLERS: Is Your Home Priced Right in Today's Market?

Get a FREE Comparative Market Analysis (CMA) tailored to your property's unique features and location. Know your home's true value in today's shifting market conditions.

GET YOUR FREE CMA NOW💰 Property Type Breakdown: Where the Value Lies

Understanding the price variations across different property types is essential for both buyers and sellers. Here's how each category performed in June 2025:

| Property Type | Average Price | Units Sold | Market Share |

|---|---|---|---|

| Detached Homes | $1,392,033 | 3,011 | 48.2% |

| Semi-Detached | $1,089,751 | 601 | 9.6% |

| Townhouse | $871,652 | 1,048 | 16.8% |

| Condominium | $696,424 | 1,510 | 24.2% |

📊 Sales Volume by Property Type

💡 Market Insight

Detached homes continue to dominate the market, representing nearly half of all sales. However, condominiums are showing strong activity, making up over 24% of transactions. This suggests a diverse market with opportunities across all price points.

📈 Market Trends: What the Numbers Really Mean

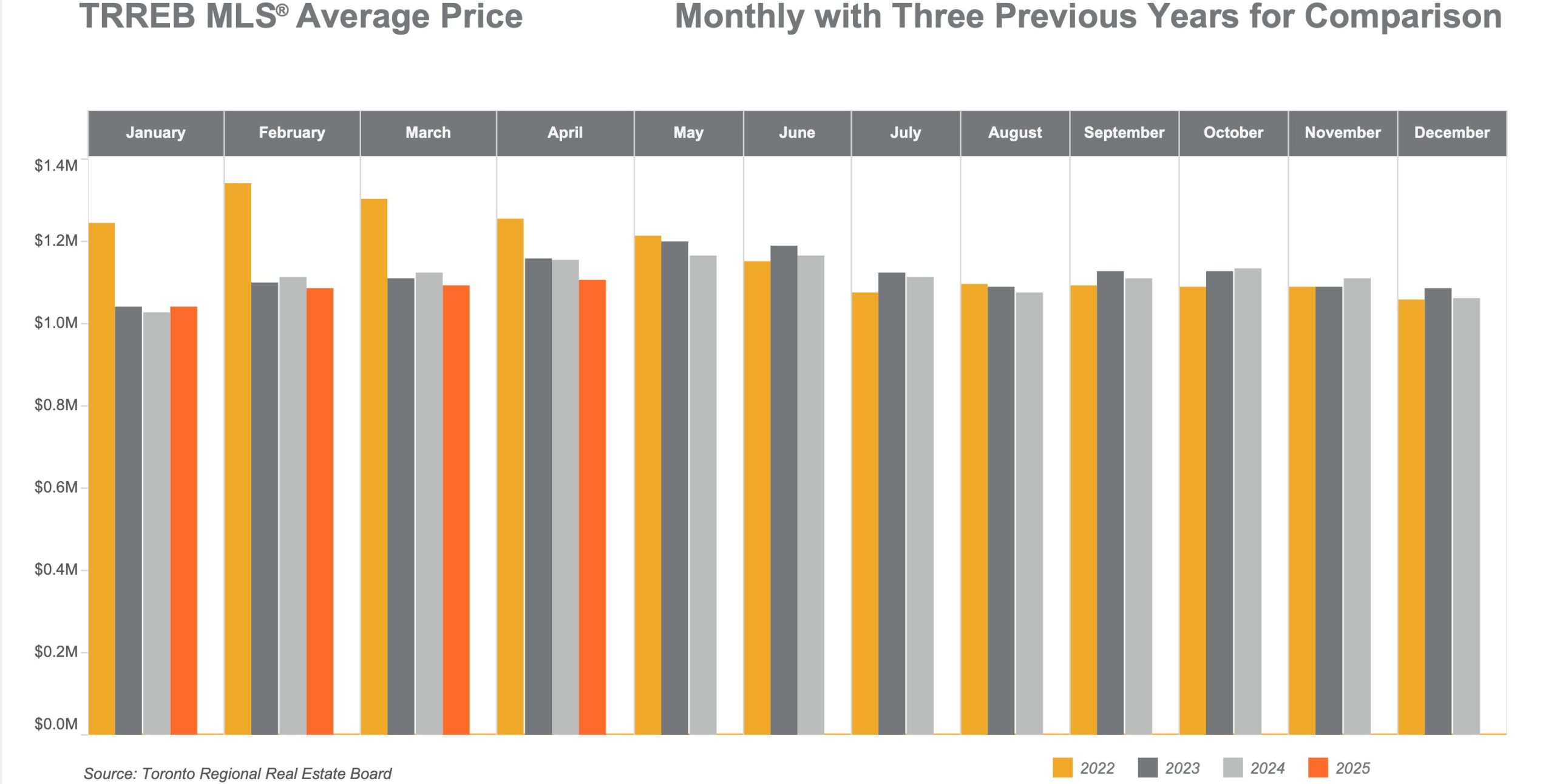

🏷️ Price Trends

The average selling price of $1,101,691 represents a 5.4% decrease from June 2024's $1,164,491. This price adjustment, combined with lower borrowing costs, is creating new opportunities for buyers who have been waiting on the sidelines.

Key Takeaway for Buyers:

Lower prices + reduced interest rates = improved affordability. This is potentially the best buying opportunity we've seen in recent years.

📋 Supply & Demand

With 19,839 new listings (up 7.7%) and 6,243 sales (down 2.4%), we're seeing increased choice for buyers. The sales-to-listings ratio of 31% indicates a balanced market with slight favor toward buyers.

Key Takeaway for Sellers:

More competition means strategic pricing and presentation are more crucial than ever. Professional guidance is essential now.

📊 Average Selling Prices by Property Type

🎯 BUYERS: Ready to Take Advantage of This Market?

With increased inventory and improved affordability, this could be your moment. Get a FREE consultation to explore your options and develop a winning strategy.

BOOK YOUR FREE CONSULTATION🎯 Strategic Insights: Expert Analysis

According to TRREB's latest market analysis, several key factors are shaping the current market dynamics:

🏦 Economic Factors

Interest Rate Environment: Lower borrowing costs compared to last year are improving affordability. Additional rate cuts could further strengthen market momentum.

Trade Relations: Economic uncertainty continues to keep some buyers on the sidelines. A firm trade deal with the United States could significantly boost consumer confidence.

🔍 Market Dynamics

Buyer's Market Characteristics: With more listings available, buyers are gaining negotiating power and securing discounts off asking prices.

Seasonal Trends: Month-over-month increases in sales, coupled with declining new listings, suggest a tightening trend through the spring season.

📊 Market Activity Comparison: June 2024 vs June 2025

🏠 What This Means for Sellers

The current market presents both challenges and opportunities for sellers:

📊 The Reality Check

- Increased Competition: 7.7% more listings mean more choice for buyers

- Price Adjustments: Average prices are down 5.4% year-over-year

- Longer Market Times: Properties may take longer to sell than in previous years

🚀 The Opportunities

- Motivated Buyers: Those entering the market now are serious about purchasing

- Strategic Positioning: Properly priced homes still sell efficiently

- Professional Advantage: Expert marketing and pricing strategies are more valuable than ever

📈 SELLERS: Maximize Your Property's Potential

Don't let market conditions discourage you. With the right strategy, pricing, and presentation, your home can stand out from the competition. Get your FREE CMA today!

REQUEST YOUR FREE CMA🎯 What This Means for Buyers

For prospective buyers, the current market conditions are creating excellent opportunities:

✅ Buyer Advantages

- More Choice: 19,839 new listings provide extensive options

- Negotiating Power: Buyers are securing discounts off asking prices

- Lower Costs: Reduced prices and lower interest rates improve affordability

- Less Competition: Fewer competing offers mean better chances of success

⚠️ Considerations

- Economic Uncertainty: Stay informed about broader economic trends

- Interest Rate Sensitivity: Be prepared for potential rate changes

- Property Condition: With more options, you can be selective about quality

📊 Sales-to-Listings Ratio Trend

🔮 Market Outlook: What's Next?

Based on current trends and expert analysis, here's what we anticipate for the remainder of 2025:

📈 Positive Indicators

- Gradual Recovery: Month-over-month improvements suggest building momentum

- Affordability Gains: Lower prices and borrowing costs are bringing buyers back

- Inventory Balance: Healthy supply levels support market stability

🎯 Key Factors to Watch

- Interest Rate Decisions: Additional cuts could significantly boost activity

- Trade Relations: Economic clarity could improve consumer confidence

- Seasonal Patterns: Traditional fall market dynamics may provide opportunities

💼 BUYERS: Don't Wait for Perfect Market Conditions

The best time to buy is when you find the right property at the right price. Let's explore what's available for you in today's market with improved affordability.

SCHEDULE FREE CONSULTATION🎯 Why Choose Gerald Lawrence as Your REALTOR®?

In a market with evolving dynamics, having an experienced professional by your side is more important than ever. Here's what sets me apart:

🏆 For Sellers

- Precise Market Analysis: Comprehensive CMAs that position your property competitively

- Strategic Marketing: Multi-channel approach to maximize exposure

- Professional Network: Access to qualified buyers and industry professionals

- Negotiation Expertise: Protecting your interests throughout the process

🎯 For Buyers

- Market Knowledge: Deep understanding of neighborhood trends and values

- Access to Listings: First look at properties matching your criteria

- Negotiation Skills: Securing the best possible terms and pricing

- Transaction Management: Smooth process from offer to closing

📞 Ready to Make Your Move?

Whether you're buying or selling, the current market presents unique opportunities that require expert navigation. Don't let these conditions pass you by without exploring what's possible.

🏠 Take Action Today!

SELLERS: Get your FREE Comparative Market Analysis and discover your property's true value in today's market.

BUYERS: Schedule your FREE consultation to explore the expanded opportunities available now.

FREE CMA FOR SELLERS FREE CONSULTATION FOR BUYERS

Data Source: Toronto Regional Real Estate Board (TRREB) Market Report, June 2025

Analysis by: Gerald Lawrence, REALTOR® - Coldwell Banker R.M.R. Real Estate, Brokerage

Move-In Ready & Full of Potential: Inside a Hidden Gem in the Heart of Stouffville

🏡 Just Listed: 14 Betula Gate, Stouffville

A Beautiful Start in a Family-Friendly Neighbourhood

Offered at $949,000

Welcome Home

A lovingly maintained 2-storey detached link home – perfect for young families and first-time buyers.

📍 Stouffville, ON | 🛏 3 Beds | 🛁 3 Baths | 🚗 1-Car Garage

📲 Book a Tour Today

Contact Me | 📞 416-556-0238

🧱 Why You’ll Love This Home

✅ Key Features

-

3 bright and spacious bedrooms, including a sunlit Primary Suite with 4-Piece Ensuite

-

3 bathrooms total — 2 full 4-piece bathrooms on the upper level, 2-Pc powder room on main floor, and a rough-in in the basement

-

Open-concept main floor — ideal for family time & entertaining

-

Eat-in kitchen with walkout to a fully fenced, landscaped backyard

-

Gas BBQ hookup, perennial flower beds, garden shed, and low-maintenance front garden

-

Built-in 1-car garage with backyard man-door

-

Finished basement featuring:

-

Recreation room

-

Bonus/office room

-

Utility & laundry room

-

Cold room and storage room with built-ins

-

-

2–5 mins from top-rated Barbara Reid PS, Sunnyridge Park, tennis & basketball courts

📍 Quiet street in a close-knit, family-oriented community!

📸 3D Interactive Virtual Tour

👨💼 About Gerald Lawrence

Hi, I’m Gerald — a full-time, full-service REALTOR® with Coldwell Banker R.M.R. Real Estate. I help first-time buyers and young families find homes where they can truly thrive. My knowledge of the Stouffville market and personalized approach ensure that you’ll feel confident and cared for every step of the way.

📧 Gerald-Lawrence@ColdwellBanker.ca

📞 416-556-0238

🌐 www.GeraldLawrence.Realtor

💬 What My Clients Say

❓ FAQs

Is this home move-in ready?

Yes — it’s been lovingly maintained by the original owner since 2010 and is in excellent condition.

What type of home is it?

It’s a 2-storey detached link home — fully detached above ground with a shared foundation wall below grade.

Can the basement be expanded?

Absolutely. The basement already mostly finished and has a rough-in for a full bathroom, allowing you to finish it to suit your needs.

Is the area good for families?

Definitely! It’s located within walking distance of Barbara Reid Public School, local parks, sports courts, and family amenities.

How do I book a tour?

📲 Contact me directly at 416-556-0238 or

📧 Email Click To Send Email

✉️ Interested in 14 Betula Gate? Let’s Talk!

Ready to book a showing or have a few questions? I’d love to help.

👉 Submit your inquiry below or email me directly.

📩 Click To Send Email

📞 416-556-0238

Your dream home could be just one message away.

🏡 Don’t miss out on 14 Betula Gate – Schedule Your Private Showing Now!

📞 416-556-0238 | 🌐 www.GeraldLawrence.Realtor

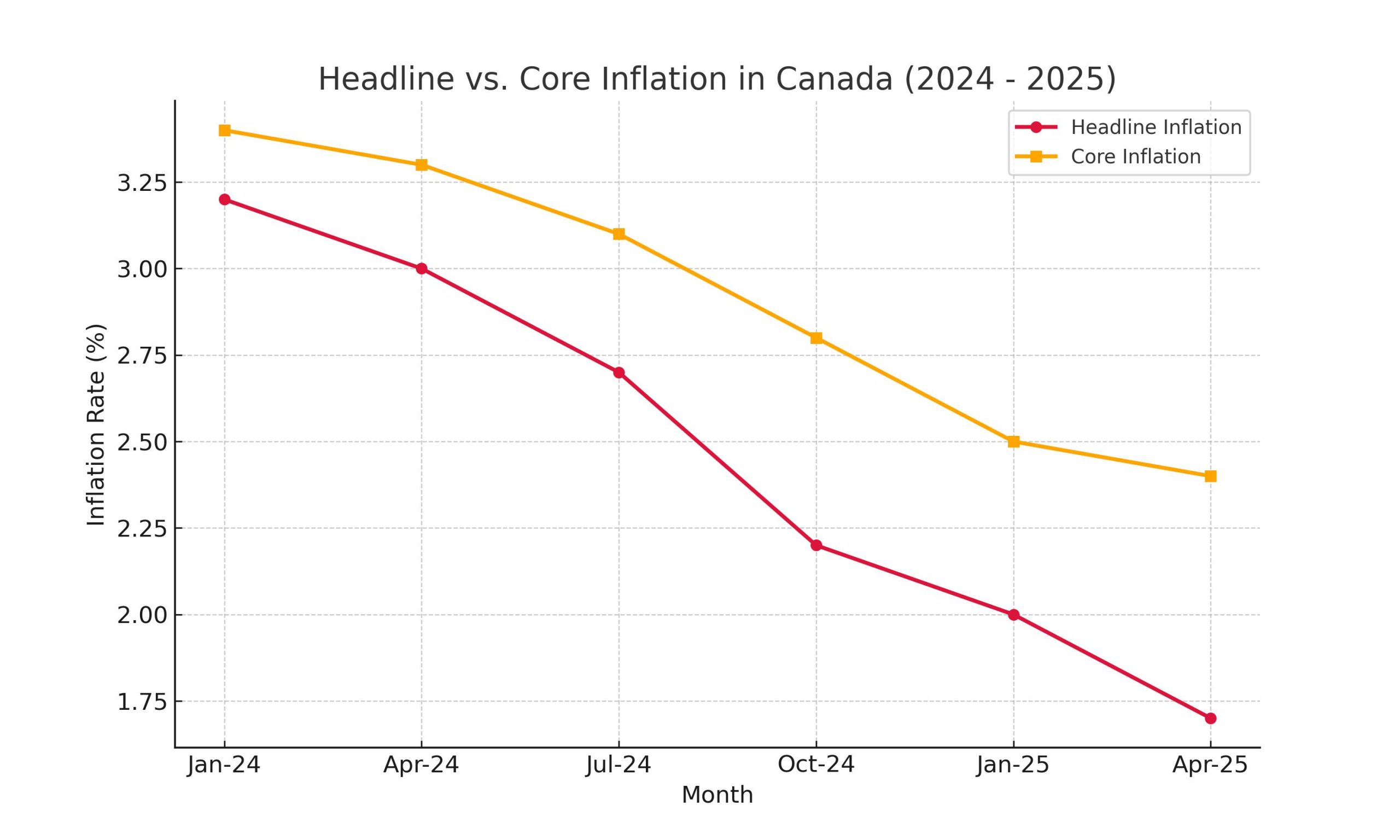

Rate Decision Breakdown: How US Tariffs and Rising Unemployment Are Shaping Canada’s Monetary Policy

🏦 Bank of Canada Holds Rate at 2.75%

🚦 BoC Hits the “Hold” Button: What Does It Mean For YOU? 🚦

The Bank of Canada’s job is like being the country’s economic pilot: they try to steer us toward stable prices (keeping inflation in check!) and healthy growth. Today’s decision to keep interest rates unchanged at 2.75% tells us a lot about what they’re seeing on their economic dashboard.

🔍 The Big Picture: Why the Hold?

The Bank’s Governing Council decided to keep rates steady because they’re navigating a complex economic landscape. Here’s what they’re seeing:

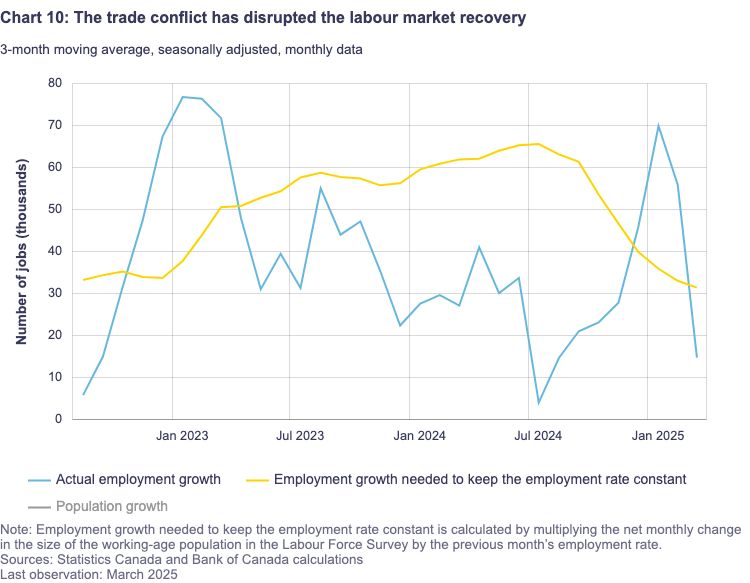

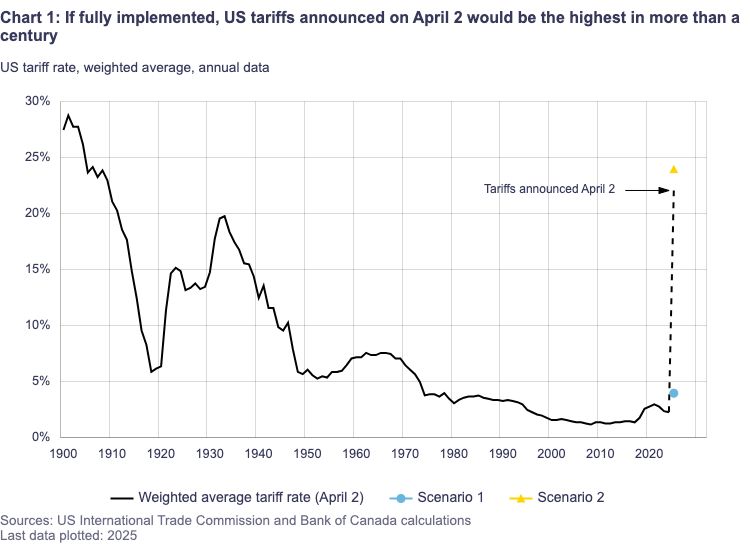

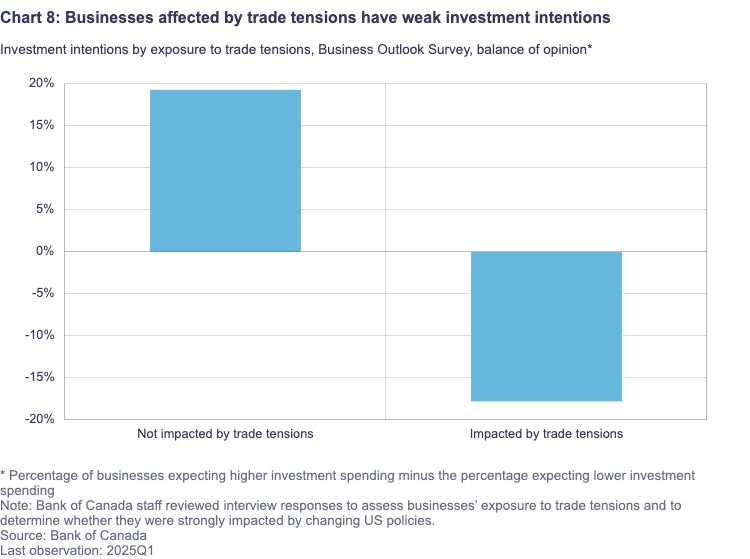

- Global Uncertainty is STILL High: 🌍 Especially concerning is the ongoing back-and-forth with U.S. tariffs and trade negotiations. This creates a big question mark for Canada’s export-driven economy. The Bank needs more clarity on how these trade policies will shake out.

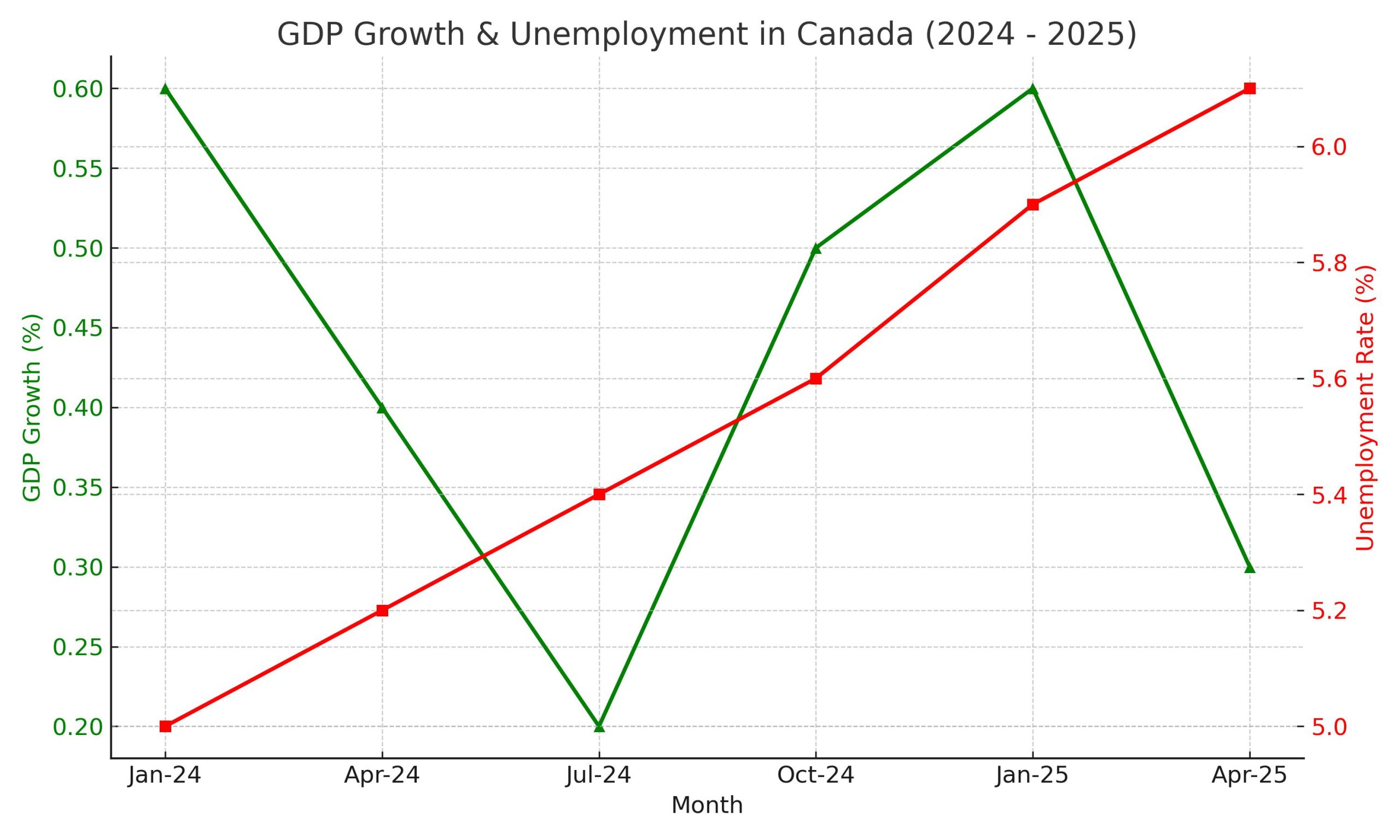

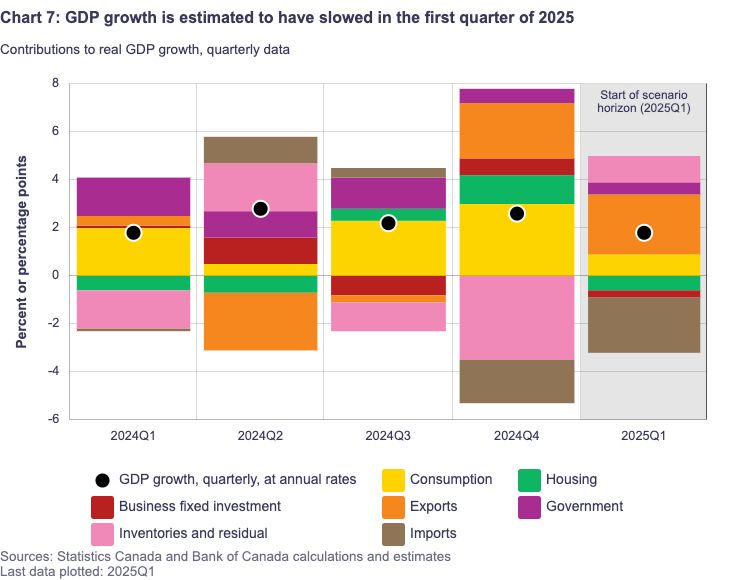

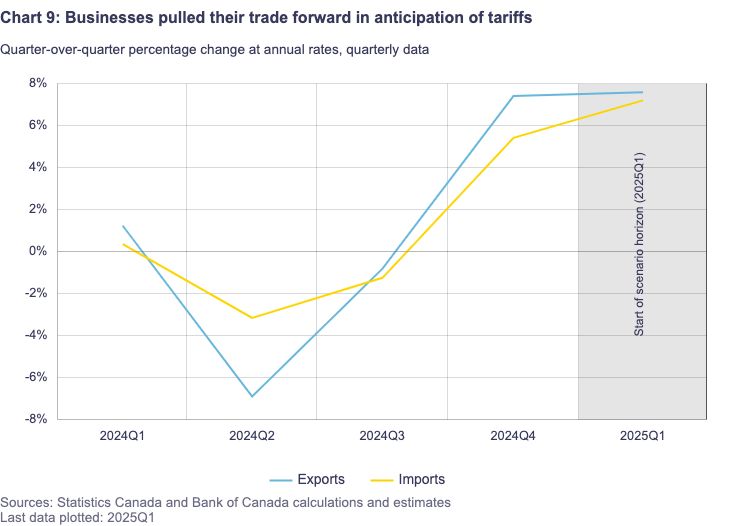

- Canadian Economy: Softer, But Not Collapsing! 💪 Canada’s economy grew a bit stronger than expected in the first quarter (2.2% GDP growth!), driven partly by exports to the U.S. and inventory building. However, they expect the second quarter to be weaker as these factors reverse. Consumer spending has slowed, and housing activity is down, particularly resales.

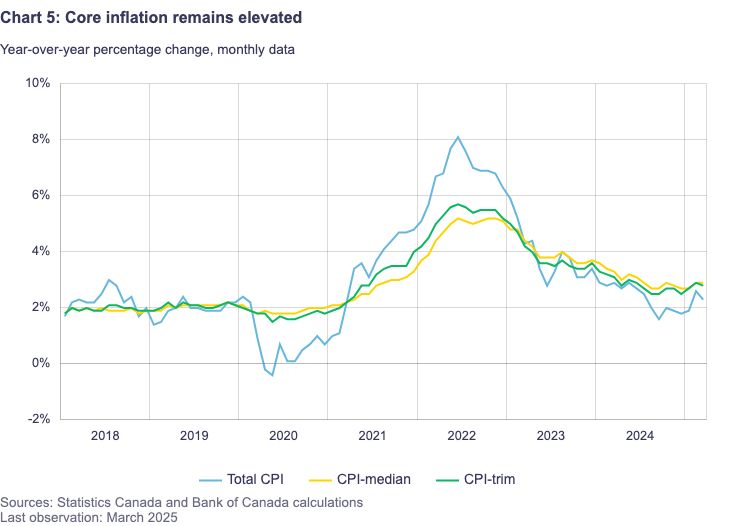

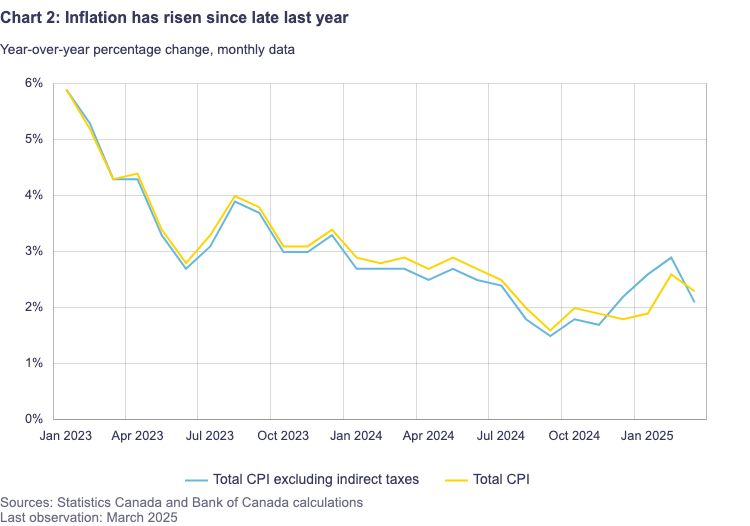

- Inflation’s Tricky Dance: 📈 While inflation has generally eased from its peak, the Bank noted “unexpected firmness” in recent inflation data, and their preferred core inflation measures have moved up. Businesses are still expecting tariffs to raise prices, and many plan to pass those costs on. This “stickiness” in inflation is a key reason for the hold.

- Labor Market Cooling: 🌬️ The job market has shown signs of weakening, especially in sectors tied to trade. The unemployment rate has risen to 6.9%. This typically puts downward pressure on inflation, but the Bank is watching carefully.

In simple terms: The Bank is seeing conflicting signals! The economy isn’t collapsing, but there’s a lot of uncertainty from tariffs and inflation isn’t quite behaving as smoothly as they’d like. So, they’re taking a cautious “wait and see” approach.

📌 Key Highlights

- Inflation: Headline inflation fell to 1.7% in April, while core inflation remains sticky.

- GDP Growth: The economy expanded by 2.2% in Q1 2025.

- Labour Market: Signs of softening with slower wage growth and rising unemployment.

- External Pressure: Tariff increases from the U.S. add uncertainty to exports.

📈 Interest Rate Trend (2024 – 2025)

💹 Headline vs. Core Inflation

📊 GDP Growth & Unemployment

🏠 What This Means for Canadians

- Homeowners: Mortgage rates likely to remain stable. Variable rate holders enjoy breathing room.

- Buyers: A continued hold on rates might support affordability — but be mindful of inflation.

- Businesses: Exporters should prepare for volatility, especially due to U.S. trade policies.

🏡 What Does This “Hold” Mean for Your Money?

This decision has direct impacts on everyday Canadians. Let’s break it down:

- For Borrowers (Especially Variable-Rate Mortgages & HELOCs): 🥳 GOOD NEWS! Your payments linked to the prime rate will stay STABLE for now. No immediate jumps in your monthly costs! This offers a much-needed breathing room. If you’re looking for a new variable mortgage, rates won’t have shifted due to this announcement.

- For Savers (HISAs & GICs): 💸 STILL DECENT RETURNS! While not increasing, the rates on high-interest savings accounts and GICs will remain relatively attractive. This is a positive for those looking to grow their cash safely.

- For the Housing Market: 🏠 The unchanged rate could bring a degree of stability, preventing further upward pressure on mortgage costs. However, affordability remains a significant hurdle for many, and the Bank noted a “sharp contraction in resales.”

- For Businesses: 💼 Borrowing costs remain unchanged, which offers predictability for investment and operational decisions. However, uncertainty from U.S. tariffs and slower domestic demand are still headwinds.

🔮 Looking Ahead: The Bank’s Crystal Ball (Sort Of!)

The Bank of Canada made it clear they are “proceeding carefully” and will be “data-dependent.” This means they’re not committing to any future moves right now. They want to see:

- How U.S. trade policy evolves and its real impact on Canadian exports.

- How much any economic slowdown spills over into business investment, employment, and household spending.

- How quickly cost increases (like from tariffs) are passed on to consumer prices.

- How inflation expectations evolve among consumers and businesses.

Key takeaway from Governor Tiff Macklem: While there might be room for future rate cuts if the economy weakens further and price pressures stay contained, the Bank is not providing forward guidance. They are focusing on the actual data as it comes in.

✨ Your Turn!

What are your thoughts on this latest decision from the Bank of Canada? Are you breathing a sigh of relief, or hoping for more changes soon? Share your perspective in the comments below! 👇

The BoC will review its stance again on July 30, 2025. With inflation easing yet core pressures lingering, a potential rate cut remains on the table — but not guaranteed.

For full details, see the official press release.

Housing Shift: Navigating April Pause – Buyers & Sellers Take Note!

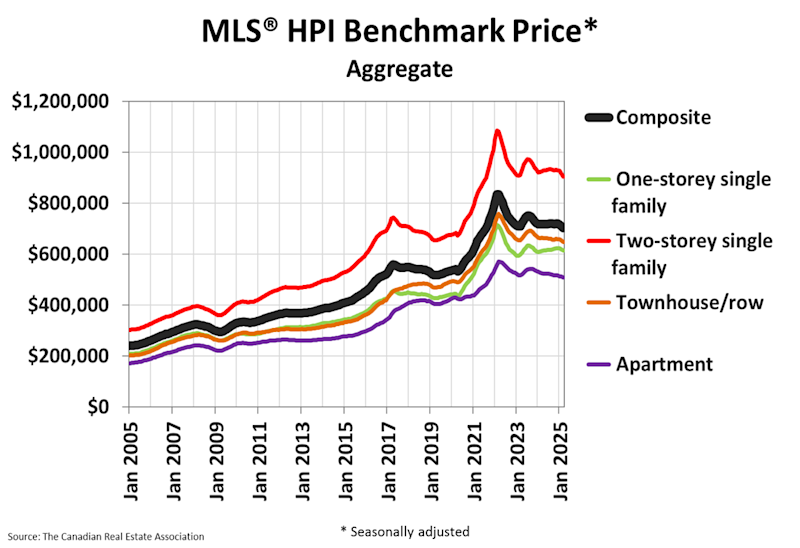

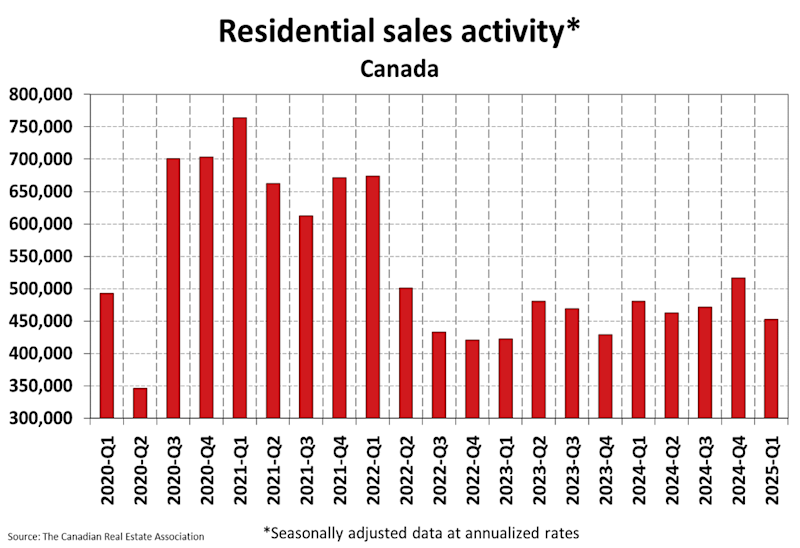

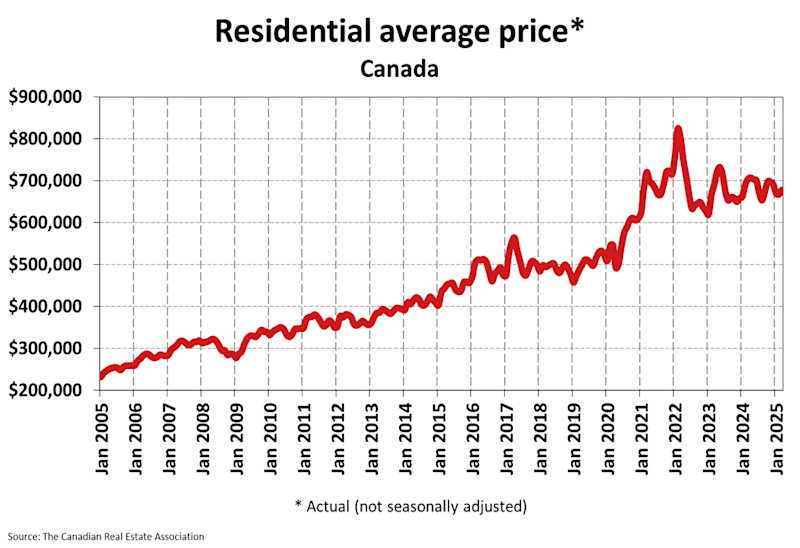

Canadian Housing Market Pauses in April 2025 Amid Shifting Conditions

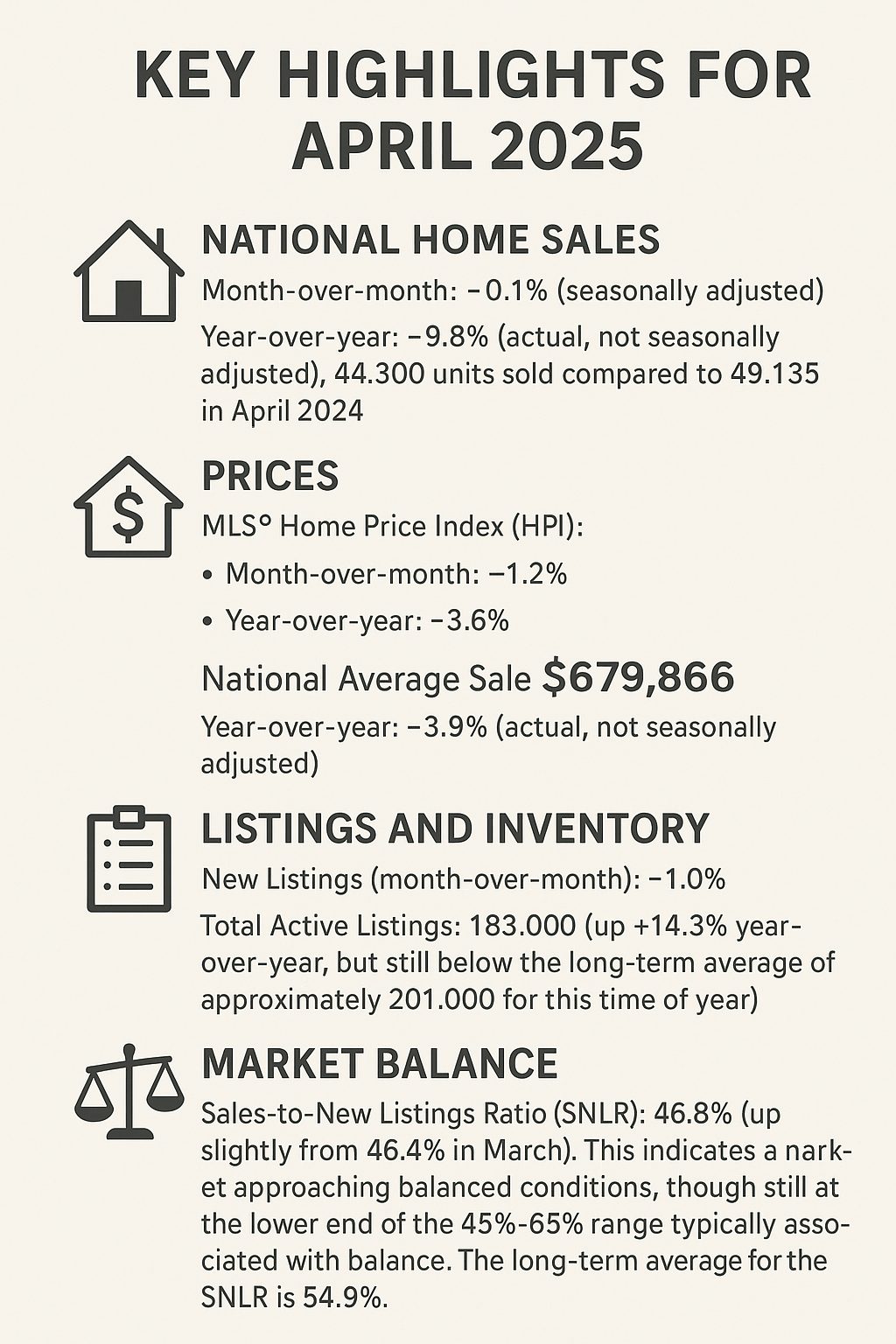

The Canadian housing market showed signs of a pause in its recent slump during April 2025, with national home sales remaining virtually unchanged from March. However, activity remains subdued compared to the previous year, and prices continue to see modest declines. This analysis, based on data released by the Canadian Real Estate Association (CREA), delves into the key trends observed in April.  Key Highlights for April 2025:

Key Highlights for April 2025:

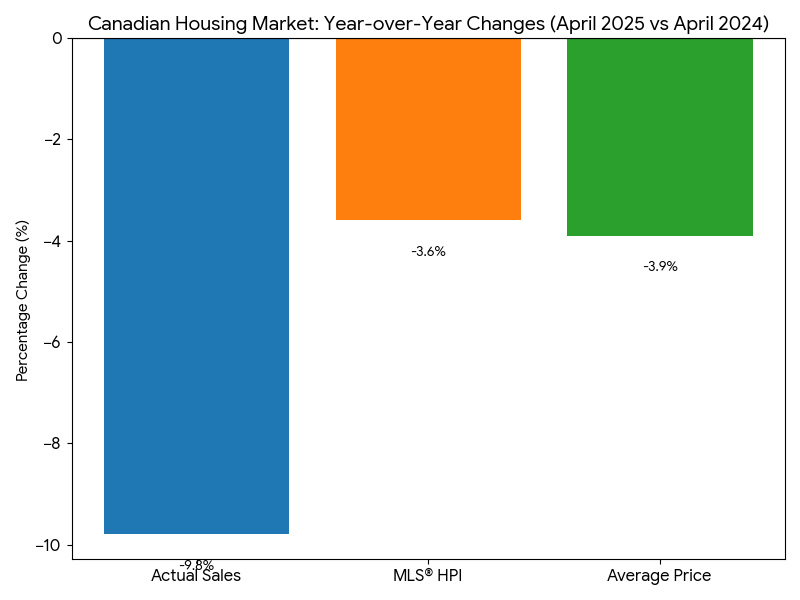

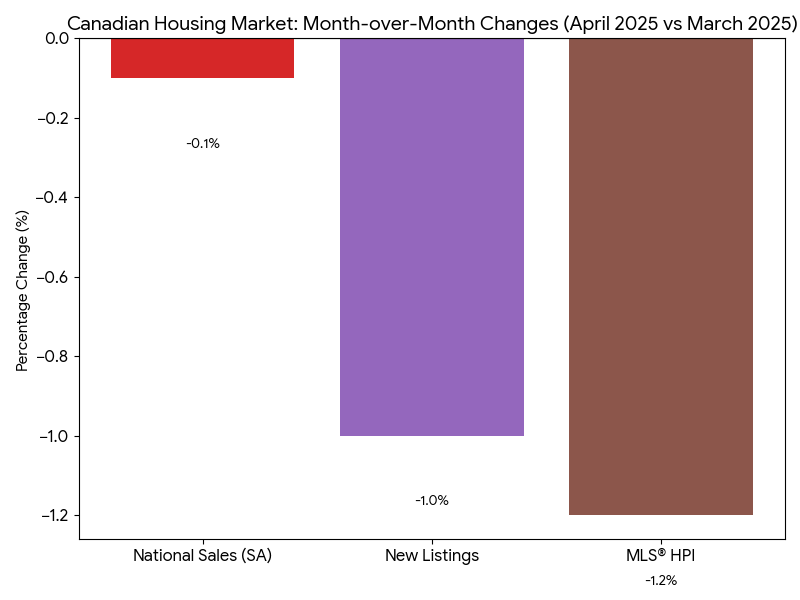

- National Home Sales:

- Month-over-month: -0.1% (seasonally adjusted)

- Year-over-year: -9.8% (actual, not seasonally adjusted), with 44,300 units sold compared to 49,135 in April 2024.

- Prices:

- MLS® Home Price Index (HPI):

- Month-over-month: -1.2%

- Year-over-year: -3.6%

- National Average Sale Price: $679,866

- Year-over-year: -3.9% (actual, not seasonally adjusted)

- MLS® Home Price Index (HPI):

- Listings and Inventory:

- New Listings (month-over-month): -1.0%

- Total Active Listings: 183,000 (up +14.3% year-over-year, but still below the long-term average of approximately 201,000 for this time of year).

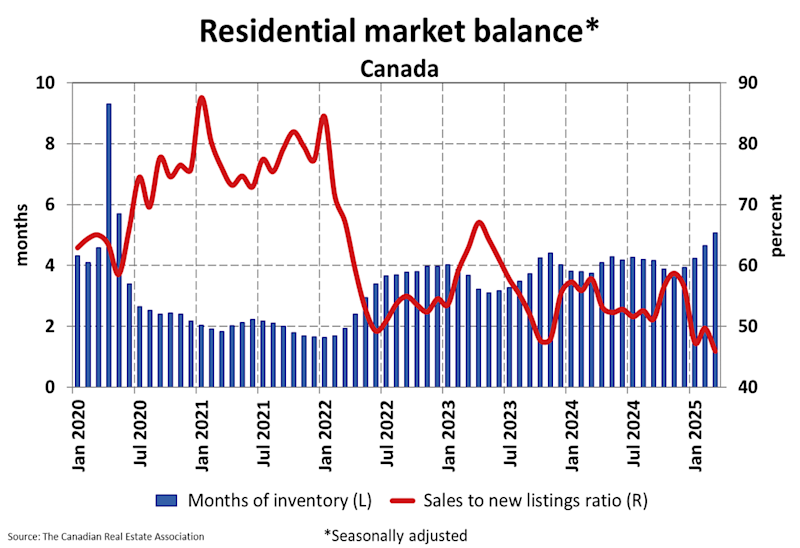

- Market Balance:

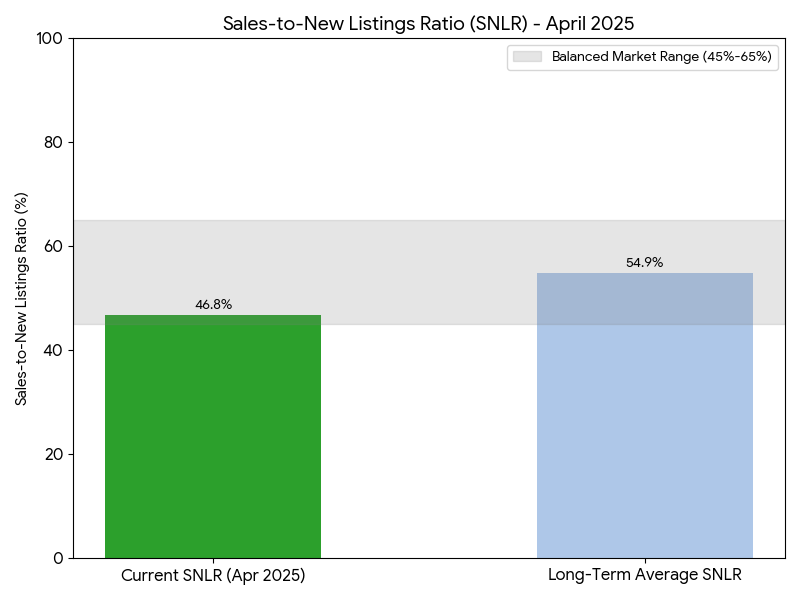

- Sales-to-New Listings Ratio (SNLR): 46.8% (up slightly from 46.4% in March). This indicates a market approaching balanced conditions, though still at the lower end of the 45%-65% range typically associated with balance. The long-term average for the SNLR is 54.9%.

- Months of Inventory: 5.1 months, which is in line with the long-term average of five months. A seller’s market is typically below 3.6 months, and a buyer’s market above 6.4 months.

Detailed Analysis:

The April 2025 data suggests a stabilization in sales activity after several months of decline. Shaun Cathcart, CREA’s Senior Economist, noted that the market is returning to the “quiet markets we’ve experienced since 2022,” with factors like “tariff uncertainty taking the place of high interest rates in keeping buyers on the sidelines.”

While sales activity paused its descent on a month-over-month basis, the year-over-year comparison still shows a significant drop, indicating that the market is considerably cooler than in April 2024. Price pressures continue, with both the MLS® HPI and the national average sale price registering year-over-year declines.

The month-over-month decrease in the HPI suggests that price adjustments are ongoing. The number of newly listed properties dipped slightly in April compared to March. However, the total number of homes available for sale has increased notably from a year ago, offering more choice to potential buyers.

Despite this increase, total inventory remains below long-term averages. The sales-to-new listings ratio moving slightly up to 46.8% and 5.1 months of inventory suggest the national market is largely balanced, albeit with regional variations.  Regional Variations: The national figures mask significant regional differences. CREA reports indicate:

Regional Variations: The national figures mask significant regional differences. CREA reports indicate:

- Ontario and British Columbia: These more expensive markets are generally experiencing larger price pullbacks and higher inventory levels, with sales potentially decreasing more significantly.

- Maritimes, Quebec, Manitoba, and Saskatchewan (Prairies, East Coast): These traditionally more affordable regions are seeing some price resilience or even increases, along with tighter inventory conditions.

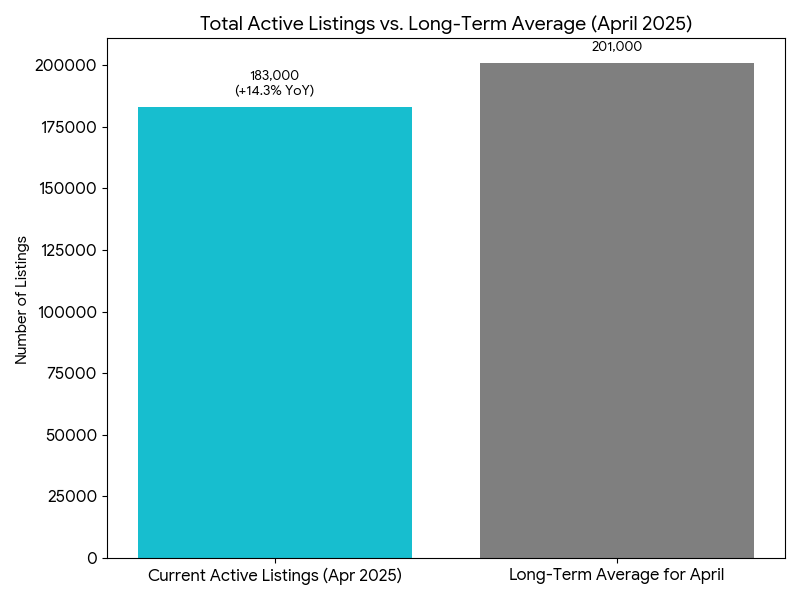

Valérie Paquin, CREA Chair, emphasized this divergence: “The number of homes for sale across Canada has almost returned to normal, but that is the result of higher inventories in B.C. and Ontario, and tight inventories everywhere else.” Visual Summary: The following charts illustrate some of the key trends: Total Active Listings vs. Long-Term Average (April 2025) This chart compares the total number of homes available for sale at the end of April 2025 against the typical long-term average for that time of year. It also notes the year-over-year change in active listings.  This chart compares the total number of homes available for sale at the end of April 2025 (183,000, up 14.3% year-over-year) against the typical long-term average for that time of year (approximately 201,000). It shows that while listings have increased from last year, they still haven’t reached the historical average for April. Sales-to-New Listings Ratio (SNLR) – April 2025 This chart shows the SNLR for April 2025, comparing it to the long-term average and the thresholds for different market conditions (buyer’s, balanced, seller’s).

This chart compares the total number of homes available for sale at the end of April 2025 (183,000, up 14.3% year-over-year) against the typical long-term average for that time of year (approximately 201,000). It shows that while listings have increased from last year, they still haven’t reached the historical average for April. Sales-to-New Listings Ratio (SNLR) – April 2025 This chart shows the SNLR for April 2025, comparing it to the long-term average and the thresholds for different market conditions (buyer’s, balanced, seller’s).

This chart shows the Sales-to-New Listings Ratio (SNLR) for April 2025 at 46.8%. It compares this to the long-term average SNLR of 54.9% and highlights the range typically considered a “balanced market” (45% to 65%). The current SNLR sits at the lower end of this balanced range, indicating that while the market isn’t strongly favouring buyers or sellers, it’s leaning slightly towards conditions that could offer buyers more leverage than if the ratio were higher.

Analysis:

April 2025 data points to a stabilization in sales activity following several months of declining figures. According to CREA’s Senior Economist, Shaun Cathcart, “the 2025 Canadian housing story would best be described as a return to the quiet markets we’ve experienced since 2022, with tariff uncertainty taking the place of high interest rates in keeping buyers on the sidelines.”

This suggests that while the sharp decline in sales may have paused, underlying caution persists among market participants. The year-over-year decrease in home sales by nearly 10% underscores that the market remains significantly cooler than in the spring of 2024. This slowdown in activity is accompanied by ongoing price adjustments.

Both the MLS® HPI and the national average sale price saw year-over-year decreases, with the HPI also declining month-over-month, indicating continued downward pressure on home values. On the supply side, new listings saw a slight dip from March to April. However, the total number of homes available for sale has risen substantially compared to the previous year, giving prospective buyers more options.

Despite this increase, overall inventory levels have not yet reached their long-term averages for this time of year. The national market, as indicated by the SNLR and months of inventory, appears to be in a state of balance. However, this national picture is an aggregation of varied local conditions.  Regional Variations: The Canadian housing market is not monolithic, and significant regional differences persist:

Regional Variations: The Canadian housing market is not monolithic, and significant regional differences persist:

- Ontario and British Columbia: These provinces, particularly their more expensive urban centers, are generally experiencing more pronounced price pullbacks. Inventory levels are higher, and sales activity has seen more significant declines compared to other parts of the country.

- Prairie Provinces (Alberta, Saskatchewan, Manitoba) and Atlantic Canada (Maritimes, Newfoundland and Labrador), and Quebec: In contrast, many markets in these regions are demonstrating more resilience. Some are even witnessing modest price growth and continue to experience tighter inventory conditions relative to demand.

CREA Chair Valérie Paquin highlighted this disparity, stating, “The number of homes for sale across Canada has almost returned to normal, but that is the result of higher inventories in B.C. and Ontario, and tight inventories everywhere else.” This underscores the importance of understanding local market dynamics when considering buying or selling property. Visual Summary of Key Market Indicators: The following charts provide a visual representation of some of the key changes in the Canadian housing market for April 2025: Canadian Housing Market – Year-over-Year Changes (April 2025 vs April 2024)  This chart illustrates the percentage change in actual home sales, the MLS® Home Price Index, and the national average sale price compared to April of the previous year. All key metrics show a decline, highlighting the cooling trend. Canadian Housing Market – Month-over-Month Changes (April 2025 vs March 2025)

This chart illustrates the percentage change in actual home sales, the MLS® Home Price Index, and the national average sale price compared to April of the previous year. All key metrics show a decline, highlighting the cooling trend. Canadian Housing Market – Month-over-Month Changes (April 2025 vs March 2025)

This chart displays the percentage change in seasonally adjusted national home sales, new listings, and the MLS® Home Price Index compared to the preceding month. It shows a near flatline in sales, a slight decrease in new listings, and a continued modest decline in the HPI. In conclusion, the Canadian housing market in April 2025 was characterized by a pause in the recent sales slump, ongoing price moderation, and a nationally balanced market that masks significant regional variations. Factors such as economic uncertainty, including trade tariff concerns, continue to influence buyer and seller behavior.

Recommendation for a Seller Considering Listing Their Home:

The decision to sell your home is significant, and the current market presents a nuanced landscape. While national prices have seen some moderation and sales activity, though stabilizing month-over-month, remains below last year’s levels, there are compelling reasons to consider listing, especially if your circumstances align. Why This Might Be a Good Time for You to Sell:

- Stabilizing Market Activity: After a period of decline, national sales activity showed signs of pausing its slump in April. This could indicate that buyers who were on the sidelines are beginning to re-engage, potentially creating a window of opportunity before any further significant market shifts.

- Inventory Levels Offer a Mixed Picture: While total active listings are up year-over-year (meaning more competition than last year), they still remain below the long-term average for this time of year in many areas. A well-priced and well-presented home can still capture significant attention.

- Regional Strengths Persist: If your property is located in markets like the Prairies, Quebec, or parts of Atlantic Canada, you might find conditions are still relatively strong with resilient pricing and tighter inventories. Even in markets like Ontario and BC that have seen more significant price adjustments, unique properties in desirable locations can still attract motivated buyers.

- Capture Current Price Levels: While prices have dipped from their peak, they are still substantial in many regions compared to historical levels. If you’re concerned about further price erosion, selling now could allow you to lock in your property’s current value. Waiting doesn’t guarantee a better outcome, especially if national price trends continue their modest decline.

- Motivated Buyers Are Still Active: Serious buyers are always in the market. Those active now are likely navigating current conditions with clear intentions, potentially leading to smoother transactions if you connect with the right one.

To maximize your success, it’s crucial to:

- Price Strategically: Overpricing in this market can lead to your home sitting longer. Work closely with a local real estate professional to set a competitive and realistic price based on the very latest comparable sales.

- Ensure Your Home Shines: With more choice for buyers than last year, presentation matters more than ever. Invest in staging, decluttering, and addressing any necessary repairs.

- Be Flexible: Understand that negotiation might be more common. Being open to reasonable offers and conditions can facilitate a successful sale.

If your personal and financial goals align with a move, listing now allows you to capitalize on the current buyer interest and potentially transition to your next property with more clarity than in a more volatile market.

Recommendation for a Buyer Considering Entering the Market:

For prospective homebuyers, the April 2025 market data reveals an environment that offers several advantages compared to the frenetic conditions of the recent past. If you’re financially prepared, this could be an opportune time to make your move. Why This Might Be a Good Time for You to Buy:

- Increased Choice and Less Frenzy: The 14.3% year-over-year increase in total active listings means you have more properties to choose from. With national sales down 9.8% compared to last April, there’s generally less competition for each home, reducing the likelihood of intense bidding wars.

- Price Moderation Offers Better Value: Both the MLS® Home Price Index and the national average sale price have declined year-over-year (by -3.6% and -3.9% respectively). This softening of prices can make homeownership more accessible and potentially offer better long-term value.

- More Balanced Market Conditions: Key indicators like the Sales-to-New Listings Ratio (46.8%) and Months of Inventory (5.1 months) point towards a more balanced national market. This environment typically affords buyers more time for due diligence, less pressure to make rushed decisions, and potentially more room for negotiation on price and conditions.

- Favourable Conditions in Certain Regions: If you are looking in markets like Ontario or British Columbia, you may find more significant price pullbacks and a greater willingness from sellers to negotiate, creating specific buying opportunities.

- Opportunity for Long-Term Investment: Housing is a long-term investment. Entering the market during a period of price stabilization or modest decline can be advantageous for buyers with a long-term horizon, as you’re potentially buying at a more sustainable price point.

- Stable Interest Rate Environment (Relatively Speaking): While interest rates remain a key consideration, the acute uncertainty around rapid rate hikes has somewhat subsided. This allows for more predictable mortgage planning. Shaun Cathcart of CREA noted “tariff uncertainty taking the place of high interest rates in keeping buyers on the sidelines,” suggesting some buyers might be adapting to the current rate environment.

To make the most of the current market, consider the following:

- Get Pre-Approved for a Mortgage: Know your budget definitively. This will strengthen your negotiating position.

- Work with an Experienced Buyer’s Agent: They can help you identify suitable properties, understand local micro-market conditions, and guide you through the negotiation process.

- Don’t Try to Perfectly Time the Bottom: It’s nearly impossible to buy at the absolute lowest point. Focus on finding a home that meets your needs and budget in a market that is offering more favorable conditions than seen in quite some time.

If you have a stable financial situation and a long-term perspective, the current market conditions provide a window of opportunity to purchase a home with more choice, less pressure, and potentially better value.

|

|

|

|

|

|

📊 GTA Real Estate Market Trends – April 2025 Update

Author: Gerald Lawrence, REALTOR®

Published: May 9, 2025

Reading Time: 7-9 minutes

🔍 Introduction

The Greater Toronto Area (GTA) real estate market continued to evolve in April 2025, reflecting broader economic pressures, buyer psychology, and seasonal trends. Whether you’re a homeowner, investor, or first-time buyer, understanding current housing data is critical.

In this article, we break down the latest TRREB Market Watch statistics, offer insight into price fluctuations, sales activity, and what this all means for your next move in the real estate market.

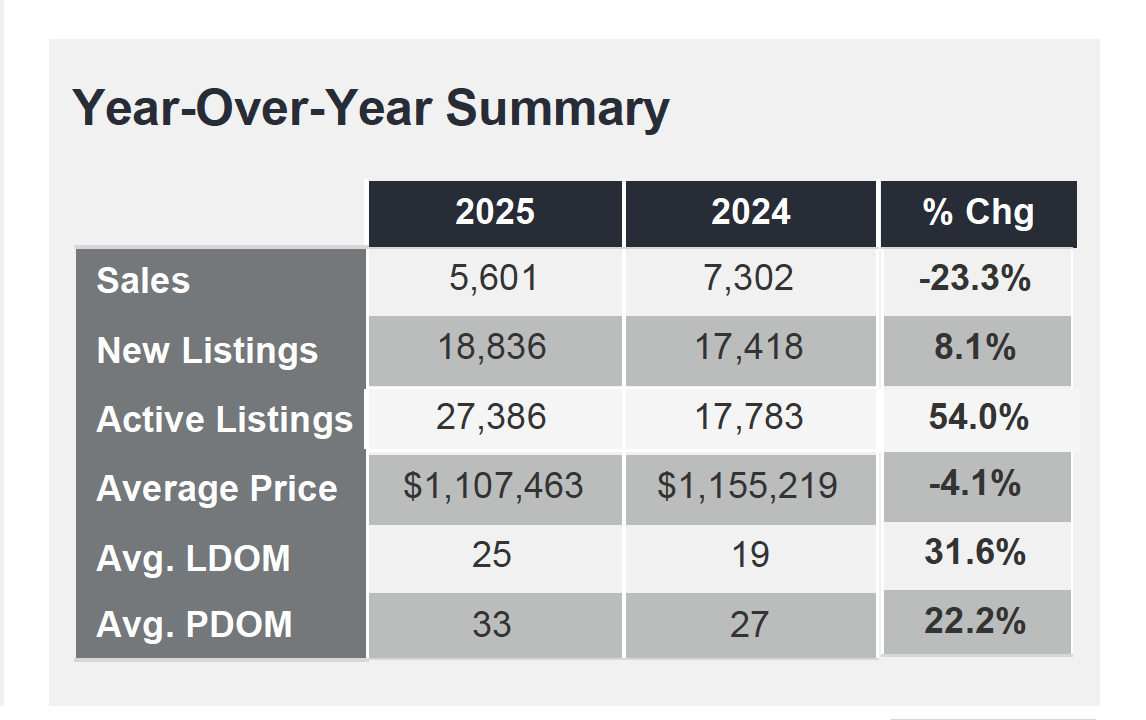

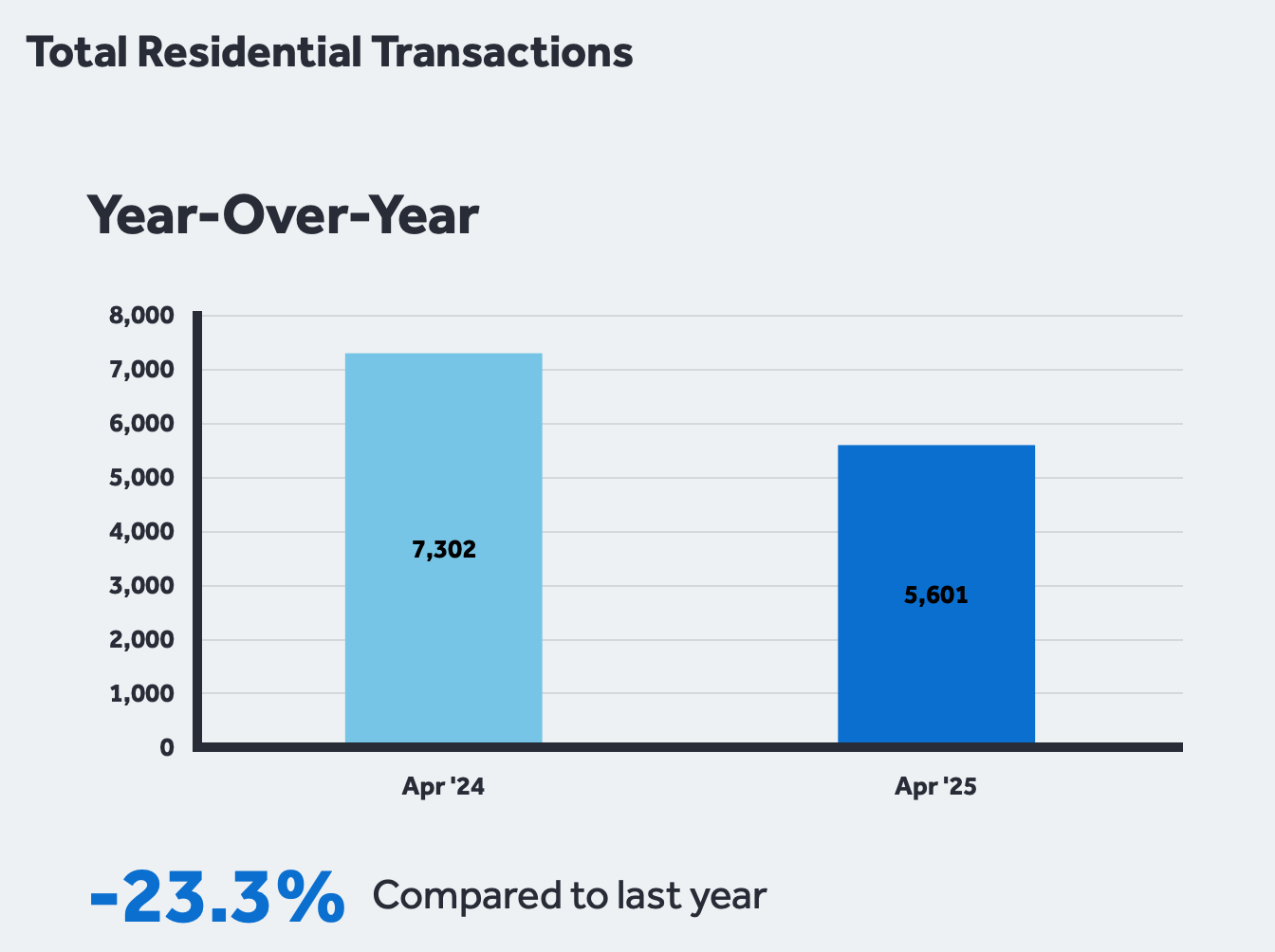

📈 Key Highlights for April 2025

| Metric | April

2025 |

April

2024 |

% Change

YoY |

|---|---|---|---|

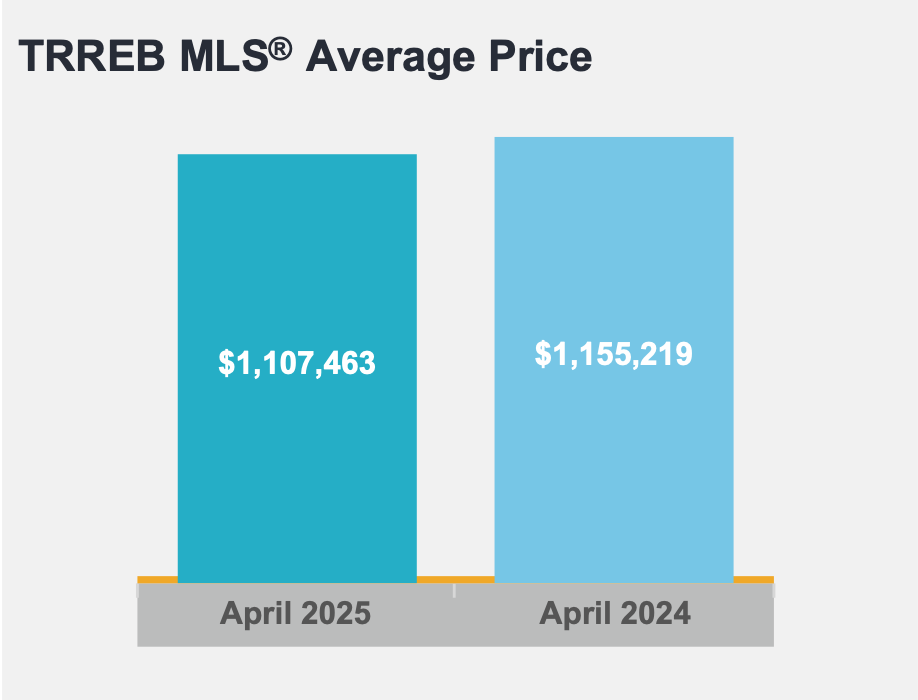

| Total Home Sales | 5,601 | 7,302 | -23.3% |

| Average Selling Price | $1,107,463 | $1,155,219 | -4.1% |

| New Listings | 18,836 | 17,418 | +8.1% |

| MLS® HPI Composite Benchmark | — | — | -5.4% |

| Average Days on Market (LDOM) | 25 | 33 | Improved |

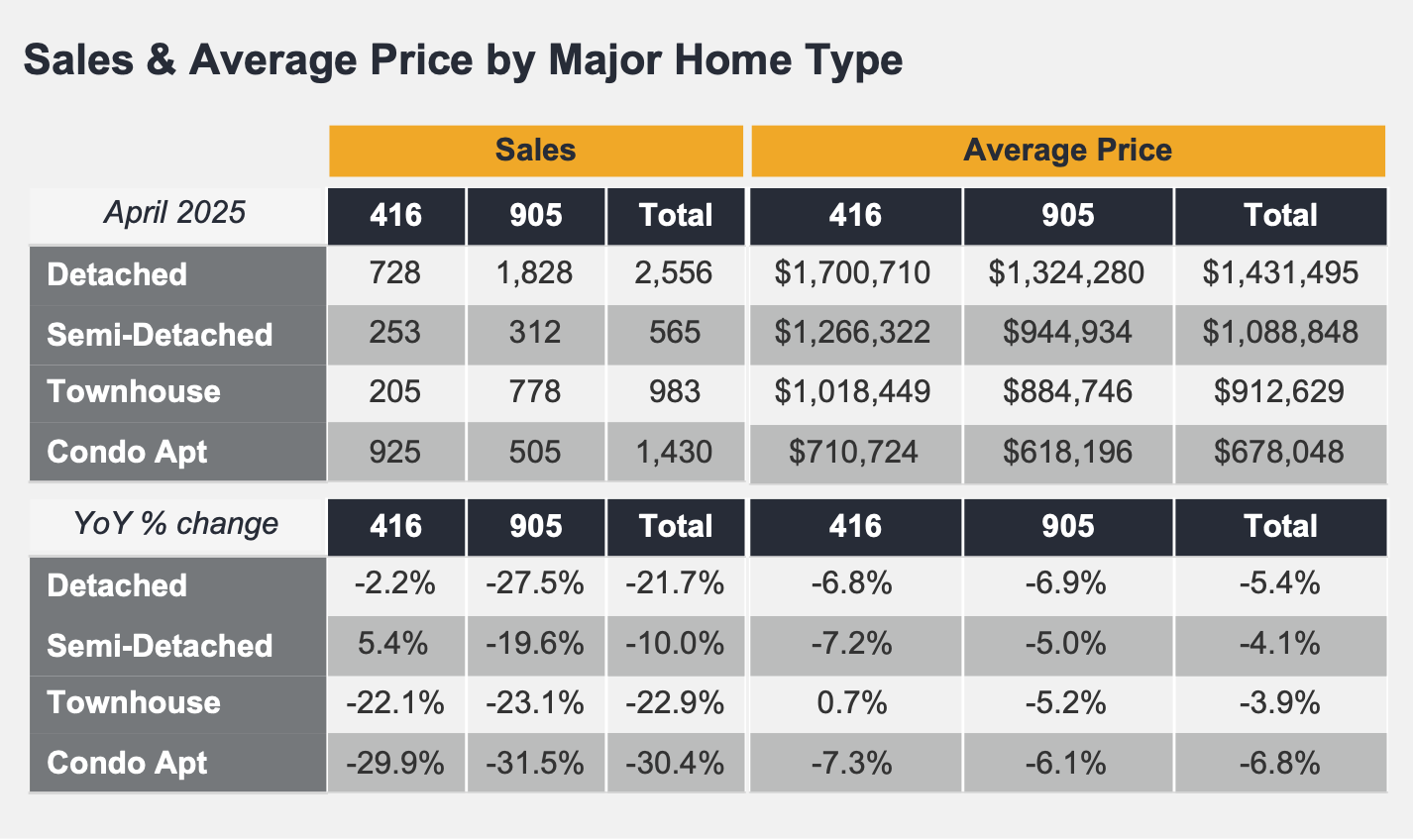

🏡 Breakdown by Housing Type

Here’s a detailed look at real estate sales and prices by home type across the 416 (Toronto) and 905 (suburban) areas.

📊 Sales & Average Price by Property Type

| Type | Sales

(416) |

Sales

(905) |

Total

Sales |

Avg Price

(416) |

Avg Price

(905) |

|---|---|---|---|---|---|

| Detached | 1,430.. | 2,556.. | 3,986.. | $1,431,495.. | $1,324,280.. |

| Semi-Detached. | 505 | 778 | 1,283 | $1,088,848 | $944,934 |

| Townhouse | 312 | 925 | 1,237 | $912,629 | $884,746 |

| Condo Apt | 983 | 728 | 1,711 | $678,048 | $618,196 |

💬 Year-over-Year Price Change by Property Type

-

Detached: -6.9%

-

Semi-Detached: -5.0%

-

Townhouse: -5.2%

-

Condo Apartment: -6.1%

📉 Across all segments, buyers gained greater leverage due to elevated real estate inventory levels and improved affordability through moderated mortgage rates.

📉 What’s Behind the Dip in Sales?

Despite following a typical seasonal uptick from March, April 2025 real estate sales fell 23.3% year-over-year. This hesitation is largely attributed to:

-

High borrowing costs: Despite some moderation, the RATE HOLD! Bank of Canada Interest Rate Announcement – April 16, 2025.

-

Economic uncertainty: Following the federal election, many are monitoring the Canada-U.S. trade relationship, which may impact consumer confidence.

-

Improved inventory: Buyers now have more choices, leading to longer decision-making timelines.

📊 Economic Indicators Snapshot

| Indicator | Value | Trend |

|---|---|---|

| Inflation (CPI YoY) | 2.8%(Apr 2025) | ↑ from 2.3% Mar |

| Toronto Unemployment Rate | 5.0%(Apr 2025) | ↑ from 4.8% Mar |

| Bank of Canada Overnight Rate | 2.750% | ↔ steady |

| Prime Lending Rate | 6.45% | ↔ steady |

| 5-Year Fixed Mortgage Rate | 5.09% avg. | ↓ slightly |

🌍 Regional Trends: Urban vs. Suburban

The 905 regions (e.g., Durham, York, Peel) showed resilience in price stability while urban centers like Toronto (416) saw sharper price drops, especially in condo segments.

🏙 Toronto (416):

-

Condos down 6.1%

-

Detached prices remain highest at $1.43M

🏘 Suburbs (905):

-

Balanced activity

-

Greater affordability attracted more buyers despite market cooling

💡 What This Means for Buyers and Sellers

🧭 For Buyers:

-

More selection: Higher active real estate listings mean less competition

-

Negotiation power: Sellers are more flexible on price and conditions

-

properties with more backyard: More real estate inventory available just outside the core within 1-2 hour drive from Toronto

💼 For Sellers:

-

Be realistic with pricing

-

Market your home’s unique features, such as workshops or acreage

-

Professional evaluation is key: Pricing right the first time shortens DOM and maximizes ROI

📍 Spotlight: Properties With Backyard Space

There’s growing demand for properties with some backyard space and/or additional buildings, especially among buyers moving from subdivision homes in City Centers. If you’re thinking of selling and your property fits this profile, now may be the perfect time to connect with qualified buyers.

📈 Chart: TRREB Sales Activity YoY

Real Estate Sales are down, but opportunities are up for savvy buyers and well-prepared sellers.

🤝 Let’s Talk: Free Market Evaluation

If you’re wondering about your home’s value in today’s changing market, I offer a FREE, no-obligation market evaluation that can help you decide if now is the right time to sell.

Whether you’re staying local or heading outside of the city to York Region or Durham Region and the Kawarthas, I can guide your move with real insights and connections to active, qualified buyers.

Summary

In April 2025, the Greater Toronto Area (GTA) real estate market saw a continued seasonal rise in activity from March, but overall real estate sales remained significantly lower than the same period in 2024. TRREB reported a 23.3% year-over-year drop in home sales, with only 5,601 transactions completed.

At the same time, new real estate listings rose by 8.1%, providing buyers with greater inventory and more negotiating power. The average home price fell by 4.1% to $1,107,463, while the MLS® Home Price Index Composite dropped 5.4% year-over-year, reflecting buyers’ cautious stance amid high borrowing costs and economic uncertainty following the recent federal election.

Elevated inventory and moderating mortgage rates contributed to more affordable housing options across the GTA. Detached, semi-detached, and condo apartment segments all experienced price declines, with detached homes in the 416 region averaging over $1.43 million.

Meanwhile, broader economic indicators showed continued inflation and employment growth, although real GDP growth remained uneven across timeframes. As households monitor developments in Canada’s trade relations and monetary policy, the GTA market is positioned for possible shifts in buyer sentiment should confidence improve and borrowing conditions ease.

❓ Frequently Asked Questions (FAQ)

1. Why are home sales down in April 2025?

Sales are lower largely due to buyer hesitation around high interest rates and economic uncertainty following the recent federal election and the ongoing trade war.

2. Is this a good time to buy real estate in the GTA?

Yes, if you’re financially ready. There’s less competition and more choice, giving buyers leverage in negotiations.

3. How can I make my home more attractive to buyers?

Highlight key features such as land, workshops, finished basements, or upgrades. Price competitively and stage professionally.

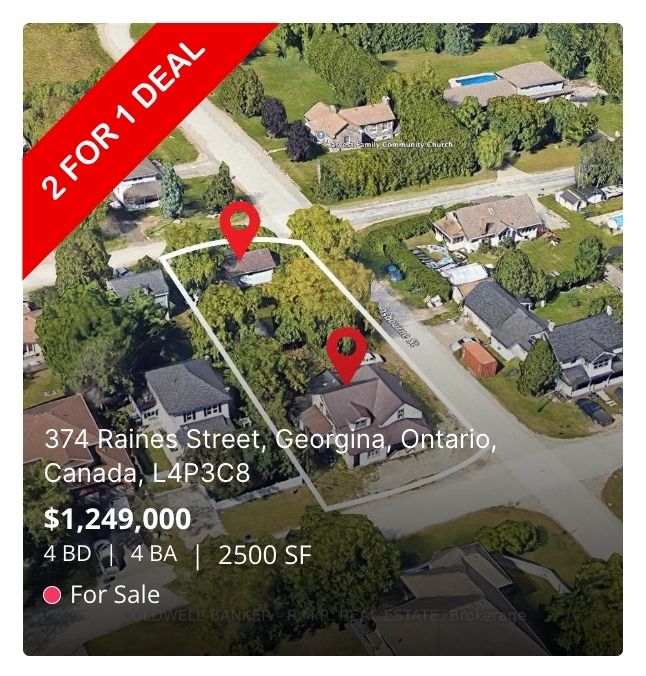

4. What’s the best area within an hour or two of Toronto to find land with buildings?

Areas north and east of York Region and Durham Region —such as Uxbridge, Clarington, Georgina, Brock, and parts of Kawartha Lakes—are growing in popularity among buyers looking for space and utility.

5. What’s the benefit of a free market evaluation?

It gives you an accurate sense of your home’s current market value, helping you plan with confidence. No strings attached.

📝 Final Thoughts

The GTA housing market is shifting, but with the right guidance, you can take full advantage of today’s conditions—whether you’re buying your dream rural property or selling your urban home.

📩 Let’s connect to discuss your goals and how I can help you navigate the market confidently.

|

|

|

|

|

📌 Capital Gains in Canada: A Must-Read Guide for Real Estate Investors

Thinking about selling your rental or secondary property? Before you do, it’s critical to understand how capital gains tax can affect your bottom line. This guide explains what you need to know, what’s changed, and how to plan ahead.

Capital Gains in Canada: What Real Estate Investors Need to Know

Thinking about selling your rental or secondary property? Before you do, it’s critical to understand how capital gains tax can affect your bottom line. This guide explains what you need to know, what’s changed, and how to plan ahead.

Capital gains taxation is an important consideration for property owners and investors across Canada, particularly those holding secondary residences and rental properties.