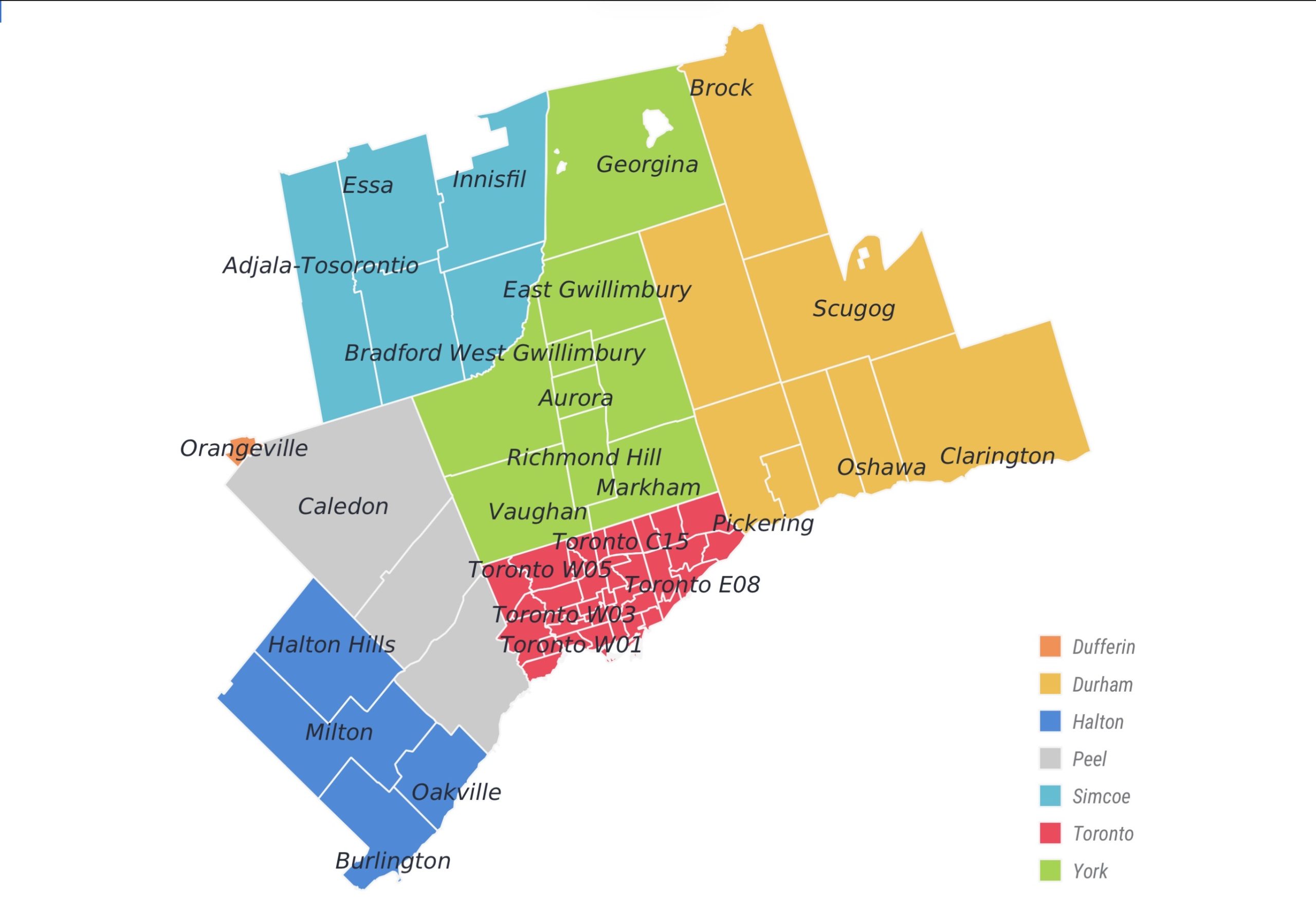

The October 2025 Durham Region real estate report reveals a balanced housing market characterized by lower home sales, increased inventory, and easing prices. The average sale price in Durham slipped by about 4-5% year-over-year to roughly $850,000, while homes sold for just under their list price and spent more time on the market. Inventory levels climbed to multi-year highs, giving buyers more options and shifting negotiations in their favor, yet some segments remain competitive—especially lower-priced properties. Sellers are adjusting expectations as market balance improves, and buyers benefit from greater choice and negotiating room, all amid ongoing economic uncertainty, declining mortgage rates, and steady but cautious transactional activity.

Screenshot

Durham Region Real Estate Market October 2025: Key Insights

October 2025 saw shifting dynamics in the Durham Region housing market. Home sales experienced a decline year-over-year, while new listings edged up, signaling a more favorable climate for buyers than in recent years. Lower mortgage rates and downward adjustments in selling prices improved affordability, though broader economic uncertainties are holding some buyers back.

Year-Over-Year Performance

-

Sales Volume: Home sales were down 9.5% in October 2025 compared to October 2024, echoing a region-wide cooling trend.

-

Listings: New listings increased by 2.7% year-over-year; active listings supply remains healthy, bolstering buyer options.

-

Average Price: The region’s average selling price fell by 7.2% compared to October 2024, showing a significant year-over-year price correction.

-

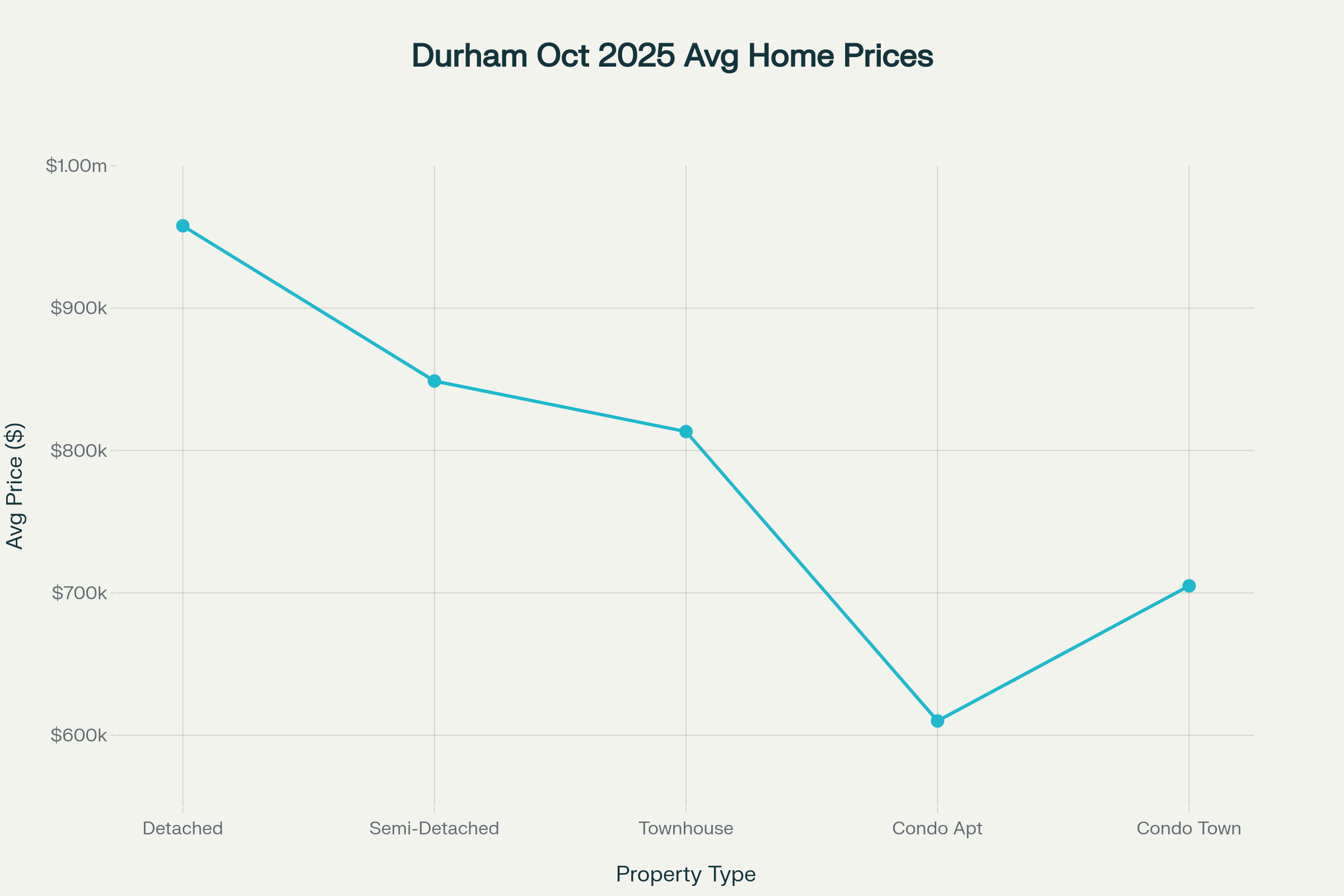

Benchmarks: In Durham, detached homes averaged $957,800, while townhouses and condos posted average prices of $813,300 and $610,000, respectively.

Market Segmentation: Home Types and Price Ranges

Detached and Semi-Detached Trends

-

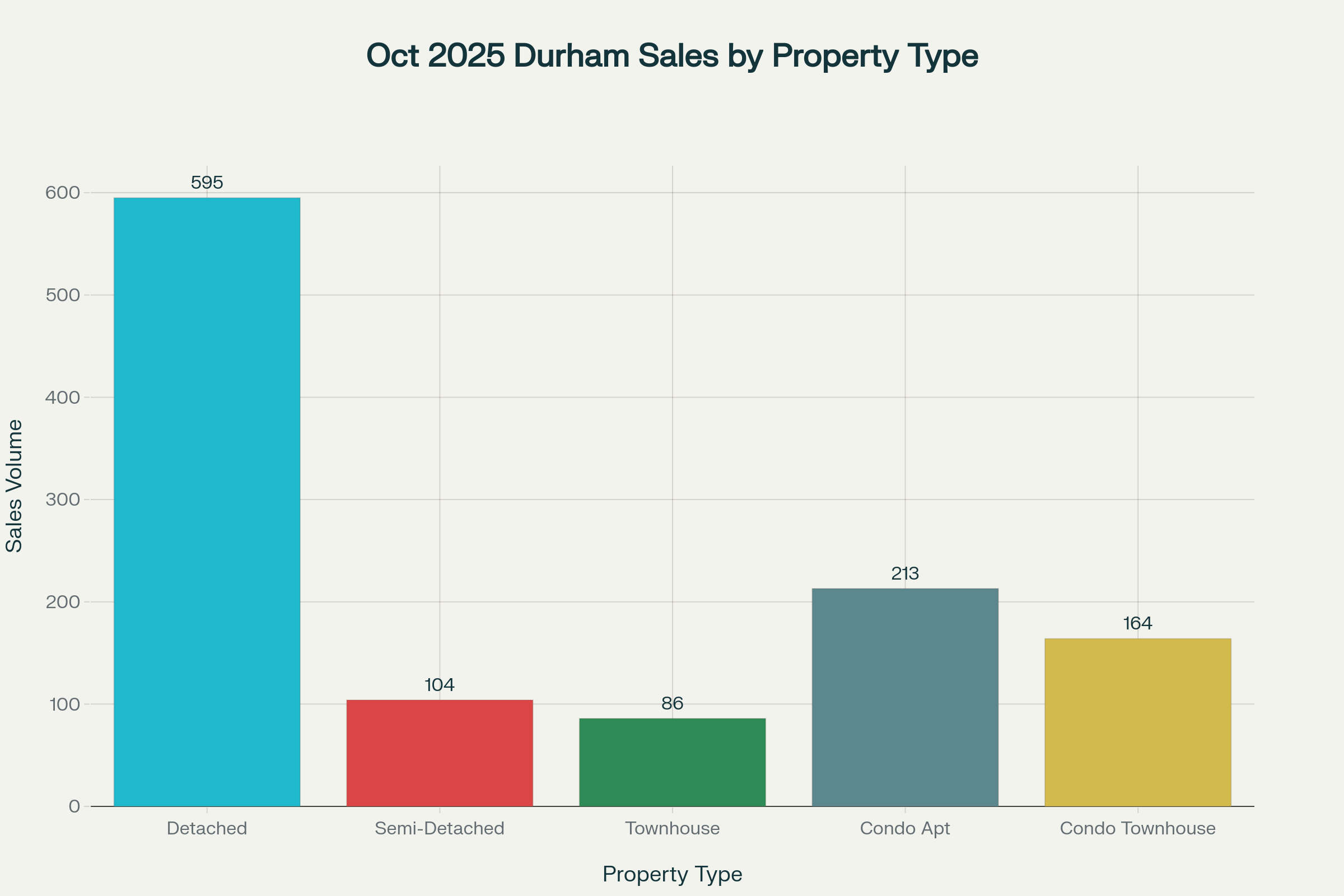

Detached Homes: Average price was $957,800, with 595 transactions. Volumes were down and prices adjusted by about 10% year-over-year, reflecting overall softer market conditions.

-

Semi-Detached: These properties averaged $848,800 with 104 sales. Year-over-year price drop was about 8%, underscoring increasing price sensitivity among buyers.

Townhouses and Condominiums

-

Townhouses: The average sale price for townhomes stood at $813,300, slightly higher supply and moderate demand led to more negotiation on sales prices.

-

Condo Apartments: Durham’s average price for a condo apartment in October 2025 was $610,000, down almost 7% year-over-year. The volume for condo apartment sales was 213, demonstrating stable but selective buyer intent in this segment.

-

Condo Townhouses: These reached an average price of $704,900, signaling relative stability in entry-level housing.

Sales Volume and Price Range Data

| Home Type | Sales Volume | Avg. Price | YoY % Change |

|---|---|---|---|

| Detached | 595 | $957,800 | -10% |

| Semi-Detached | 104 | $848,800 | -8% |

| Att/Row Townhouse | 86 | $813,300 | -7% |

| Condo Apt | 213 | $610,000 | -7% |

| Condo Townhouse | 164 | $704,900 | -7% |

Inventory, Listings, and Buyer/Seller Dynamics

Inventory and Listings

-

Months of Inventory: Durham Region held around 4–5 months of inventory, up slightly year-over-year. This metric indicates a slowly growing buyer’s market, with more choice and less upward price pressure.

-

SNLR (Sales-to-New-Listings Ratio): Durham’s ratio hovered in the low 30s, indicative of balanced market conditions. Buyers now have more negotiating power, which translates into lower sale-to-list price ratios.

Buyer and Seller Strategies

-

Affordability: Lower interest rates and price drops have improved affordability for qualified buyers, especially those with job security and stable financing.

-

Listing Strategy: Sellers need to price realistically and stage homes attractively, as days-on-market are up, and average property days on market (PDOM) often exceeds 30 days.

-

Investor Impact: Investors have returned to monitoring the market closely for signs of price bottoms, but most are remaining selective, focused on properties that will cash-flow under higher interest costs.

Durham Region: Community-Specific Highlights

-

Ajax: 48 detached homes sold at an average of $957,800, while 15 condos averaged $610,000. Average listing days on market ranged from 20 to 30 days.

-

Oshawa: 144 detached transactions with an average price of $704,900; the town remains a magnet for entry-level buyers due to relatively affordable prices across all property categories.

-

Pickering and Whitby: Both cities maintained robust new listing activity and had average sale prices in the high $900,000s for detached, with strong diversity in available inventory from condos to large single-family homes.

Economic Factors and Forward-Looking Statements

-

Interest Rates: The Bank of Canada’s overnight rate in October was 4.7%, with most mortgage products reflecting favorable buyer terms. Weaker monthly sales contributed to weaker price gains, but falling borrowing costs create longer-term optimism.

-

Unemployment: Toronto’s seasonally adjusted unemployment rate dropped to 2.3%, supporting buyer confidence but not eliminating broader economic anxieties.

-

Policy Watch: Calls continue for governments to cut buyer costs, end exclusionary zoning, and prioritize new construction, especially as the population grows and housing diversity becomes critical.

What to Expect in Durham Region Real Estate

The Durham Region real estate market in October 2025 provided a classic example of the transition to a buyer-favored environment. While price corrections and increased supply benefitted buyers, overall sales volumes declined as some remained sidelined due to uncertainty. If macroeconomic confidence rebounds, expect pent-up demand to gradually return, particularly if borrowing costs remain low and local job markets stay robust. For now, Durham’s property market offers opportunity for buyers and a clear message to sellers: adapt strategies to this more competitive climate.

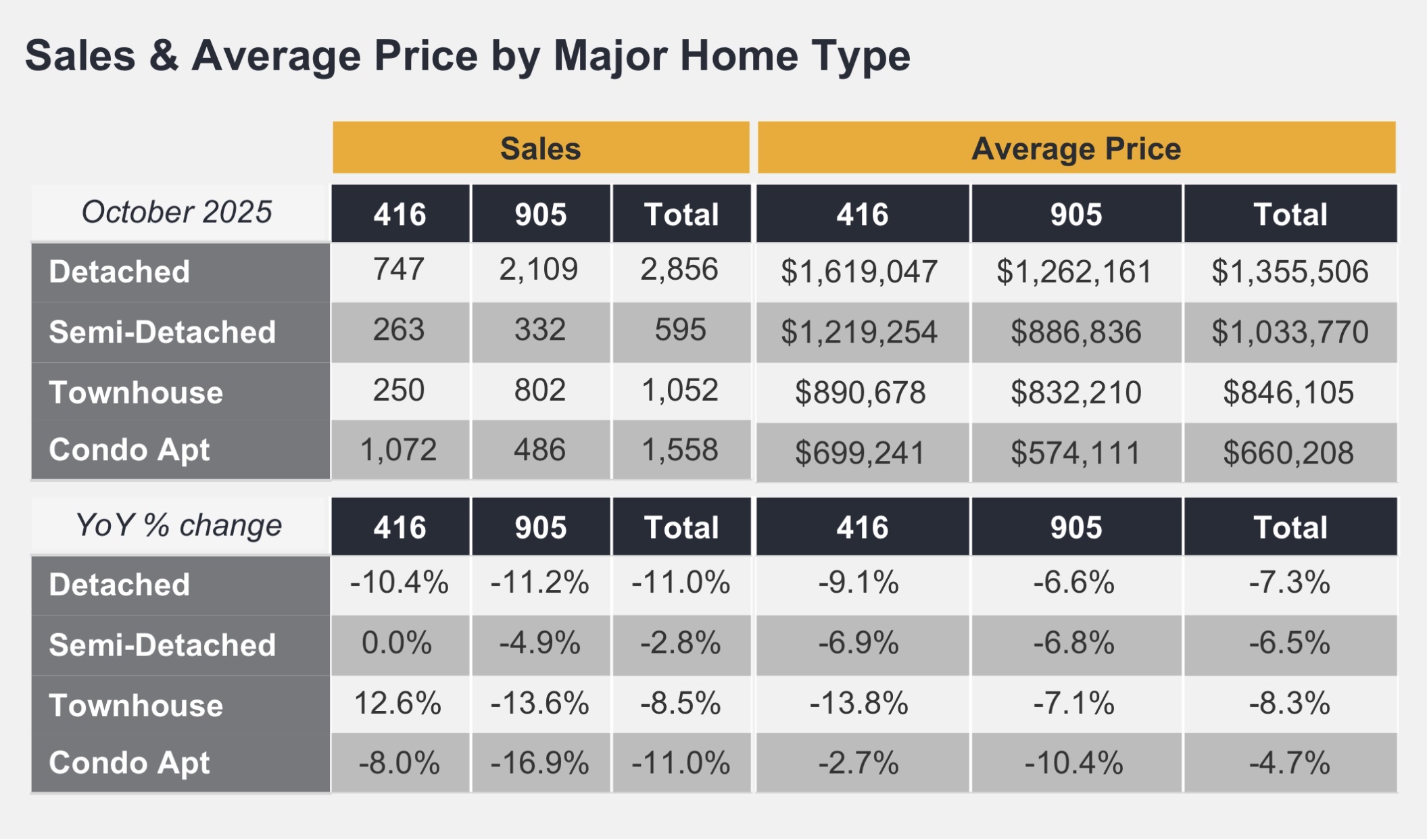

The Greater Toronto Real Estate Market Update

The Greater Toronto Area (GTA) real estate market in October 2025 has created a rare and powerful window of opportunity for homebuyers. The latest stats from GTA REALTORS® confirm a clear shift to a buyer’s market, marked by increased inventory, lower prices, and more affordable mortgage payments.

If you’ve been waiting on the sidelines, this is your sign to move forward with confidence.

📉 Buyer Advantage: Prices & Payments Are Down

October’s data presents an undeniable financial benefit for buyers with long-term certainty in their employment and income.

- Average Selling Price Down: The average selling price in the GTA dropped to $1,054,372, a significant 7.2% decrease compared to October 2024.

- Lower Monthly Payments: As TRREB’s Chief Information Officer noted, the monthly mortgage payment for an average-priced home is trending lower. This is due to the combined effect of negotiated price reductions and generally lower borrowing costs, making homeownership more accessible.

- Price Benchmark Eased: The MLS® Home Price Index (HPI) Composite benchmark was down by five per cent year-over-year. This indicates a broader, sustained cooling in home values.

Key Takeaway: You can now enter the GTA housing market at a more affordable price point and secure a lower monthly payment than buyers faced just one year ago.

🏡 More Choice: Inventory Is Up

Buyers now have time to breathe, compare, and make a decision without the pressure-cooker bidding wars of the past.

- Listings Increase: New listings totaled 16,069 in October, a 2.7% increase year-over-year. While sales were down, the increase in listings means a more diverse selection of properties for you to choose from.

- Conditions Favour Buyers: With sales down by 9.5% year-over-year against a rise in new listings, the competition is significantly reduced. This is the definition of market conditions that favour homebuyers, giving you the negotiating leverage you’ve been waiting for.

🚀 Seize the Negotiation Window!

The current market dynamic won’t last forever. As TRREB experts suggest, once economic uncertainty fades and business confidence returns, demand is likely to increase and tighten the market again.

The time to act is now, while inventory is high, prices are favourable, and your negotiation power is at its peak.

Don’t wait for the next wave of buyers to jump in. Secure your future home and lock in your price before the market starts to turn.

🔥 Buyers: Stop Waiting! Schedule Your Exclusive Strategy Call TODAY.

Ready to capitalize on lower prices and higher negotiating power? Let’s discuss a tailored buying strategy to find your dream home at the best possible value.

Click Here to Schedule a Free, No-Obligation Buyer Consultation Now!

Are you a homeowner thinking of selling? Even in a buyer’s market, a properly priced and professionally marketed home will still attract the right buyer.

✅ Sellers: Get a Free, Expert Home Valuation.

Don’t let market headlines scare you. Discover what your home is truly worth in today’s competitive environment.

Find Out Your Home’s Current Value – Get Your FREE Market Report!

GTA Real Estate Market, October 2025 Stats, Buyer’s Market GTA, Lower Mortgage Payments, Toronto Home Prices Down, GTA Housing Market Forecast, Buy a Home in Toronto, Negotiation Power Real Estate, Affordable GTA Homes

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link