Thank You For The Booked Showing – 19 Forestgreen Drive!

Thanks for Booking A Showing for 19 Forestgreen Dr by Gerald Lawrence, REALTOR®

“Pay to Say”: The Controversial New Rule Blocking Tenants From Court (Unless They Pay Up)

Bill 60 Deep Dive: The Ultimate Guide for Ontario Landlords, Tenants, Buyers, and Sellers

Bill 60, formally known as the Fighting Delays, Building Faster Act, 2025, has officially shaken up the landscape of rental housing in Ontario. Whether you are a seasoned investor, a first-time renter, or someone looking to buy or sell a tenanted property, these changes are not just “fine print”—they fundamentally alter your rights, timelines, and financial obligations.

This comprehensive guide breaks down every critical aspect of the new legislation, offering detailed analysis, practical scenarios, and checklists to keep you compliant and protected.

What is Bill 60?

At its core, Bill 60 was introduced by the Ontario government with the stated aim of “reducing red tape” and clearing the massive backlog at the Landlord and Tenant Board (LTB). For years, both landlords and tenants have suffered from wait times that can stretch to 8-12 months for a simple hearing.

While the goal of speed is universally appreciated, the methods used in Bill 60 have sparked intense debate. The legislation aggressively shortens timelines for evictions and limits certain tenant defenses, tilting the procedural balance significantly.

The 4 Key Changes You Must Know

1. The “Cash for Keys” Trade-Off (N12 Compensation)

-

Old Rule: If a landlord wanted to move into their unit (or move a family member in), they had to give 60 days’ notice and pay the tenant 1 month’s rent as compensation.

-

New Bill 60 Rule: Landlords can now avoid paying the 1-month compensation if they provide a longer notice period of 120 days (4 months) instead of the standard 60 days.

-

Note: This specifically applies to Section 48 (Landlord’s Own Use).

-

Strategy: This creates a “Time vs. Money” decision for landlords. If you are cash-poor but have time, you can save money. If you need the unit fast, you pay the compensation for the 60-day exit.

-

2. “Pay to Say” (Rent Arrears Hearings)

-

Old Rule: If a landlord filed for eviction due to unpaid rent (L1 application), the tenant could show up at the hearing and raise “new issues” like maintenance problems or harassment to explain why they withheld rent.

-

New Bill 60 Rule: Tenants can no longer raise these issues at an arrears hearing unless they:

-

Provide advance written notice.

-

Pay 50% of the alleged rent arrears into the Board or to the landlord before the hearing can proceed with those arguments.

-

Impact: This effectively bars tenants who are withholding rent due to severe disrepair (and have spent the money on repairs or other needs) from using that defense without a significant upfront payment.

-

3. The 7-Day Eviction Clock (N4 Notice)

-

Old Rule: If a tenant missed rent, the landlord gave an N4 notice. The landlord had to wait 14 days after the notice was served before they could file an application with the LTB.

-

New Bill 60 Rule: The waiting period has been slashed to 7 days.

-

Impact: This cuts a week off the eviction timeline. If rent is due on the 1st and unpaid, an N4 can be issued on the 2nd, and the LTB filing can happen as early as the 9th or 10th.

-

4. Slashed Appeal Windows

-

Old Rule: Parties had 30 days to appeal an LTB decision to the Divisional Court or request a review.

-

New Bill 60 Rule: The appeal window is reduced to 15 days.

-

Impact: You must have your legal counsel and paperwork ready immediately after a decision is rendered.

-

Pros and Cons Analysis

For Landlords

For Tenants

Real-World Scenarios

Scenario A: The “Patient” Landlord

Situation: Sarah owns a condo downtown. Her daughter is graduating university in 5 months and needs the unit.

Action: Sarah serves an N12 notice now, opting for the 120-day termination date.

Result: Sarah does not have to pay her tenant the standard $2,800 compensation. The tenant gets 4 months to find a place, and Sarah saves nearly $3,000.

Scenario B: The “Emergency” Repair Defense

Situation: Mark, a tenant, stops paying rent because his roof is leaking and destroying his furniture. He owes $4,000 in back rent.

Bill 60 Impact: The landlord files for eviction. Mark wants to show photos of the roof at the hearing. The adjudicator asks, “Have you paid $2,000 (50%) of the arrears?” Mark has not.

Result: Mark is blocked from raising the maintenance issue as a defense against the eviction. The eviction for non-payment is likely granted, and Mark must pursue a separate (and later) application for the roof.

Critical Advice for Buyers and Sellers of Tenanted Properties

This is the most complex area of the new bill. The distinction between Landlord’s Own Use (Section 48) and Purchaser’s Own Use (Section 49) is vital.

For Sellers

-

The “Compensation Trap”: If you are selling a tenanted property, do not assume you can waive the compensation for the buyer. The legislation specifically amends Section 48 (Landlord’s Own Use). It is legally risky to assume this applies to Section 49 (Purchaser’s Own Use).

-

Recommendation: If your buyer wants vacant possession, stick to the standard 60-day N12 and pay the compensation. Using the 120-day rule to save a few thousand dollars could spook a buyer who doesn’t want to wait 4 months to close.

-

Marketing: If you have a long closing (e.g., 5-6 months), you might be able to use the 120-day notice before listing or early in the process to clear the unit cost-effectively, but consult a paralegal first.

For Buyers

-

Closing Dates: If you are buying a tenanted property for your own use, demand a standard 60-day N12. Do not let the seller try to save money with the 120-day notice unless you are perfectly happy waiting 4+ months to move in.

-

Vacant Possession Clauses: Ensure your Agreement of Purchase and Sale (APS) has a strict clause requiring the Seller to provide vacant possession. With the new appeal window shortened to 15 days, you will know sooner if a tenant is fighting the eviction, allowing you to walk away or renegotiate faster.

Actionable To-Do Lists

For Landlords

-

[ ] Update Your Forms: Ensure you are using the newest versions of N4 and N12 forms that reflect Bill 60 changes. Old forms may be considered defective.

-

[ ] Audit Your Arrears: If a tenant is late, issue the N4 on day 2. Mark your calendar for Day 8 to file the L1 application (down from Day 15).

-

[ ] Budget for Legal: If you plan to use the 120-day notice, verify with a legal professional that your specific scenario qualifies for the compensation waiver.

For Tenants

-

[ ] Don’t Withhold Rent: Under Bill 60, withholding rent is riskier than ever. Pay your rent, and file a separate T6 (Maintenance) application immediately if repairs are needed.

-

[ ] Act Fast on N4s: If you receive a 7-day notice, contact a rent bank or legal clinic immediately. You have half the time you used to have.

-

[ ] Check the Notice: If a landlord gives you 120 days notice and doesn’t pay compensation, make sure they are actually moving in. If they re-rent it or sell it, you can file a T5 (Bad Faith) application for significant damages.

Conclusion

Bill 60 is a double-edged sword. It offers speed and cost-saving potential for landlords but demands rigorous adherence to new, tighter schedules. For tenants, it strips away financial leverage and safety nets, making “paying rent on time” the only safe harbor. Whether you agree with the politics or not, understanding these rules is the only way to survive in Ontario’s new rental reality.

Bill 60 protest video This video provides visual context on the public reaction and protests regarding Bill 60, highlighting the intensity of the debate surrounding these changes.

🚨 Critical Action: Are Your New Notices Legal?

Bill 60 has eliminated your margin for error. The new 7-day N4 timelines and the complex N12 compensation waivers mean a single mistake on paperwork can lead to your LTB application being dismissed—forcing you to start over, or worse, facing substantial bad-faith fines.

Don’t rely on outdated templates or guesswork. Ensure your documentation is 100% compliant with the new Fighting Delays, Building Faster Act before you file.

Protect Your Investment: Book a Bill 60 Compliance Audit

Click below to schedule a rapid, 15-minute audit with a licensed paralegal specializing in Ontario landlord-tenant law.

We will confirm if:

-

Your 7-day N4 is properly timed and served.

-

Your 120-day N12 compensation waiver is legally applicable to your scenario (Section 48 vs. Section 49).

-

Your selling strategy complies with the new purchaser use rules.

Protect your legal right to the unit and save thousands in potential compensation and fines.

Thank You For The Booked Showing – 470 Blue Mountain Rd!

Thanks for Booking A Showing for 470 Blue Mountain Rd by @YorkDurhamHomes

Thank You For The Booked Showing – 12885 Hwy 12!

Thanks for Booking A Showing for 12885 Hwy 12! Gerald Lawrence -REALTOR®

STOP WAITING: GTA Home Prices CRASHED 7.2%! 📉 The October/November Secret Buyers Need to Know Now

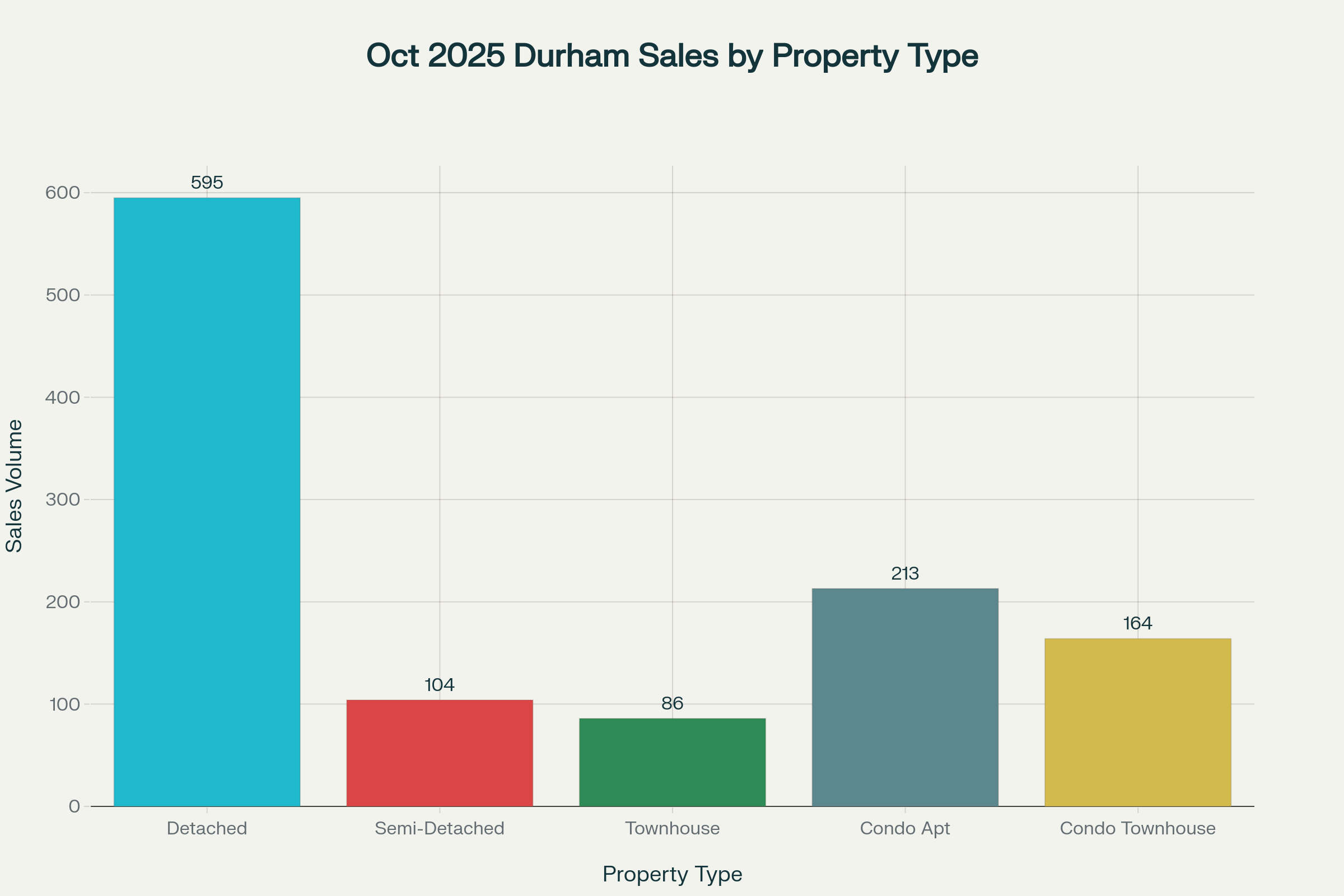

The October 2025 Durham Region real estate report reveals a balanced housing market characterized by lower home sales, increased inventory, and easing prices. The average sale price in Durham slipped by about 4-5% year-over-year to roughly $850,000, while homes sold for just under their list price and spent more time on the market. Inventory levels climbed to multi-year highs, giving buyers more options and shifting negotiations in their favor, yet some segments remain competitive—especially lower-priced properties. Sellers are adjusting expectations as market balance improves, and buyers benefit from greater choice and negotiating room, all amid ongoing economic uncertainty, declining mortgage rates, and steady but cautious transactional activity.

Screenshot

Durham Region Real Estate Market October 2025: Key Insights

October 2025 saw shifting dynamics in the Durham Region housing market. Home sales experienced a decline year-over-year, while new listings edged up, signaling a more favorable climate for buyers than in recent years. Lower mortgage rates and downward adjustments in selling prices improved affordability, though broader economic uncertainties are holding some buyers back.

Year-Over-Year Performance

-

Sales Volume: Home sales were down 9.5% in October 2025 compared to October 2024, echoing a region-wide cooling trend.

-

Listings: New listings increased by 2.7% year-over-year; active listings supply remains healthy, bolstering buyer options.

-

Average Price: The region’s average selling price fell by 7.2% compared to October 2024, showing a significant year-over-year price correction.

-

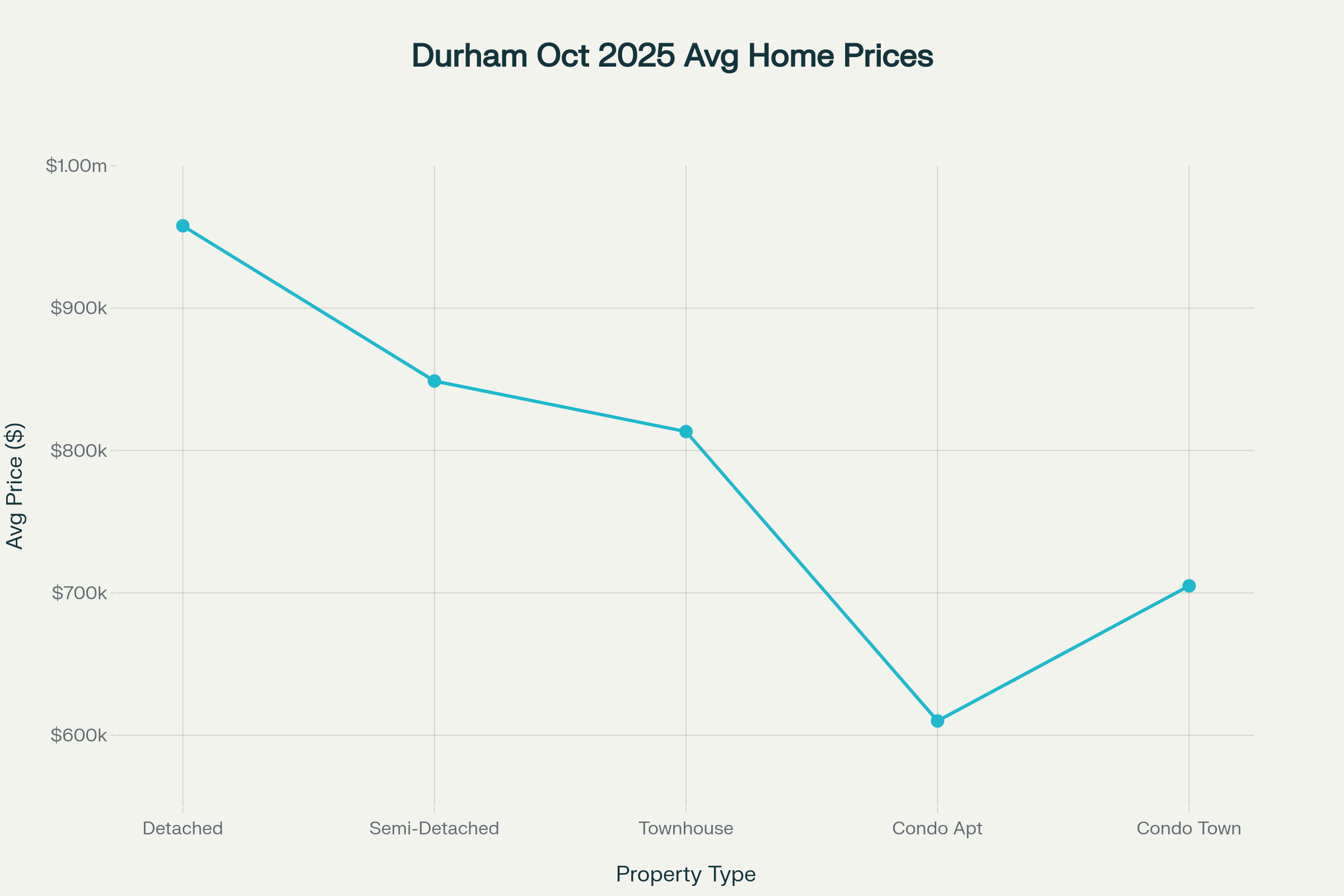

Benchmarks: In Durham, detached homes averaged $957,800, while townhouses and condos posted average prices of $813,300 and $610,000, respectively.

Market Segmentation: Home Types and Price Ranges

Detached and Semi-Detached Trends

-

Detached Homes: Average price was $957,800, with 595 transactions. Volumes were down and prices adjusted by about 10% year-over-year, reflecting overall softer market conditions.

-

Semi-Detached: These properties averaged $848,800 with 104 sales. Year-over-year price drop was about 8%, underscoring increasing price sensitivity among buyers.

Townhouses and Condominiums

-

Townhouses: The average sale price for townhomes stood at $813,300, slightly higher supply and moderate demand led to more negotiation on sales prices.

-

Condo Apartments: Durham’s average price for a condo apartment in October 2025 was $610,000, down almost 7% year-over-year. The volume for condo apartment sales was 213, demonstrating stable but selective buyer intent in this segment.

-

Condo Townhouses: These reached an average price of $704,900, signaling relative stability in entry-level housing.

Sales Volume and Price Range Data

| Home Type | Sales Volume | Avg. Price | YoY % Change |

|---|---|---|---|

| Detached | 595 | $957,800 | -10% |

| Semi-Detached | 104 | $848,800 | -8% |

| Att/Row Townhouse | 86 | $813,300 | -7% |

| Condo Apt | 213 | $610,000 | -7% |

| Condo Townhouse | 164 | $704,900 | -7% |

Inventory, Listings, and Buyer/Seller Dynamics

Inventory and Listings

-

Months of Inventory: Durham Region held around 4–5 months of inventory, up slightly year-over-year. This metric indicates a slowly growing buyer’s market, with more choice and less upward price pressure.

-

SNLR (Sales-to-New-Listings Ratio): Durham’s ratio hovered in the low 30s, indicative of balanced market conditions. Buyers now have more negotiating power, which translates into lower sale-to-list price ratios.

Buyer and Seller Strategies

-

Affordability: Lower interest rates and price drops have improved affordability for qualified buyers, especially those with job security and stable financing.

-

Listing Strategy: Sellers need to price realistically and stage homes attractively, as days-on-market are up, and average property days on market (PDOM) often exceeds 30 days.

-

Investor Impact: Investors have returned to monitoring the market closely for signs of price bottoms, but most are remaining selective, focused on properties that will cash-flow under higher interest costs.

Durham Region: Community-Specific Highlights

-

Ajax: 48 detached homes sold at an average of $957,800, while 15 condos averaged $610,000. Average listing days on market ranged from 20 to 30 days.

-

Oshawa: 144 detached transactions with an average price of $704,900; the town remains a magnet for entry-level buyers due to relatively affordable prices across all property categories.

-

Pickering and Whitby: Both cities maintained robust new listing activity and had average sale prices in the high $900,000s for detached, with strong diversity in available inventory from condos to large single-family homes.

Economic Factors and Forward-Looking Statements

-

Interest Rates: The Bank of Canada’s overnight rate in October was 4.7%, with most mortgage products reflecting favorable buyer terms. Weaker monthly sales contributed to weaker price gains, but falling borrowing costs create longer-term optimism.

-

Unemployment: Toronto’s seasonally adjusted unemployment rate dropped to 2.3%, supporting buyer confidence but not eliminating broader economic anxieties.

-

Policy Watch: Calls continue for governments to cut buyer costs, end exclusionary zoning, and prioritize new construction, especially as the population grows and housing diversity becomes critical.

What to Expect in Durham Region Real Estate

The Durham Region real estate market in October 2025 provided a classic example of the transition to a buyer-favored environment. While price corrections and increased supply benefitted buyers, overall sales volumes declined as some remained sidelined due to uncertainty. If macroeconomic confidence rebounds, expect pent-up demand to gradually return, particularly if borrowing costs remain low and local job markets stay robust. For now, Durham’s property market offers opportunity for buyers and a clear message to sellers: adapt strategies to this more competitive climate.

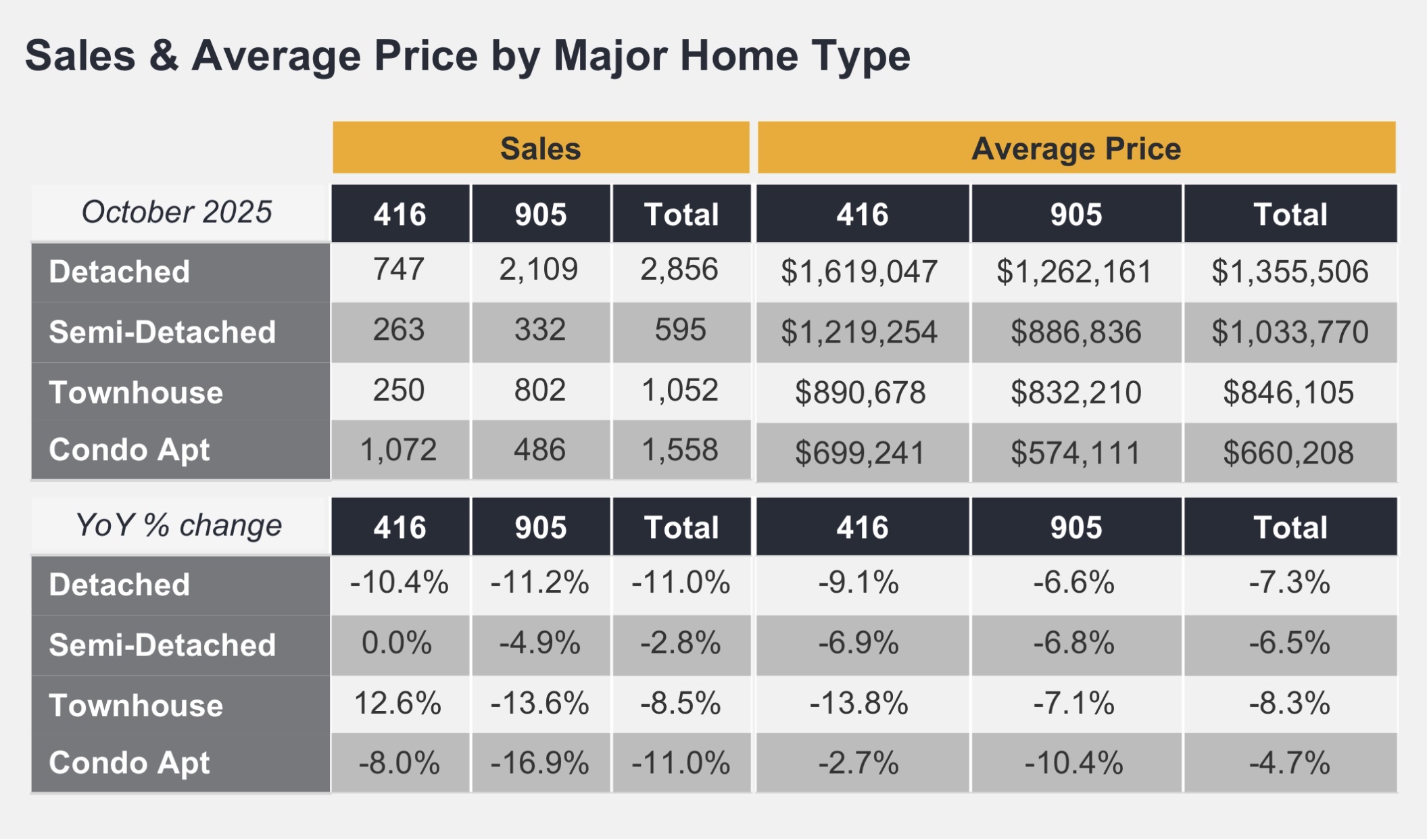

The Greater Toronto Real Estate Market Update

The Greater Toronto Area (GTA) real estate market in October 2025 has created a rare and powerful window of opportunity for homebuyers. The latest stats from GTA REALTORS® confirm a clear shift to a buyer’s market, marked by increased inventory, lower prices, and more affordable mortgage payments.

If you’ve been waiting on the sidelines, this is your sign to move forward with confidence.

📉 Buyer Advantage: Prices & Payments Are Down

October’s data presents an undeniable financial benefit for buyers with long-term certainty in their employment and income.

- Average Selling Price Down: The average selling price in the GTA dropped to $1,054,372, a significant 7.2% decrease compared to October 2024.

- Lower Monthly Payments: As TRREB’s Chief Information Officer noted, the monthly mortgage payment for an average-priced home is trending lower. This is due to the combined effect of negotiated price reductions and generally lower borrowing costs, making homeownership more accessible.

- Price Benchmark Eased: The MLS® Home Price Index (HPI) Composite benchmark was down by five per cent year-over-year. This indicates a broader, sustained cooling in home values.

Key Takeaway: You can now enter the GTA housing market at a more affordable price point and secure a lower monthly payment than buyers faced just one year ago.

🏡 More Choice: Inventory Is Up

Buyers now have time to breathe, compare, and make a decision without the pressure-cooker bidding wars of the past.

- Listings Increase: New listings totaled 16,069 in October, a 2.7% increase year-over-year. While sales were down, the increase in listings means a more diverse selection of properties for you to choose from.

- Conditions Favour Buyers: With sales down by 9.5% year-over-year against a rise in new listings, the competition is significantly reduced. This is the definition of market conditions that favour homebuyers, giving you the negotiating leverage you’ve been waiting for.

🚀 Seize the Negotiation Window!

The current market dynamic won’t last forever. As TRREB experts suggest, once economic uncertainty fades and business confidence returns, demand is likely to increase and tighten the market again.

The time to act is now, while inventory is high, prices are favourable, and your negotiation power is at its peak.

Don’t wait for the next wave of buyers to jump in. Secure your future home and lock in your price before the market starts to turn.

🔥 Buyers: Stop Waiting! Schedule Your Exclusive Strategy Call TODAY.

Ready to capitalize on lower prices and higher negotiating power? Let’s discuss a tailored buying strategy to find your dream home at the best possible value.

Click Here to Schedule a Free, No-Obligation Buyer Consultation Now!

Are you a homeowner thinking of selling? Even in a buyer’s market, a properly priced and professionally marketed home will still attract the right buyer.

✅ Sellers: Get a Free, Expert Home Valuation.

Don’t let market headlines scare you. Discover what your home is truly worth in today’s competitive environment.

Find Out Your Home’s Current Value – Get Your FREE Market Report!

GTA Real Estate Market, October 2025 Stats, Buyer’s Market GTA, Lower Mortgage Payments, Toronto Home Prices Down, GTA Housing Market Forecast, Buy a Home in Toronto, Negotiation Power Real Estate, Affordable GTA Homes

🤯 A Weekend of Overload: Clocks, Cleats, and ‘Staches in the GTA

What a whirlwind! If you live in the Greater Toronto Area, this past weekend wasn’t just another spin around the calendar—it was a sensory overload of major events, from time-bending clock changes to nail-biting sports drama and the annual start of a hairy health initiative. It truly felt like everything was happening all at once.

Let’s break down the trifecta that made the last couple of days a massive moment in the city.

⏰ The Great Fall Back: An Extra Hour of Chaos

It began late Saturday night/early Sunday morning with the semi-annual ritual that is Daylight Saving Time (DST) ending. The clocks “fell back” an hour, giving us all the theoretical gift of a glorious extra hour of sleep.

But let’s be honest, it was a little more chaotic than peaceful. Did you set your clock back an hour before bed? Did your phone do it automatically? Did you wake up an hour early, momentarily panic, and then realize you had a bonus hour to… well, probably check Twitter for Blue Jays updates? The GTA’s collective internal clock just got a hard reset, and it’s a groggy adjustment for everyone.

💔 The Heartbreak on the Diamond: Blue Jays’ World Series Thriller

Speaking of Blue Jays updates, the end of DST coincided with one of the most agonizing and electric finishes to a baseball season in recent memory! The last two Blue Jays World Series games were nothing short of a spectacular, emotional rollercoaster.

Game 6 and the decisive Game 7 had us all glued to our screens, shouting at the television, and riding every pitch. The games were a nail-biting, edge-of-your-seat marathon, culminating in a truly heartbreaking loss in extra innings in Game 7. From incredible plays to clutch home runs that had the Rogers Centre crowd absolutely roaring, the team left absolutely everything on the field. It was a tough end, but what an unforgettable run! Thank you, Blue Jays, for a season that kept the entire country on the edge of its collective dugout.

The Show Must Go On: What’s Next for Toronto Sports?

With the baseball season officially over, the Toronto sports focus immediately pivots. This past weekend’s drama was actually preceded and followed by major action on the ice and the court! The Toronto Maple Leafs (NHL) and the Toronto Raptors (NBA) are already well into their seasons, providing the next major events to rally around. After a few rescheduled games to accommodate the Jays, the Leafs and Raptors now take centre stage in their respective title chases. Expect the excitement to shift from the Rogers Centre to the Scotiabank Arena for the foreseeable future!

🧔 Grow for a Great Cause: Movember is HERE!

As the calendar officially flipped, November arrived, and with it, the start of Movember. For those new to the movement, Movember is a global initiative dedicated to raising funds and awareness for men’s health, particularly prostate cancer, testicular cancer, and men’s mental health and suicide prevention.

The visible sign of support? Men growing out their moustaches for the entire month! This weekend was the crucial “Shave Down,” where countless men across the GTA went clean-shaven, ready to start growing their ‘staches for the cause. It’s an excellent conversation starter and a highly visible tribute to the fight against men’s health issues. Keep an eye out for the fledgling Mos around town!

How to Get Involved with Movember Fundraising

Want to do more than just grow a killer ‘stache? There are many ways to support Movember in the GTA:

- Grow a Mo: The classic way! Register on the Movember website, shave down, and get your friends and family to donate to your “Mo Space” fundraising page.

- Move for Movember: Not a grower? Commit to running or walking 60km over the month. That’s 60 kilometres for the 60 men we lose to suicide globally, every single hour.

- Host a Mo-ment: Organize a fun event, like a trivia night, a bake sale, or a friendly sports tournament (maybe a post-Blue Jays softball game!) and charge an entry fee as a donation.

- Mo Your Own Way: Take on any unique challenge! Give up coffee for the month and donate the savings, or try a personal fitness challenge.

The money raised goes to fund groundbreaking men’s health projects, so every action makes a difference!

A Weekend to Remember

So, this past weekend was a lot. We collectively gained an hour, lost a championship, and started an entire month-long facial hair journey, all within a 48-hour window. It was a weekend that proved the city doesn’t slow down, even when the clocks do. Now, as we adjust to the earlier sunsets, mourn the season, and embrace the fuzz, let’s carry that incredible energy into the next phase of the Toronto sports calendar and the vital mission of Movember.

What was the most memorable part of your whirlwind weekend? Let me know in the comments!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link