Ontario Modernizing Rules Governing Province’s Real Estate Services Sector

News Release From The Ministry of Public and Business Service – Ontario

New protections designed to strengthen consumer confidence when dealing with brokerages, brokers, and salespersons

November 28, 2023

TORONTO — The Ontario government is updating the rules governing the province’s real estate brokerages, brokers, and salespersons to strengthen consumer protection, educate home buyers and sellers, and enhance professionalism. The new rules, effective December 1, 2023, will give Ontarians more choice in the real estate trade process by allowing a brokerage to disclose the details of competing offers. They also include an updated Code of Ethics to strengthen professional obligations related to integrity, conflict of interest and the prevention of fraud.

“Buying, leasing and selling real estate is one of the biggest and most important decisions a person or business will ever make so it’s critical that rules for real estate brokerages, brokers, and salespersons reflect modern business practices that foster a strong and vibrant real estate market,” said Todd McCarthy, Minister of Public and Business Service Delivery. “We want to ensure Ontarians feel empowered and informed when participating in real estate transactions, and for professionals in the sector to be seen as trusted and ethical. These latest rule changes coming into effect December 1 will help us do just that.”

Phase 2 of legislative and regulatory changes introduced under the Trust in Real Estate Services Act (TRESA), 2020, will modernize the province’s real estate market by:

- Allowing real estate brokerages to disclose the details of competing offers if the seller directs them to do so, excluding personal or identifying information.

- Better protecting and educating Ontarians through enhanced disclosure requirements for real estate brokerages, brokers and salespersons (known as registrants) and the development of an information guide to help individuals make informed decisions when they trade in real estate.

- Requiring registrants to comply with an updated Code of Ethics that strengthens professionalism by focusing on their obligations related to integrity, quality of service and conflicts of interest.

- Providing the Real Estate Council of Ontario (RECO) with new powers and tools to better hold registrants accountable for non-compliance with the rules.

- Allowing brokerages to enter designated representation agreements so clients could be represented by a specific broker or salesperson at a brokerage who would actively promote their interests in a trade.

“Phase 2 of TRESA represents the most significant change in consumer protection measures for Ontario’s real estate sector since the 1990s,” said Michael Beard, Chief Executive Officer, Real Estate Council of Ontario (RECO). “Ontarians who buy or sell a home now have greater clarity on their rights, as well as the duties owed to them by real estate agents and brokerages. The changes also include new powers that will further strengthen RECO’s compliance and enforcement efforts. Ultimately, this represents important progress for consumers, while also enhancing professionalism for real estate salespeople and brokers.”

“Ontario’s REALTORS® are thrilled to see the Phase Two legislative and regulation changes come into effect. This marks a historic moment for real estate professionals in Ontario and is the result of a decade of hard work, advocacy and collaboration with the province,” said Tim Hudak, Chief Executive Officer, Ontario Real Estate Association (OREA). “Thanks to TRESA, Ontario will raise the bar on consumer protections and become a North American leader in professional standards, ethics, and modern business tools. OREA commends the Ontario government for their work on TRESA and looks forward to collaborating on the third phase of implementation.”

Quick Facts

- RECO administers and enforces the Real Estate and Business Brokers Act, 2002 (REBBA), the legislation governing Ontario’s brokerages, brokers and salespersons.

- On December 1, 2023, REBBA will be renamed the Trust in Real Estate Services Act, 2002.

- The Trust in Real Estate Services Act (TRESA), 2020, which amends REBBA, was passed by the legislature on February 28, 2020, and received Royal Assent on March 4, 2020.

- The first phase of changes related to TRESA, 2020, came into effect in October 2020. Those changes allowed salespersons and brokers to incorporate and be paid through a personal real estate corporation. They also allowed registrants to use more recognizable terms like “real estate agent” and “REALTOR®” in their advertisements to better reflect the services they provide.

- Additional regulations are required to fully implement the amendments made by TRESA, 2020.

Additional Resources

Media Contacts

Doug Allingham

Minister’s Office

doug.allingham@ontario.ca

Media Desk

Ministry of Public and Business Service Delivery Communications Branch

MPBSD.MediaRelations@ontario.ca

The 2023 GTA Housing Market: High Borrowing Costs and Growing Affordability Challenges

TRREB: The 2023 GTA Housing Market: High Borrowing Costs and Growing Affordability Challenges

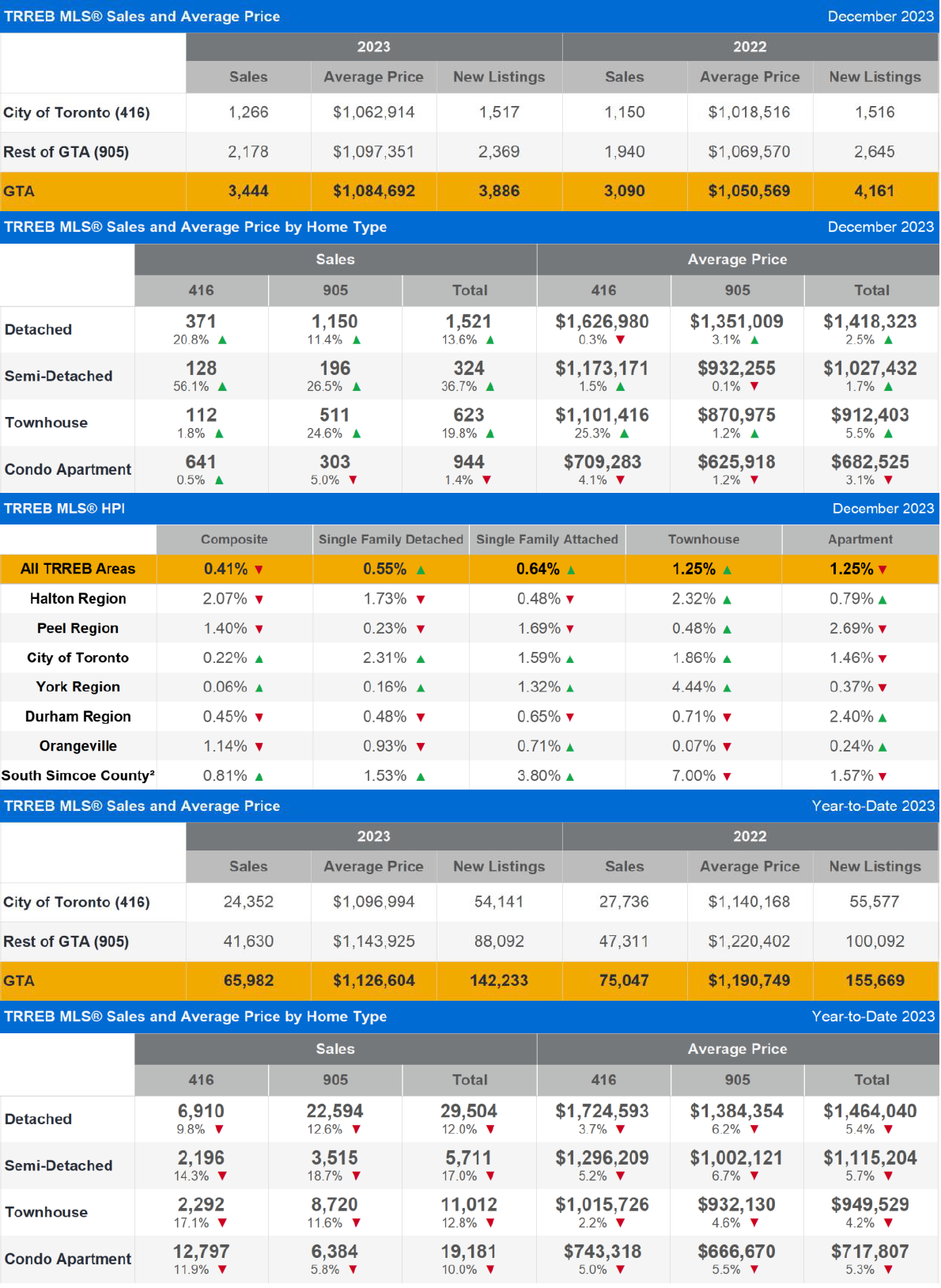

TORONTO, ONTARIO, January 4, 2024 – While the overall demand for housing remained buoyed by record immigration in 2023, more of this demand was pointed at the rental market. The number of Greater Toronto Area (GTA) home sales in 2023 came in at less than 70,000 due to affordability issues brought about by high mortgage rates.

“High borrowing costs coupled with unrealistic federal mortgage qualification standards resulted in an unaffordable home ownership market for many households in 2023. With that said, relief seems to be on the horizon. Borrowing costs are expected to trend lower in 2024. Lower mortgage rates coupled with a relatively resilient economy should see a rebound in home sales this year,” said new Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce.

There were 65,982 home sales reported through TRREB’s MLS® System in 2023 – a 12.1 per cent dip compared to 2022. Despite an uptick during the spring and summer, the number of new listings also declined in 2023. The trend for listings has been largely flat-to-down over the past decade, which is problematic in the face of a steadily growing population. On a seasonally adjusted monthly basis, sales increased compared to November, while new listings declined for the third straight month.

The average selling price for all home types in 2023 was $1,126,604, representing a 5.4 per cent decline compared to 2022. On a seasonally adjusted monthly basis, the average selling price edged higher, while the MLS® Home Price Index Composite edged lower.

“Buyers who were active in the market benefitted from more choice throughout 2023. This allowed many of these buyers to negotiate lower selling prices, alleviating some of the impact of higher borrowing costs. Assuming borrowing costs trend lower this year, look for tighter market conditions to prompt renewed price growth in the months ahead,” said TRREB Chief Market Analyst Jason Mercer.

“Record immigration into the GTA in the coming years will require a corresponding increase in the number of homes available to rent or purchase. People need to have comfort in knowing that they can plan their lives and future with the certainty that they will have the stability of an affordable place to live,” said TRREB CEO John DiMichele.

TRREB is releasing its 2024 Market Outlook and Year in Review report and digital digest on Thursday, February 8. Discover the listings, sales and price forecast for 2024 and a more in-depth look at the 2023 housing market. The outlook will also include the latest Ipsos polling on home buying and selling intentions, homeowners’ viewpoints on government policy and taxation, and insights on immigration.

|

|

|

|

|

|

|

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link