Bank of Canada Holds Steady Amid US Trade Turmoil: Decoding the Latest Monetary Policy Report

The Bank of Canada, in its announcement on April 16, 2025, elected to maintain its target for the overnight rate at 2.75%, alongside the Bank Rate at 3% and the deposit rate at 2.70%.

This decision arrives at a pivotal moment for the Canadian economy, as it grapples with the significant and unpredictable shifts in United States trade policy, which continue to cast a shadow of uncertainty over economic prospects.

The April Monetary Policy Report (MPR), released concurrently, underscores the substantial challenges in forecasting GDP growth and inflation for both Canada and the global economy amidst this evolving trade landscape.

The report outlines two distinct scenarios that explore potential future paths, contingent on the direction of US trade policy.

🛍️ Recommendation for Buyers:

With the Bank of Canada holding its key interest rate, mortgage rates may remain relatively stable in the short term, offering buyers a chance to breathe and plan strategically. This is an opportune moment to:

-

Get pre-approved while fixed-rate options remain appealing.

-

Take advantage of less volatility in borrowing costs, especially if you’ve been sitting on the sidelines waiting for clarity.

-

Act early if you’re eyeing a property—if inflation cools further, rates may begin to decline, sparking increased competition.

📌 Tip: Locking in a rate hold with your lender now can shield you from potential upticks while giving you time to shop with confidence.

🏡 Recommendation for Sellers:

For sellers, a rate hold brings welcome stability to the market. Buyers are less hesitant, and there’s reduced fear of sudden rate hikes derailing deals. This creates an environment where:

-

Buyer confidence is likely to improve, especially in the entry-to-mid level segments.

-

You may benefit from a more predictable negotiation landscape with fewer financing surprises.

-

Listing sooner rather than later could help you get ahead of any surge in inventory should rates eventually drop.

📌 Tip: Work with a REALTOR® (yes, like me 😄) to position your home competitively and highlight value—especially with buyers now able to stretch their budgets a little further.

On April 16, 2025, the Bank of Canada decided to keep its benchmark interest rate unchanged at 2.75%. This move follows a series of seven consecutive reductions in the key rate, implemented to support economic activity as trade tensions began to escalate.

The Bank Rate was held at 3%, and the deposit rate remained at 2.70%. This decision to pause rate cuts was anticipated by a slight majority of economists, reflecting the delicate balance the central bank must strike between supporting growth and managing potential inflationary pressures stemming from trade disruptions.

The next scheduled announcement regarding the overnight rate target is set for June 4, 2025. The Bank's decision to refrain from further easing monetary policy at this time suggests a cautious stance, allowing policymakers to observe how the unfolding trade situation impacts the Canadian economy.

This approach acknowledges the limitations of monetary policy as a tool to directly address the uncertainties inherent in international trade disputes.

"The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%."

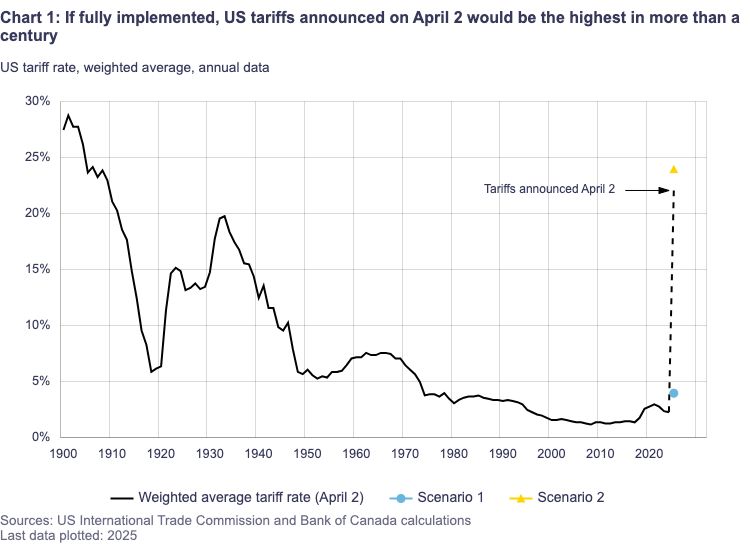

The significant reorientation of US trade policy and the unpredictable nature of tariffs have injected a high degree of uncertainty into the economic outlook, both domestically and internationally.

This unpredictability has diminished the prospects for robust economic growth and has simultaneously elevated expectations for inflation. The financial markets have reacted sharply to the stream of tariff-related announcements, including implementations, postponements, and ongoing threats of further escalation, contributing significantly to the prevailing atmosphere of uncertainty.

This environment of pervasive uncertainty poses considerable challenges for accurately forecasting the trajectory of GDP growth and inflation, not only for Canada but for the global economy as a whole.

The interconnectedness of the Canadian and US economies amplifies the impact of these policy shifts, creating a climate where businesses and consumers alike are hesitant to make long-term commitments, potentially leading to a deceleration in economic activity.

In light of the significant uncertainty surrounding US trade policy, the April MPR presents two illustrative scenarios to explore potential economic pathways.

-

Scenario 1: High Uncertainty, Limited Tariffs This scenario posits a situation where uncertainty remains elevated concerning US trade policy, but the actual implementation of tariffs is limited in scope. Under these conditions, the Canadian economy is projected to experience a temporary weakening in its growth trajectory.

However, despite this temporary slowdown, inflation is expected to remain anchored around the Bank of Canada's target of 2%. Even with a limited imposition of tariffs, the sustained high level of uncertainty can still act as a deterrent to economic activity, as businesses and households may adopt a more cautious approach to spending and investment.

The fact that inflation is projected to remain near the target suggests that any upward price pressures from the limited tariffs are likely to be counterbalanced by other factors, such as the anticipated weakening in economic growth or the removal of the consumer carbon tax.

-

Scenario 2: The Protracted Trade War The second scenario outlines a much more severe outcome, where a protracted trade war ensues, leading to a significant and sustained disruption to international trade.

In this case, the Bank of Canada anticipates that the Canadian economy would fall into recession within the current year. Furthermore, inflation is projected to rise temporarily above 3% in the following year. A prolonged trade war, characterized by widespread tariffs and potential retaliatory measures, would severely impact Canadian businesses and consumers.

The resulting economic contraction would likely lead to job losses and reduced household spending. The temporary surge in inflation would be driven by higher import costs due to tariffs and disruptions to global supply chains.

It is important to note that these two scenarios represent only a fraction of the possible outcomes, and the actual evolution of US trade policy could take many other forms.

The unprecedented nature and rapid pace of the shifts in US trade policy contribute to a significant degree of uncertainty surrounding the economic consequences, making it unusually challenging to predict the precise impacts.

Examining the global economic landscape, the Bank of Canada's report highlights varying conditions across major economies. In the United States, there are indications of a slowdown in economic activity, accompanied by increasing policy uncertainty and a decline in overall sentiment. Simultaneously, inflation expectations have been on the rise.

The Euro Area experienced modest economic growth in early 2025, with the manufacturing sector continuing to exhibit weakness. China's economy demonstrated strength at the close of 2024, but recent data suggests a moderate deceleration in its growth momentum.

Financial markets have experienced considerable turbulence due to the ongoing uncertainty surrounding trade policies. This extreme market volatility is contributing to the overall sense of economic unease.

Notably, global oil prices have fallen significantly since January, primarily reflecting diminished prospects for global economic growth in the face of these trade tensions. In contrast, the Canadian dollar has recently appreciated in value, largely driven by a broad weakening of the US dollar.

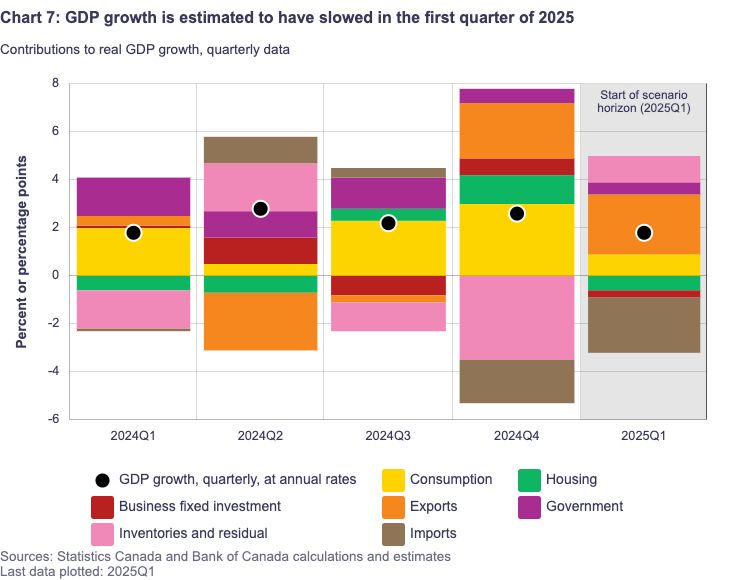

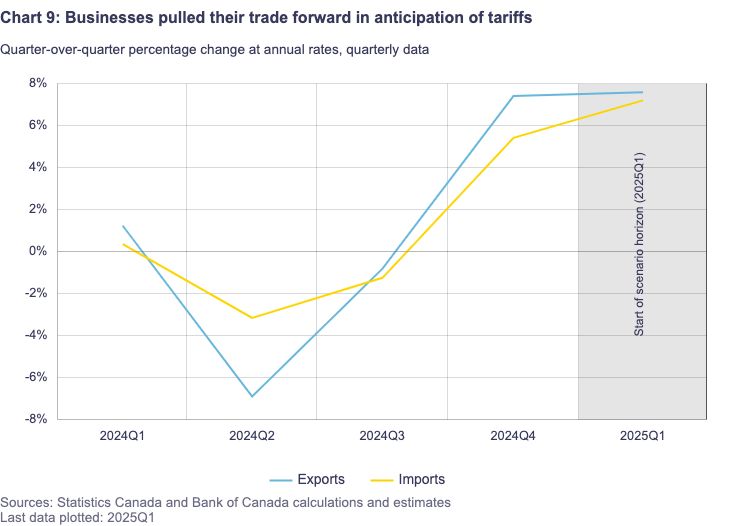

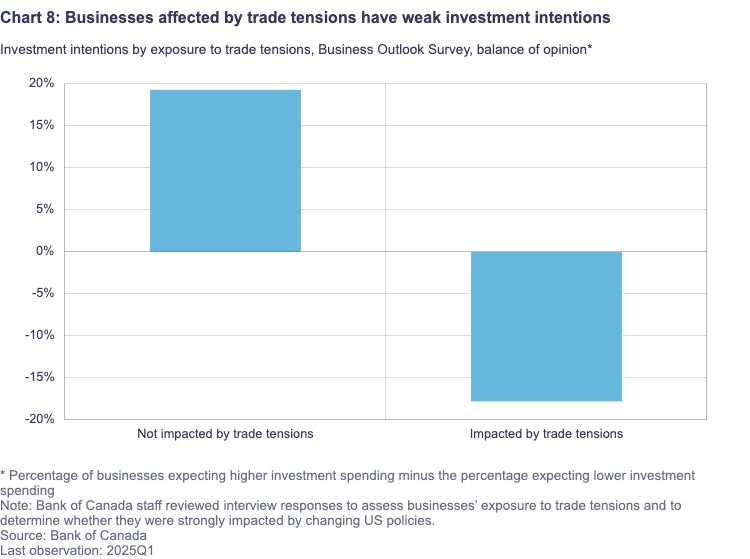

Within Canada, the economy is showing signs of a slowdown as the uncertainty surrounding tariff announcements weighs on both consumer and business confidence. Data from the first quarter of 2025 indicate a weakening in consumption, residential investment, and business spending.

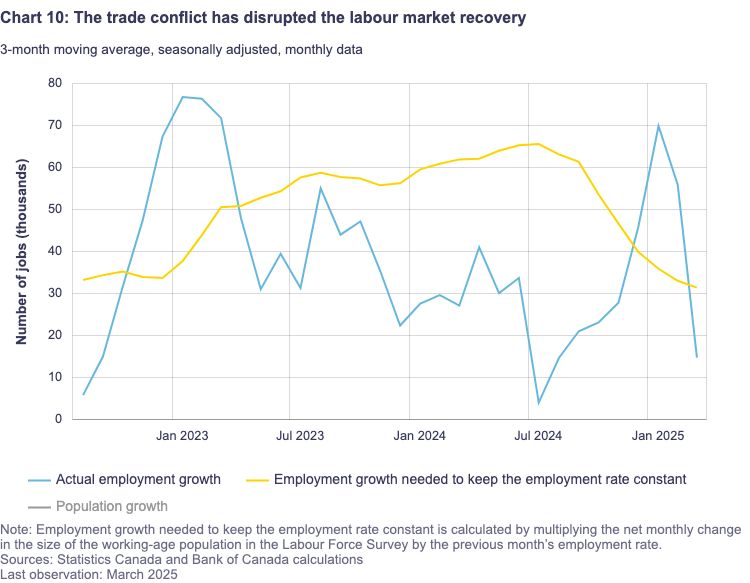

The ongoing trade tensions are also disrupting the recovery of the labor market, with employment declining in March and businesses reporting intentions to curtail hiring. Furthermore, wage growth continues to exhibit signs of moderation.

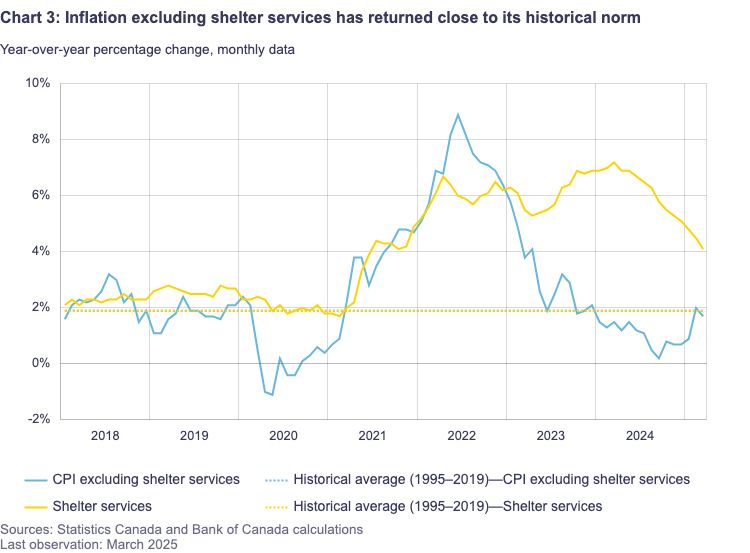

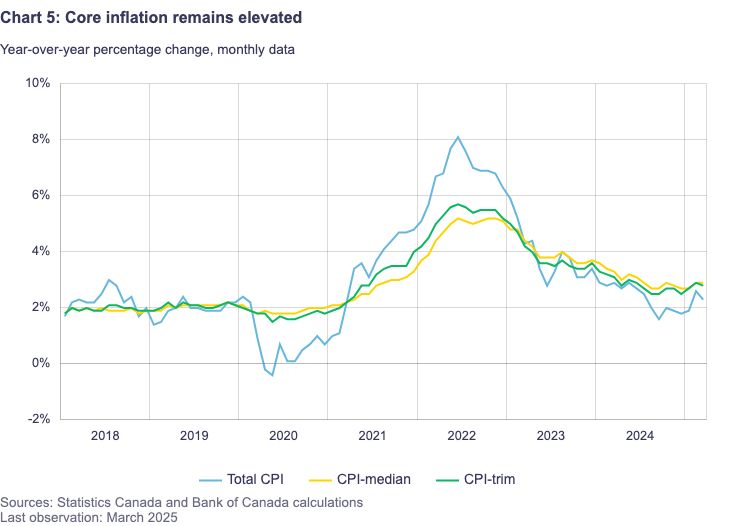

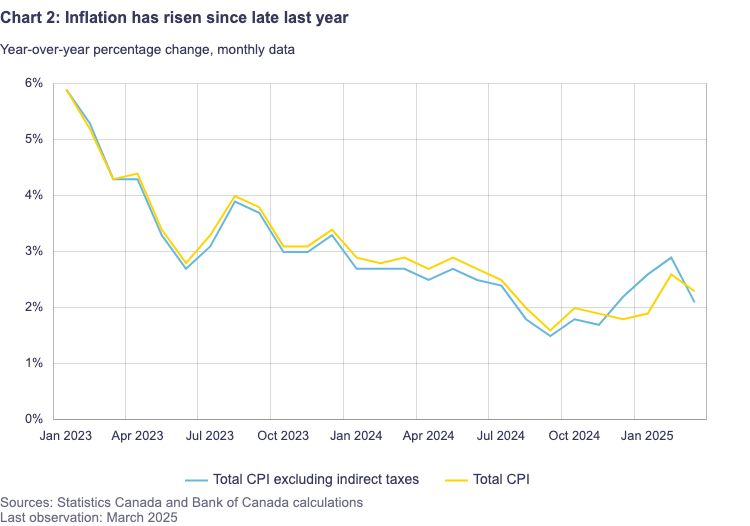

Canada's inflation rate stood at 2.3% in March, a decrease from February's 2.6% but still above the 1.8% recorded at the time of the January MPR. The recent uptick in inflation is partly attributed to a rebound in goods price inflation and the cessation of the temporary GST/HST suspension.

Looking ahead, the removal of the consumer carbon tax starting in April is expected to exert downward pressure on CPI inflation for a year. Additionally, lower global oil prices are anticipated to dampen inflation in the near term.

However, the potential for tariffs and supply chain disruptions to drive up certain prices remains a concern. Consequently, short-term inflation expectations have edged upward as businesses and consumers foresee higher costs arising from trade conflicts and supply chain issues, while longer-term inflation expectations remain relatively stable.

The Bank of Canada's Governing Council will continue its careful evaluation of the interplay between the downward pressures on inflation stemming from a potentially weaker economy and the upward pressures resulting from increased costs.

Their primary objective is to ensure that Canadians maintain confidence in price stability throughout this period of global economic turbulence. This necessitates a strategy that supports economic growth while diligently controlling inflation.

"Governing Council will proceed carefully, with particular attention to the risks and uncertainties facing the Canadian...source

In conclusion, the Bank of Canada has opted to maintain its key interest rate amid significant uncertainty stemming from US trade policy. The April MPR outlines two potential scenarios, one involving limited tariffs and the other a protracted trade war, each with distinct implications for Canadian economic growth and inflation.

While the global economic outlook presents a mixed picture, the Canadian economy is already showing signs of slowing in response to trade tensions. The factors influencing inflation are multifaceted, with the removal of the carbon tax and lower oil prices potentially offsetting some of the upward pressure from tariffs. The Bank of Canada remains committed to navigating this period of uncertainty with a focus on maintaining price stability for Canadians.