As a REALTOR® working in the Toronto area, this week’s interest-rate decision by the Bank of Canada (BoC) is very meaningful for you—whether you are on the buy side or the sell side of a real-estate transaction. Below is a breakdown of the decision, its real-estate implications, and how you and your clients can respond.

1. What did the Bank of Canada decide?

-

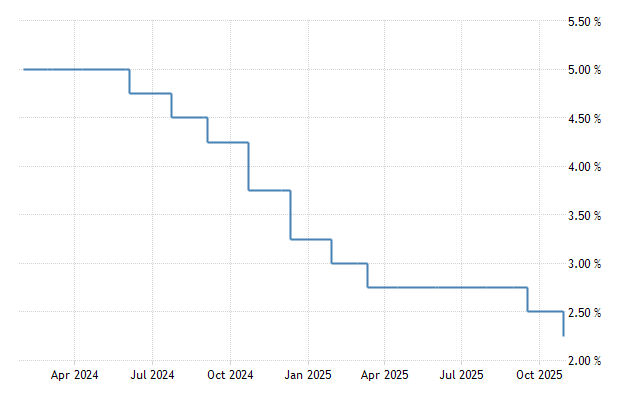

On October 29, 2025 the Bank of Canada cut its target overnight rate by 25 basis points, bringing it to 2.25%.

-

The Bank Rate now stands at 2.50% and the deposit rate at 2.20%.

-

The BoC signalled that, if inflation and activity evolve broadly in line with its October projections, “the current policy rate is at about the right level …” and further cuts are not guaranteed.

-

The underlying economic backdrop: modest growth, trade-headwinds (particularly U.S. tariffs) and inflation near, but slightly above, 2% (with core inflation a little higher) are influencing the decision.

In short: borrowing costs for banks should ease slightly (or at least stabilise) and the BoC is signalling caution about further rate moves—so this is a window of opportunity.

2. Why this is especially relevant for the real-estate market

For Buyers:

-

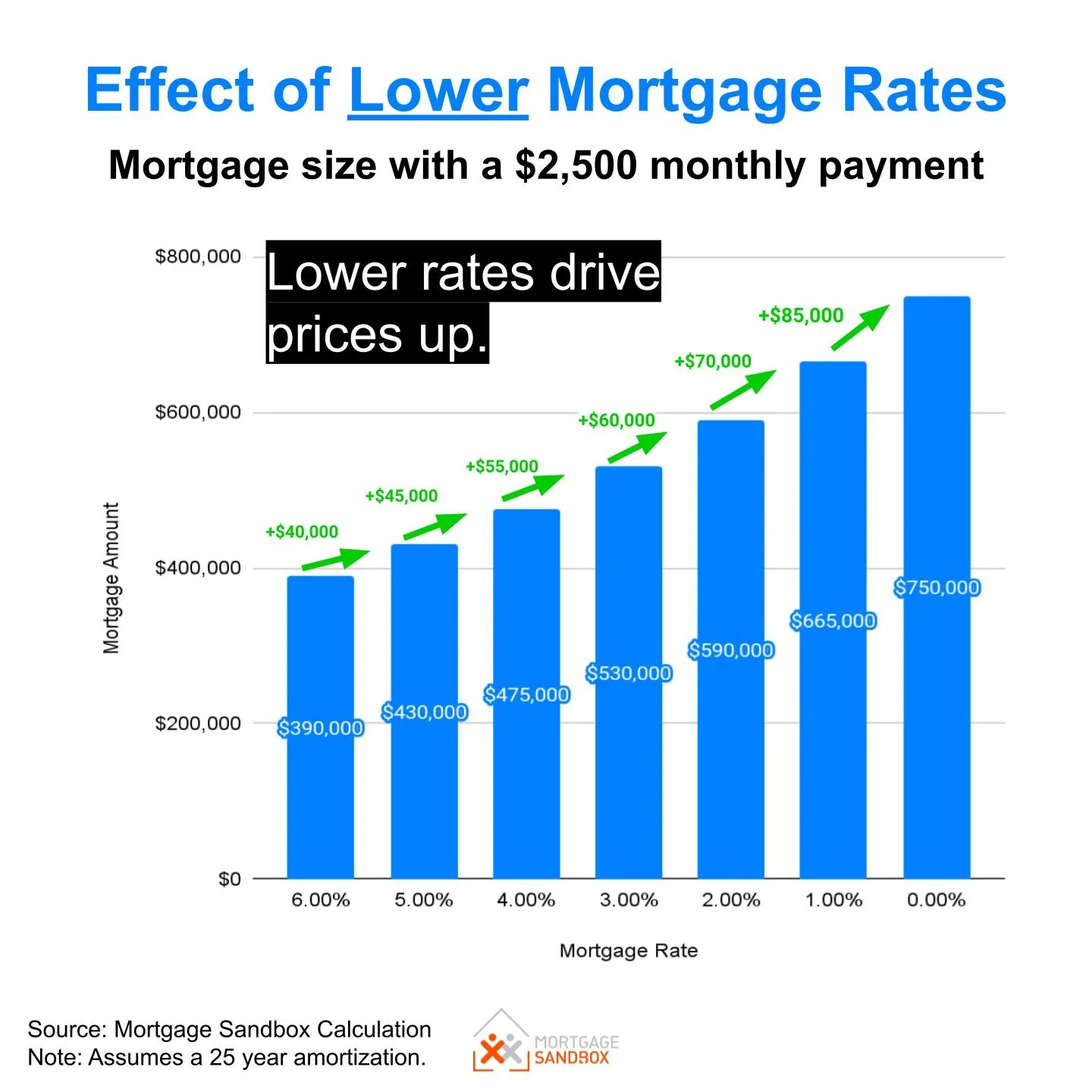

Lower policy rates => banks may offer slightly better mortgage terms (or at least less upward pressure) which can boost affordability.

-

If variable-rate or adjustable mortgage products respond quickly to BoC moves, you may see a dip in payments or an improved debt‐service ratio.

-

With this rate cut signalling a potential floor, buyers may be more confident stepping into the market now rather than waiting.

Call to action for buyers: If you’ve been on the fence, let’s review your financing options now—this could be a timely moment to lock in favourable terms before any shifting sentiment or rate increases.

For Sellers:

-

A marginally better affordability environment can broaden the buyer pool—especially first-time buyers or investors who were hassled by elevated rates.

-

Motivation to list now: If rates remain near current levels and affordability improves, competition can heat up. Listing later could mean facing more competition or less favourable financing for buyers.

Call to action for sellers: Let’s evaluate your home’s market value now, prepare your property for listing, and capitalise on potentially improved buyer demand while this window is open.

3. What’s going on in the Ottawa decision and economy

-

The BoC emphasised that “ongoing weakness in the economy and inflation expected to remain close to the 2 % target” drove the decision.

-

On the flip side, the trade‐shock (tariffs) has elevated costs for certain sectors and added uncertainty, meaning the Bank remains cautious.

-

According to projections, growth remains modest and risks remain elevated — meaning the BoC has to balance supporting the economy and keeping inflation contained.

-

Mortgage rates don’t immediately mirror the policy rate, but the policy rate serves as a key anchor for banks’ cost of funds and thus influences what lenders offer.

📌 Real-estate note: While a 25 basis-point cut may not immediately translate into a dramatic drop in mortgage rates, the expectation of easier policy and stable rates matters for buyer psychology and listing strategies.

4. How this affects the Toronto / Ontario market specifically

-

In the greater Toronto region, affordability has been a key issue—higher interest rates squeezed budgets and slowed some sales activity. An easing environment can help.

-

Sellers who might have been cautious may now find there are more qualified buyers coming off the sidelines.

-

For investors: lower financing costs can improve cash-flow projections and return calculations, making small-scale investment properties more attractive again.

-

For first-time buyers: this may be a timely reminder to revisit budgeting and purchase-readiness.

-

As your REALTOR®, I can help interpret how this interest-rate backdrop translates into your specific neighbourhood, home-type, and budget scenario.

5. Strategic next-steps for you

Buyers:

-

Get pre-qualified now—we’ll work with your lender to survey the impact of the rate cut on your mortgage options.

-

Review fixed vs variable rate strategies in light of this decision and your risk-tolerance.

-

Expand your search with confidence: if the payment burden eases, you might access homes you thought were out of reach.

-

Let’s craft an offer strategy that capitalises on this moment of improved affordability.

Sellers:

-

Let’s conduct a market evaluation now: assess your home’s competitive positioning in the upcoming window of opportunity.

-

Prepare your home—staging, minor repairs, presentation—to ensure you’re ready to list when buyer interest rises.

-

Timing matters: listing now may catch buyers before they shift focus to other markets or before inventory builds.

-

Let’s discuss pricing strategy that reflects the slightly improved financing environment for buyers.

6. Visualising the Impact

7. Final Thoughts & Your Next Move

This week’s rate cut by the Bank of Canada is an important signal to both buyers and sellers: the environment for real-estate transactions is shifting favourably. Buyers have an opportunity to act with somewhat improved affordability, and sellers have a chance to access a broader buyer pool.

👉 If you are considering entering the market — contact me today. I’ll provide a tailored consultation:

-

For buyers: we’ll map out the best financing strategy and target homes at your new budget.

-

For sellers: we’ll prepare your home for listing, capitalise on current conditions, and hit the market at an optimal time.

Let’s leverage this interest-rate moment together. Markets move quickly when policy pivots. I’m here to ensure you’re ready.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link