Buying a Home in Ontario for Immigrants

Canada is one of the most immigrant-friendly countries in the world, and Ontario, being its most populous province, is often the first stop for newcomers. But buying a home or condo in Ontario-especially if you’re new to Canada or returning after time abroad-can feel like navigating a maze. Fortunately, it’s not only doable, but with the right guidance, it can also be smooth, strategic, and exciting. In this comprehensive guide, we’ll walk you through the entire home-buying journey-from understanding your eligibility as a non-citizen, to landing the keys to your first Canadian property. Along the way, you’ll gain insider tips, explore available resources, and learn how to avoid the common pitfalls many immigrants and expats face. Whether you’re a permanent resident, skilled worker, international student, or a Canadian returning from abroad, this article is for you.

Understanding the Canadian Real Estate Market

Before diving into the home-buying process, it’s essential to understand Ontario’s real estate environment. Key Market Trends (2024):

| City | Avg. Home Price (CAD) | Market Type |

|---|---|---|

| Toronto………. | $1,084,500……………………. | Competitive/Hot |

| Ottawa………… | $658,800………………………. | Balanced |

| Mississauga…. | $890,000………………………. | High Demand/Suburban |

| Windsor……… | $502,000………………………. | Affordable |

| Hamilton…….. | $755,000………………………. | Growing |

Ontario’s market has experienced high demand driven by immigration, limited supply, and low-interest periods. Whether you’re buying for your family or investing long-term, knowing local prices helps you plan smarter.

Key Housing Types in Ontario

Detached Homes: Ideal for families needing more space. Comes with land and higher taxes.

Condos: Popular among newcomers due to lower maintenance. Great in city centers.

Townhouses: A middle ground-affordable, moderately spacious, and often part of planned communities.

Tip: Condos in Toronto or Ottawa are often the starting point for immigrants due to convenience, cost, and lifestyle perks.

Do Immigrants Need Citizenship to Buy Property?

Short answer: No. Anyone can buy property in Canada, regardless of immigration status. But, if you’re a non-resident, you may face:

- Higher down payment requirements (35%+)

- Limited mortgage options

- Non-Resident Speculation Tax (NRST)

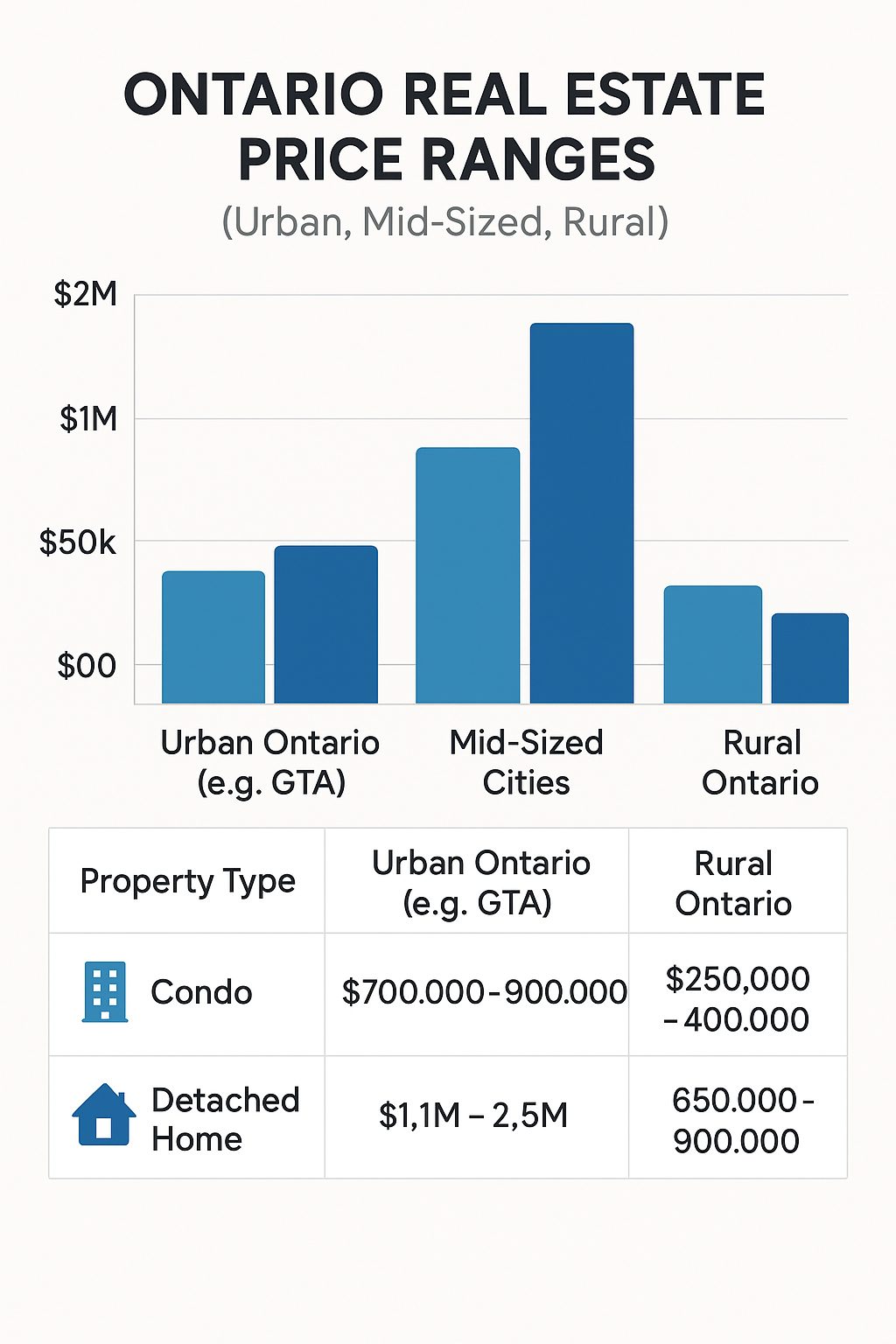

How Much Does a Home Cost in Ontario?

Prices vary widely. Here’s a snapshot of average costs:

| Type | Urban Ontario (e.g. GTA) | Mid-Sized Cities | Rural Ontario |

|---|---|---|---|

| Condo | $700,000 – $900,000 | $450,000 – $600,000 | $250,000 – $400,000 |

| Detached Home…. | $1.1M – $2.5M | $650,000 – $900,000 | $350,000 – $600,000 |

Be sure to budget for:

Setting a Realistic Budget for Expats

If you’re returning to Canada after years abroad, start with:

- Rebuilding Canadian credit if you’ve been away for 6+ years.

- Proving foreign income via CRA-accepted documentation.

- Understanding currency transfer and tax implications when bringing savings to Canada.

Credit History & Banking Tips for Immigrants

Your credit score influences your mortgage eligibility and rate. Quick Wins for Newcomers:

- Open a Canadian bank account immediately

- Apply for a secured credit card

- Always pay bills on time (even your phone!)

- Avoid maxing out credit limits

First-Time Home Buyer Incentives in Canada

Good news! Canada offers federal and provincial programs for newcomers:

- First-Time Home Buyer Incentive: Shared equity plan with CMHC

- Land Transfer Tax Rebates: Especially in Ontario and Toronto

- RRSP Home Buyers’ Plan (HBP): Withdraw up to $35,000 tax-free

Even non-permanent residents may qualify-depending on visa type and income source.

Understanding the Non-Resident Speculation Tax (NRST)

Ontario charges 25% tax on property purchases in designated areas by foreign nationals. However, you may be exempt if:

- You’re a permanent resident

- You’re a Canadian citizen returning home

- You apply for a rebate after obtaining PR

Always consult a real estate lawyer about your tax position.

Working with Real Estate Professionals in Ontario

1. Realtor: Helps you find, negotiate, and close the deal

2. Mortgage Broker: Finds you the best rate-even with limited Canadian credit

3. Lawyer: Handles title transfer, tax forms, and legal review Ask if they have experience working with newcomers or expats. It can save you thousands and plenty of stress.

Step-by-Step Buying Process in Ontario

| Step | Description |

|---|---|

| Pre-Approval | Secures your buying power |

| Home Search | Online listings, open houses |

| Offer & Negotiation…. | Make a conditional offer |

| Home Inspection | Professional assessment of condition |

| Final Financing | Mortgage locked in |

| Legal Closing | Lawyer finalizes paperwork |

| Key Transfer | Move-in day! |

Conditional Offers: Why They Matter

Newcomers often skip inspections or financing conditions due to urgency. That’s risky. Protect yourself by including:

- Financing condition (5 days)

- Inspection clause

- Lawyer review

Even in a hot market, a bad deal is worse than no deal.

What if You’re Still Abroad?

Buying remotely is possible with:

- Digital signings (DocuSign)

- Video showings

- Power of attorney

- Remote lawyer services

This is especially useful for returning expats planning months in advance.

Best Ontario Cities for Immigrants

| City | Why It’s Great |

|---|---|

| Toronto | Diversity, Jobs, Schools |

| Ottawa | Safety, Family-friendly |

| Mississauga | Affordable Suburbs |

| Kitchener-Waterloo…. | Tech hub, Growing economy |

| London | Lower home prices, Education |

Common Mistakes Immigrants Make When Buying

❌ Overextending your budget

❌ Trusting one agent without checking credentials

❌ Skipping due diligence

❌ Not understanding local bylaws, condo rules, or neighborhood dynamics

Post-Purchase To-Do List

- Set up utilities: Hydro, Gas, Internet, Waste pickup

- Apply for municipal taxes: Your lawyer usually registers this

- Insurance: Home, contents, and liability insurance

- Join the community: Local libraries, schools, healthcare, and social clubs

Real Stories from Newcomers

“We bought our first condo in Mississauga after just 8 months in Canada. Our realtor explained everything, and the mortgage broker worked miracles with my international income.” – Arjun & Priya from India “I moved back after 12 years in the UAE. It felt overwhelming at first, but I got a great townhouse in Ottawa. Don’t underestimate the paperwork!” – Linda, Returning Canadian Expat

FAQs

Can immigrants buy homes in Canada without PR?

Yes! Even temporary visa holders can purchase, though financing and taxes may differ.

What is the Non-Resident Speculation Tax?

An extra 25% tax for foreign buyers in parts of Ontario-rebate possible after PR.

Are expats returning to Canada considered non-residents?

Sometimes. You may be treated as a non-resident until you re-establish ties like income or address.

Do I need a job in Canada to qualify for a mortgage?

Typically yes, or proof of sufficient income abroad with proper documentation.

Can I buy a home while living abroad?

Absolutely, using remote tools and professionals like lawyers and realtors.

How long does the process take?

Generally, 2-3 months from mortgage pre-approval to closing.

Conclusion: Your Next Chapter Starts Here

Buying a home or condo in Ontario as an immigrant or expat isn’t just a financial decision-it’s an emotional milestone. It means stability. It means roots. It’s the first brick in your Canadian dream. With planning, the right team, and this roadmap, you’re more than ready to take that step. Download Our Free Checklist: Home Buying Guide for Immigrants & Expats in Ontario

- Cost of Living in Ontario: A Complete Breakdown

- How to Build Canadian Credit as a Newcomer

- Best Cities in Canada for Immigrants

- Government of Ontario Land Transfer Tax Info

- Canada Mortgage and Housing Corporation (CMHC)

- Immigration, Refugees and Citizenship Canada (IRCC)

|

|

|

|

|

|

|

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link