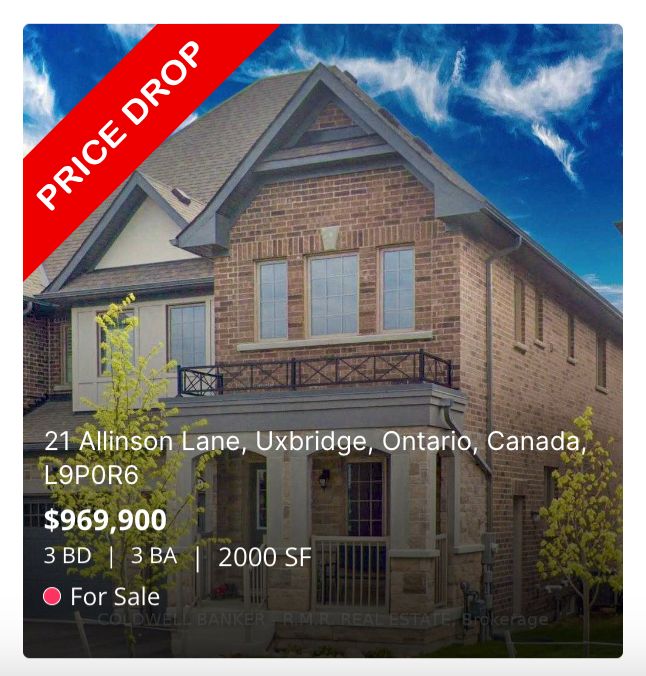

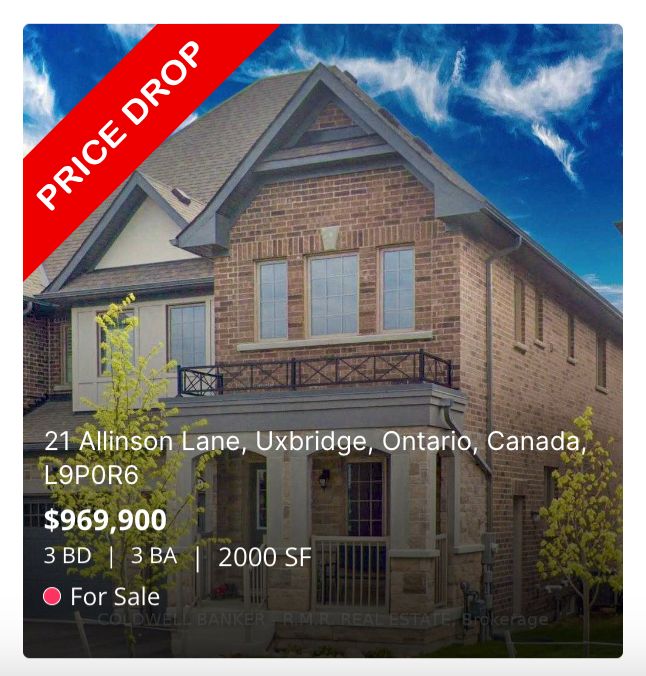

Detached Properties For Sale UNDER $500,000 in the GTA: A Rare Opportunity

Detached Properties For Sale UNDER $500,000 Canadian Dollars in the GTA

Detached homes priced under $500,000 in the Greater Toronto Area (GTA) are becoming increasingly scarce, yet they offer an exceptional opportunity for savvy buyers. In a market where the average detached property often costs well over $1 million, finding homes at this price point seems like a dream come true. However, these homes typically come with unique characteristics—many are fixer-uppers, stigmatized properties, estate sales, power of sale listings, or are deliberately priced low to ignite competitive bidding wars.

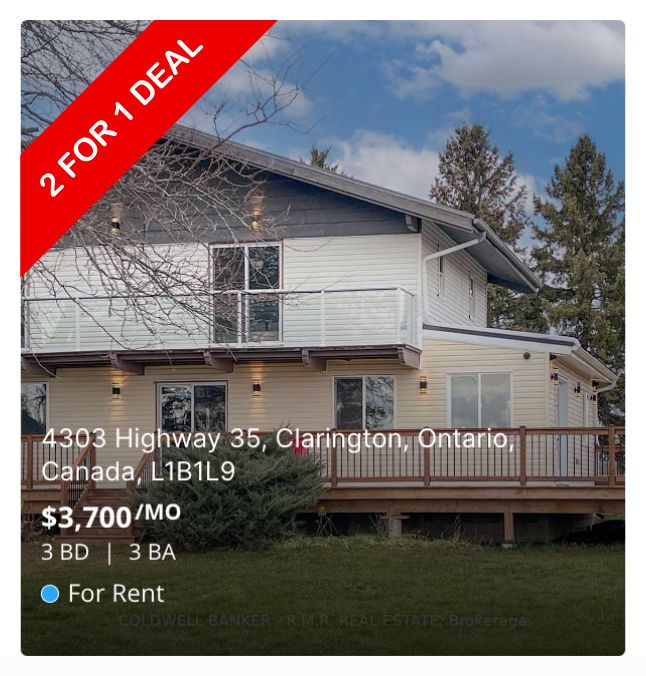

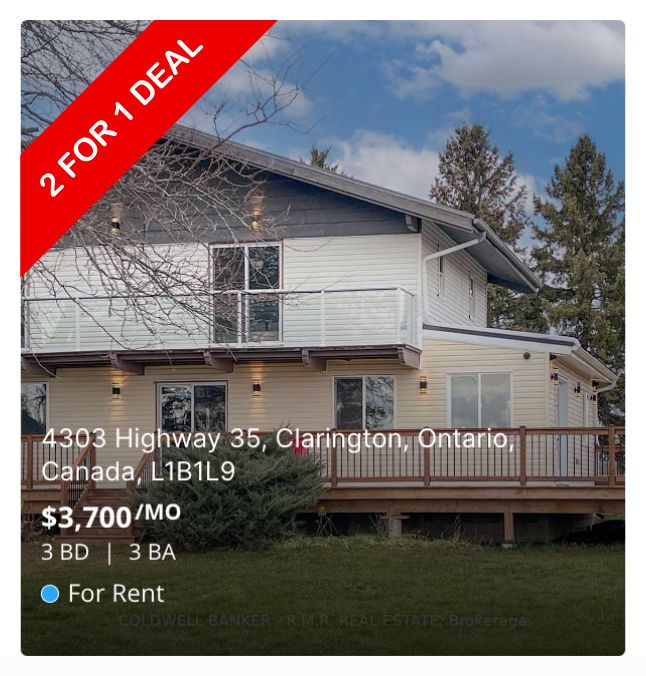

Despite these complexities, more than 30 such properties are currently listed across the GTA. The majority of these homes are found in Oshawa, Georgina, and Clarington—particularly in Newcastle and Bowmanville. Other regions like Brock, Scugog, Toronto, and Halton host only a handful of listings. Most are 2-bedroom bungalows, with some including 2 bathrooms, while the smaller group of 3-bedroom homes is split between those with 1 or 2 bathrooms.

Below, we break down the types of properties typically found in this price range, including their advantages, disadvantages, and potential caveats you should be aware of before making a purchase.

1. Fixer-Uppers

Fixer-uppers are homes in need of renovation or repair, often priced lower to reflect the investment required to bring them up to modern standards.

Advantages:

-

Lower initial purchase price

-

Opportunity to add value through renovations

-

Potential for customization to match your vision

Disadvantages:

-

Renovation costs can quickly add up

-

Might uncover hidden issues (plumbing, electrical, structural)

-

Financing can be trickier as lenders may demand repairs upfront

Caveats: Many of these homes will require detailed property condition disclosures. Always opt for a home inspection, even if it’s waived contractually, and budget for surprises.

2. Stigmatized Properties

These are homes where a death, crime, or other psychologically impactful event occurred, which may deter some buyers.

Advantages:

-

Significantly reduced price

-

Less competition from other buyers

Disadvantages:

-

Potential difficulty reselling in the future

-

Emotional discomfort depending on the situation

Caveats: In Ontario, sellers aren’t always legally required to disclose stigmas unless directly asked. It’s wise to conduct your own research or work with a local realtor who knows the history of the area.

3. Estate Sales

An estate sale occurs when the owner has passed away and their estate is selling off the home, often as-is.

Advantages:

-

More room for negotiation with motivated sellers

-

Can be priced below market to ensure a quick sale

Disadvantages:

-

Typically sold “as-is,” with no updates or repairs

-

Probate processes can delay closing

Caveats: There may be limited documentation on the property’s history, and disclosure can be minimal. You may also need to work through legal intermediaries rather than traditional sellers.

4. Power of Sale Properties

These occur when lenders seize and sell homes after mortgage defaults.

Advantages:

-

Priced below market value for a fast sale

-

Quicker closing processes in many cases

Disadvantages:

-

Sold without warranty or guarantee of condition

-

Minimal negotiation leverage

Caveats: Lenders are legally obligated to disclose any known defects, but they may not know much about the property’s condition. Buyers must conduct thorough due diligence and often accept “as-is” terms.

5. Deliberately Underpriced Listings for Bidding Wars

Some properties are intentionally priced below market value to spark a bidding war.

Advantages:

-

May appear to be a great deal at first glance

-

Occasionally, buyers snag a win if competition is low

Disadvantages:

-

Final sale price often exceeds listing price

-

Pressure to waive conditions (like inspections or financing) to stay competitive

Caveats: Fast-paced offers leave little time for proper evaluation. This high-pressure environment can lead to overpaying or skipping essential steps like due diligence.

Where These Properties Are Found

Let’s take a look at where the bulk of these listings are appearing (as at the time of this blog article):

The overwhelming majority are 2-bedroom homes, some with two bathrooms. Three-bedroom options are limited, and only half of those offer a second bathroom.

Who’s Buying These Properties?

Given their affordability and potential for future value, these listings are drawing attention from a range of buyers:

-

Contractors looking to flip or rebuild

-

Investors eyeing rental returns

-

First-time homebuyers seeking an entry point into the market

-

Landlords expanding their rental portfolios

Because of the heightened interest and reduced inventory, these homes don’t tend to last long on the market. In some cases, properties receive multiple offers within just a few days.

Important Disclosures and Legal Considerations

It’s essential to understand that many of these properties come with specific disclosure requirements. You may encounter:

-

Property-related disclosures: Structural issues, previous damages, or material latent defects.

-

Legal disclosures: Probate timelines, rights of way, and power of sale regulations.

-

Lender disclosures: For power of sale homes, lenders often provide limited information.

Buyers should always consult a qualified real estate agent and legal professional before proceeding. A property inspection, title search, and review of the seller’s disclosures are critical steps you shouldn’t skip.

📩 Call to Action: Get Your Custom List Now

Are you ready to explore the best detached property deals under $500,000 in the GTA?

👉 Click here or leave your email to receive a curated list of available properties, complete with photos, descriptions, and neighbourhood insights—delivered directly to your inbox.

These listings move fast—don’t miss your chance to grab a home in this rare price bracket!

The Ultimate Guide: Key Steps to Buying a Home in Ontario for Immigrants or Returning Expats

Buying a Home in Ontario for Immigrants

Canada is one of the most immigrant-friendly countries in the world, and Ontario, being its most populous province, is often the first stop for newcomers. But buying a home or condo in Ontario-especially if you’re new to Canada or returning after time abroad-can feel like navigating a maze. Fortunately, it’s not only doable, but with the right guidance, it can also be smooth, strategic, and exciting. In this comprehensive guide, we’ll walk you through the entire home-buying journey-from understanding your eligibility as a non-citizen, to landing the keys to your first Canadian property. Along the way, you’ll gain insider tips, explore available resources, and learn how to avoid the common pitfalls many immigrants and expats face. Whether you’re a permanent resident, skilled worker, international student, or a Canadian returning from abroad, this article is for you.

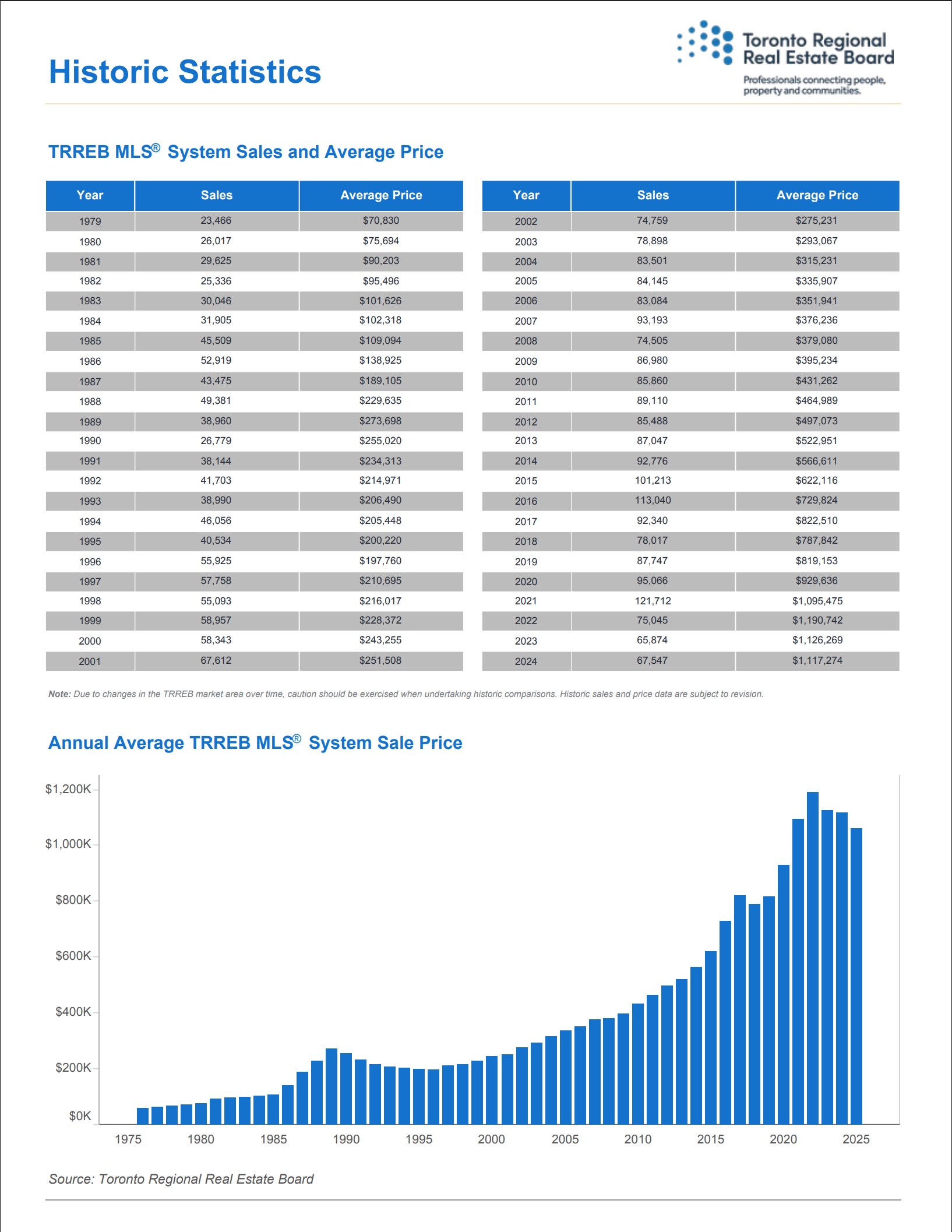

Understanding the Canadian Real Estate Market

Before diving into the home-buying process, it’s essential to understand Ontario’s real estate environment. Key Market Trends (2024):

| City | Avg. Home Price (CAD) | Market Type |

|---|---|---|

| Toronto………. | $1,084,500……………………. | Competitive/Hot |

| Ottawa………… | $658,800………………………. | Balanced |

| Mississauga…. | $890,000………………………. | High Demand/Suburban |

| Windsor……… | $502,000………………………. | Affordable |

| Hamilton…….. | $755,000………………………. | Growing |

Ontario’s market has experienced high demand driven by immigration, limited supply, and low-interest periods. Whether you’re buying for your family or investing long-term, knowing local prices helps you plan smarter.

Key Housing Types in Ontario

Detached Homes: Ideal for families needing more space. Comes with land and higher taxes.

Condos: Popular among newcomers due to lower maintenance. Great in city centers.

Townhouses: A middle ground-affordable, moderately spacious, and often part of planned communities.

Tip: Condos in Toronto or Ottawa are often the starting point for immigrants due to convenience, cost, and lifestyle perks.

Do Immigrants Need Citizenship to Buy Property?

Short answer: No. Anyone can buy property in Canada, regardless of immigration status. But, if you’re a non-resident, you may face:

- Higher down payment requirements (35%+)

- Limited mortgage options

- Non-Resident Speculation Tax (NRST)

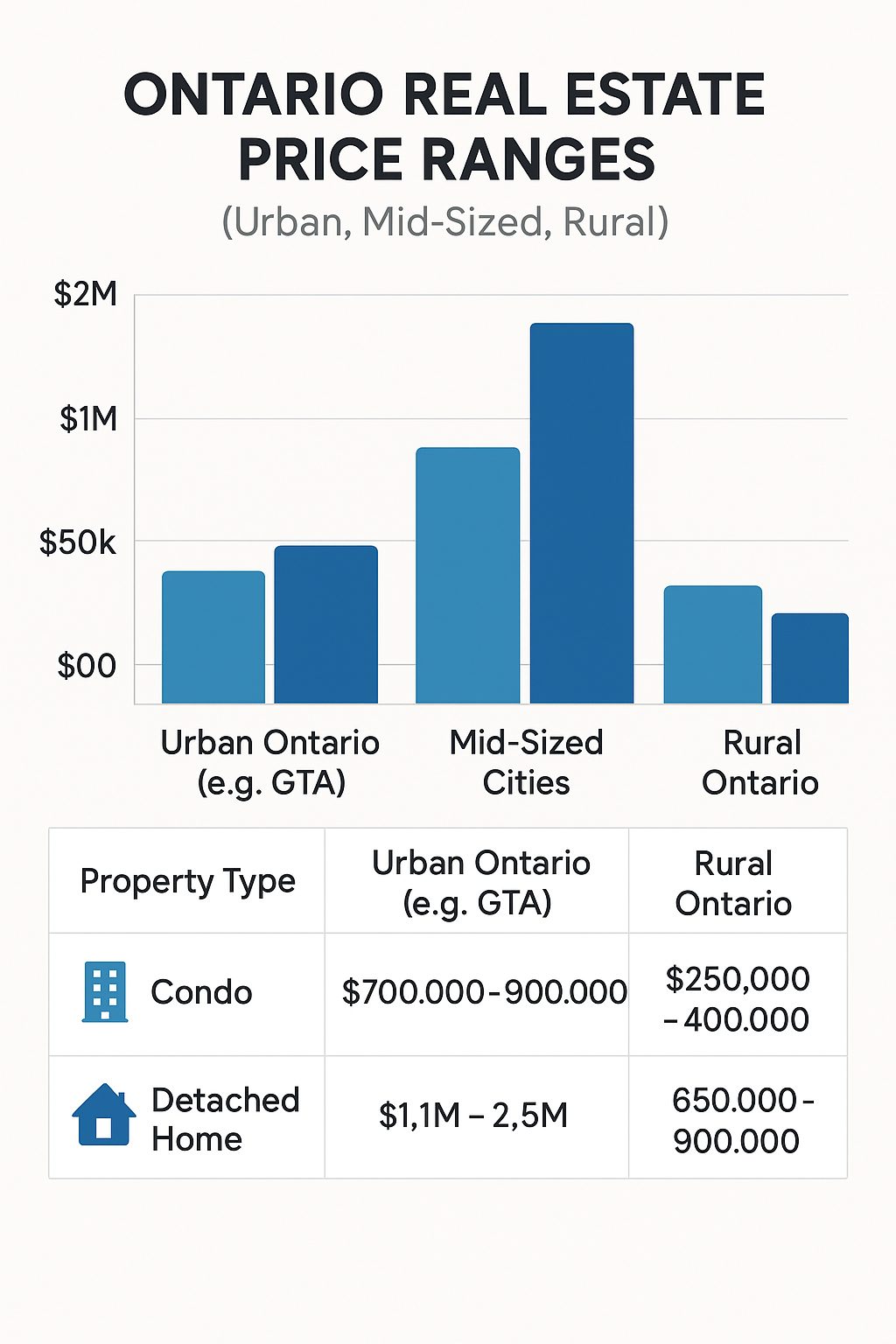

How Much Does a Home Cost in Ontario?

Prices vary widely. Here’s a snapshot of average costs:

| Type | Urban Ontario (e.g. GTA) | Mid-Sized Cities | Rural Ontario |

|---|---|---|---|

| Condo | $700,000 – $900,000 | $450,000 – $600,000 | $250,000 – $400,000 |

| Detached Home…. | $1.1M – $2.5M | $650,000 – $900,000 | $350,000 – $600,000 |

Be sure to budget for:

Setting a Realistic Budget for Expats

If you’re returning to Canada after years abroad, start with:

- Rebuilding Canadian credit if you’ve been away for 6+ years.

- Proving foreign income via CRA-accepted documentation.

- Understanding currency transfer and tax implications when bringing savings to Canada.

Credit History & Banking Tips for Immigrants

Your credit score influences your mortgage eligibility and rate. Quick Wins for Newcomers:

- Open a Canadian bank account immediately

- Apply for a secured credit card

- Always pay bills on time (even your phone!)

- Avoid maxing out credit limits

First-Time Home Buyer Incentives in Canada

Good news! Canada offers federal and provincial programs for newcomers:

- First-Time Home Buyer Incentive: Shared equity plan with CMHC

- Land Transfer Tax Rebates: Especially in Ontario and Toronto

- RRSP Home Buyers’ Plan (HBP): Withdraw up to $35,000 tax-free

Even non-permanent residents may qualify-depending on visa type and income source.

Understanding the Non-Resident Speculation Tax (NRST)

Ontario charges 25% tax on property purchases in designated areas by foreign nationals. However, you may be exempt if:

- You’re a permanent resident

- You’re a Canadian citizen returning home

- You apply for a rebate after obtaining PR

Always consult a real estate lawyer about your tax position.

Working with Real Estate Professionals in Ontario

1. Realtor: Helps you find, negotiate, and close the deal

2. Mortgage Broker: Finds you the best rate-even with limited Canadian credit

3. Lawyer: Handles title transfer, tax forms, and legal review Ask if they have experience working with newcomers or expats. It can save you thousands and plenty of stress.

Step-by-Step Buying Process in Ontario

| Step | Description |

|---|---|

| Pre-Approval | Secures your buying power |

| Home Search | Online listings, open houses |

| Offer & Negotiation…. | Make a conditional offer |

| Home Inspection | Professional assessment of condition |

| Final Financing | Mortgage locked in |

| Legal Closing | Lawyer finalizes paperwork |

| Key Transfer | Move-in day! |

Conditional Offers: Why They Matter

Newcomers often skip inspections or financing conditions due to urgency. That’s risky. Protect yourself by including:

- Financing condition (5 days)

- Inspection clause

- Lawyer review

Even in a hot market, a bad deal is worse than no deal.

What if You’re Still Abroad?

Buying remotely is possible with:

- Digital signings (DocuSign)

- Video showings

- Power of attorney

- Remote lawyer services

This is especially useful for returning expats planning months in advance.

Best Ontario Cities for Immigrants

| City | Why It’s Great |

|---|---|

| Toronto | Diversity, Jobs, Schools |

| Ottawa | Safety, Family-friendly |

| Mississauga | Affordable Suburbs |

| Kitchener-Waterloo…. | Tech hub, Growing economy |

| London | Lower home prices, Education |

Common Mistakes Immigrants Make When Buying

❌ Overextending your budget

❌ Trusting one agent without checking credentials

❌ Skipping due diligence

❌ Not understanding local bylaws, condo rules, or neighborhood dynamics

Post-Purchase To-Do List

- Set up utilities: Hydro, Gas, Internet, Waste pickup

- Apply for municipal taxes: Your lawyer usually registers this

- Insurance: Home, contents, and liability insurance

- Join the community: Local libraries, schools, healthcare, and social clubs

Real Stories from Newcomers

“We bought our first condo in Mississauga after just 8 months in Canada. Our realtor explained everything, and the mortgage broker worked miracles with my international income.” – Arjun & Priya from India “I moved back after 12 years in the UAE. It felt overwhelming at first, but I got a great townhouse in Ottawa. Don’t underestimate the paperwork!” – Linda, Returning Canadian Expat

FAQs

Can immigrants buy homes in Canada without PR?

Yes! Even temporary visa holders can purchase, though financing and taxes may differ.

What is the Non-Resident Speculation Tax?

An extra 25% tax for foreign buyers in parts of Ontario-rebate possible after PR.

Are expats returning to Canada considered non-residents?

Sometimes. You may be treated as a non-resident until you re-establish ties like income or address.

Do I need a job in Canada to qualify for a mortgage?

Typically yes, or proof of sufficient income abroad with proper documentation.

Can I buy a home while living abroad?

Absolutely, using remote tools and professionals like lawyers and realtors.

How long does the process take?

Generally, 2-3 months from mortgage pre-approval to closing.

Conclusion: Your Next Chapter Starts Here

Buying a home or condo in Ontario as an immigrant or expat isn’t just a financial decision-it’s an emotional milestone. It means stability. It means roots. It’s the first brick in your Canadian dream. With planning, the right team, and this roadmap, you’re more than ready to take that step. Download Our Free Checklist: Home Buying Guide for Immigrants & Expats in Ontario

- Cost of Living in Ontario: A Complete Breakdown

- How to Build Canadian Credit as a Newcomer

- Best Cities in Canada for Immigrants

- Government of Ontario Land Transfer Tax Info

- Canada Mortgage and Housing Corporation (CMHC)

- Immigration, Refugees and Citizenship Canada (IRCC)

|

|

|

|

|

|

|

|

|

10 Powerful Ways to Build Canadian Credit Fast as a Newcomer

How to Build Canadian Credit as a Newcomer

Relocating to a new country comes with its own share of exciting opportunities and practical challenges. One of the most crucial tasks for any newcomer to Canada is learning how to build Canadian credit as a newcomer. Your credit score can open doors—or close them. From getting your first apartment to financing your future home, your credit history is a powerful tool in your new life.

So, how can you, as a newcomer with no Canadian credit history, build a strong credit score from scratch? It’s easier than you think—but only if you take the right steps from the beginning.

Understanding the Canadian Credit System

Before you can build credit, you need to understand what it is. In Canada, your credit report is a detailed record of how you’ve used credit over time, while your credit score is a number that summarizes your creditworthiness. The higher the score (which ranges from 300 to 900), the better.

There are two major credit bureaus in Canada: Equifax and TransUnion. They collect and maintain your credit information, and you have the right to request your credit report from both for free.

Why Credit History Matters in Canada

In Canada, your credit history influences more than just your ability to borrow money. It can affect:

-

Rental approvals

-

Employment offers

-

Insurance rates

-

Interest rates on loans

Having no credit is almost as limiting as having poor credit, so building it should be a priority.

Get Started: Apply for a SIN and Bank Account

Your Social Insurance Number (SIN) is your gateway to almost all financial activity in Canada. Get it as soon as possible, then open a Canadian bank account. Many banks offer newcomer packages that include low-fee accounts and advice tailored to immigrants.

Get a Secured Credit Card

This is the single most recommended tool for newcomers. A secured credit card requires you to put down a refundable deposit that acts as your credit limit. As you use the card and make payments on time, your credit score begins to build. Some of the best providers for secured cards include:

-

Capital One Guaranteed Mastercard

-

Home Trust Secured Visa

-

Neo Financial Secured Card

Become an Authorized User

If you have a trusted family member or friend with good credit, ask them to add you as an authorized user on their credit card. Their positive history will help build your own, though not all lenders report authorized user activity—check first.

Try a Credit Builder Loan

A credit builder loan is like a savings plan that builds your credit. You “repay” the loan monthly, but the funds are held in a locked savings account until the term ends. Once done, you receive the full amount, and your positive payment history is reported to the credit bureaus.

Always Pay On Time and Keep Balances Low

Credit scoring models heavily favor on-time payments and low credit utilization (ideally under 30%). Even one late payment can lower your score significantly.

Use autopay features or calendar reminders to stay on top of your bills.

Check Your Score Regularly

Knowing your score is half the battle. You can check your Canadian credit score and report for free using tools like:

-

Credit Karma Canada

-

Borrowell

-

Equifax/TransUnion (annually)

Avoid These Common Mistakes

Newcomers often fall into traps such as:

-

Applying for too many credit products at once

-

Maxing out credit cards

-

Closing old accounts too soon

Avoid these, and your score will rise steadily.

Use Utility and Cell Phone Bills to Your Advantage

Some services now allow you to report on-time utility or cell phone payments to credit bureaus. Look into programs like Rent Advantage or KOHO Credit Building for this purpose.

Keep Building Over Time

Building credit is a marathon, not a sprint. Keep your accounts open, diversify your credit types, and stay consistent. In time, you’ll be eligible for lower-interest loans, better credit cards, and larger financial opportunities.

Frequently Asked Questions

How long does it take to build credit in Canada as a newcomer?

With consistent habits, you can begin seeing a credit score in as little as 3 to 6 months. A good score typically takes 12+ months to develop.

Can I transfer my credit history from my home country to Canada?

Usually no. Canadian credit bureaus do not recognize international credit history. You must start fresh.

Do all landlords and employers check credit scores in Canada?

Not all, but many do—especially in major cities. A good credit score boosts your credibility.

Is a credit score of 650 good in Canada?

Yes, 650 is considered fair. A score above 700 is good, and 750+ is excellent.

Will checking my credit score lower it?

Not if you use soft checks like Borrowell or Credit Karma. Hard inquiries from loan or card applications can lower it slightly.

What’s the best first credit card for newcomers in Canada?

The Home Trust Secured Visa and Neo Secured Card are great starters. Look for cards with low fees and no income requirements.

Conclusion

Building credit in Canada as a newcomer isn’t just possible—it’s highly achievable with the right knowledge and tools. By starting with secured cards, making timely payments, and using tools designed for immigrants, you can build a strong financial foundation that supports your new life in Canada.

Remember, your credit score is a reflection of your financial habits. Keep them clean, consistent, and controlled, and the opportunities in your new homeland will follow.

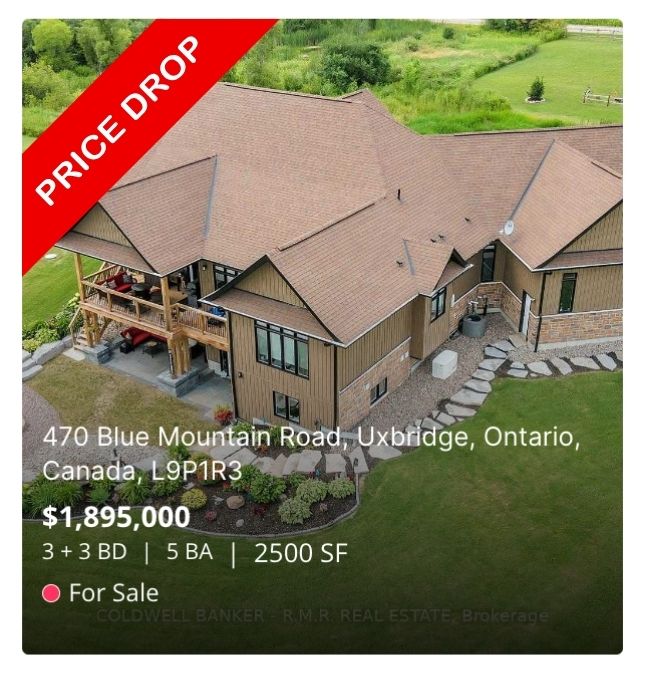

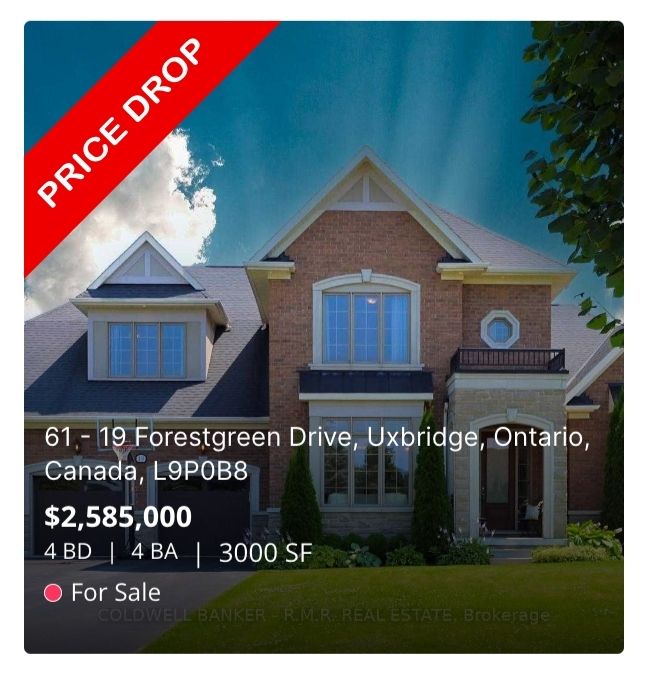

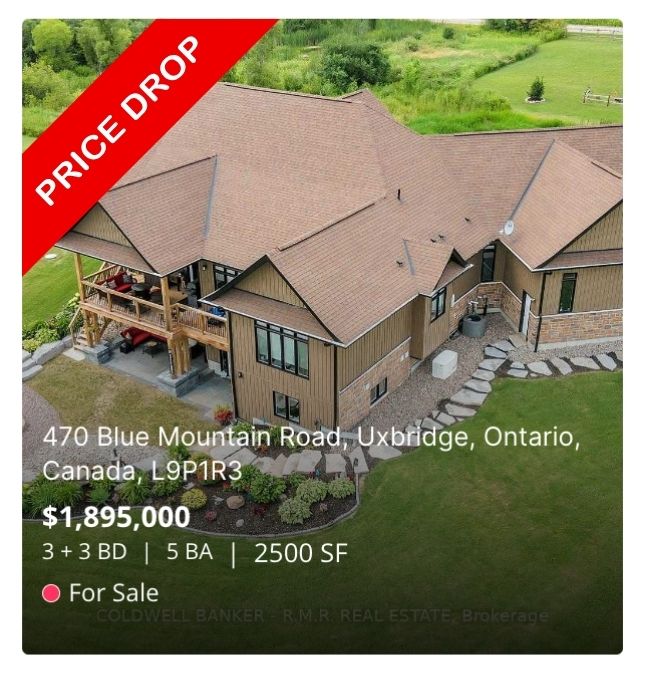

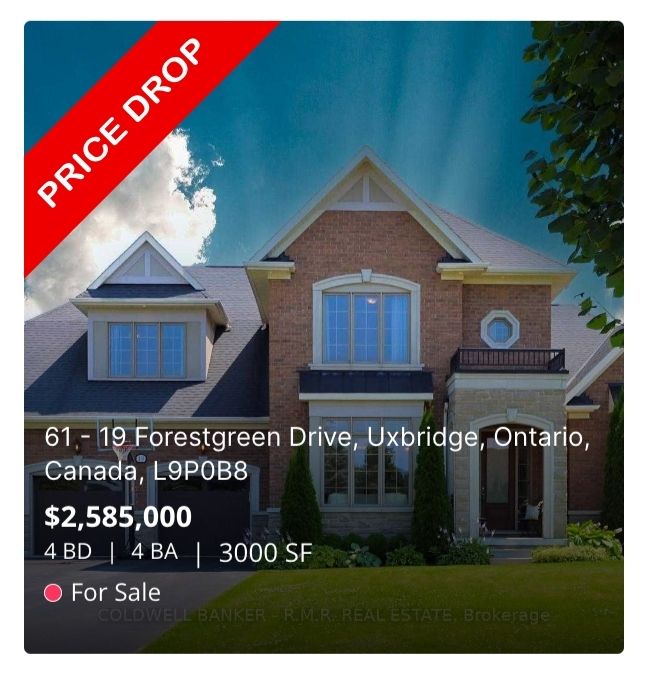

✨ For Sale: Majestic 4-Bedroom Home in Uxbridge’s Prestigious Gated Community with Golf Membership!

Welcome to 19 Forestgreen Drive, an exquisite estate nestled within the prestigious gated community of The Estates of Wyndance in Uxbridge, Ontario.

This luxurious Sheffield model home, perched atop the community's highest point, offers unparalleled privacy and breathtaking panoramic views.

Situated on the largest lot in the neighborhood, spanning 1.17 acres, this residence epitomizes elegance and sophistication.

Exceptional Design and Craftsmanship

Step inside to discover a harmonious blend of classic design and modern amenities. The main level boasts hardwood floors, wainscoting, and intricate tray and waffle ceilings, creating an ambiance of refined luxury.

The gourmet kitchen is a chef's dream, featuring top-of-the-line stainless steel appliances, granite countertops, and a spacious center island.

Adjacent to the kitchen, the breakfast area opens to an expansive covered deck, perfect for enjoying picturesque skyline views.

The living room, adorned with a captivating double-sided gas fireplace, offers a cozy retreat for relaxation.

Spacious and Versatile Living

This 2-storey home encompasses 4 bedrooms and 4 bathrooms, providing ample space for family and guests.

The primary bedroom features a 5-piece ensuite and his-and-hers closets, while additional bedrooms offer generous proportions and access to well-appointed bathrooms.

The walk-out basement presents an opportunity to create an in-law suite, complete with space for up to two additional bedrooms, a full kitchen, living area, and a pre-existing rough-in for a 4-piece bathroom.

The three-car tandem garage ensures ample space for vehicles and storage needs.

Exclusive Community Amenities

Residents of The Estates of Wyndance enjoy a host of premium amenities, including:

-

Two-(2) gated entrances with a security gatehouse

- Paved & lit walking trails

-

Two-(2) ponds with water features

-

Basketball and tennis courts

-

A charming gazebo and paved walking paths

-

A postal outlet within the community

-

A lifetime Platinum-level golf membership at the adjacent Clublink Golf Course

Monthly fees of $553.91 cover water, sewer, snow clearing of roads, road maintenance, landscaping, community fencing, street and park lights, insurance, and access to the aforementioned facilities.

Prime Location

Located in Rural Uxbridge, this home offers the tranquility of country living with convenient access to nearby amenities.

The area boasts over 220 kilometers of seasonally managed trails, attracting cyclists, hikers, and nature enthusiasts.

Nearby schools include Uxbridge Secondary School and Stouffville District Secondary School, providing excellent educational opportunities for families.

Property Video

Community Video

Investment Potential

This property represents a significant investment in a rapidly appreciating area.

Uxbridge has seen a consistent population increase in recent years, as more potential buyers discover the tranquil way of life found in such a scenic place.

Schedule Your Private Tour Today

Don't miss the opportunity to own this exceptional property. Contact me today to schedule a private tour and experience the unparalleled luxury of 19 Forestgreen Drive. Your dream home awaits.

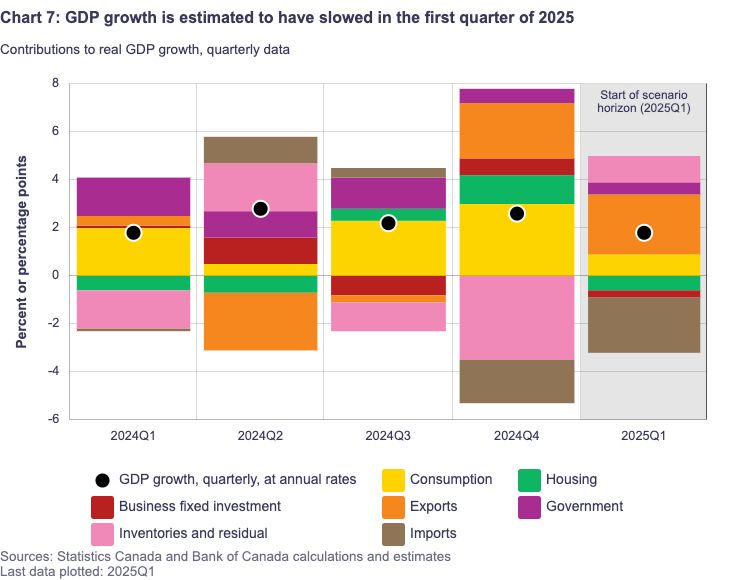

RATE HOLD! Bank of Canada Interest Rate Announcement – April 16, 2025

Bank of Canada Holds Steady Amid US Trade Turmoil: Decoding the Latest Monetary Policy Report

The Bank of Canada, in its announcement on April 16, 2025, elected to maintain its target for the overnight rate at 2.75%, alongside the Bank Rate at 3% and the deposit rate at 2.70%.

This decision arrives at a pivotal moment for the Canadian economy, as it grapples with the significant and unpredictable shifts in United States trade policy, which continue to cast a shadow of uncertainty over economic prospects.

The April Monetary Policy Report (MPR), released concurrently, underscores the substantial challenges in forecasting GDP growth and inflation for both Canada and the global economy amidst this evolving trade landscape.

The report outlines two distinct scenarios that explore potential future paths, contingent on the direction of US trade policy.

🛍️ Recommendation for Buyers:

With the Bank of Canada holding its key interest rate, mortgage rates may remain relatively stable in the short term, offering buyers a chance to breathe and plan strategically. This is an opportune moment to:

-

Get pre-approved while fixed-rate options remain appealing.

-

Take advantage of less volatility in borrowing costs, especially if you’ve been sitting on the sidelines waiting for clarity.

-

Act early if you’re eyeing a property—if inflation cools further, rates may begin to decline, sparking increased competition.

📌 Tip: Locking in a rate hold with your lender now can shield you from potential upticks while giving you time to shop with confidence.

🏡 Recommendation for Sellers:

For sellers, a rate hold brings welcome stability to the market. Buyers are less hesitant, and there’s reduced fear of sudden rate hikes derailing deals. This creates an environment where:

-

Buyer confidence is likely to improve, especially in the entry-to-mid level segments.

-

You may benefit from a more predictable negotiation landscape with fewer financing surprises.

-

Listing sooner rather than later could help you get ahead of any surge in inventory should rates eventually drop.

📌 Tip: Work with a REALTOR® (yes, like me 😄) to position your home competitively and highlight value—especially with buyers now able to stretch their budgets a little further.

On April 16, 2025, the Bank of Canada decided to keep its benchmark interest rate unchanged at 2.75%. This move follows a series of seven consecutive reductions in the key rate, implemented to support economic activity as trade tensions began to escalate.

The Bank Rate was held at 3%, and the deposit rate remained at 2.70%. This decision to pause rate cuts was anticipated by a slight majority of economists, reflecting the delicate balance the central bank must strike between supporting growth and managing potential inflationary pressures stemming from trade disruptions.

The next scheduled announcement regarding the overnight rate target is set for June 4, 2025. The Bank's decision to refrain from further easing monetary policy at this time suggests a cautious stance, allowing policymakers to observe how the unfolding trade situation impacts the Canadian economy.

This approach acknowledges the limitations of monetary policy as a tool to directly address the uncertainties inherent in international trade disputes.

"The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%."

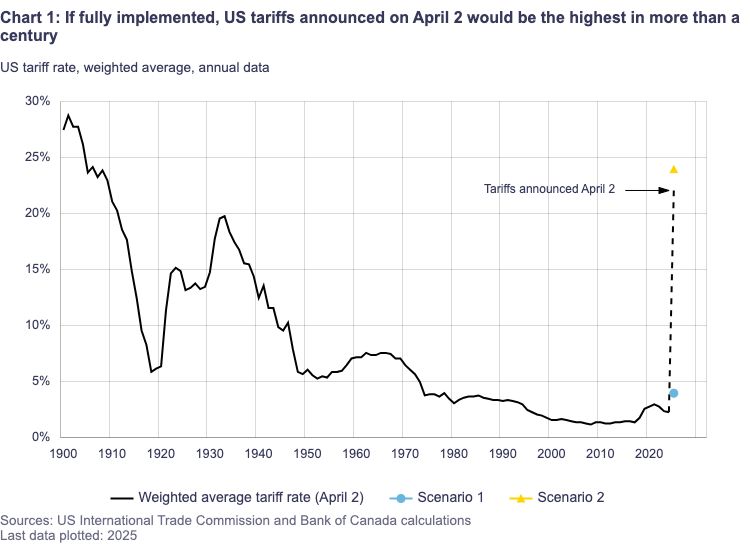

The significant reorientation of US trade policy and the unpredictable nature of tariffs have injected a high degree of uncertainty into the economic outlook, both domestically and internationally.

This unpredictability has diminished the prospects for robust economic growth and has simultaneously elevated expectations for inflation. The financial markets have reacted sharply to the stream of tariff-related announcements, including implementations, postponements, and ongoing threats of further escalation, contributing significantly to the prevailing atmosphere of uncertainty.

This environment of pervasive uncertainty poses considerable challenges for accurately forecasting the trajectory of GDP growth and inflation, not only for Canada but for the global economy as a whole.

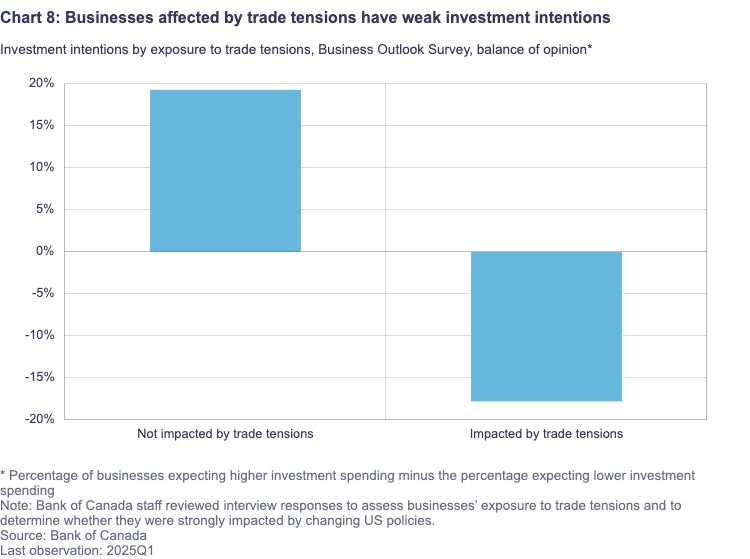

The interconnectedness of the Canadian and US economies amplifies the impact of these policy shifts, creating a climate where businesses and consumers alike are hesitant to make long-term commitments, potentially leading to a deceleration in economic activity.

In light of the significant uncertainty surrounding US trade policy, the April MPR presents two illustrative scenarios to explore potential economic pathways.

-

Scenario 1: High Uncertainty, Limited Tariffs This scenario posits a situation where uncertainty remains elevated concerning US trade policy, but the actual implementation of tariffs is limited in scope. Under these conditions, the Canadian economy is projected to experience a temporary weakening in its growth trajectory.

However, despite this temporary slowdown, inflation is expected to remain anchored around the Bank of Canada's target of 2%. Even with a limited imposition of tariffs, the sustained high level of uncertainty can still act as a deterrent to economic activity, as businesses and households may adopt a more cautious approach to spending and investment.

The fact that inflation is projected to remain near the target suggests that any upward price pressures from the limited tariffs are likely to be counterbalanced by other factors, such as the anticipated weakening in economic growth or the removal of the consumer carbon tax.

-

Scenario 2: The Protracted Trade War The second scenario outlines a much more severe outcome, where a protracted trade war ensues, leading to a significant and sustained disruption to international trade.

In this case, the Bank of Canada anticipates that the Canadian economy would fall into recession within the current year. Furthermore, inflation is projected to rise temporarily above 3% in the following year. A prolonged trade war, characterized by widespread tariffs and potential retaliatory measures, would severely impact Canadian businesses and consumers.

The resulting economic contraction would likely lead to job losses and reduced household spending. The temporary surge in inflation would be driven by higher import costs due to tariffs and disruptions to global supply chains.

It is important to note that these two scenarios represent only a fraction of the possible outcomes, and the actual evolution of US trade policy could take many other forms.

The unprecedented nature and rapid pace of the shifts in US trade policy contribute to a significant degree of uncertainty surrounding the economic consequences, making it unusually challenging to predict the precise impacts.

Examining the global economic landscape, the Bank of Canada's report highlights varying conditions across major economies. In the United States, there are indications of a slowdown in economic activity, accompanied by increasing policy uncertainty and a decline in overall sentiment. Simultaneously, inflation expectations have been on the rise.

The Euro Area experienced modest economic growth in early 2025, with the manufacturing sector continuing to exhibit weakness. China's economy demonstrated strength at the close of 2024, but recent data suggests a moderate deceleration in its growth momentum.

Financial markets have experienced considerable turbulence due to the ongoing uncertainty surrounding trade policies. This extreme market volatility is contributing to the overall sense of economic unease.

Notably, global oil prices have fallen significantly since January, primarily reflecting diminished prospects for global economic growth in the face of these trade tensions. In contrast, the Canadian dollar has recently appreciated in value, largely driven by a broad weakening of the US dollar.

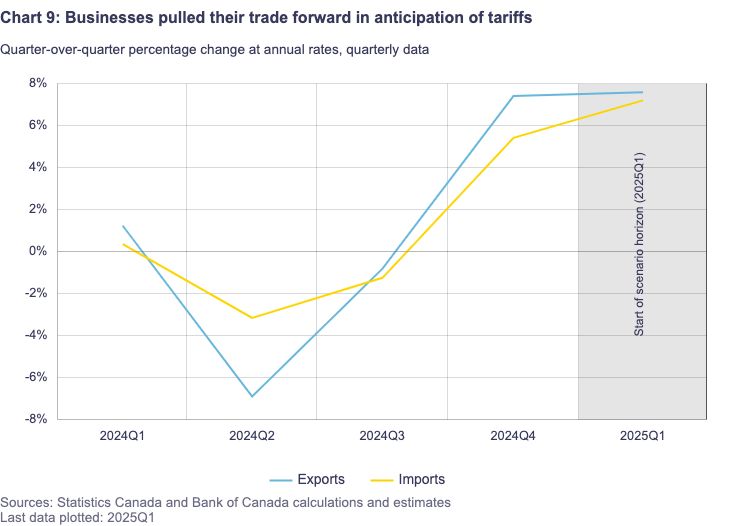

Within Canada, the economy is showing signs of a slowdown as the uncertainty surrounding tariff announcements weighs on both consumer and business confidence. Data from the first quarter of 2025 indicate a weakening in consumption, residential investment, and business spending.

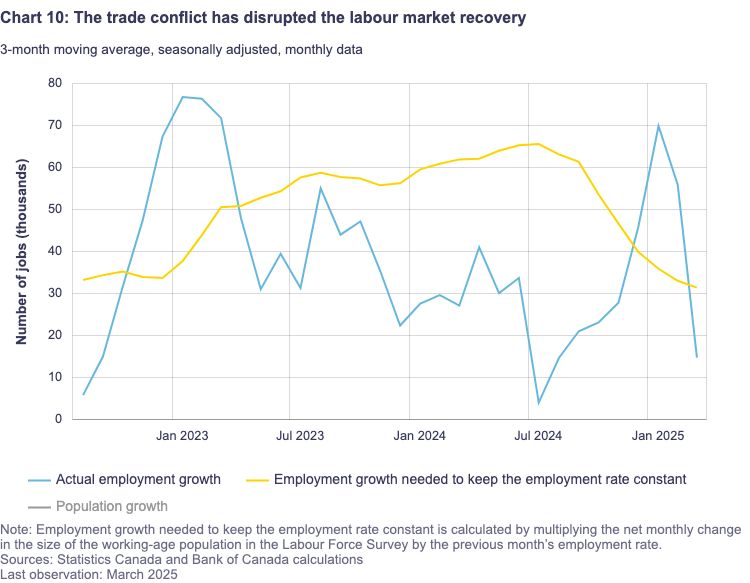

The ongoing trade tensions are also disrupting the recovery of the labor market, with employment declining in March and businesses reporting intentions to curtail hiring. Furthermore, wage growth continues to exhibit signs of moderation.

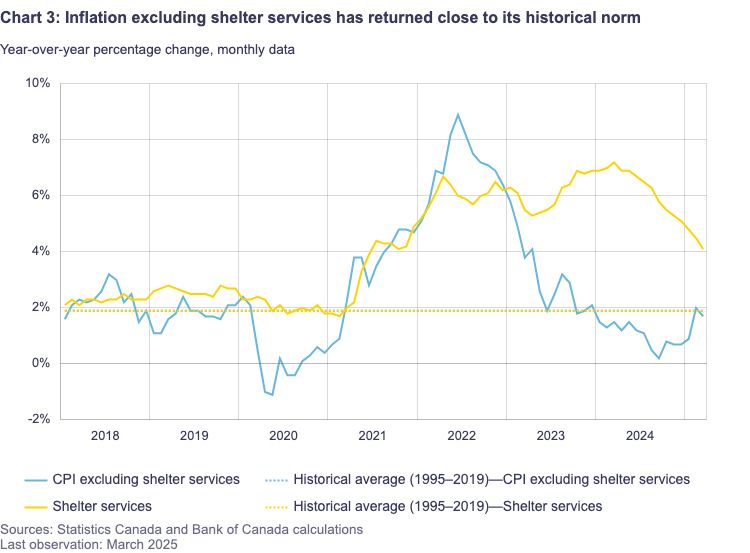

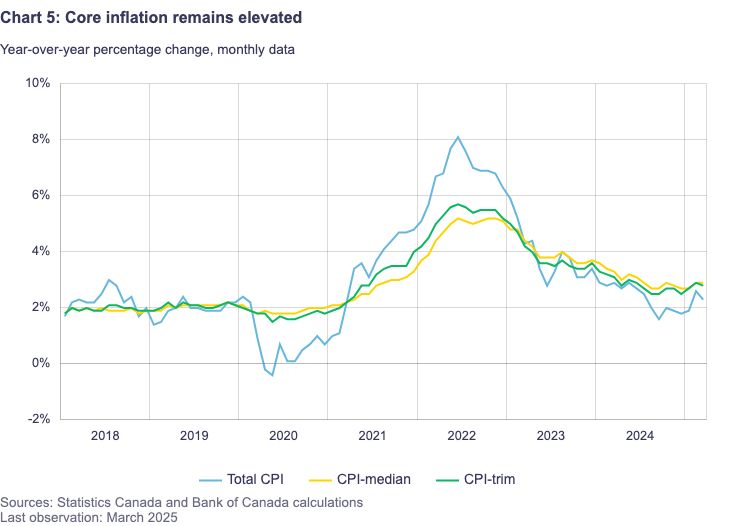

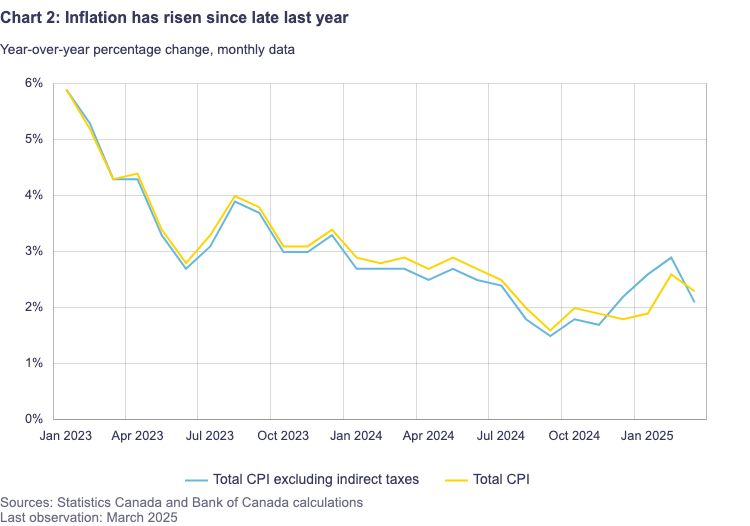

Canada's inflation rate stood at 2.3% in March, a decrease from February's 2.6% but still above the 1.8% recorded at the time of the January MPR. The recent uptick in inflation is partly attributed to a rebound in goods price inflation and the cessation of the temporary GST/HST suspension.

Looking ahead, the removal of the consumer carbon tax starting in April is expected to exert downward pressure on CPI inflation for a year. Additionally, lower global oil prices are anticipated to dampen inflation in the near term.

However, the potential for tariffs and supply chain disruptions to drive up certain prices remains a concern. Consequently, short-term inflation expectations have edged upward as businesses and consumers foresee higher costs arising from trade conflicts and supply chain issues, while longer-term inflation expectations remain relatively stable.

The Bank of Canada's Governing Council will continue its careful evaluation of the interplay between the downward pressures on inflation stemming from a potentially weaker economy and the upward pressures resulting from increased costs.

Their primary objective is to ensure that Canadians maintain confidence in price stability throughout this period of global economic turbulence. This necessitates a strategy that supports economic growth while diligently controlling inflation.

"Governing Council will proceed carefully, with particular attention to the risks and uncertainties facing the Canadian...source

In conclusion, the Bank of Canada has opted to maintain its key interest rate amid significant uncertainty stemming from US trade policy. The April MPR outlines two potential scenarios, one involving limited tariffs and the other a protracted trade war, each with distinct implications for Canadian economic growth and inflation.

While the global economic outlook presents a mixed picture, the Canadian economy is already showing signs of slowing in response to trade tensions. The factors influencing inflation are multifaceted, with the removal of the carbon tax and lower oil prices potentially offsetting some of the upward pressure from tariffs. The Bank of Canada remains committed to navigating this period of uncertainty with a focus on maintaining price stability for Canadians.

The Impact of Tariffs on the Ontario Real Estate Market, with a Focus on the Greater Toronto Area

1. Introduction

The Ontario real estate market, particularly in the Greater Toronto Area (GTA), has always been influenced by various economic factors such as interest rates, foreign investments, and government policies. However, one less commonly discussed factor is the role of tariffs. These import taxes, especially on construction materials, significantly impact housing costs, affordability, and investment strategies.

2. Understanding Tariffs

Tariffs are government-imposed taxes on imported goods. They are often used to protect domestic industries, retaliate against foreign trade policies, or generate government revenue. While tariffs can have broad economic implications, their effects on real estate are particularly profound when applied to materials such as steel, aluminum, and lumber—key components in construction.

3. History of Tariffs in Canada

Canada has a history of imposing and responding to tariffs, often in reaction to U.S. trade policies. Over the years, tariffs on construction materials have fluctuated based on trade agreements such as NAFTA and its successor, the USMCA. Understanding the historical context of these tariffs provides insight into their recurring impact on real estate markets.

4. Major Tariffs Affecting Real Estate

Steel and Aluminum Tariffs

Steel and aluminum are crucial in high-rise construction and infrastructure development. Tariffs on these materials increase costs for developers, affecting the pricing of new housing projects in the GTA.

Lumber Tariffs

Lumber tariffs have a direct effect on homebuilding costs. Since many GTA homes are built with wood framing, increased costs lead to higher home prices.

Other Construction Materials

Tariffs on items such as glass, appliances, and plumbing fixtures also contribute to rising construction expenses.

5. How Tariffs Increase Construction Costs

Higher tariffs mean increased costs for builders, who pass these expenses onto buyers. This phenomenon leads to:

- Increased Home Prices: Higher costs of raw materials make homes more expensive.

- Reduced Housing Supply: Developers may delay or cancel projects due to inflated costs.

- Longer Construction Timelines: Increased expenses can lead to financial constraints, slowing down construction projects.

6. The Role of U.S.-Canada Trade Relations

Since much of Ontario’s building materials are imported from the U.S., changes in American trade policies significantly affect Canada’s real estate market. Political shifts and renegotiated agreements like the USMCA dictate tariff rates and their subsequent impact.

7. Foreign Investment and Tariffs

Foreign investors often look for cost-effective opportunities. Rising tariffs may deter international buyers from investing in the GTA market, affecting demand and price trends.

8. Tariffs’ Effect on New Developments

Real estate developers in Ontario, especially in the GTA, are directly impacted by tariffs. Increased costs often lead to:

- Smaller Developments: Builders may opt for fewer units to mitigate expenses.

- Higher Pre-construction Pricing: Buyers must pay more for homes even before they’re built.

- Shifts in Material Sourcing: Developers may seek alternative suppliers to cut costs, potentially compromising quality.

9. Impact on Home Prices and Affordability

With rising construction costs due to tariffs, housing affordability in the GTA becomes a major issue. First-time buyers struggle to enter the market, and existing homeowners see fluctuating property values.

10. How Tariffs Influence Mortgage Rates

While tariffs don’t directly affect mortgage rates, they contribute to inflation. In response, the Bank of Canada may adjust interest rates, indirectly influencing mortgage affordability.

11. Impact on Homebuyers

Increased Costs

Higher home prices mean buyers need larger down payments and higher mortgage approvals.

Limited Choices

A reduced supply of new builds leaves fewer options for prospective homeowners.

Market Timing Concerns

Uncertainty surrounding tariffs makes it difficult for buyers to predict when to enter the market.

12. Impact on Sellers

Changing Buyer Demand

Higher prices may limit the pool of eligible buyers, leading to longer listing times.

Price Adjustments

Sellers may need to adjust their expectations based on market fluctuations caused by tariffs.

13. Government Policies and Responses

To counteract tariff effects, the Canadian government may introduce:

- Subsidies for Builders

- Tax Breaks for First-time Buyers

- Negotiated Trade Agreements to Reduce Tariffs

14. Economic Forecasts and Market Predictions

Experts suggest that unless tariffs decrease, the GTA real estate market will continue experiencing high prices and limited affordability. However, government intervention and alternative supply strategies could mitigate these effects.

15. Strategies for Buyers and Sellers

For Buyers

- Monitor Market Trends: Stay informed about tariff changes.

- Consider Alternative Housing Options: Condos may be more affordable than single-family homes.

- Secure Mortgage Pre-approval Early: Lock in lower rates before they rise.

For Sellers

- Price Competitively: Adjust listing prices to attract buyers.

- Highlight Home Features: Showcase value beyond pricing.

- Be Open to Negotiation: Buyers may seek flexibility due to rising costs.

16. Case Studies and Real-Life Examples

Case Study 1: Condo Development in Downtown Toronto

A developer faced higher costs due to steel tariffs, resulting in a 15% price increase for pre-construction units.

Case Study 2: First-Time Buyer in Mississauga

A couple struggled with affordability as new home prices surged, leading them to opt for a resale property instead.

17. Conclusion and Final Thoughts

Tariffs have a profound impact on the Ontario real estate market, particularly in the GTA. Buyers and sellers must stay informed and adopt strategic approaches to navigate these economic challenges. While tariffs create obstacles, government policies and market adaptability can help mitigate long-term effects.

GTA March 2025 Real Estate Market: Enhanced Affordability and Increased Choices

The Greater Toronto Area (GTA) real estate market in March 2025 has presented a landscape marked by improved affordability and a broader selection of properties for prospective homebuyers. This shift is attributed to declining borrowing costs, moderated home prices, and a surge in new listings.

However, underlying economic uncertainties, particularly related to international trade tensions and the impending federal election, have influenced buyer sentiment and market dynamics.

Key Market Indicators

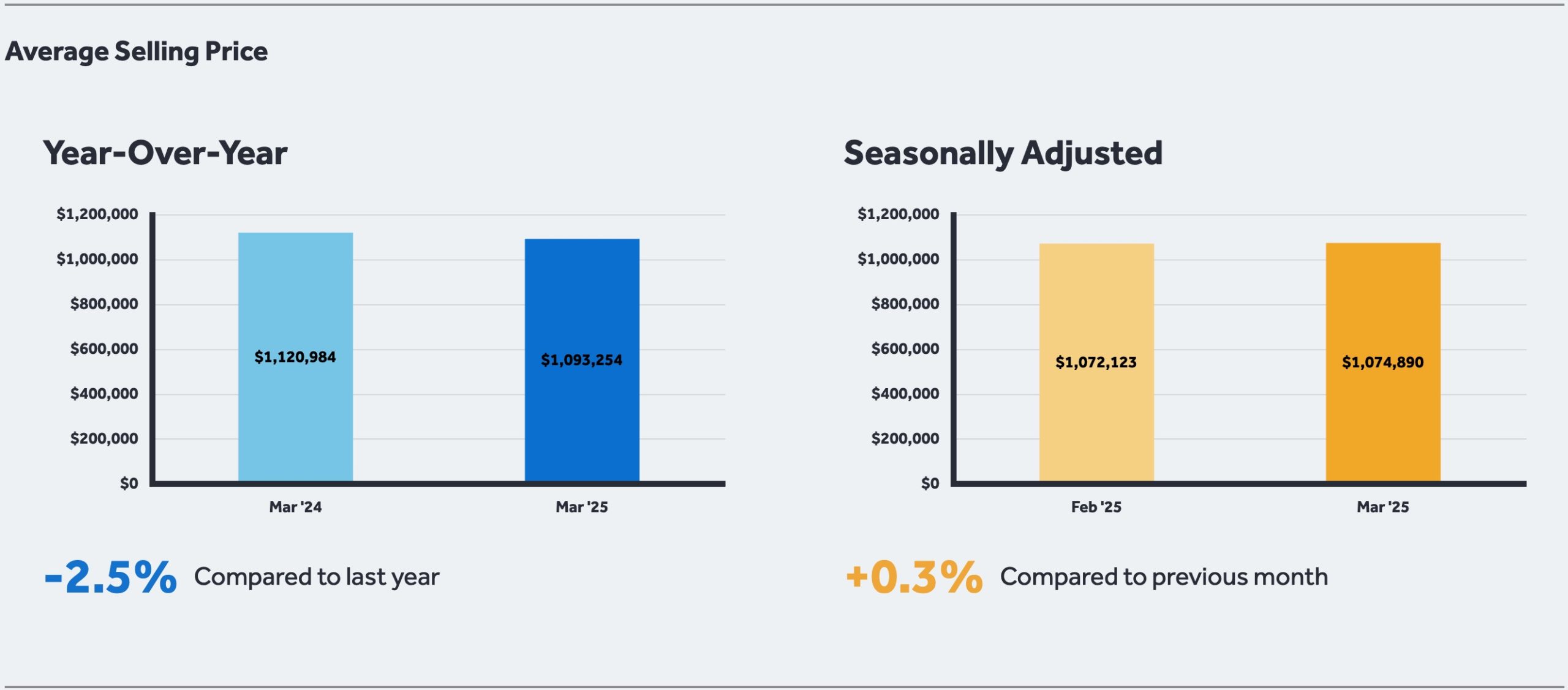

In March 2025, GTA REALTORS® reported 5,011 home sales through the Toronto Regional Real Estate Board’s (TRREB) MLS® System, representing a 23.1% decrease compared to March 2024. Conversely, new listings rose by 28.6% year-over-year, totaling 17,263 properties.

The MLS® Home Price Index Composite benchmark declined by 3.8% annually, while the average selling price decreased by 2.5% to $1,093,254.

The following table summarizes these key metrics:

| Metric | March 2024 | March 2025 | Year-over-Year Change |

|---|---|---|---|

| Home Sales | 6,519 | 5,011 | -23.1% |

| New Listings | 13,423 | 17,263 | +28.6% |

| MLS® HPI Composite Benchmark Price . | N/A | N/A | -3.8% |

| Average Selling Price | $1,120,000 | $1,093,254 | -2.5% |

Affordability and Borrowing Costs

The decline in both home prices and borrowing costs over the past year has enhanced affordability for potential homeowners. TRREB President Elechia Barry-Sproule noted, “Homeownership has become more affordable over the past 12 months, and we expect further rate cuts this spring.”

The Bank of Canada’s recent interest rate reductions have played a pivotal role in lowering borrowing costs, thereby making monthly mortgage payments more manageable for households. This trend is expected to continue, providing further relief to buyers.

Impact of Economic Uncertainty

Despite improved affordability, economic uncertainties have led many potential buyers to adopt a cautious approach. TRREB’s Chief Information Officer Jason Mercer stated, “Given the current trade uncertainty and the upcoming federal election, many households are likely taking a wait-and-see approach to home buying.”

The introduction of a 10% baseline tariff on all U.S. imports by President Donald Trump has heightened trade tensions, potentially impacting Canada’s economy and, consequently, consumer confidence in the housing market.

Market Dynamics: Supply and Demand

The substantial increase in new listings has expanded the inventory available to buyers, granting them greater negotiating power. This influx of supply, coupled with tempered demand due to economic uncertainties, has contributed to the observed decline in home prices. The following chart illustrates the trend in new listings and home sales over the past year:

Chart: Total New Listings and Sale-to-New Listings Ratio for March 2024 / March 2025

Housing Policy and Future Outlook

Housing remains a focal point in the political arena, with federal parties emphasizing its importance in their platforms. TRREB CEO John DiMichele highlighted, “Building this housing will be a key economic driver moving forward.”

The upcoming federal election and potential policy changes are expected to influence market conditions. Buyers and sellers alike are advised to stay informed about policy developments that may impact housing affordability and availability.

Conclusion

The GTA real estate market in March 2025 reflects a complex interplay of improved affordability, increased housing choices, and economic uncertainties. Prospective buyers benefit from lower prices and borrowing costs, alongside a wider selection of properties.

However, factors such as trade tensions and political developments continue to shape market dynamics. Stakeholders are encouraged to monitor these trends closely and consult with real estate professionals to navigate this evolving landscape effectively.

|

|

|

|

|

|

|

|

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link