Canada’s GST Elimination for First-Time Homebuyers: A Comprehensive Analysis

| Main Topics | Subtopics |

|---|---|

| Introduction | – Overview of Canada’s housing crisis – Government’s response to the crisis |

| Understanding the GST Elimination | – Definition of GST – Details of the GST elimination policy |

| Advantages for First-Time Homebuyers | – Financial savings – Increased affordability – Encouragement of homeownership |

| Impact on Builders | – Reduction in construction costs – Incentives for new projects – Potential challenges |

| Effects on the Real Estate Market | – Increase in housing supply – Stabilization of housing prices – Market dynamics |

| Potential Challenges and Considerations | – Regional disparities – Long-term sustainability – Monitoring and evaluation |

| Frequently Asked Questions (FAQs) | – Six common questions and answers |

| Conclusion | – Summary of key points – Future outlook |

Published: March 20, 2025

Introduction

Canada is currently facing a significant housing crisis characterized by soaring demand, limited supply, and escalating prices. In response, the federal government has introduced a pivotal measure aimed at alleviating these challenges: the elimination of the Goods and Services Tax (GST) for first-time homebuyers on homes priced at or below $1 million. This article delves into the intricacies of this policy, exploring its advantages for first-time homebuyers, implications for builders, and its broader impact on the real estate market.

Understanding the GST Elimination

- Definition of GST

The Goods and Services Tax (GST) is a federal tax applied to most goods and services sold in Canada. Typically set at 5%, this tax contributes to the overall cost of purchasing a home, thereby affecting affordability.

- Details of the GST Elimination Policy

On March 20, 2025, Prime Minister Mark Carney announced the removal of the GST for first-time homebuyers purchasing homes valued at or under $1 million. This initiative is designed to reduce upfront costs, potentially saving buyers up to $50,000, thus making homeownership more attainable for many Canadians.

Advantages for First-Time Homebuyers

- Financial Savings

The most immediate benefit of this policy is the substantial financial savings. By eliminating the 5% GST on eligible homes, first-time buyers can save a significant amount, which can be redirected towards other expenses such as home improvements, furnishings, or reducing mortgage principal.

Removing the GST lowers the overall purchase price of homes, thereby enhancing affordability. This reduction in cost can enable more young people and families to enter the housing market, fulfilling their aspirations of homeownership.

- Encouragement of Homeownership

This tax relief serves as an incentive for individuals who were previously hesitant due to high costs, encouraging a new wave of homeowners and promoting economic stability through increased property ownership.

Impact on Builders

√ Reduction in Construction Costs

For builders, the elimination of GST on homes under $1 million can lead to reduced construction costs. This reduction can improve profit margins or allow for more competitive pricing, thereby stimulating the construction industry.

√ Incentives for New Projects

Lower costs and increased demand from first-time buyers can motivate builders to initiate new projects, contributing to an increase in housing supply across the country.

√ Potential Challenges

While the policy presents opportunities, builders may face challenges such as ensuring quality amidst rapid construction and navigating regional market variations that could affect project viability.

Effects on the Real Estate Market

- Increase in Housing Supply

The anticipated surge in construction projects is expected to boost the housing supply, addressing the current shortage and aligning supply more closely with demand.

- Stabilization of Housing Prices

An increased supply of homes can lead to a stabilization of housing prices, making the market more accessible and reducing the pressure on buyers.

- Market Dynamics

The policy may lead to shifts in market dynamics, including changes in investment patterns and a potential reevaluation of property values in various regions.

Potential Challenges and Considerations

Regional Disparities

The impact of the GST elimination may vary across regions, with urban areas potentially experiencing different effects compared to rural communities.

Long-Term Sustainability

While the policy addresses immediate affordability issues, considerations regarding its long-term sustainability and effectiveness in solving the housing crisis are crucial.

Monitoring and Evaluation

Continuous monitoring and evaluation are essential to assess the policy’s impact and make necessary adjustments to ensure it meets its objectives.

Frequently Asked Questions (FAQs)

-

Who qualifies as a first-time homebuyer under this policy?

- A first-time homebuyer is typically defined as an individual who has not owned a home in the past four years. Specific eligibility criteria may vary, so it’s advisable to consult official guidelines.

-

Does the GST elimination apply to both new and resale homes?

- The policy primarily targets new home purchases; however, details regarding its application to resale homes should be confirmed with official sources.

-

Are there any regional restrictions on the GST elimination?

- The GST elimination is a federal policy applicable nationwide, but regional housing markets may experience varying impacts.

-

How does this policy affect mortgage qualification?

- While the GST elimination reduces the purchase price, mortgage qualification still depends on factors such as income, credit score, and debt levels.

-

Will this policy lead to a decrease in housing prices?

- The policy aims to stabilize housing prices by increasing supply, but actual price movements will depend on various market factors.

-

Is the GST elimination a temporary measure?

- As of the announcement, the policy is intended as a permanent measure, but future governments may reassess its continuation.

Conclusion

The elimination of GST for first-time homebuyers represents a significant step towards addressing Canada’s housing affordability crisis. By reducing financial barriers, encouraging new construction, and potentially stabilizing the real estate market, this policy holds promise. However, careful implementation and ongoing assessment are essential to ensure it effectively meets the diverse needs of Canadians and contributes to a sustainable housing environment.

For a visual summary of Prime Minister Carney’s announcement, you can watch the following video:

The Ultimate Stone & Siding Raised Bungaloft – A Dream Home on 3.87 Acres!

Introduction: Welcome to Luxury, Space & Pure Awesomeness!

If you’ve ever dreamed of a home that has it all—space, elegance, modern amenities, and enough parking for every single one of your friends—then buckle up, because this Stone & Siding Raised Bungaloft is about to blow your mind.

Nestled on 3.87 acres of pristine land, this stunning 6-bedroom, 5-bathroom estate isn’t just a house—it’s a lifestyle. Whether you love hosting epic gatherings, need space for a growing family, or simply want to stretch out and enjoy the finer things in life, this property has you covered.

And let’s be real—how often do you find a home with 14 driveway parking spaces and a 3-bay built-in garage with high ceilings? That’s right, not often.

But that’s just the beginning…

The Numbers: Breaking Down This 5,037 Sq. Ft. Beauty

Before we dive into the juicy details, let’s talk size—because this home is BIG in all the best ways.

| Level of Home | Square Footage |

|---|---|

| Main Floor | 2,325 sq. ft. |

| Loft | 447 sq. ft. |

| Basement | 2,265 sq. ft. |

| Total | 5,037 sq. ft. |

That’s over 5,000 sq. ft. of meticulously designed living space. Add in the 3.87-acre lot, and you’ve got the perfect blend of indoor comfort and outdoor freedom.

Main Floor: Where Elegance Meets Everyday Living

Open-Concept Living & Dining – Spacious & Stunning

The main floor is where luxury meets functionality. With an open-concept design, soaring ceilings, and expansive windows that let in a flood of natural light, every inch of this home screams sophistication.

Whether you’re curling up by the fireplace with a book, entertaining guests in the elegant dining area, or whipping up a feast in the gourmet kitchen, you’ll feel at home in an instant.

Gourmet Kitchen – A Chef’s Paradise

Foodies, rejoice! This kitchen is what dreams are made of. Equipped with top-of-the-line appliances, sleek countertops, and an open-concept layout, it’s designed to make cooking a joy. And if one kitchen isn’t enough, don’t worry—there’s another one in the basement!

Bedrooms & Bathrooms – A Slice of Comfort

- 3 spacious bedrooms on the main floor, including a luxurious primary suite with an ensuite bathroom.

- 5 total bathrooms with heated floors (yes, HEATED FLOORS—because nobody likes cold feet).

- A mix of 5-piece, 4-piece, and 2-piece baths, so there’s always a bathroom nearby when you need it.

The Loft: A Cozy & Versatile Bonus Space

Perched above the main floor, the loft is an incredibly versatile space. Whether you turn it into a home office, a reading nook, a playroom, or an extra bedroom, the options are endless.

With 447 sq. ft. of additional space, you have plenty of room to make it your own.

The Fully Finished Basement: An Entire Home of Its Own!

Now, let’s talk about the basement—because it’s not just a basement. It’s practically another home.

What’s Inside?

- 3 additional bedrooms

- Full & semi-ensuite baths

- A full kitchen & dining area

- A spacious living room AND a great room

- A walk-out patio for direct outdoor access

Whether you use it as an in-law suite, a rental unit, or a guest space, this basement offers ultimate flexibility.

The Garage & Parking: Because More is Always Better

Have a car collection? A boat? A need for excessive amounts of parking? Say no more.

- 3-bay built-in garage with high ceilings (plenty of space for a lift if you need one).

- Access to both the basement and the side yard.

- A whopping 14 parking spaces in the driveway. Yes, you read that right. FOURTEEN.

Your guests will never have to hunt for street parking again.

Outdoor Features: A Nature Lover’s Dream

Massive Lot = Endless Possibilities

- Lot dimensions: 384.13 ft (front) x 550.53 ft (depth) – that’s a whole lot of land!

- Two garden sheds for extra storage.

- A stone pad with power & water hookups—ready for a mobile home, guesthouse, or your wildest backyard dreams.

Luxury Meets Efficiency

- 83ft deep drilled well—because fresh, clean water is non-negotiable.

- Dual septic tanks for reliability and efficiency.

- 400 AMP service and a Generac whole-home propane generator—because power outages should never be a problem.

Additional Features That Make This Home Unbeatable

✔ High-speed internet available via Bell 5G—work-from-home and stream Netflix without interruption.

✔ Two sump pumps & an ejector (sewage) pump—because water management is key.

✔ HRV system for optimal indoor air quality & moisture control.

Final Thoughts: Why You Need This Home

This Stone & Siding Raised Bungaloft isn’t just a house—it’s an experience.

- Sprawling 3.87-acre lot with unmatched privacy.

- 6 bedrooms & 5 bathrooms with heated floors for the ultimate comfort.

- 5,037 sq. ft. of thoughtfully designed living space.

- Fully finished basement with a separate kitchen & walk-out patio.

- Garage & driveway space that will make any car enthusiast jealous.

- Luxury, convenience, and efficiency—all in one stunning package.

If you’re ready to level up your lifestyle, don’t miss out on this rare gem.

📞 Schedule a private viewing today and come see what luxury country living is all about!

FAQs About This Stunning Bungaloft

1. Is the basement a separate living space?

Yes! It’s fully equipped with 3 bedrooms, a kitchen, bathrooms, and a walk-out patio, making it perfect for extended family or guests.

2. How many parking spaces are available?

Between the 3-bay garage and the 14-space driveway, you’ve got plenty of room for all your vehicles and then some.

3. What type of internet service is available?

The property has access to Bell 5G high-speed internet, ensuring fast and reliable connectivity.

4. Is there backup power in case of an outage?

Absolutely! The home is equipped with a Generac whole-home propane generator and 400 AMP service for uninterrupted power.

5. Can I build a guesthouse or add a mobile home?

Yes as long as the relevant authorities grant permit for same! There’s already a stone pad with power & water hookups, ready for your vision.

6. What outdoor storage options are available?

The property includes two-(2) garden sheds, perfect for storing tools, equipment, or seasonal items.

If this home sounds like your dream come true, don’t wait—schedule a tour today! 🌟

Bank of Canada Cuts Policy Rate by 25 Basis Points to 2.75% Amid Rising Trade Tensions

The Bank of Canada (BoC) has announced a 25 basis point reduction in its overnight target rate, bringing it down to 2.75%. Consequently, the Bank Rate is now set at 3.00%, while the deposit rate stands at 2.70%. This decision comes as the Canadian economy, despite entering 2025 on solid footing, faces growing uncertainty due to heightened trade tensions and tariffs imposed by the United States.

Current Economic Landscape: Strengths and Challenges

A Strong Start to 2025 Amid Rising Uncertainty

At the beginning of 2025, Canada’s economy exhibited robust performance, with inflation hovering near the 2% target and GDP growth showing resilience. However, escalating trade tensions with the United States are expected to slow economic activity and contribute to inflationary pressures. The BoC acknowledges that the economic outlook remains uncertain, largely due to rapid shifts in global trade policies.

Global Economic Conditions: Slower US Growth and Market Volatility

The US economy, after a period of strong growth, has shown signs of deceleration in recent months. Inflation in the US remains slightly above the Federal Reserve’s target, adding pressure on policymakers. Meanwhile:

- The euro zone reported modest economic growth in late 2024.

- China’s economy demonstrated strong gains, bolstered by government-driven stimulus measures.

- Financial markets have responded to economic uncertainty with declining equity prices and eased bond yields amid concerns about weaker North American growth.

- Oil prices have remained volatile, trading below earlier projections made in the Bank’s January Monetary Policy Report (MPR).

- The Canadian dollar has remained relatively stable against the US dollar but has weakened against other major global currencies.

Canada’s Economic Performance: A Mixed Picture

Stronger-Than-Expected Growth in Late 2024

Canada’s GDP expanded by 2.6% in Q4 2024, exceeding earlier forecasts and building on the revised 2.2% growth rate from Q3. This better-than-expected economic momentum was partly driven by past interest rate cuts, which fueled higher consumer spending and housing market activity.

Potential Slowdown in Early 2025

Despite the strong finish in 2024, growth in Q1 2025 is projected to slow. The primary reasons include:

- Deteriorating consumer and business confidence, as firms hesitate to invest due to ongoing trade uncertainties.

- Rising costs due to US-imposed tariffs, leading to potential inflationary pressures.

- A decline in domestic demand, partially offset by a temporary export surge before tariff deadlines.

Labour Market Developments

Canada’s employment growth strengthened between November 2024 and January 2025, driving the unemployment rate down to 6.6%. However, in February, job creation stagnated, suggesting growing fragility in the labour market. While previous rate cuts boosted hiring, concerns are rising that escalating trade conflicts could disrupt job growth moving forward.

Inflation Trends and Expectations

The Consumer Price Index (CPI) remained near the 2% target, but inflationary pressures are expected to rise in March, potentially reaching 2.5%, as a temporary GST/HST suspension ends.

- Shelter price inflation remains persistently high, influencing core inflation measures.

- Short-term inflation expectations have risen, with businesses and consumers bracing for tariff-induced price increases.

Monetary Policy Response: Why the Bank Cut Rates

Given the uncertain economic climate and rising inflation risks, the Bank of Canada decided to lower the policy rate by 25 basis points to ensure monetary stability.

While monetary policy cannot fully counteract the negative effects of a trade war, it plays a crucial role in preventing inflation from spiraling out of control. The BoC will continue monitoring inflation expectations, assessing whether economic weakness exerts downward pressure on inflation, or if higher costs from trade disruptions push inflation higher.

Looking Ahead: Next Policy Announcement

The next scheduled announcement for the overnight rate target is set for April 16, 2025. At that time, the Bank will release its next Monetary Policy Report, offering a detailed economic and inflation outlook, including an updated risk assessment.

Frequently Asked Questions (FAQs)

1. How will this interest rate cut impact Canadian consumers?

The lower interest rate will make borrowing more affordable, benefiting homebuyers, businesses, and consumers with loans. However, inflation risks remain, meaning prices could rise due to tariffs despite lower borrowing costs.

2. Will this rate cut help counteract the effects of the US trade tariffs?

Not entirely. The BoC’s rate cut aims to support domestic economic activity, but trade tariffs directly impact costs for businesses. This could lead to higher prices for consumers despite lower interest rates.

3. What impact will the rate cut have on the housing market?

Lower rates typically boost demand for homes, potentially driving prices higher. However, economic uncertainty and declining consumer confidence might limit significant gains in the housing sector.

4. How will businesses be affected by this rate cut?

Companies will benefit from lower borrowing costs, which could support investment. However, trade tensions and potential supply chain disruptions may cause businesses to remain cautious despite lower interest rates.

5. Could inflation rise significantly due to trade tariffs?

Yes. Tariffs increase the cost of imports, leading to higher consumer prices. While the BoC aims to manage inflation expectations, external factors like US trade policies remain unpredictable.

6. How does this decision compare to actions by other central banks?

Other central banks, such as the US Federal Reserve and European Central Bank, have also been closely monitoring inflation and trade conditions. Some have taken a more cautious approach, while others have signaled potential rate adjustments in response to economic slowdowns.

The Bank of Canada remains committed to its price stability mandate, ensuring that inflation remains controlled while supporting economic growth in a highly uncertain global environment.

Conclusion

The Bank of Canada’s decision to cut rates underscores the uncertain economic environment Canada faces due to escalating trade tensions with the US. While the rate reduction aims to support economic growth, the long-term impacts of tariffs, inflation pressures, and global economic conditions remain key concerns. As the situation unfolds, the BoC will continue to monitor inflation trends, employment data, and business confidence levels to determine future policy adjustments.

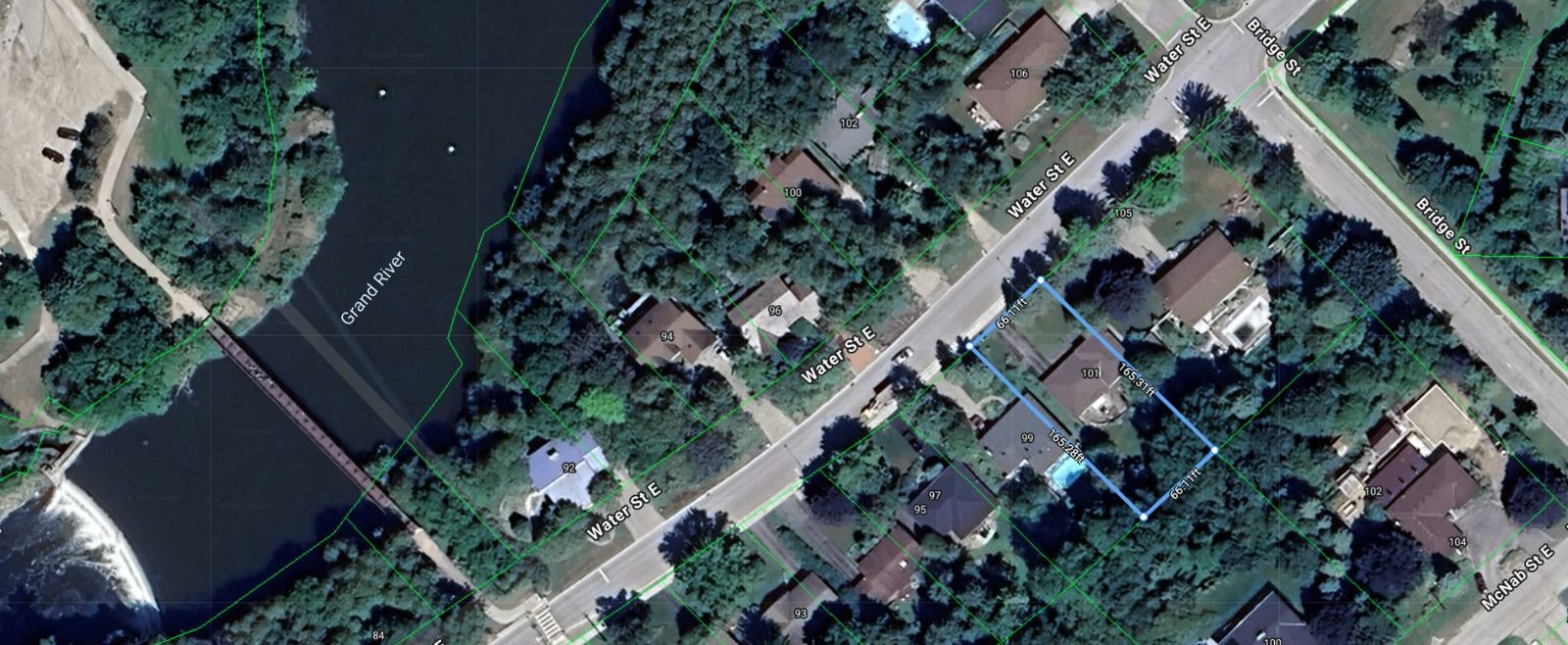

Beautifully Upgraded Side Split Home for Sale in the Heart of Elora

If you’re searching for a charming, upgraded home in one of Ontario’s most picturesque towns, look no further. This stunning side split home in the heart of Elora offers an unbeatable combination of comfort, convenience, and community charm. Nestled on a 0.25-acre lot, this property boasts a fully fenced backyard, perfect for families, pet lovers, and outdoor enthusiasts alike.

With the Grand River just across the street and Bissell Park only steps away where you can check out the farmer’s market, as well as enjoy direct access to scenic walking trails, vibrant community events, and the renowned Riverfest Elora. Plus, a short stroll takes you to downtown Elora, where you’ll find an array of fantastic restaurants, boutique shops, and lively bars.

Let’s dive into what makes this 5-bedroom, 2-bathroom home an extraordinary find!

🏡 Property Overview

| Feature | Details |

|---|---|

| 📍 Location | Highly desirable street in the heart of Elora |

| 🏠 Home Type | Beautifully upgraded side split home |

| 🌳 Lot Size | 0.25 acres with a fully fenced backyard |

| 🚗 Parking | 1-car attached garage + 6-car driveway |

| 🛏 Bedrooms | 5 spacious bedrooms (3 Up + 2 Down) |

| 🛁 Bathrooms | 2 full bathrooms (both new) |

| 🔥 Heating | Newer furnace & on-demand hot water tank |

| ⚡ Electrical | Upgraded 200-amp system |

| 💧 Water | Municipal – Newer water softener |

🏡 Inside the Home: Comfort & Style

✨ Open-Concept Living Area

Step inside to an inviting open-concept space that blends warmth and functionality:

- Bright living room with large windows bringing in natural light

- Spacious dining area with sliding doors leading to a small patio

- Generous-sized kitchen with ample counter space & cabinetry

Perfect for entertaining or cozy family gatherings!

🛏️ Spacious Bedrooms & Updated Bathrooms

- Primary bedroom: Large and serene, offering a peaceful retreat

- Two additional bedrooms: Spacious with plenty of closet space

- Updated bathroom: Features modern fixtures and fresh renovations

🔽 Lower-Level In-Law Suite – Ideal for Multi-Generational Living or Rental Income

The fully finished lower level is a standout feature, offering a separate entrance and great potential for:

✅ In-law suite

✅ Guest space

✅ Rental income opportunity

This renovated area includes:

- 2 additional bedrooms

- Open-concept kitchen, living and dining

- 3-piece new bathroom

- Separate laundry room

- Crawl space for extra storage

🌿 Outdoor Oasis: Private, Fenced Backyard

The beautiful backyard offers:

✅ A small patio for relaxing & entertaining

✅ Mature trees providing shade & privacy

✅ Plenty of space for gardening, kids, & pets

Enjoy the serene outdoor environment right in your own backyard!

🚶♂️ Location: Living the Elora Lifestyle

🌊 Steps from the Grand River & Bissell Park

Enjoy stunning riverside views, scenic walking trails, and access to Bissell Park, where you can experience Elora’s famous Riverfest and other community events.

🍽️ Minutes from Downtown Elora

A short walk brings you to downtown Elora, known for:

✔️ Charming boutique shops

✔️ Fantastic restaurants & cozy cafés

✔️ Lively bars & entertainment

🏫 Close to Top-Rated Schools & Parks

Families will love the safe, friendly neighbourhood with easy access to excellent schools, parks, and community amenities.

🏡 Why Buy This Home?

✅ Move-in ready with thoughtful upgrades

✅ Prime location in one of Ontario’s most sought-after towns

✅ Spacious home perfect for families, multi-generational living, or investment

✅ Proximity to nature, arts, and culture

This home won’t stay on the market long—act fast to make it yours!

📝 Frequently Asked Questions (FAQs)

1. Is the home move-in ready?

Yes! The home has been beautifully upgraded, with a newly renovated lower level, modern kitchen, and updated bathrooms.

2. How many vehicles can the property accommodate?

There’s an attached one-car garage plus a six-car driveway, providing ample parking space.

3. What schools are nearby?

Elora is home to top-rated schools, making it a great location for families.

4. Is there a rental income opportunity?

Yes! The finished lower-level suite with a separate entrance is perfect for rental income or multi-generational living.

5. What updates have been made to the home?

Recent updates include:

- Newer gas furnace

- On-demand hot water tank

- 200-amp electrical system upgrade

- Newer water softener

- New Laminate Floors

- New Interior Paint Job

- New Exterior Paint (Wood Siding)

- New 1-Car Attached Garage

6. How close is the home to downtown Elora?

Just a short walk from the heart of Elora, with access to restaurants, boutiques, and entertainment.

Click below to explore the immersive, interactive 3D virtual tour

📞 Contact Me For More Details Or A Private Showing!

Don’t miss out on this incredible opportunity! For more information or to schedule a private tour, get in touch today.

🌟 Live the dream in Elora—your perfect home awaits! 🌟

GTA Real Estate Market Overview – February 2025

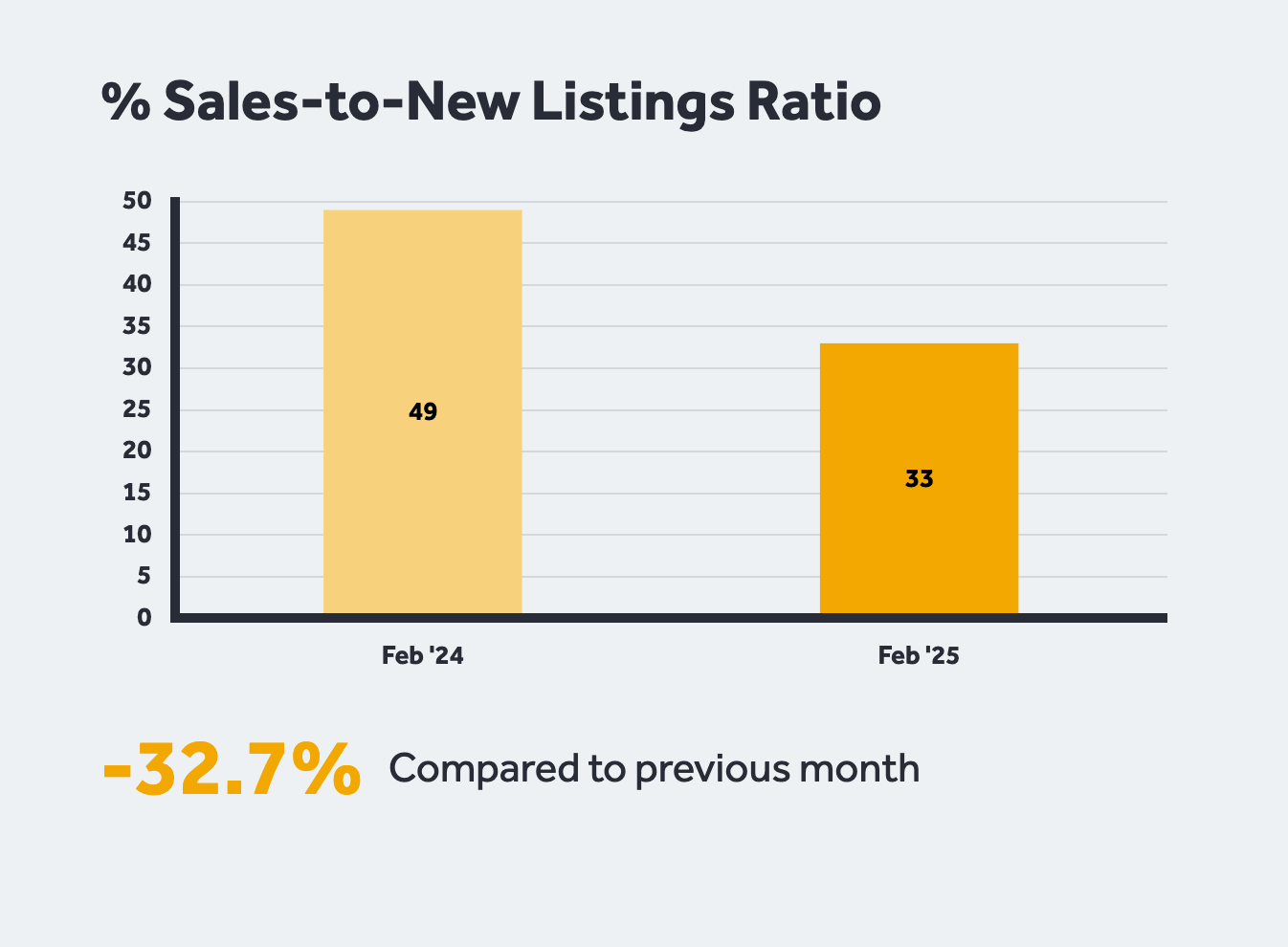

The Greater Toronto Area (GTA) real estate market continued to provide substantial choice for home buyers in February 2025, as resale inventory remained high while sales declined significantly compared to the previous year. With mortgage rates still elevated, affordability challenges persisted, but market experts anticipate improvements as borrowing costs are expected to drop later this year.

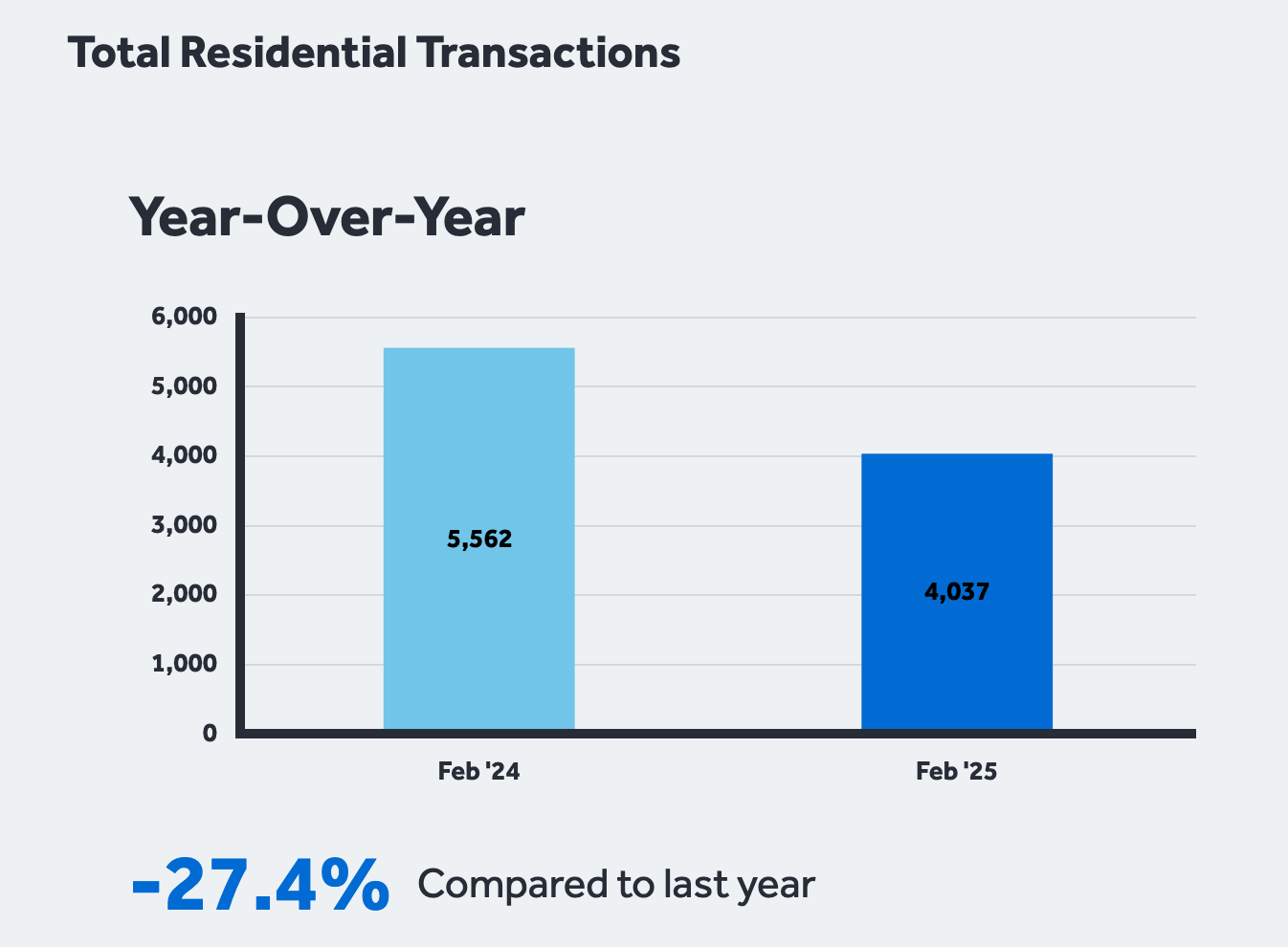

According to the Toronto Regional Real Estate Board (TRREB), home sales in February 2025 totaled 4,037 transactions, representing a 27.4% year-over-year decline. Meanwhile, new listings rose 5.4% YoY to 12,066, reinforcing buyer-friendly conditions with increased housing inventory.

Key Highlights of GTA’s February 2025 Housing Market

| Metric | February 2025 | February 2024 | YoY Change |

|---|---|---|---|

| Home Sales | 4,037 | 5,560 | ▼ 27.4% |

| New Listings | 12,066 | 11,450 | ▲ 5.4% |

| MLS® HPI Composite | ▼ 1.8% | – | ▼ 1.8% |

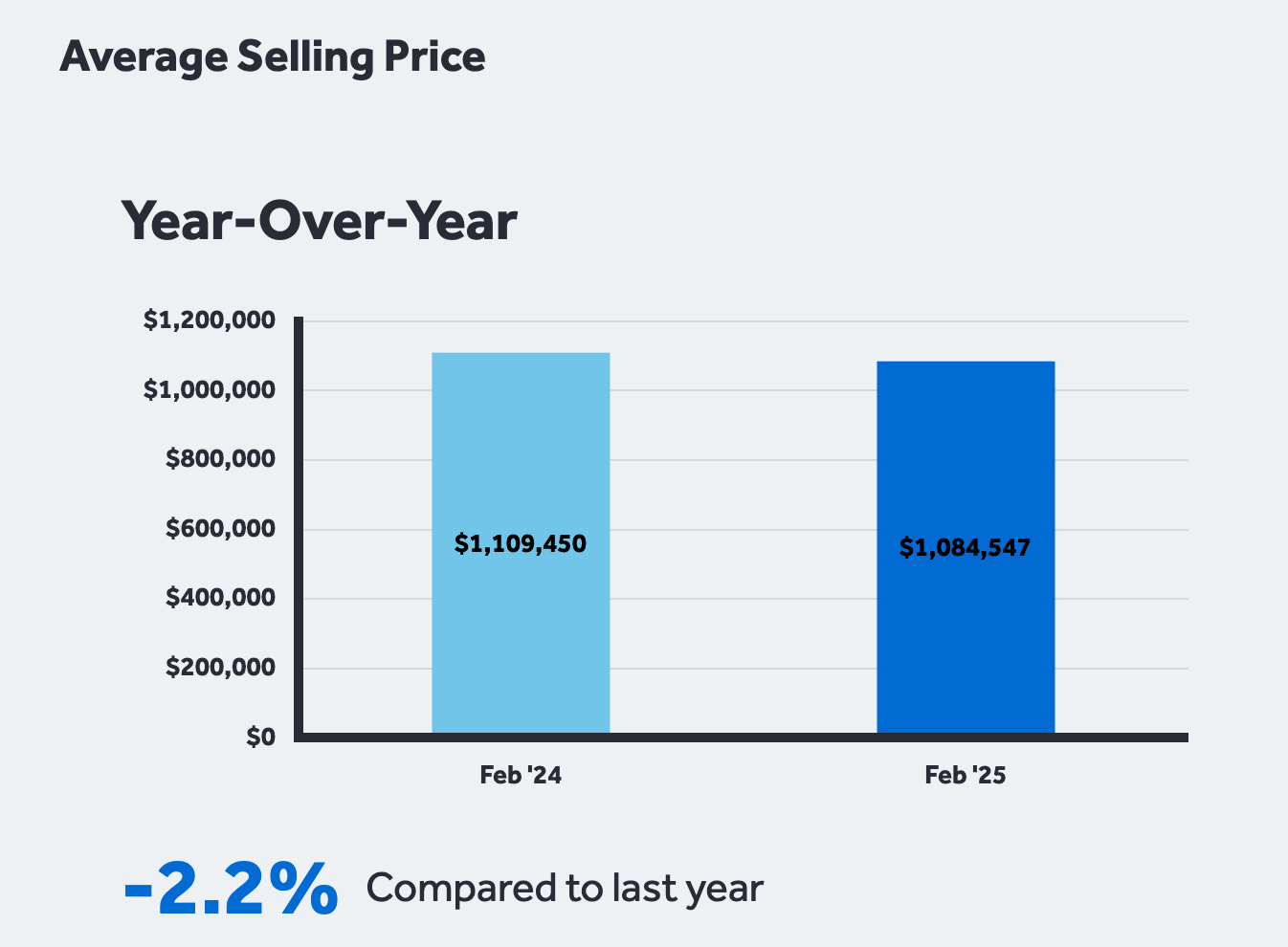

| Average Selling Price | $1,084,547 | $1,108,982 | ▼ 2.2% |

GTA Homebuyers Gain Negotiation Power Amid Market Slowdown

The GTA housing market in February 2025 clearly favoured buyers over sellers. The significant increase in available listings, combined with reduced sales, meant that buyers had greater negotiating power when making offers.

TRREB President Elechia Barry-Sproule acknowledged that while many GTA residents are eager to purchase homes, higher mortgage rates continue to impact affordability. However, she expressed optimism that borrowing costs could decline in the coming months, making homeownership more accessible.

“Many households in the GTA are eager to purchase a home, but current mortgage rates make it difficult for the average household income to comfortably cover monthly payments. Fortunately, we anticipate a decline in borrowing costs, which should improve affordability.”

With economic uncertainty still lingering—especially due to concerns over Canada’s trade relationship with the U.S.—many potential homebuyers are choosing to wait and see before making a purchase decision.

TRREB Chief Market Analyst Jason Mercer highlighted this sentiment, stating that if economic conditions stabilize and borrowing costs decrease, the second half of 2025 could see a rebound in sales activity.

“If trade uncertainty is alleviated and borrowing costs continue to trend lower, we could see much stronger home sales activity later this year.”

Home Prices Decline: What It Means for Sellers & Buyers

In addition to lower sales volume, GTA home prices also experienced a moderate decline in February 2025:

- The MLS® Home Price Index (HPI) Composite Benchmark declined by 1.8% YoY

- The average selling price fell 2.2% YoY to $1,084,547

On a seasonally adjusted basis, both the HPI Composite Benchmark and the average home price dropped slightly compared to January 2025, signaling a continued cooling in the market.

For Home Sellers:

- Sellers must price homes competitively to attract buyers in the current environment.

- Longer listing times are likely, as more inventory means buyers have multiple options.

For Home Buyers:

- More inventory = more choices and stronger negotiation power.

- Lower prices + potential rate cuts = improved affordability in the coming months.

Market Outlook: What to Expect in the Coming Months

Several key factors will shape the GTA housing market in 2025:

1. Interest Rate Cuts Could Revive Market Activity

Experts predict that Canada’s central bank may start cutting interest rates in mid-to-late 2025, which could lead to a surge in buyer demand. Lower rates will make mortgage payments more manageable, increasing housing affordability.

2. Economic & Trade Uncertainty Remains a Concern

Ongoing trade negotiations with the U.S. and overall economic stability will impact consumer confidence. If trade relations improve and economic uncertainty diminishes, more buyers may enter the market.

3. Policy Changes on Housing Supply & Affordability

With the Ontario provincial election behind us and federal policies in flux, housing supply and affordability remain hot-button issues. TRREB CEO John DiMichele emphasized the need for clear government direction:

“Policy makers need to clarify their plans for housing supply and affordability, as well as trade and economic strategies. Clear direction will go a long way to strengthen consumer confidence.”

4. Potential for a Stronger Second Half of 2025

If interest rates decrease and economic confidence rebounds, the GTA real estate market may experience a surge in sales activity in late 2025. Buyers who are currently waiting on the sidelines may re-enter the market, leading to increased competition.

Final Thoughts: Is Now a Good Time to Buy in GTA?

While February 2025 presented challenges for home sellers, it provided opportunities for buyers. With a higher inventory of listings, softer pricing, and the potential for lower interest rates, buyers may find favorable conditions to purchase homes in the GTA.

For Sellers: Pricing competitively and being patient will be key to securing a sale.

For Buyers: Now is the time to explore options and prepare for potential mortgage rate decreases later in the year.

As the market evolves, keeping an eye on mortgage rate trends, economic conditions, and government policy decisions will be essential for anyone planning to buy or sell in the GTA real estate market.

Check Out My Current Listings Below! |

||

|

|

|

|

|

|

|

|

|

|

Frequently Asked Questions (FAQs)

1. Why did GTA home sales decline in February 2025?

Home sales dropped 27.4% YoY due to high mortgage rates, economic uncertainty, and cautious buyer sentiment amid trade concerns.

2. Are home prices expected to drop further in 2025?

While prices dipped in February 2025, future trends will depend on interest rate cuts and economic conditions. A rebound is possible in late 2025 if borrowing costs decrease.

3. Is now a good time to buy a home in GTA?

Yes, buyers currently have strong negotiating power, a higher selection of listings, and may benefit from potential rate cuts later in 2025.

4. What impact will lower interest rates have on the housing market?

Lower rates will increase affordability, potentially leading to higher sales activity and price stabilization later in the year.

5. What should sellers do in the current market?

Sellers should price competitively, stage homes effectively, and be prepared for longer listing times due to increased inventory.

6. How does government policy impact the real estate market?

Housing policies on supply, affordability, and economic stability significantly influence market trends and consumer confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link