Move-In Ready & Full of Potential: Inside a Hidden Gem in the Heart of Stouffville

🏡 Just Listed: 14 Betula Gate, Stouffville

A Beautiful Start in a Family-Friendly Neighbourhood

Offered at $949,000

Welcome Home

A lovingly maintained 2-storey detached link home – perfect for young families and first-time buyers.

📍 Stouffville, ON | 🛏 3 Beds | 🛁 3 Baths | 🚗 1-Car Garage

📲 Book a Tour Today

Contact Me | 📞 416-556-0238

🧱 Why You’ll Love This Home

✅ Key Features

-

3 bright and spacious bedrooms, including a sunlit Primary Suite with 4-Piece Ensuite

-

3 bathrooms total — 2 full 4-piece bathrooms on the upper level, 2-Pc powder room on main floor, and a rough-in in the basement

-

Open-concept main floor — ideal for family time & entertaining

-

Eat-in kitchen with walkout to a fully fenced, landscaped backyard

-

Gas BBQ hookup, perennial flower beds, garden shed, and low-maintenance front garden

-

Built-in 1-car garage with backyard man-door

-

Finished basement featuring:

-

Recreation room

-

Bonus/office room

-

Utility & laundry room

-

Cold room and storage room with built-ins

-

-

2–5 mins from top-rated Barbara Reid PS, Sunnyridge Park, tennis & basketball courts

📍 Quiet street in a close-knit, family-oriented community!

📸 3D Interactive Virtual Tour

👨💼 About Gerald Lawrence

Hi, I’m Gerald — a full-time, full-service REALTOR® with Coldwell Banker R.M.R. Real Estate. I help first-time buyers and young families find homes where they can truly thrive. My knowledge of the Stouffville market and personalized approach ensure that you’ll feel confident and cared for every step of the way.

📧 Gerald-Lawrence@ColdwellBanker.ca

📞 416-556-0238

🌐 www.GeraldLawrence.Realtor

💬 What My Clients Say

❓ FAQs

Is this home move-in ready?

Yes — it’s been lovingly maintained by the original owner since 2010 and is in excellent condition.

What type of home is it?

It’s a 2-storey detached link home — fully detached above ground with a shared foundation wall below grade.

Can the basement be expanded?

Absolutely. The basement already mostly finished and has a rough-in for a full bathroom, allowing you to finish it to suit your needs.

Is the area good for families?

Definitely! It’s located within walking distance of Barbara Reid Public School, local parks, sports courts, and family amenities.

How do I book a tour?

📲 Contact me directly at 416-556-0238 or

📧 Email Click To Send Email

✉️ Interested in 14 Betula Gate? Let’s Talk!

Ready to book a showing or have a few questions? I’d love to help.

👉 Submit your inquiry below or email me directly.

📩 Click To Send Email

📞 416-556-0238

Your dream home could be just one message away.

🏡 Don’t miss out on 14 Betula Gate – Schedule Your Private Showing Now!

📞 416-556-0238 | 🌐 www.GeraldLawrence.Realtor

Rate Decision Breakdown: How US Tariffs and Rising Unemployment Are Shaping Canada’s Monetary Policy

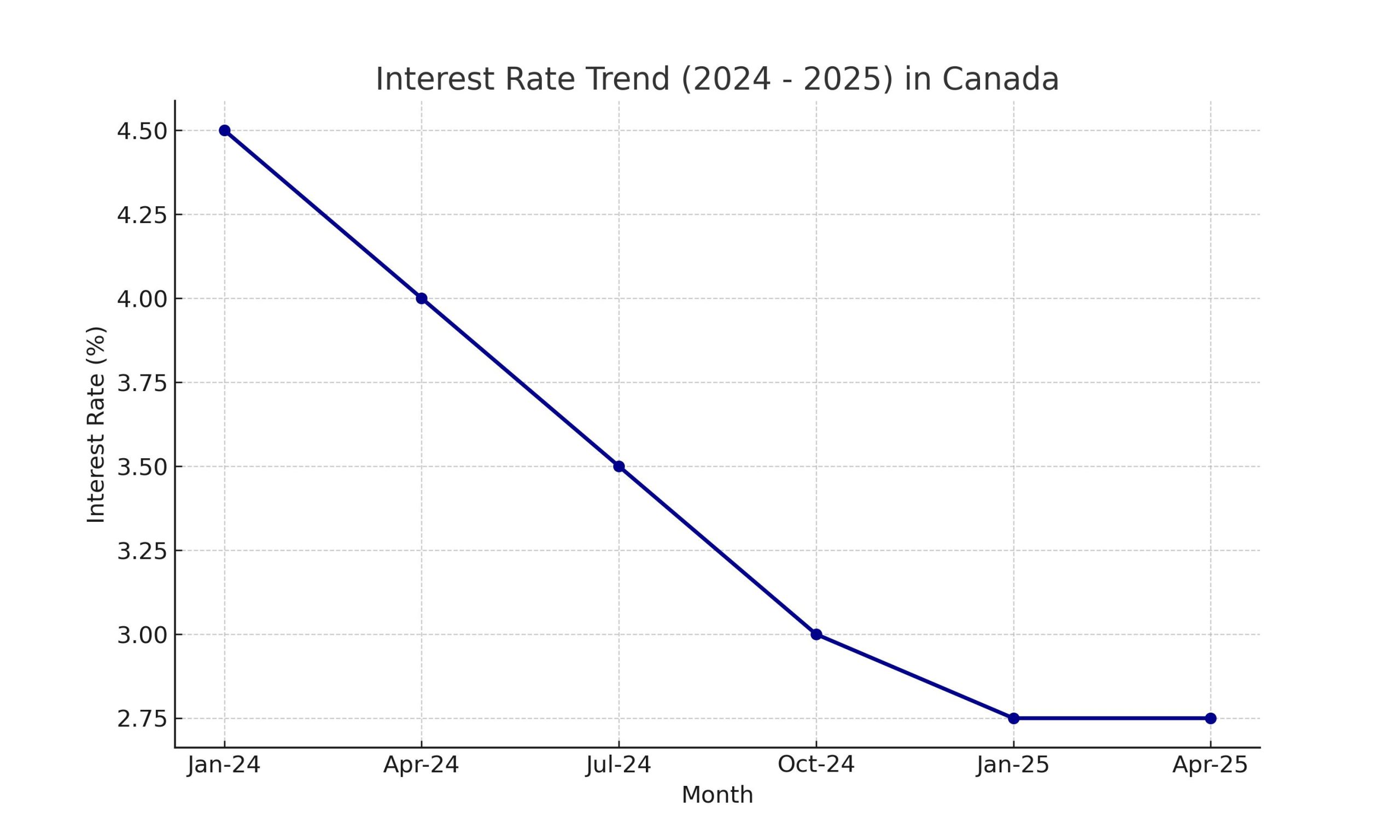

🏦 Bank of Canada Holds Rate at 2.75%

🚦 BoC Hits the “Hold” Button: What Does It Mean For YOU? 🚦

The Bank of Canada’s job is like being the country’s economic pilot: they try to steer us toward stable prices (keeping inflation in check!) and healthy growth. Today’s decision to keep interest rates unchanged at 2.75% tells us a lot about what they’re seeing on their economic dashboard.

🔍 The Big Picture: Why the Hold?

The Bank’s Governing Council decided to keep rates steady because they’re navigating a complex economic landscape. Here’s what they’re seeing:

- Global Uncertainty is STILL High: 🌍 Especially concerning is the ongoing back-and-forth with U.S. tariffs and trade negotiations. This creates a big question mark for Canada’s export-driven economy. The Bank needs more clarity on how these trade policies will shake out.

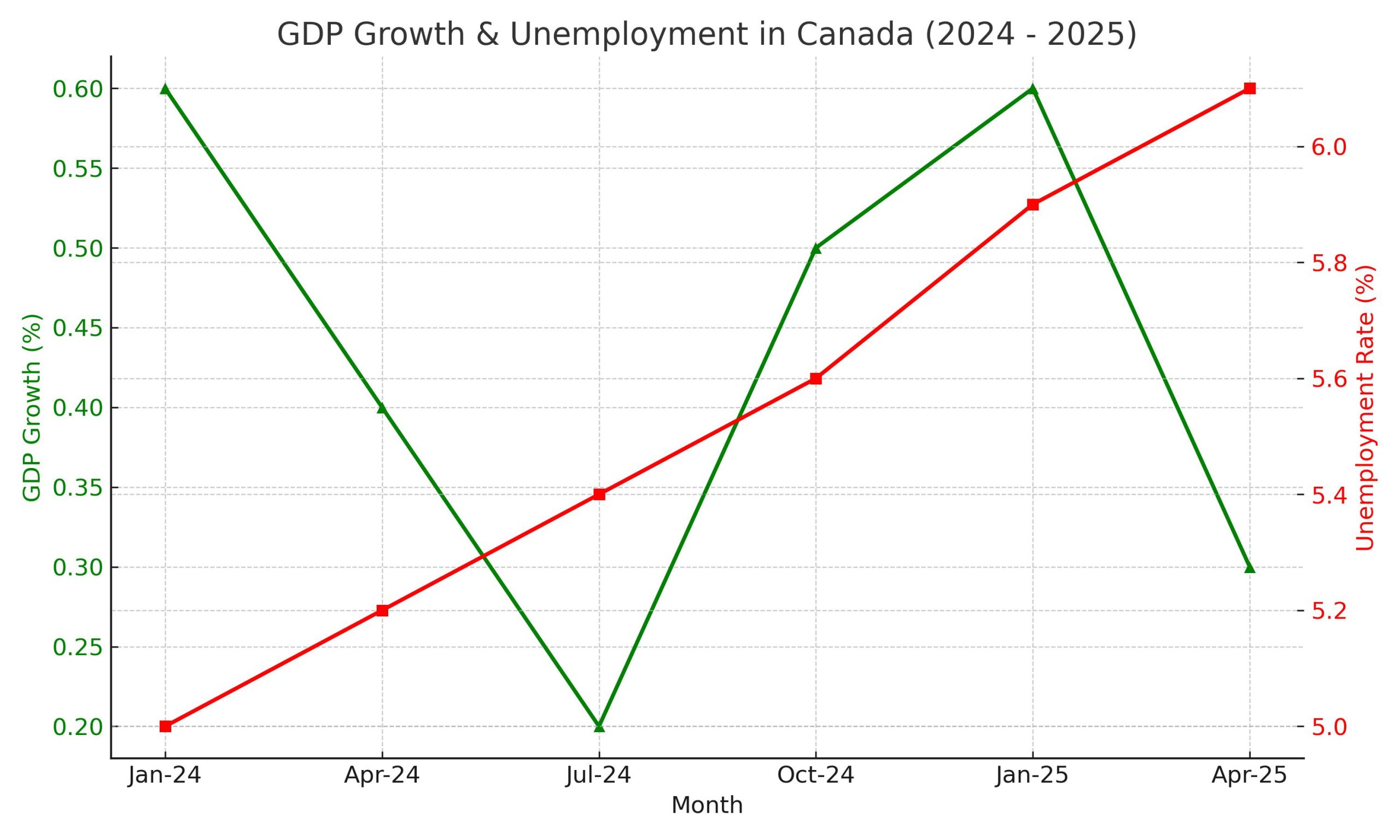

- Canadian Economy: Softer, But Not Collapsing! 💪 Canada’s economy grew a bit stronger than expected in the first quarter (2.2% GDP growth!), driven partly by exports to the U.S. and inventory building. However, they expect the second quarter to be weaker as these factors reverse. Consumer spending has slowed, and housing activity is down, particularly resales.

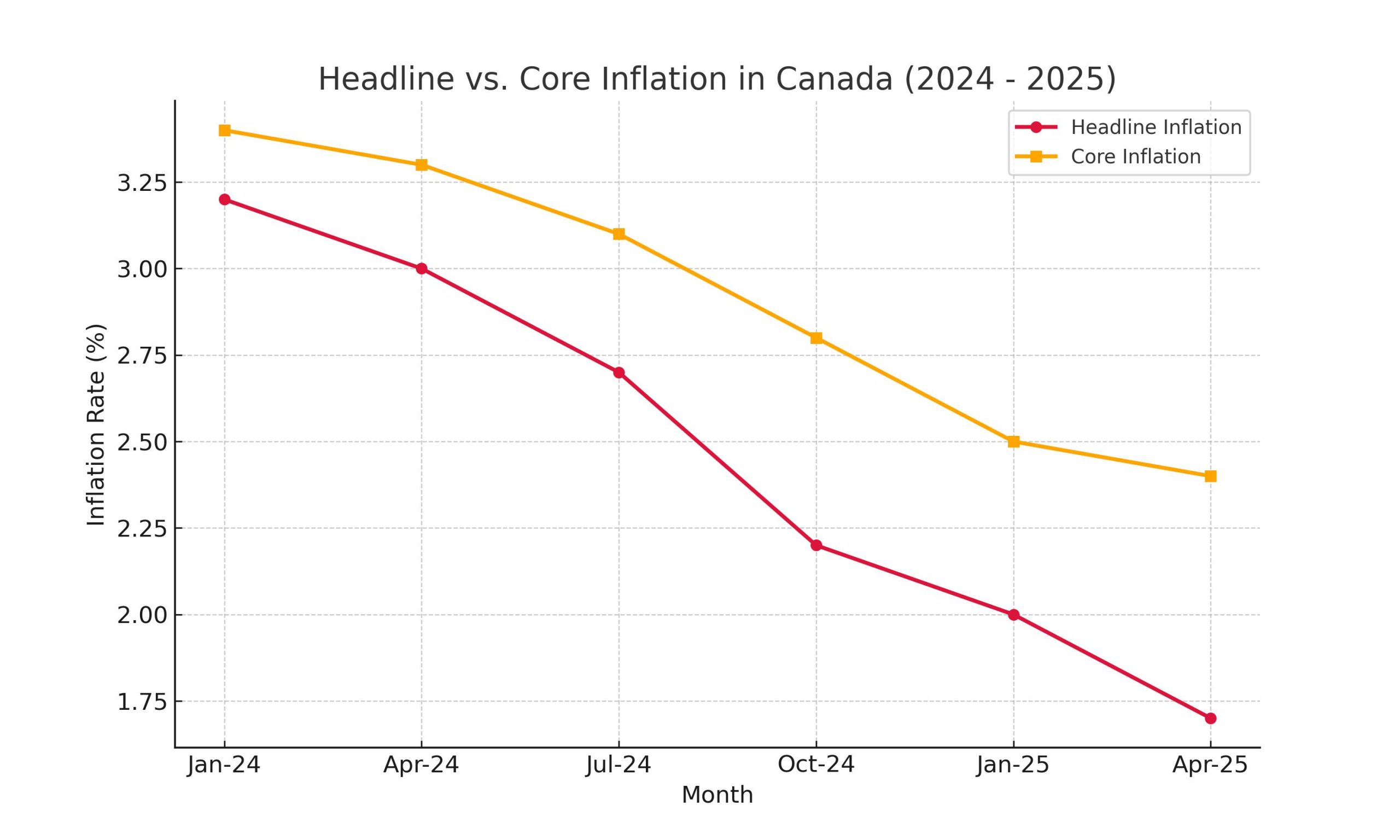

- Inflation’s Tricky Dance: 📈 While inflation has generally eased from its peak, the Bank noted “unexpected firmness” in recent inflation data, and their preferred core inflation measures have moved up. Businesses are still expecting tariffs to raise prices, and many plan to pass those costs on. This “stickiness” in inflation is a key reason for the hold.

- Labor Market Cooling: 🌬️ The job market has shown signs of weakening, especially in sectors tied to trade. The unemployment rate has risen to 6.9%. This typically puts downward pressure on inflation, but the Bank is watching carefully.

In simple terms: The Bank is seeing conflicting signals! The economy isn’t collapsing, but there’s a lot of uncertainty from tariffs and inflation isn’t quite behaving as smoothly as they’d like. So, they’re taking a cautious “wait and see” approach.

📌 Key Highlights

- Inflation: Headline inflation fell to 1.7% in April, while core inflation remains sticky.

- GDP Growth: The economy expanded by 2.2% in Q1 2025.

- Labour Market: Signs of softening with slower wage growth and rising unemployment.

- External Pressure: Tariff increases from the U.S. add uncertainty to exports.

📈 Interest Rate Trend (2024 – 2025)

💹 Headline vs. Core Inflation

📊 GDP Growth & Unemployment

🏠 What This Means for Canadians

- Homeowners: Mortgage rates likely to remain stable. Variable rate holders enjoy breathing room.

- Buyers: A continued hold on rates might support affordability — but be mindful of inflation.

- Businesses: Exporters should prepare for volatility, especially due to U.S. trade policies.

🏡 What Does This “Hold” Mean for Your Money?

This decision has direct impacts on everyday Canadians. Let’s break it down:

- For Borrowers (Especially Variable-Rate Mortgages & HELOCs): 🥳 GOOD NEWS! Your payments linked to the prime rate will stay STABLE for now. No immediate jumps in your monthly costs! This offers a much-needed breathing room. If you’re looking for a new variable mortgage, rates won’t have shifted due to this announcement.

- For Savers (HISAs & GICs): 💸 STILL DECENT RETURNS! While not increasing, the rates on high-interest savings accounts and GICs will remain relatively attractive. This is a positive for those looking to grow their cash safely.

- For the Housing Market: 🏠 The unchanged rate could bring a degree of stability, preventing further upward pressure on mortgage costs. However, affordability remains a significant hurdle for many, and the Bank noted a “sharp contraction in resales.”

- For Businesses: 💼 Borrowing costs remain unchanged, which offers predictability for investment and operational decisions. However, uncertainty from U.S. tariffs and slower domestic demand are still headwinds.

🔮 Looking Ahead: The Bank’s Crystal Ball (Sort Of!)

The Bank of Canada made it clear they are “proceeding carefully” and will be “data-dependent.” This means they’re not committing to any future moves right now. They want to see:

- How U.S. trade policy evolves and its real impact on Canadian exports.

- How much any economic slowdown spills over into business investment, employment, and household spending.

- How quickly cost increases (like from tariffs) are passed on to consumer prices.

- How inflation expectations evolve among consumers and businesses.

Key takeaway from Governor Tiff Macklem: While there might be room for future rate cuts if the economy weakens further and price pressures stay contained, the Bank is not providing forward guidance. They are focusing on the actual data as it comes in.

✨ Your Turn!

What are your thoughts on this latest decision from the Bank of Canada? Are you breathing a sigh of relief, or hoping for more changes soon? Share your perspective in the comments below! 👇

The BoC will review its stance again on July 30, 2025. With inflation easing yet core pressures lingering, a potential rate cut remains on the table — but not guaranteed.

For full details, see the official press release.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link